When the Fed Cuts Rates, Buy Small-Cap Stocks

Extreme capitulation breeds extreme rallies.

We are in the midst of a powerful broadening boom.

And one area is set to thrive further.

When the Fed cuts rates, buy small-cap stocks.

Back in May, we pounded the table that breadth would expand. Post extreme outflows, smaller areas tend to thrive.

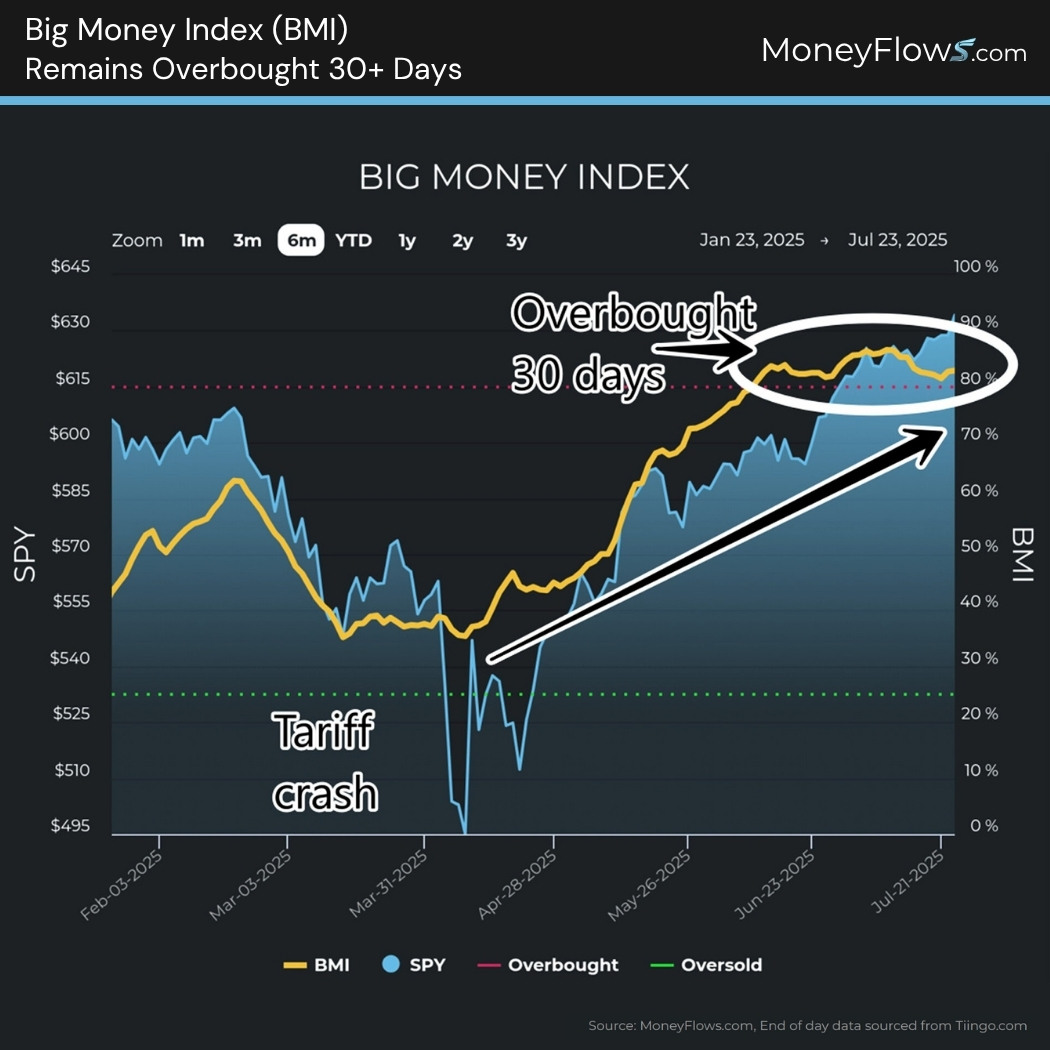

Now that we’ve been overbought for 30 sessions, we made the case to buy any summertime dip should it come.

Today we will reinforce that BTD stance with a powerful historical study.

As of this morning, the odds of a Fed interest rate cut for September stand at 66%. This is a fluid target.

Whether or not the cuts begin then or shortly after, won’t matter.

As Alec Young says, rate cuts may be delayed, but they won’t be denied. I agree! Rates are heading lower, so let’s make a plan now.

Today, we’ll run through our latest data. Then we’ll fire off a signal study…and of course layout stocks to play the rate cut induced equity rally.

Money is Pouring into Small- and Mid-cap Stocks

All equity boats are rising lately.

Over the past month, large-, mid-, and small-caps are up gigantically.

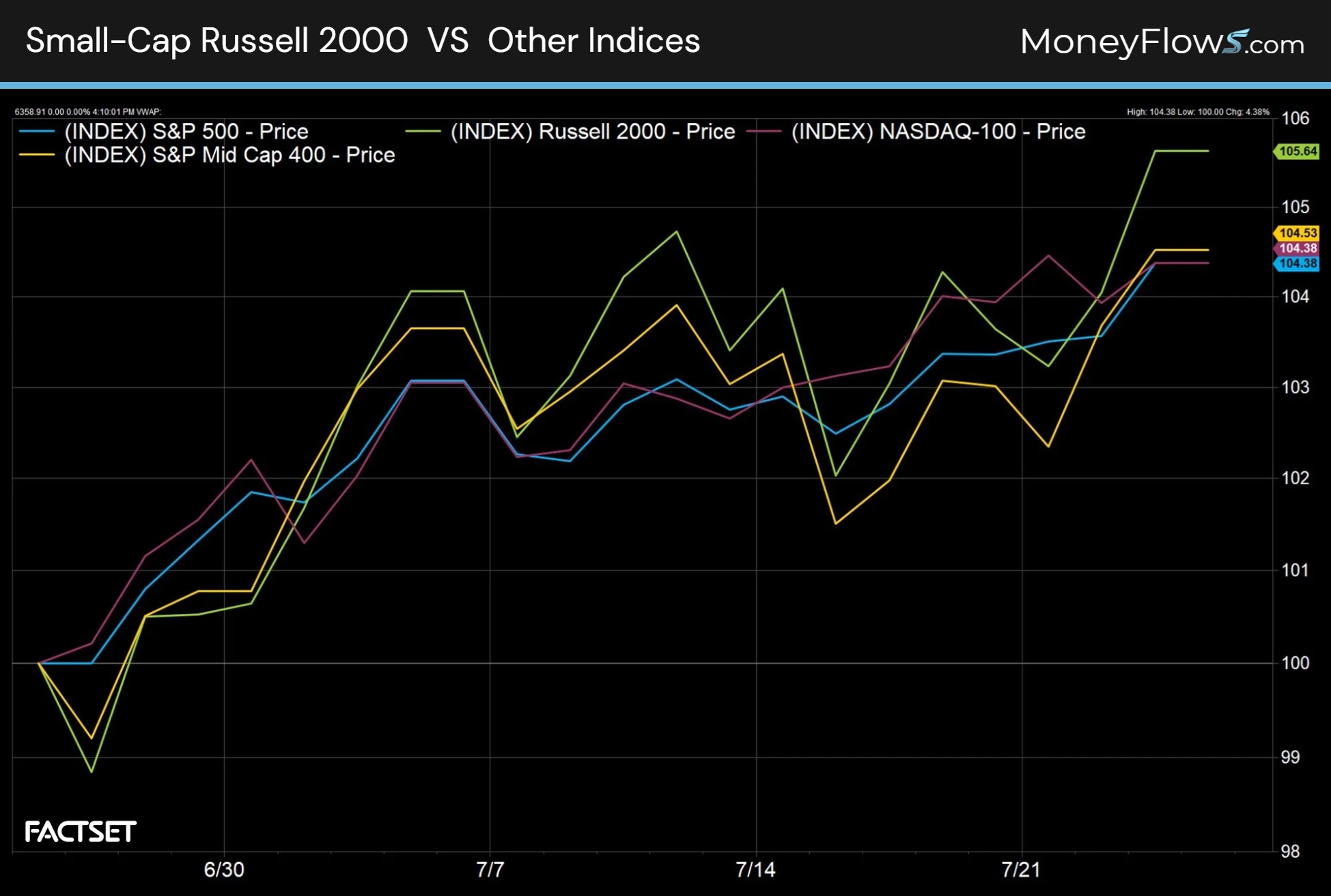

The S&P 500, NASDAQ 100, and S&P Mid Cap 400 have climbed just over 4%. The small-cap Russell 2000 has vaulted 5.64%:

Much of this has to do with the excitement around trade deals, better than feared inflation numbers, and the belief that A.I. will spill through, allowing for stronger efficiencies.

Our data has been completely risk-on over the same time period.

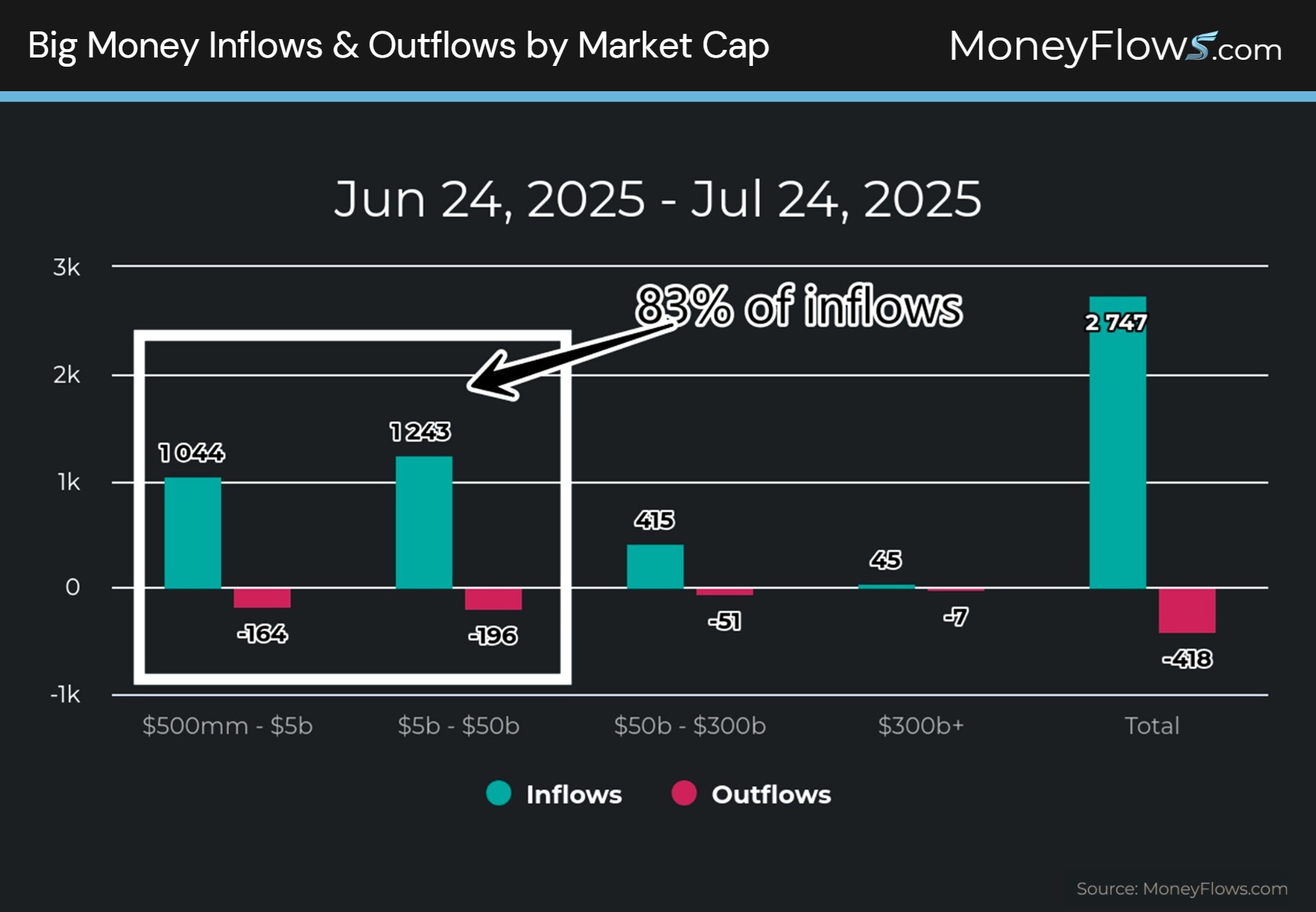

In fact, over the past month 83% of our inflows have been isolated in companies with market caps <$50 billion.

This level of participation is why the Big Money Index (BMI) has remained overbought for 30 days.

When institutions are piling into stocks hand over fist, indices have nowhere to go but UP:

But there’s another major reason for the flood of capital to small- and mid-cap names: the coming Fed interest rate cuts.

Lower rates means that the noose around highly capitalized firms will loosen. Bottom lines will heal. Smaller companies stand to benefit the most.

Our data this year highlighted monster winning stocks in this revival…it’s been one of the best stock-picking environments in years.

New leadership has emerged. Plenty of under-the-radar stocks are under heavy accumulation week after week.

And I’m here to tell you that the good times are going to keep rolling.

When the Fed Cuts Rates, Buy Small-Cap Stocks

Pundits like to scare the crowd about rate cuts.

They cite the dot-com bust of the late nineties and early 2000s and the GFC. Both of those environments saw brutal stock performances as the economy fell into nasty recessions.

However, important for today’s situation, when the Fed cuts interest rates and the economy holds up well, stocks flourish…in a very big way.

Check this out.

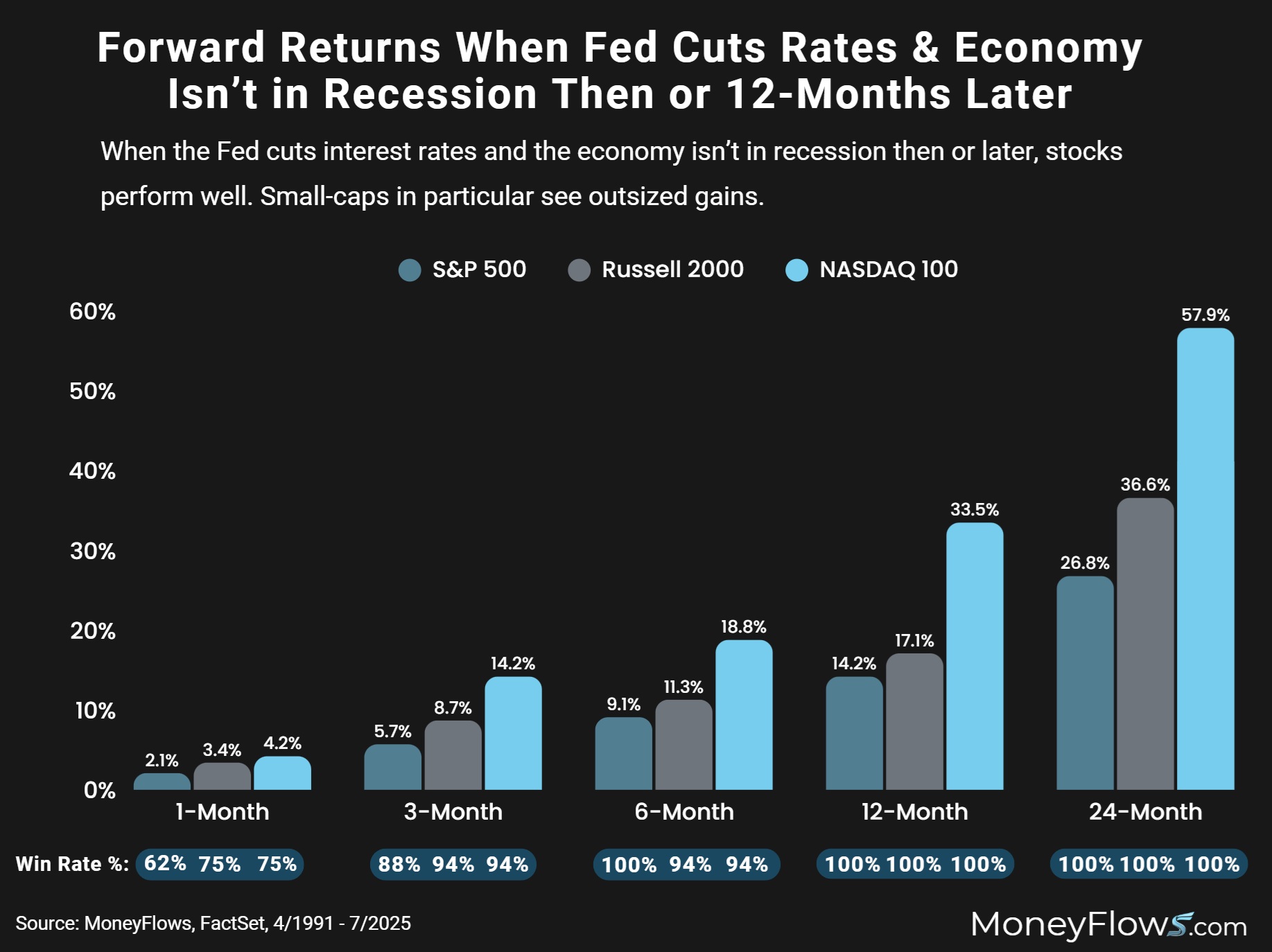

Back to 1991, whenever the Fed cuts rates, and the economy isn’t in recession then and doesn’t fall into one 12-months later…equities boom.

These instances include the Gulf War of 1991 and 1992, the Mid-Cycle 90s, and the Global Currency Crisis in 1998.

That’s how I see today’s environment…a healthy economy with the soon-to-come stimulative effects of lower rates.

When the Fed cuts rates and our economy holds up - large, small, and the NASDAQ surge:

- 1-3 months later sees the S&P 500 jump 5.7% and the Russell 2000 climb 8.7%

- 6-months later the Russell 2000 jumps 11.3% while the NASDAQ climbs 18.8%

- 12-months later the S&P 500 rips 14.2%, Russell 2000 pops 17.1%, and the NASDAQ 100 rallies 33.5%

- 24-months later the S&P 500 gains 26.8%, Russell 2000 surges 36.6%, and the tech-heavy NASDAQ 100 ramps 57.9%

Note, these returns do not include the rate cuts of 2024 as 12-months have yet to pass.

Also keep in mind that the Russell 2000 is a massive basket. There will be cases where single name equities will violently surpass the benchmark’s average return.

So, if we get any summertime pullback, you’ll want to have a buy list ready to go.

This is where our Outlier 20 reports come in handy. Outlier stocks under repeated accumulation are found in this prized weekly report.

Get started by becoming a PRO member today. Contact us here for more information, if you’re a money manager wanting portfolio insights.

If you’re looking to upgrade your research, I can’t think of a better time given what’s ahead.

Below are 3 of our top smaller companies primed for acceleration in the years ahead…including nuclear and A.I. plays.

Each of these have seen continual inflows and boast powerful MAP Scores.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.