Volatility Crashed to New Lows in 2025

Stocks are bringing joy this holiday season.

The uptrend quietly notched a new high for the S&P 500 yesterday.

And that wasn’t the only stocking stuffer for investors.

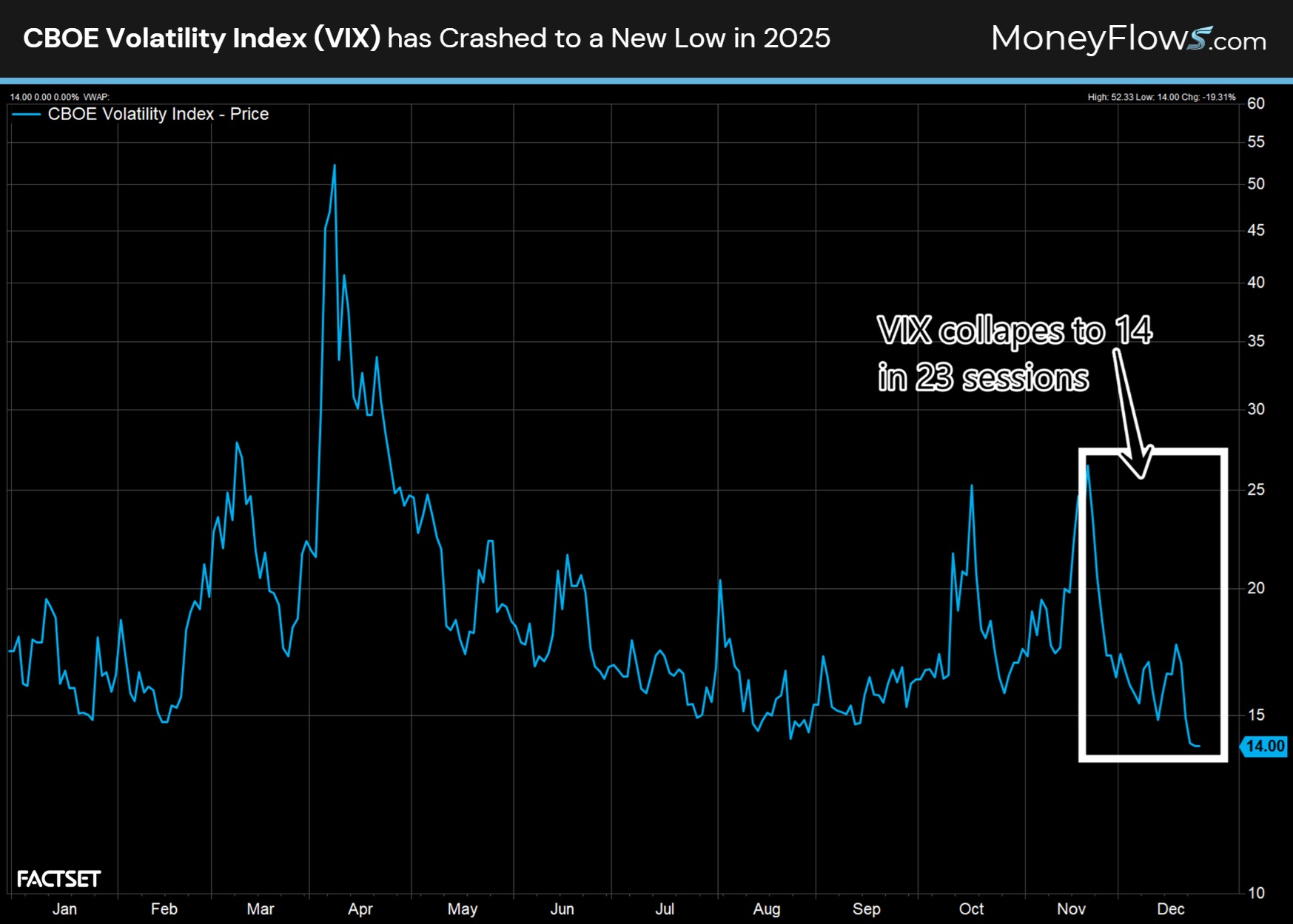

Volatility crashed to new lows in 2025.

This year is proof that investors should always prepare for the unexpected as it relates to markets.

We all dealt with a tariff crash and subsequent breath-taking rally…all in a matter of months.

Keeping a calm head and spotting opportunities has paid off handsomely. All major indices notched strong returns this year.

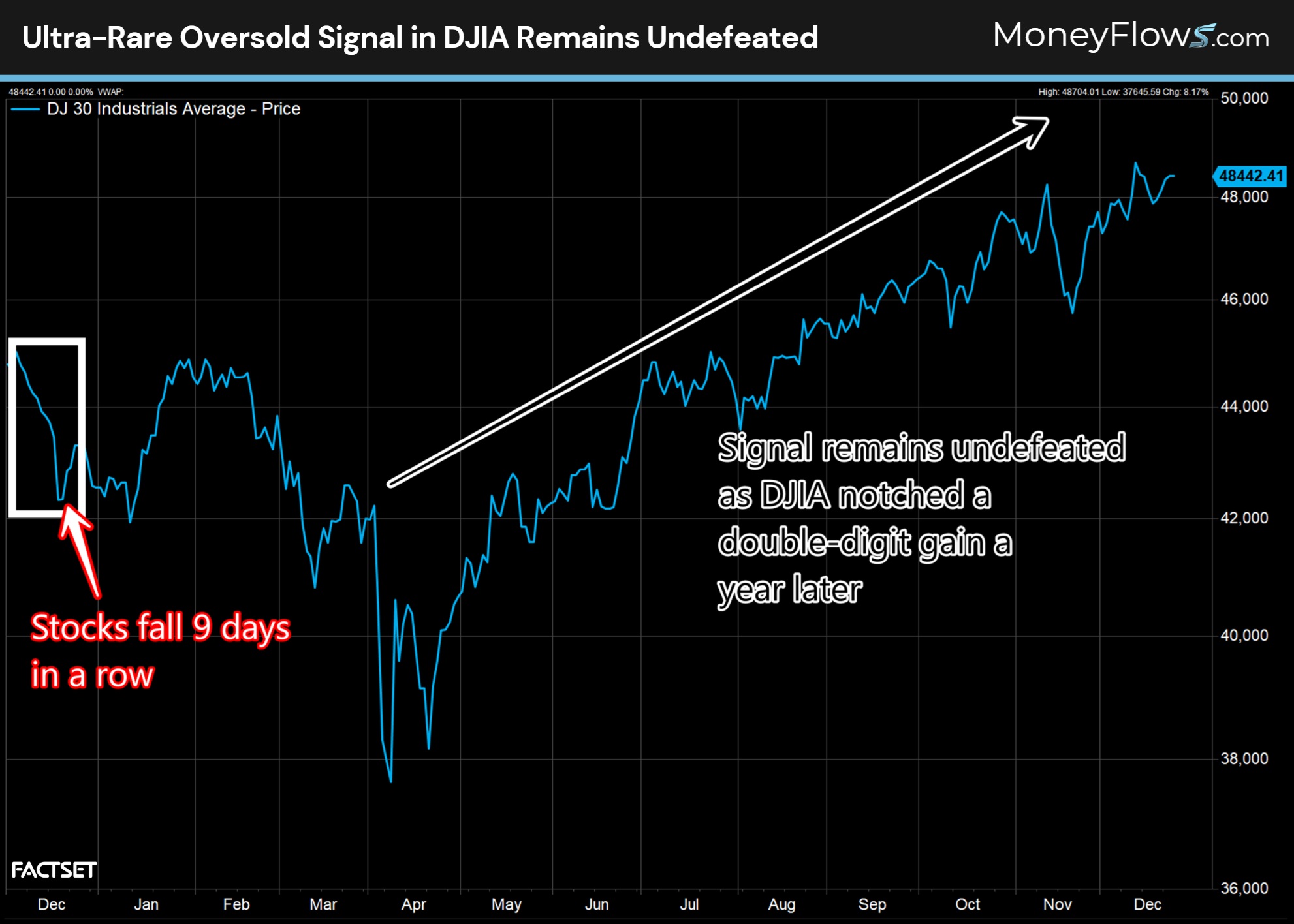

But I’ll remind you that in December 2024, markets were in shambles…and we offered a powerful signal study to keep you invested.

We’ll update that study.

Then we’ll offer a new signal study for today’s volatility crash. The CBOE Volatility Index (VIX) just plummeted in relatively rare fashion.

History says this is a good setup for stocks going forward.

Volatility Crashed to New Lows in 2025

As investors pop champagne this holiday season, it’s important to recall that last year stocks were suffering.

In fact, the Dow Jones Industrial Average fell 9 consecutive days in a row through December 17th, 2024.

Pundits had you believe that stocks were a bad bet given those conditions. We tested this theory and found the opposite to be true.

We stated that this ultra-rare oversold signal is undefeated. Check out that post for more details.

Below I’ve updated the chart and returns given a year has now passed.

Here you will see how this signal still remains undefeated as the DJIA has gained 10.2% from December 17th and 13.3% from December 18th, 2024, on a 12-month basis:

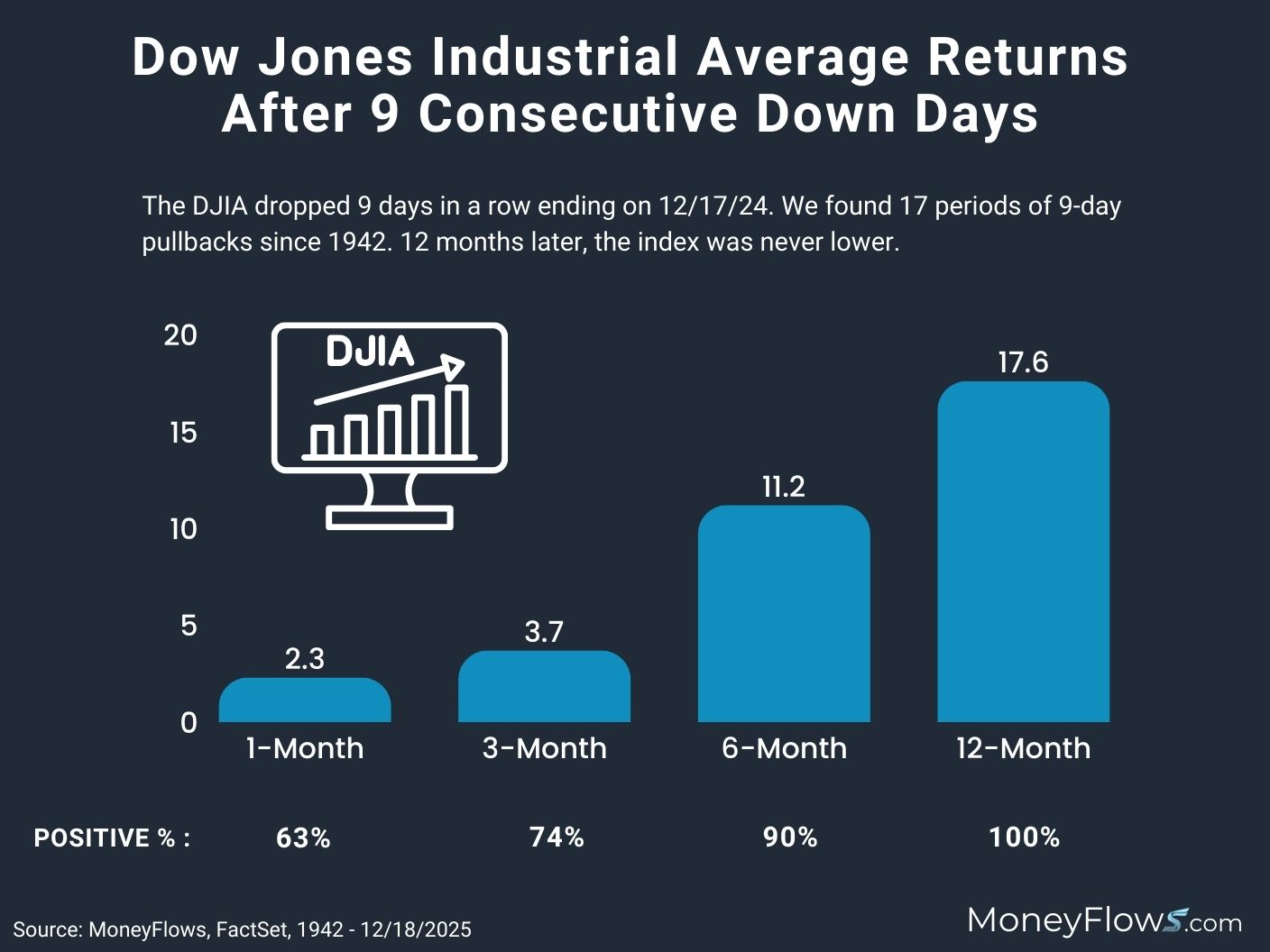

Below recaps all these rare events. It pays to have data on your side when the world is drowning in negativity:

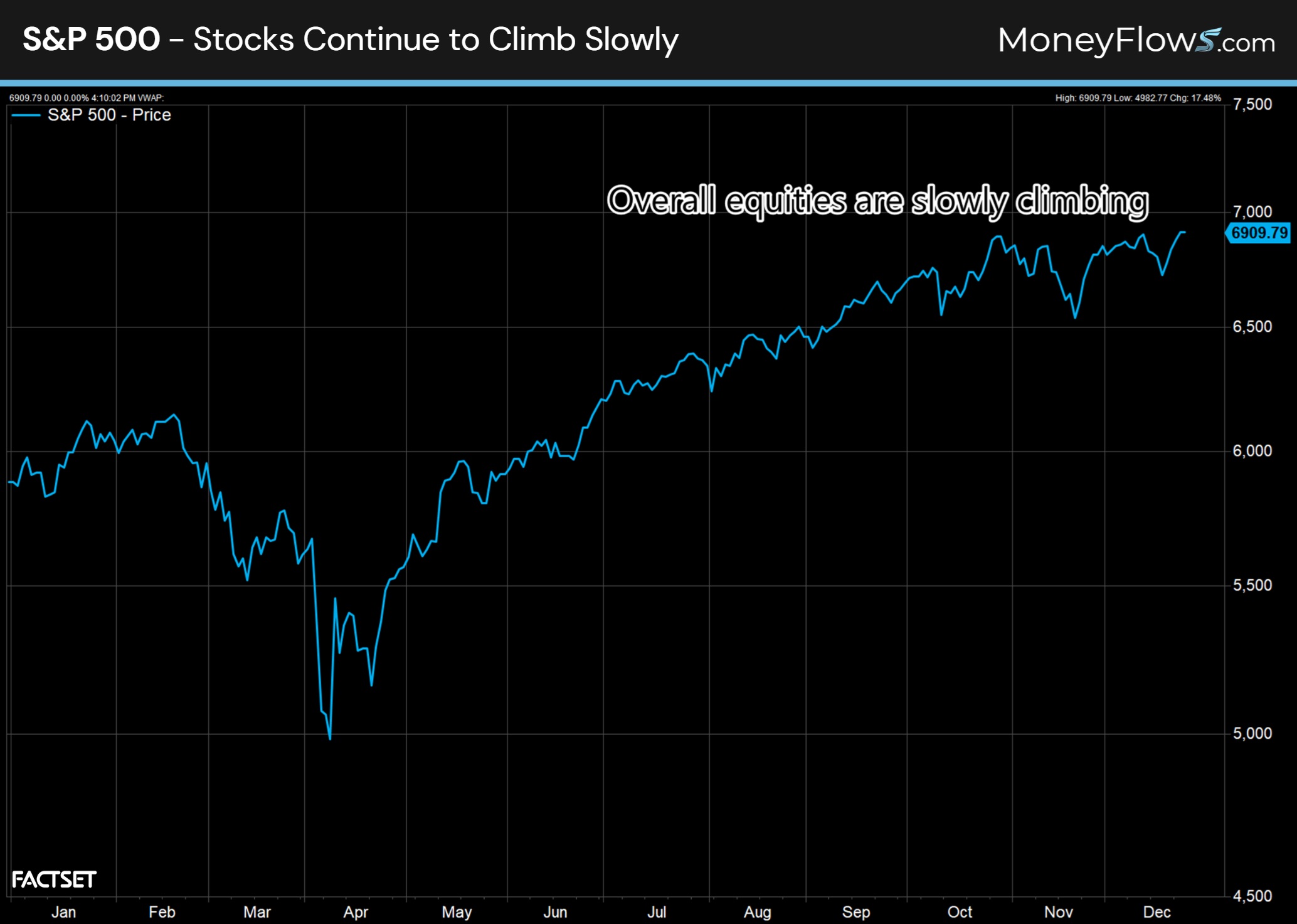

Today’s environment is quite different. Stocks are moving up and to the right.

Viewing the S&P 500 we can see how quiet the uptrend has been. We just notched an all-time high with the index closing at 6909:

This steady march has caused volatility to plummet.

The CBOE Volatility Index (VIX) has crashed to a new low in 2025 with the latest reading of 14.

Keep in mind that on November 20th the VIX stood at an elevated 26.42:

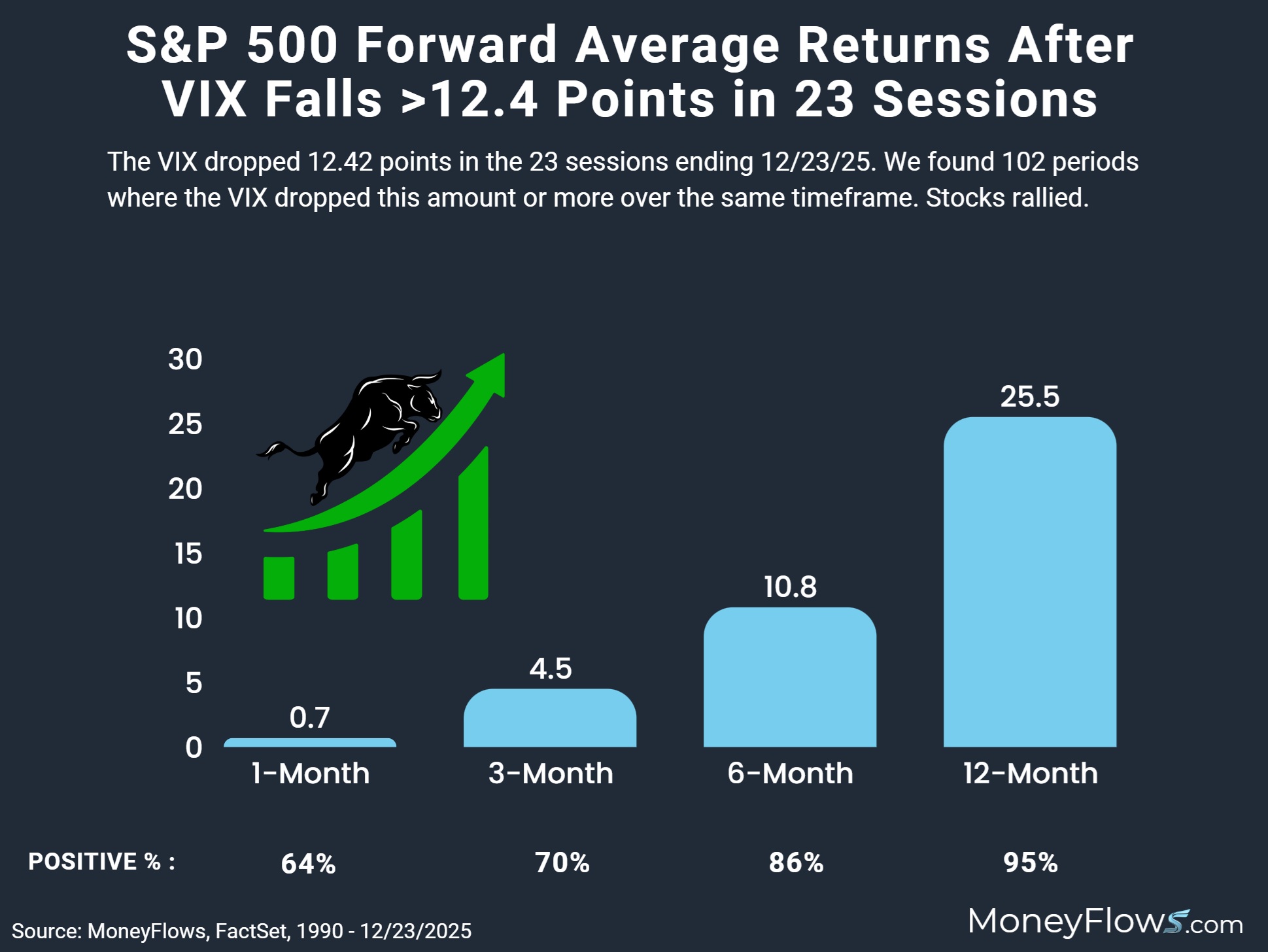

Turns out that the VIX dropping 12.42 points in 23 sessions is rather significant.

Back to 1990, the VIX has collapsed by 12.4 points or more in just 102 instances, including today.

Here’s why you need to keep a constructive stance.

The S&P 500 offers market beating gains when the VIX falls more than 12.4 points over 23 sessions with:

- 3-month average gains of 4.5%

- 6-month average gains of 10.8%

- 12-month average gains of 25.5%

So be happy that volatility crashed to new lows in 2025!

At MoneyFlows we take an evidence-based approach to investing.

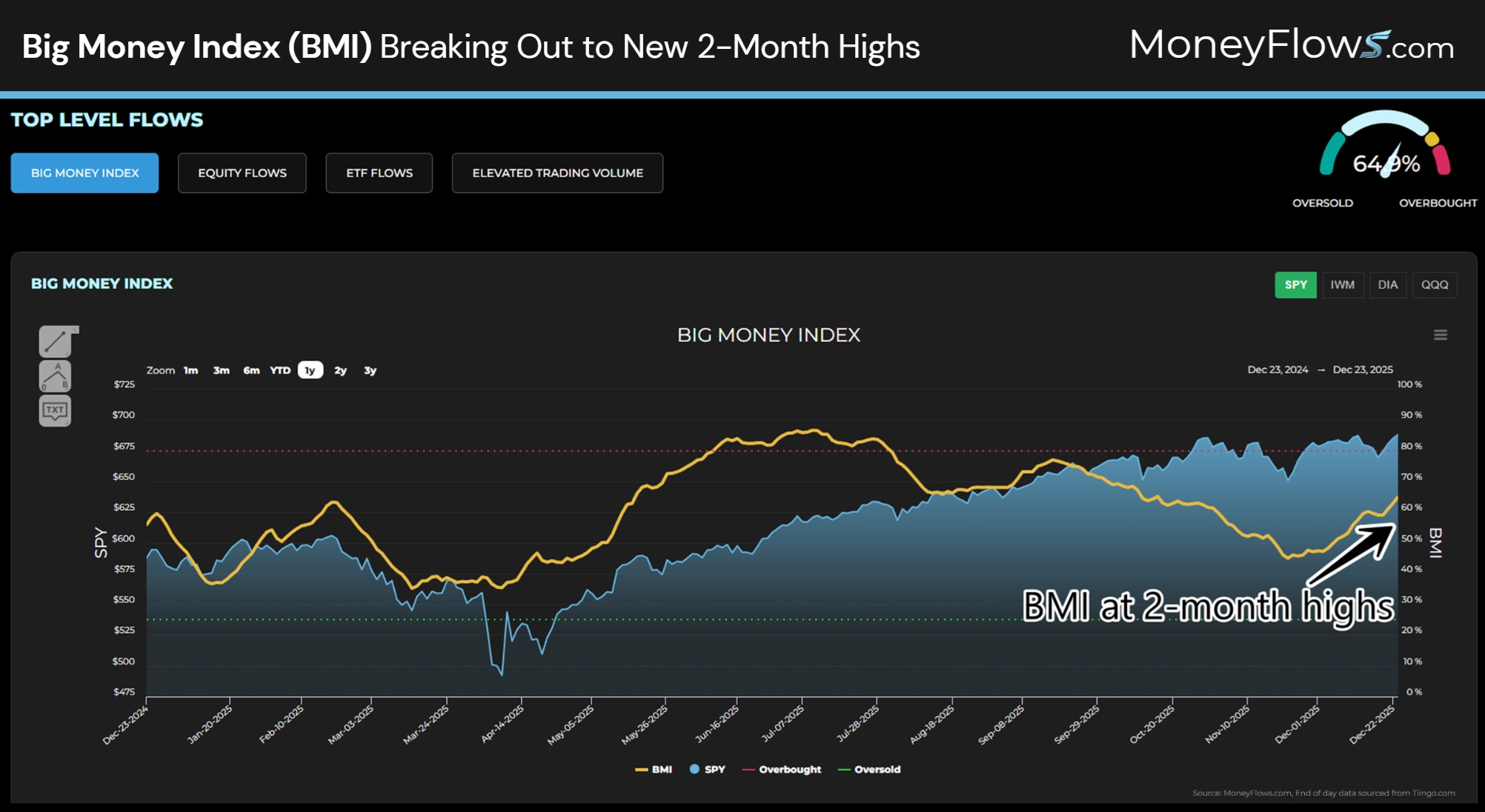

Not only do we study history for clues…we focus on the ultimate power law in markets: Supply and demand.

Our data has been risk-on for months with inflows overpowering outflows massively. We can see this with the Big Money Index (BMI) breaking out to new 2-month highs:

This data-driven approach presents the 1-2 punch that you can depend on as we head into January.

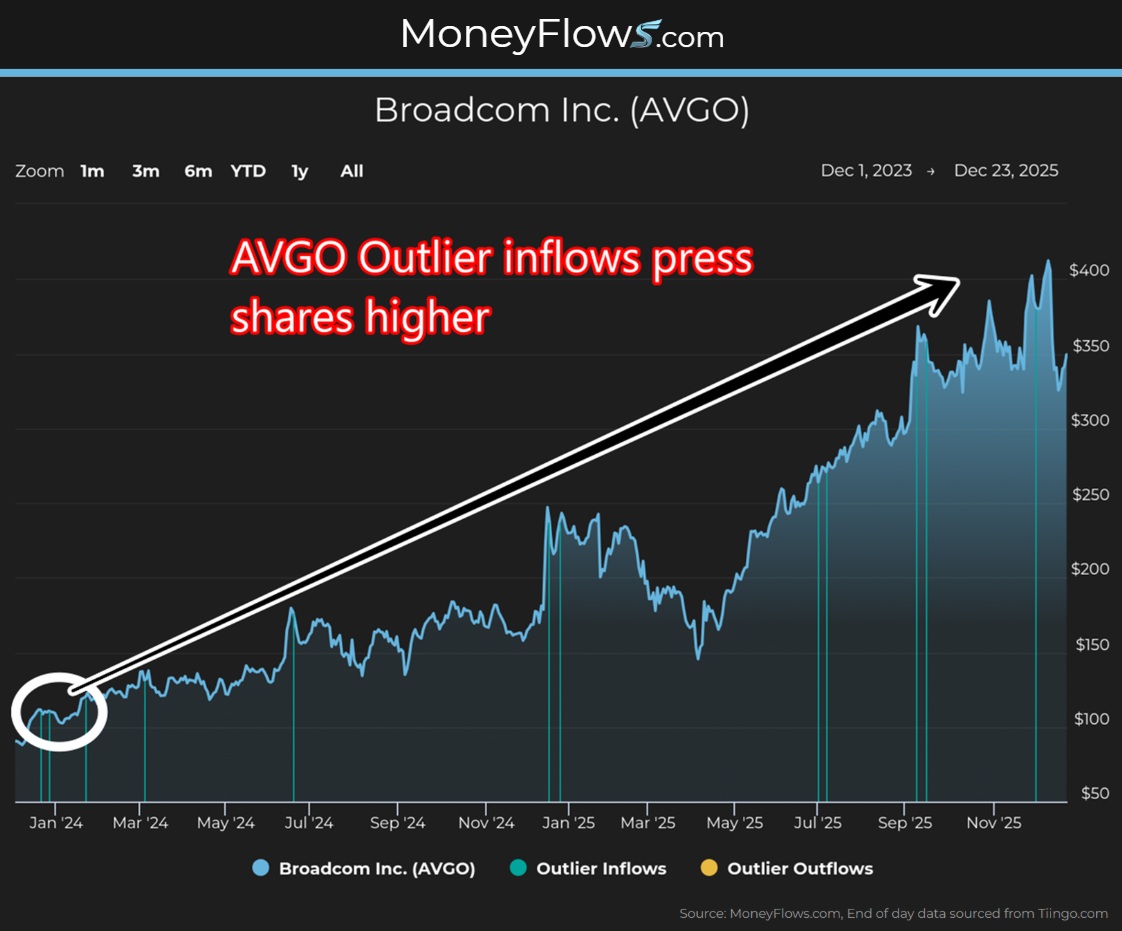

Big investors tend to make massive moves in the first month of the year. Last year we offered up 2 all-star stocks loved by institutions back in January.

As they say, the rest is history. Note the continued Outlier inflows pressing AVGO higher:

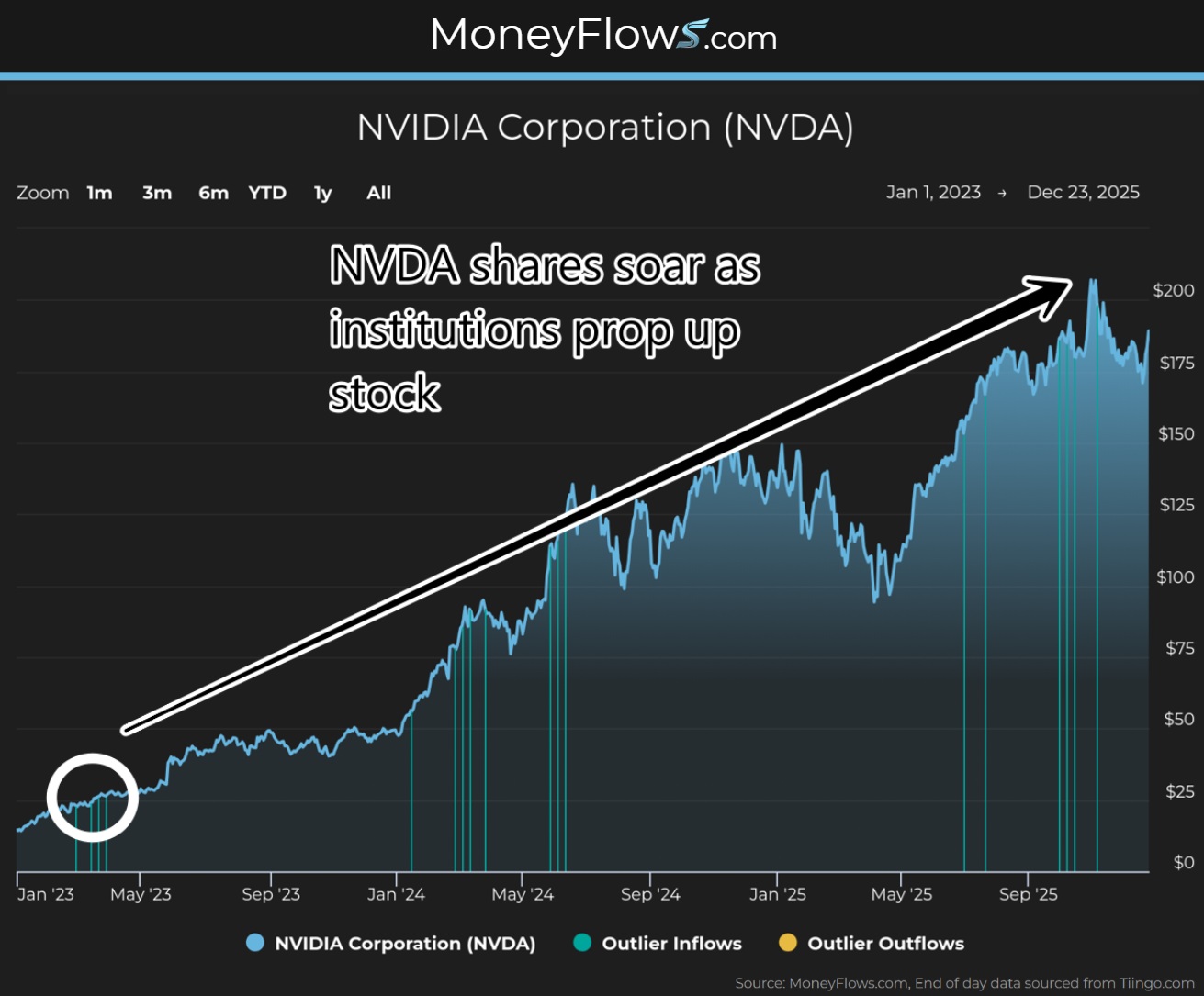

Here’s the same rare Outlier picture for NVIDIA (NVDA):

As we wrap up a tremendous year for the stock market, keep in mind that outliers will show themselves starting at the beginning of the year.

Don’t invest blind – follow the flows.

That’s what the pros do.

YOU CAN TOO!

Merry Christmas and Happy Holidays to you and yours!

Become a PRO subscriber today and gain access to our top stocks each day.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.