Undefeated Buy Signal: A Path to Unthinkable Rallies

Being a bull has paid off.

Stocks have seen one of the biggest risk-on rallies ever.

In fact, an ultra-rare momentum signal just triggered.

Since 1984, this undefeated buy signal has been a path to unthinkable rallies.

5 months ago, most research shops were terrified as tariffs sent equities plunging. Few saw a setup for the ages.

Fortunately for MoneyFlows, our data forecasted an unthinkable rally was ahead right at the market low in April.

We’ve seen forced selling events before and we’ve learned through experience how quickly tides can turn.

Today we’re in a different situation.

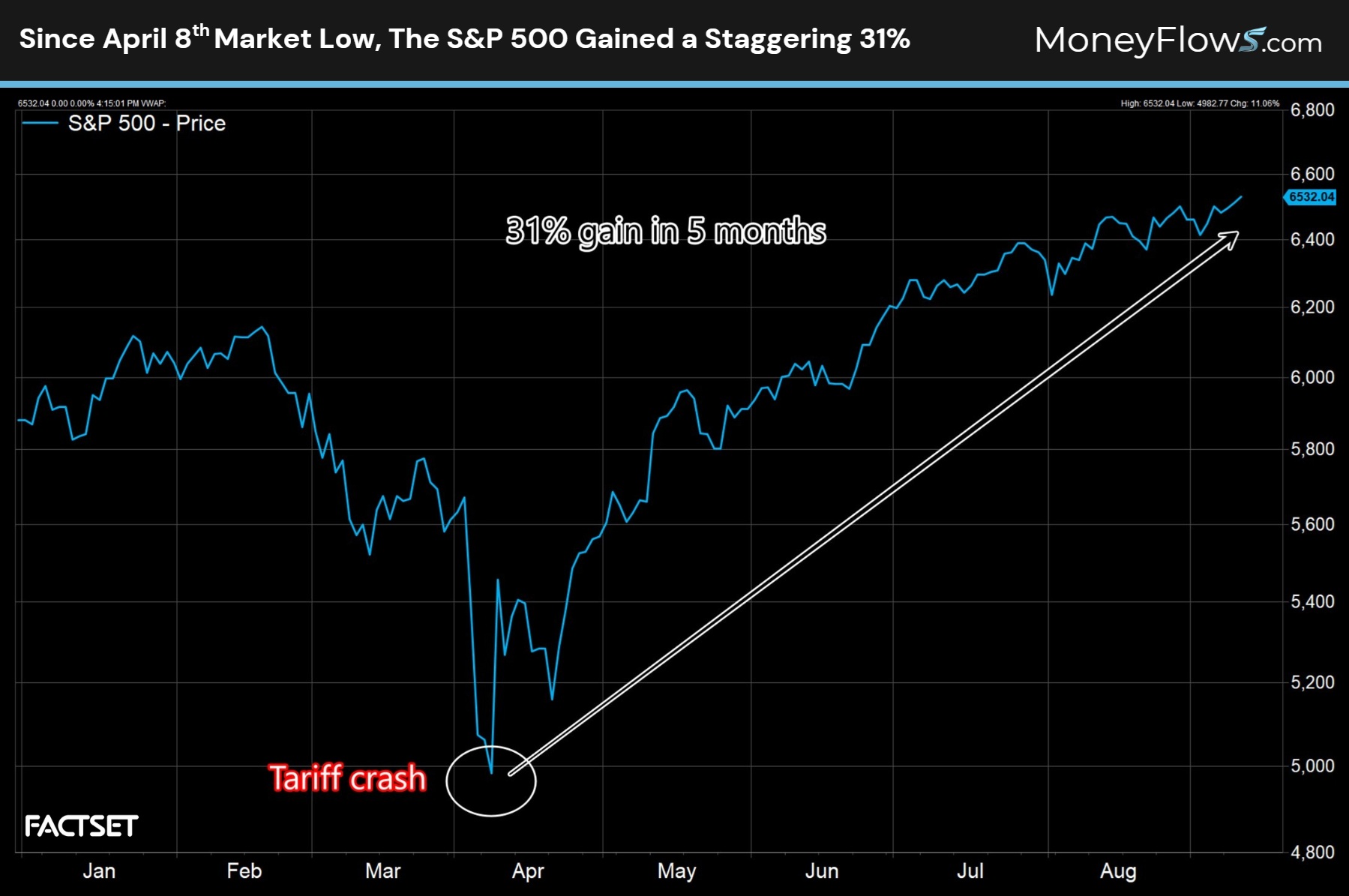

The S&P 500 has surged 31% from the April bottom…marking one of the swiftest recoveries in decades.

Here’s why this is important. This level of thrust signals prosperity in the months ahead.

Just make sure you’re loaded in the highest quality stocks heading into next year.

Undefeated Buy Signal: A Path to Unthinkable Rallies

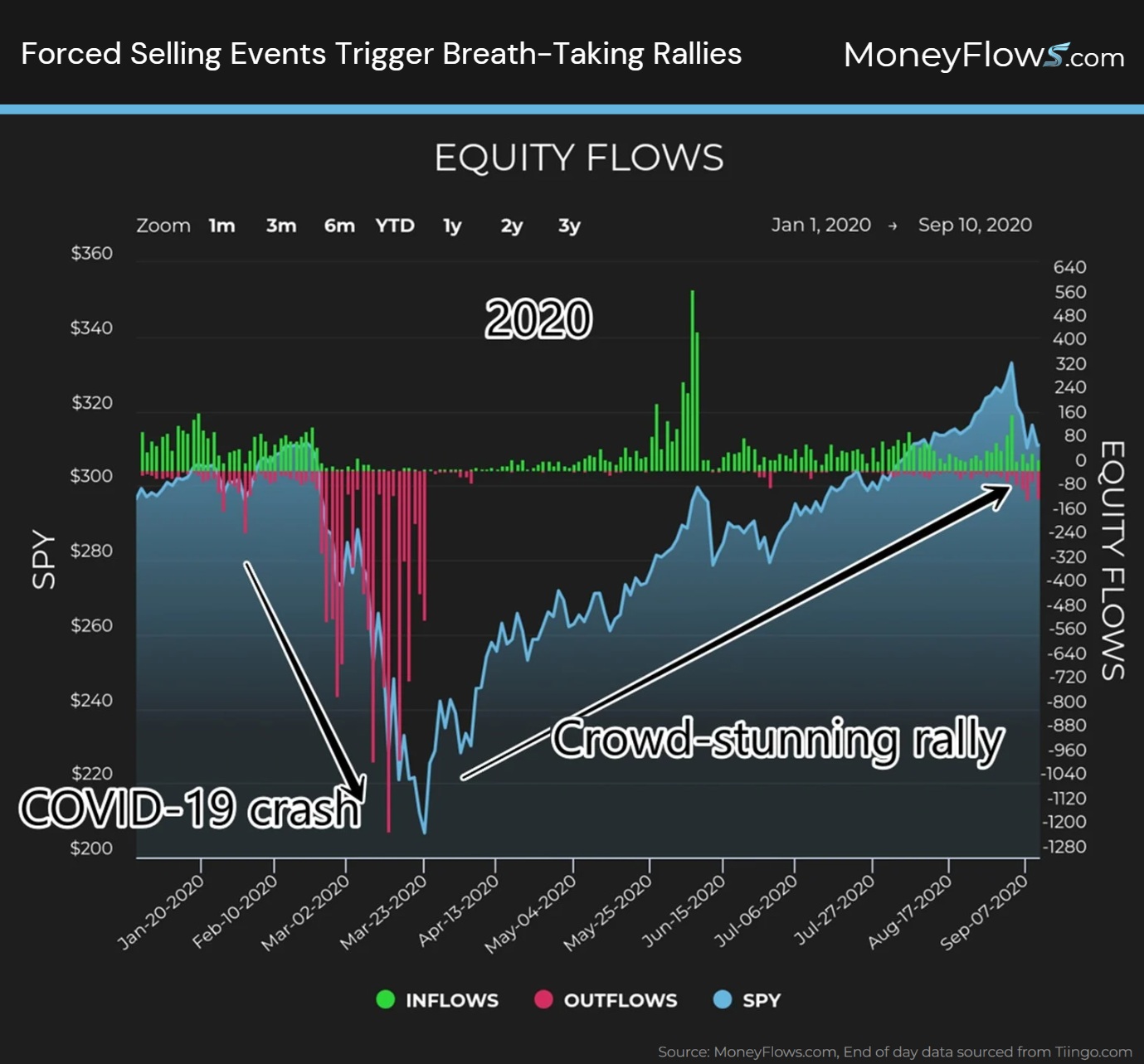

We’ve been on record many times suggesting the 2025 tariff crash and rally echoes the COVID-19 crash and recovery of 2020.

Forced selling events tend to trigger breath-taking rallies.

Here’s our data from 2020. At the market low on March 19th, we turned incredibly bullish as our data forecasted a massive rally ahead.

One of our biggest calls ever was to send the marines.

This muscle memory helped us tremendously in 2025.

When forced selling takes hold, it’s only a matter of time before value hunters step in and send stocks vertical.

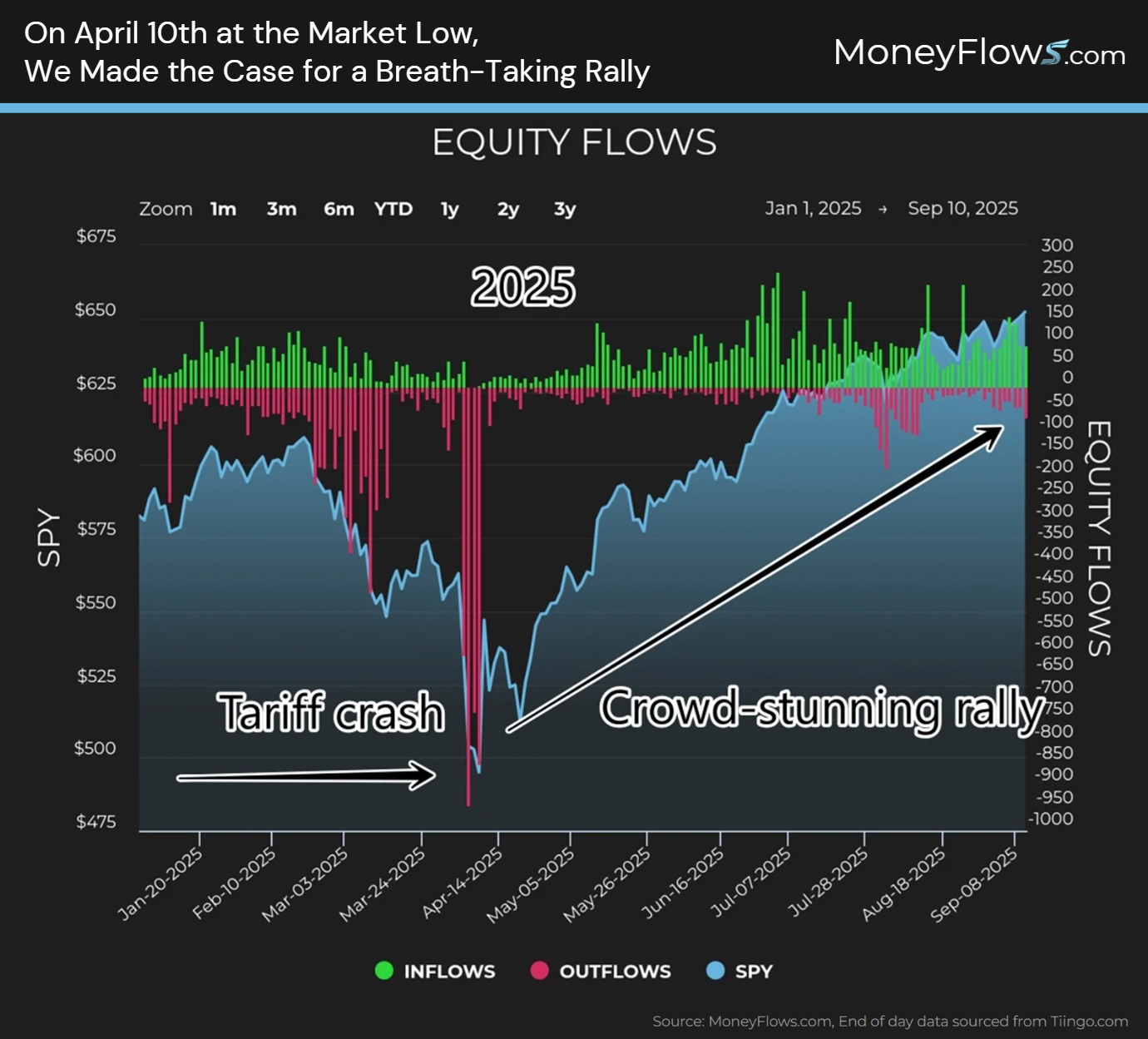

On April 10th at the market low in 2025, we made the case for a breath-taking rally.

Kudos to those of you who heeded this non-consensus advice.

I remember giving a presentation in early April to nearly 1000 people. I provided evidence suggesting the unthinkable is coming…and it did!

This takes us to today’s powerful study.

From the market low on April 8th, 2025, the S&P 500 has gained 31%.

This is the best 5-month performance since COVID-19 back in September 2020.

Here’s why this level of thrust is so important for your portfolio today.

The Undefeated Buy Signal

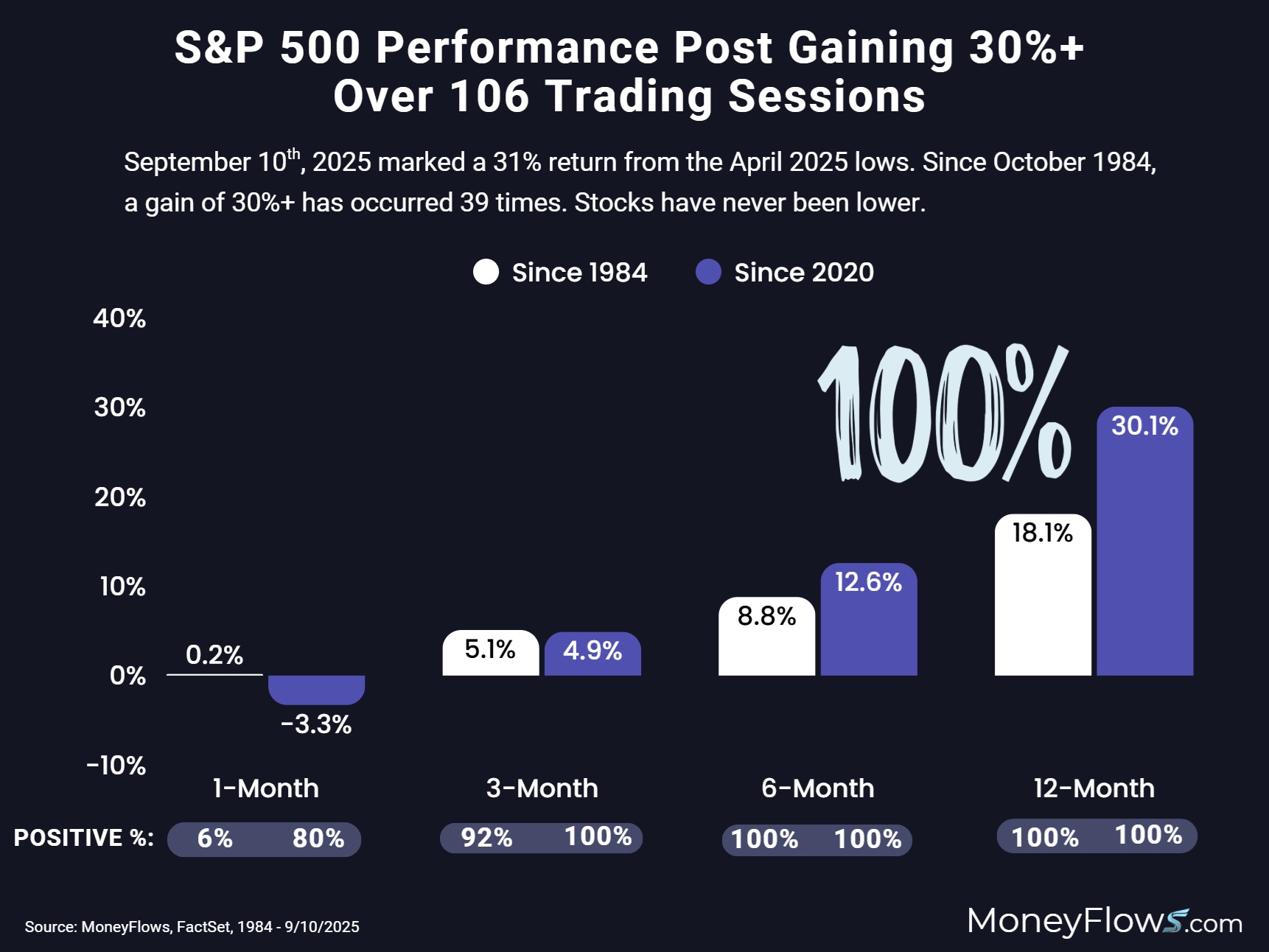

Back to October 1984, we found just 39 discrete instances where the S&P 500 gained 30% or more in 106 trading days.

The sample includes 3 periods:

- 1999

- Post-GFC 2009

- COVID-19 2025

Important to note this level of gain typically occurs after a massive washout…i.e. forced-selling event.

2025’s tariff meltdown fits right in line as it relates to extreme outflows.

Here’s why you need to remain invested in high-quality stocks.

This undefeated buy signal has been a path to unthinkable rallies.

Since 1984, when the S&P 500 has gained 30%+ over 5 months, stocks have never been lower with:

- Average 6-month gains of 8.8%

- Average 12-month gains of 18.1%

Additionally, I plotted this signal from 2020 to today and note that stocks were higher 100% of the time 3,6, and 12 months later. This buy signal is undefeated:

Folks, these rare moments are where you can make incredible gains. But you need to know where to look.

Just yesterday, we can see a bifurcation in equities. Out of 160 equity flows, 90 were inflows and 68 were outflows.

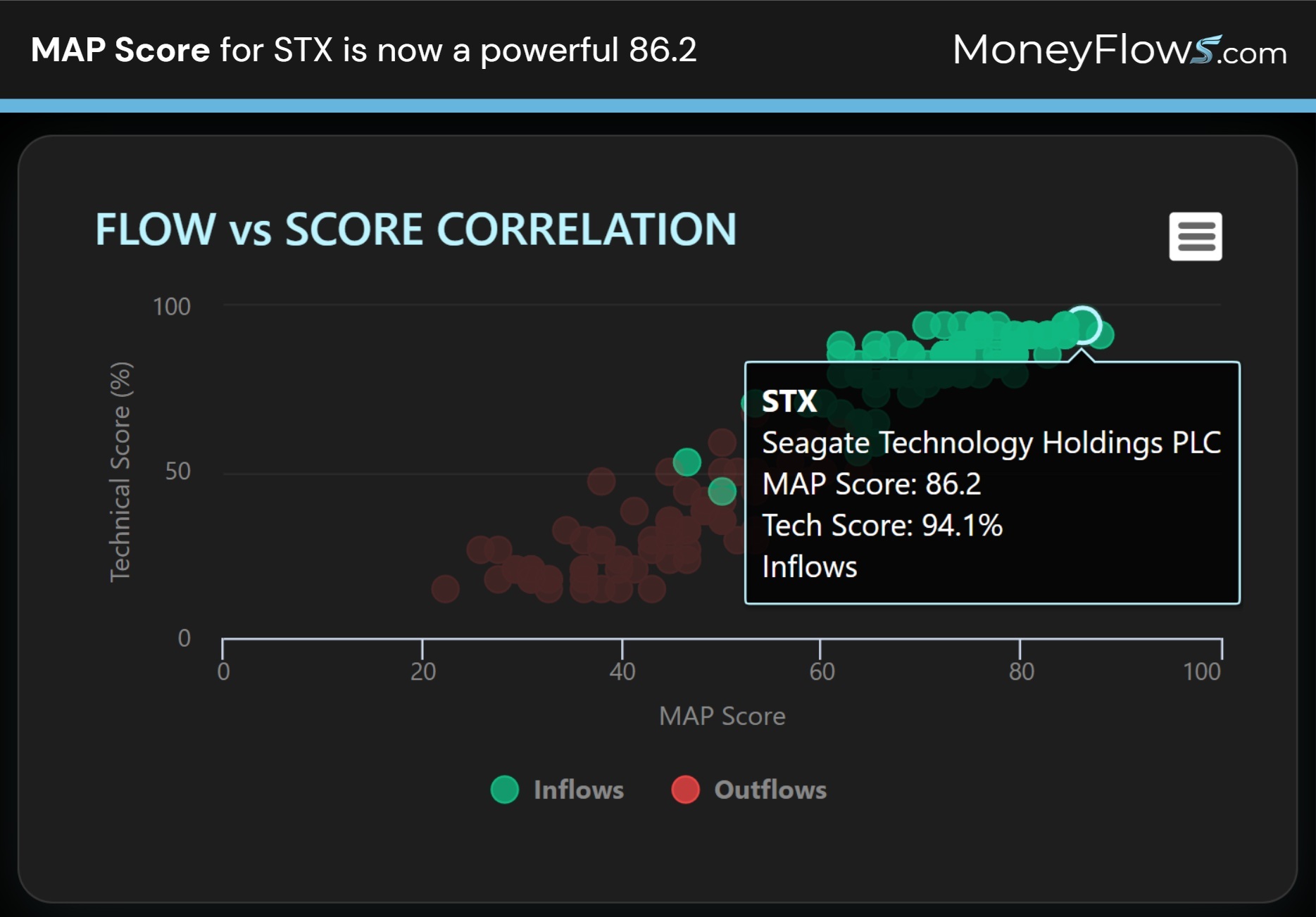

I’ve highlighted, from our portal, one name that has been under extreme accumulation from the market bottom: Seagate Technology (STX):

You can note how powerful the MAP Score is for STX, ranking at 86.2.

Few companies can command this level of sponsorship.

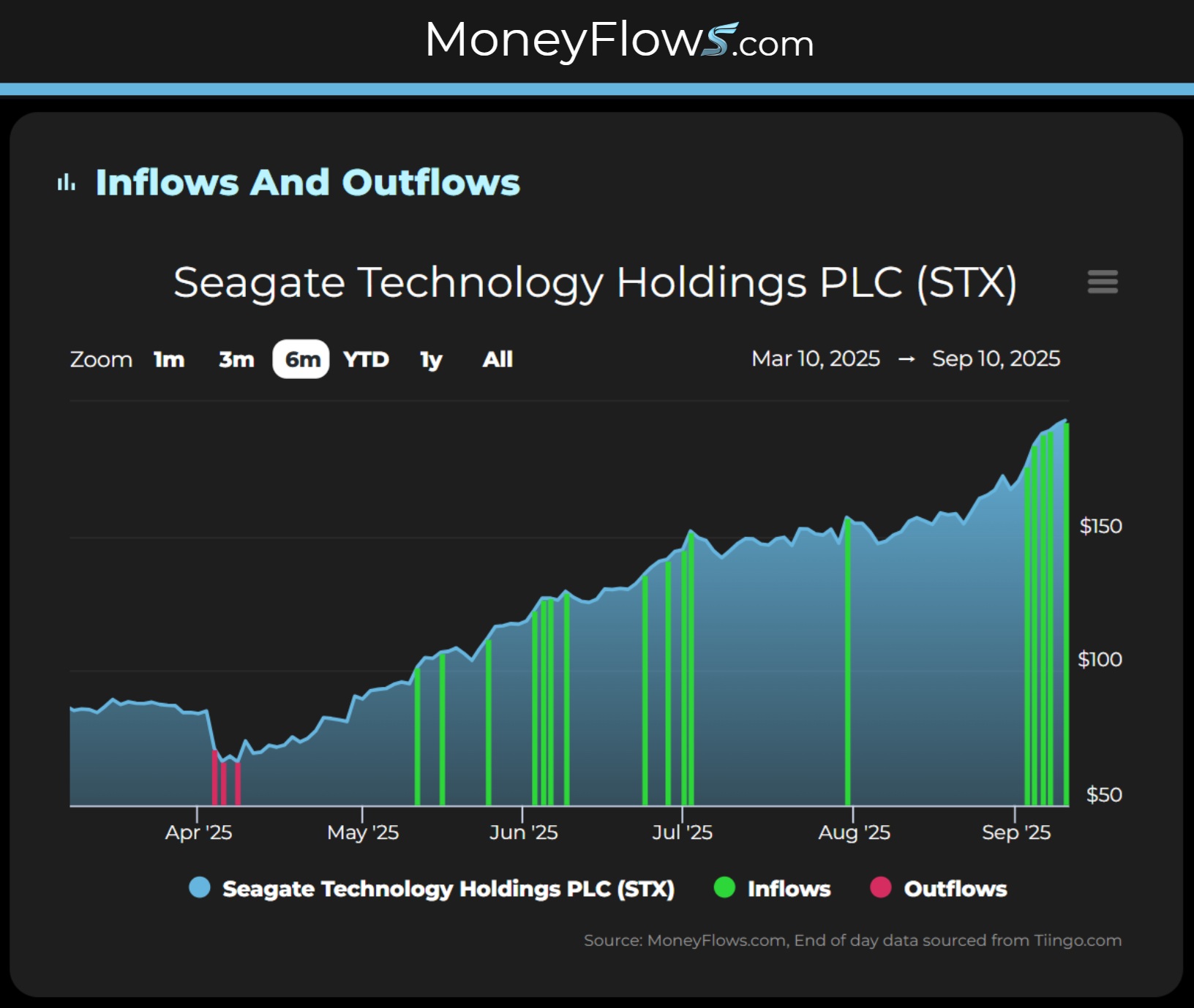

And if you think this inflow is new…think again. Institutional money flows often cluster for months as more and more money is allocated to winning trades.

Once the forced selling stopped in April, Seagate began to attract inflows.

Dozens of green signals followed, propelling the stock higher and higher.

This is why it is paramount to not only know the best stocks in the market EARLY. But also so you can research the stocks in your own portfolio.

This way you can separate the studs from the duds.

MoneyFlows does just that, making you aware of the biggest themes in this ever-changing market.

So what should you do with this information today?

Simple. Plan for a lot more upside in the months to come.

Powerful market thrusts signal more momentum is coming.

You just need a market map to help you see the alpha.

Can you invest without MoneyFlows?

Maybe.

But I can’t recommend it!

If you’re a serious investor, get started with a PRO subscription and spot the handful of stocks under accumulation day after day.

If you’re a money manager or RIA, our Advisor solution will provide you with data-driven insights you can’t find anywhere else.

That’s the winning ticket.

***Join Jason Bodner LIVE in Orlando at the MoneyShow TradersExpo, Oct. 16th -18th, as he presents: Using MoneyFlows to Identify Winning Investments.

Click the image below to register now. You don’t want to miss this!