Top Technology Stocks for October 2025

The artificial intelligence boom has kicked into overdrive.

Companies levered to data center growth and high-performance semiconductors are soaring.

Here are the top technology stocks for October 2025.

Whenever markets kick into overdrive, the best way to take advantage of it is to follow money flows.

Stocks move due to one basic law: supply and demand. When demand is high, stocks have nowhere to go but up.

Given the Fed is cutting rates, semiconductors in particular do very well.

Today we’ll dive into 3 high ranking tech stocks that have attracted immense institutional capital.

Finding the next NVIDIA (NVDA) early is possible.

Our software spots them early.

Top Technology Stocks for October 2025

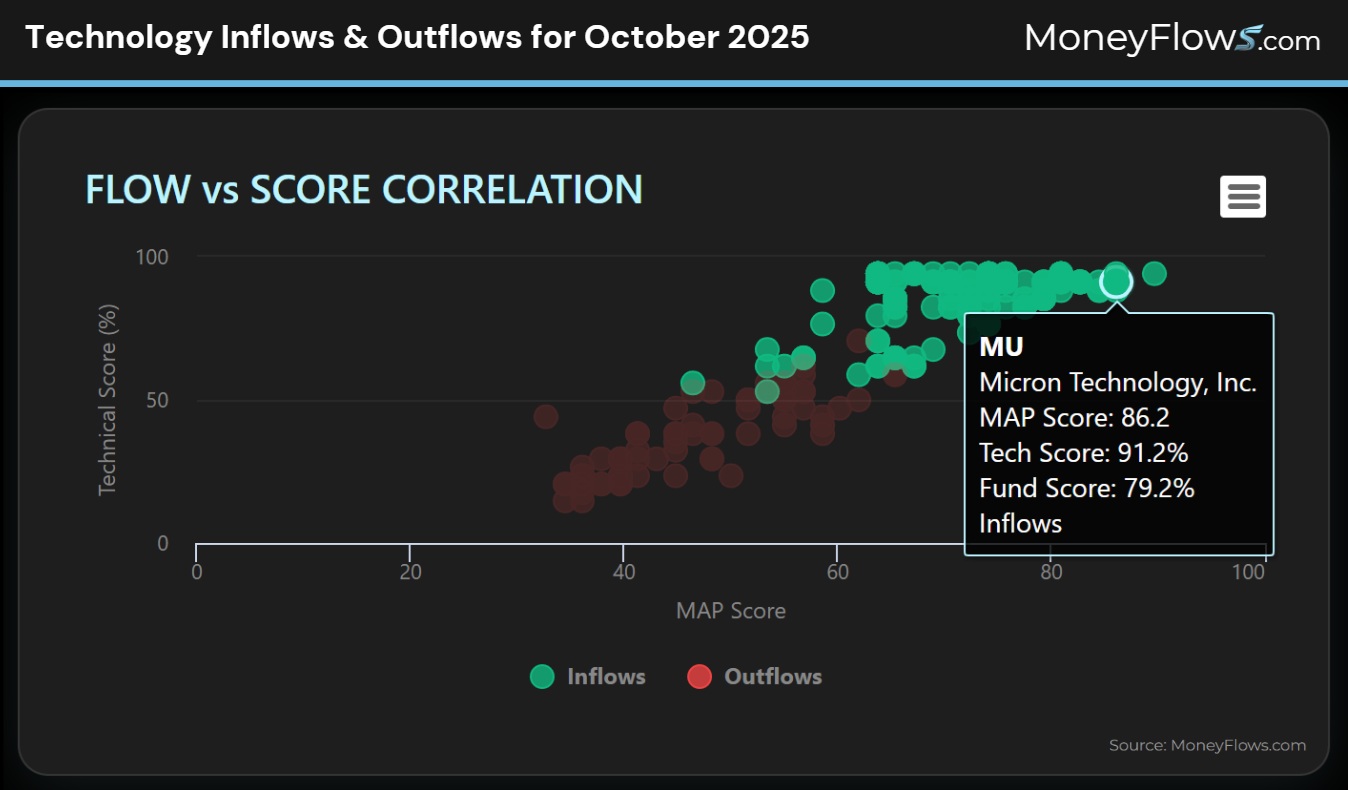

Each day we measure inflows and outflows on thousands of stocks. We break down this data by sector.

You can spot outlier stocks easily through this process.

Below are all technology inflows and outflows for October 1 – 15, 2025. You’ll notice there are quite a few green bubbles.

I hovered over Micron Technology (MU) and you’ll see a breakdown of its MAP Score, Tech Score, and Fundamental Score:

This simple process helps you spot the studs and avoid the duds.

When it comes to the best stocks, continual inflows are the hallmark trait of the best performers. Keep it simple.

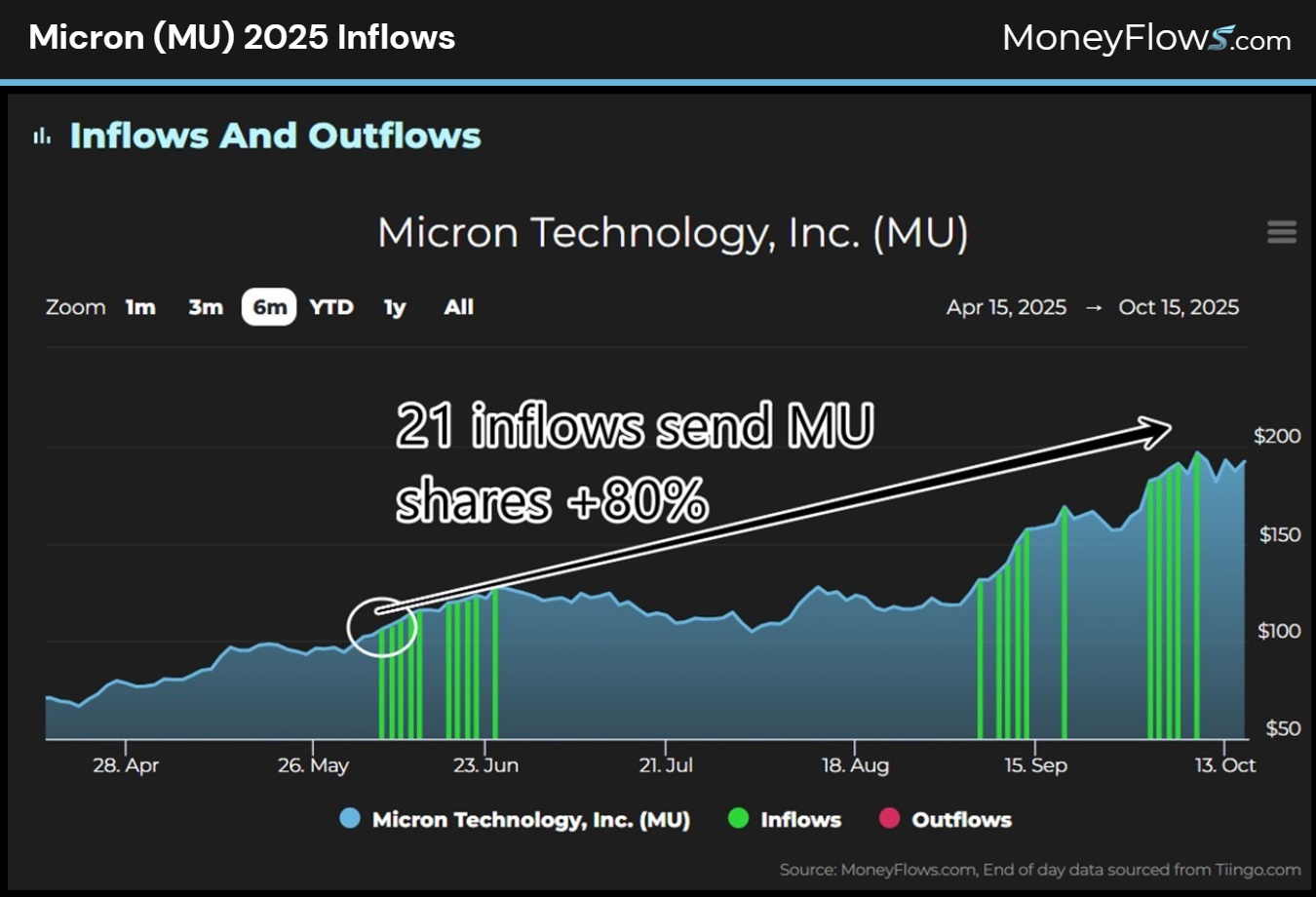

The number 1 top technology stock is Micron Technology (MU).

Micron is a memory and storage solutions provider in the fast-growing semiconductor industry.

The $214 billion market cap company outlined a rosy earnings picture in September. MU highlighted strong AI demand and an improving server business.

In the 4th quarter, the company reported $11.32 billion in revenue and EPS of $3.03, both above estimates.

But what caused the stock to jump is the Q1 guidance. Micron said EPS will be $3.75/sh +/- $.15, shattering Wall Street estimates of $3.10/sh.

Revenue guidance of $12.5B +/- $300MM also was well ahead of estimates of $11.91B.

That’s rocket fuel for a stock.

Often, a beat and raise is priced into the stock ahead of time.

Check out this chart of flows. MU shares have recorded 21 continuous inflows, beginning in early June…demand for the shares have sent the stock up 80% since the first buy signal:

Investing is easy when you’re on the right side of the Big Money! Let’s keep going.

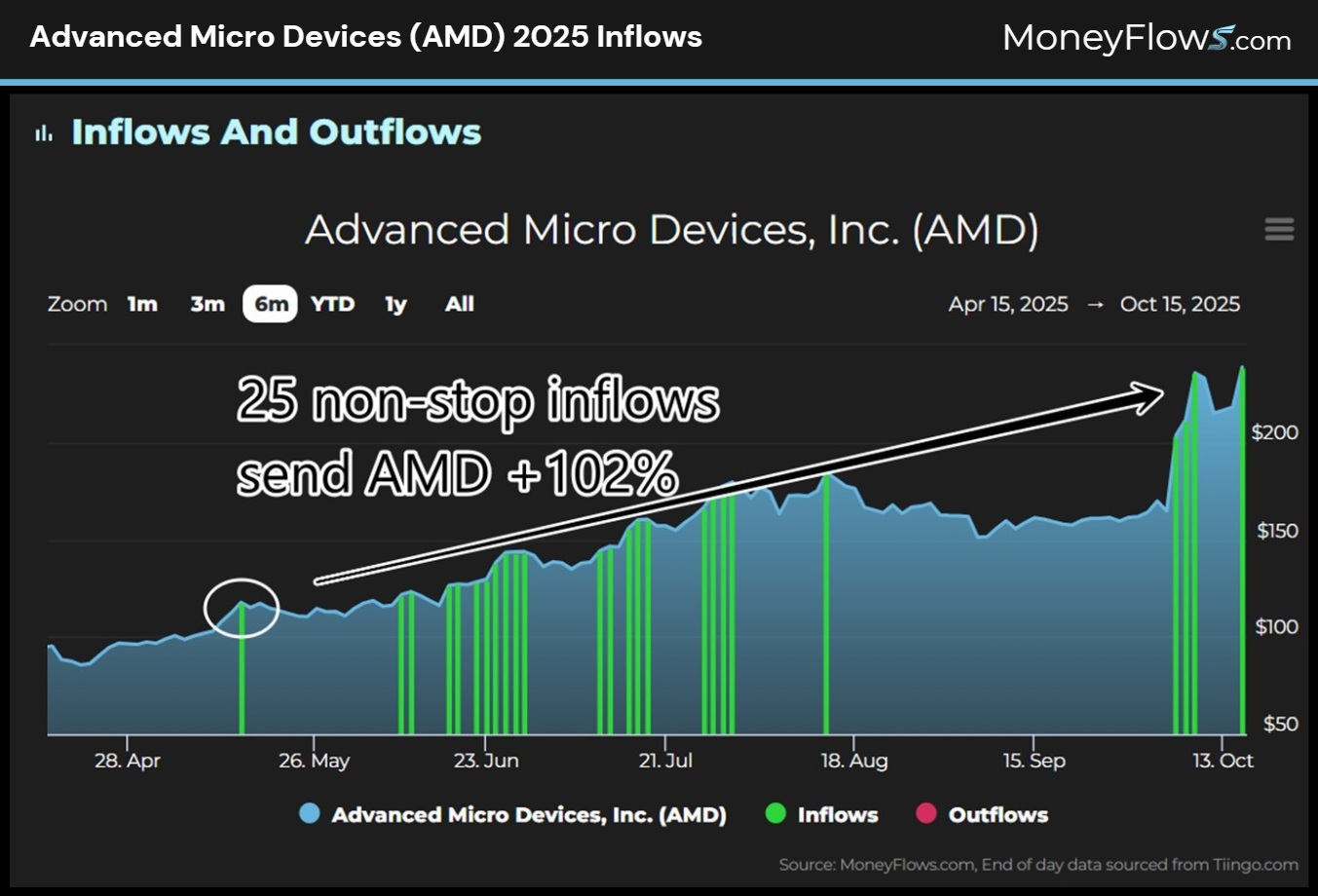

The number 2 top technology stock for October 2025 is Advanced Micro Devices (AMD).

AMD is another hypergrowth semiconductor player operating in the hot data center space including AI accelerators, CPUs, GPUs and more.

AMD is the ultimate AI trade. The $387B market cap firm is slated to see revenues jump to $33.1 billion in 2025 while net income surges to $6.48 billion.

Recent news of a deal with OpenAI to deploy 6 gigawatts of AMD GPUs sent the shares to all-time highs recently.

Even more, headlines that Oracle Cloud will deploy 50,000 AMD chips beginning in 2026 has further jolted the shares.

But this move has been in place since May. The stock recorded 25 inflow signals powering the stock +102% since the initiation:

Money flows help you spot trends early in their development.

Let’s do one more.

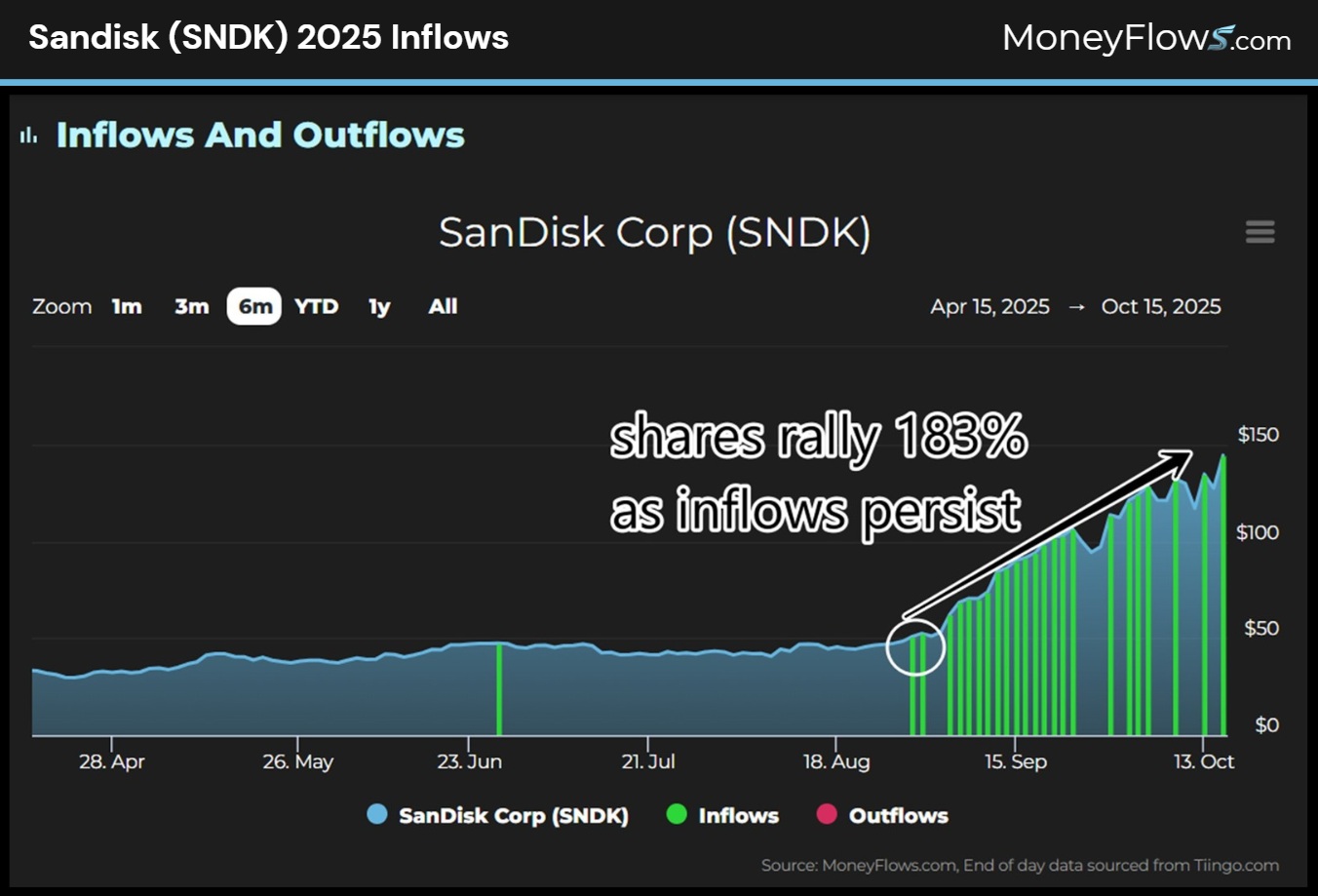

The number 3 top technology stock for October 2025 is SanDisk Corp. (SNDK).

SanDisk is a fast-growing manufacturer of storage and flash solutions. SNDK is levered to hyperscalers and the data center boom.

The $21 billion market cap firm is estimated to see revenues climb to $7.35 billion in 2025 and $ 9 billion in 2026.

Net income is slated to turn positive to the tune of $872 million in 2026.

A wall of institutional sponsorship has sent shares rallying 183% since late August.

Powerful inflows are responsible for SanDisk’s climb:

Our process helps investors “be early” to trends.

All powerful stock moves reflect institutional demand.

As we enter the bullish fourth quarter, make sure your portfolio is armed with the best Technology names attracting capital day after day.

That’s how you outperform and find all-star growth stocks.

Our proprietary software allows PRO subscribers to spot our top-rated stocks every single day. You can search for flows on any stock, too.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

Don’t waste this bull market by buying low-quality stocks.

Be early.

And always go with the flows.

***Lastly, December 1 – 3rd, join co-founder Jason Bodner LIVE at the MoneyShow Masters Symposium in Sarasota, FL. As he presents: Quantitative Intelligence: The Best Stocks to Own for 2026.

Click the image below to register now. You don’t want to miss this!