Top 2 Outlier Stocks in 2025

We are living through one of the most powerful rallies in history.

Extreme capitulation creates incredible stock picking environments.

MoneyFlows spots compounders early.

Here are the top 2 outlier stocks in 2025.

The key to winning over and over in the stock market is to understand the overall supply and demand trend.

It’s simple. Follow the money flows.

Our most powerful real-time leading indicator, the Big Money Index (BMI), is our North Star.

At the Tariff crash low of 2025, we pounded the table that money flows were flipping positive…and to position for a crowd-stunning rally.

Catching a swift bounce in indices is fun…but it doesn’t hold a candle to outlier stocks.

Those are the rare stocks exhibiting both high MAP scores and inflows.

Today we’ll briefly describe the current market conditions and showcase the 2 stocks that made our Outlier 20 list the most in the first half of 2025.

If you think the Magnificent 7 are the only stocks working right now…I’ve got news for you.

2020 Crash and Recovery Analog is Still in Play

We are witnessing history.

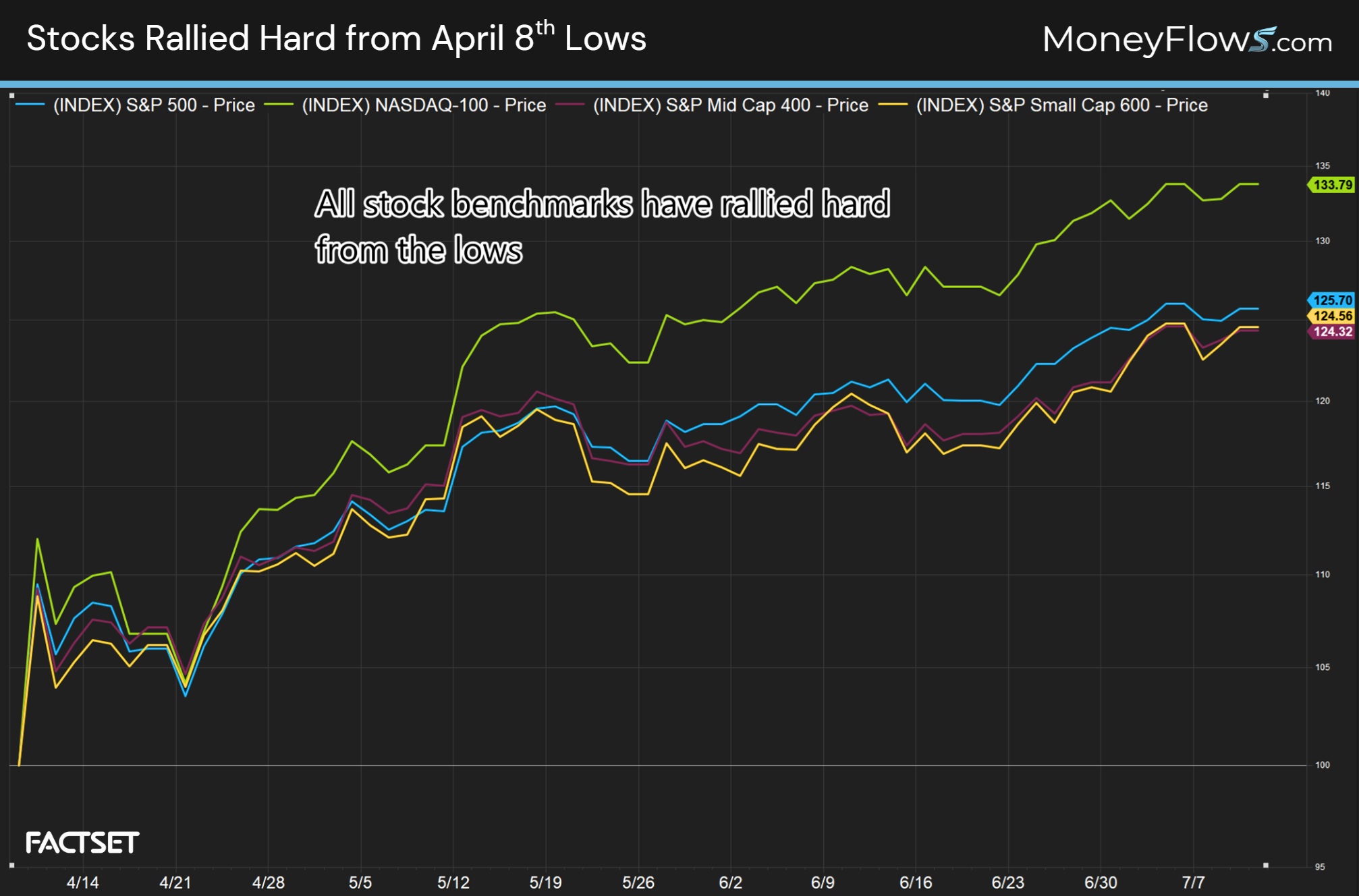

From the market low on April 8th, the S&P 500 has jumped 25.7%. The S&P Small Cap 600 and S&P Mid Cap 400 have each gained 24%.

On top is the NASDAQ 100 with a 33.8% rally in 3-months:

As shocking as this may appear on the surface, we weren’t surprised one bit.

The reason? Historical precedent.

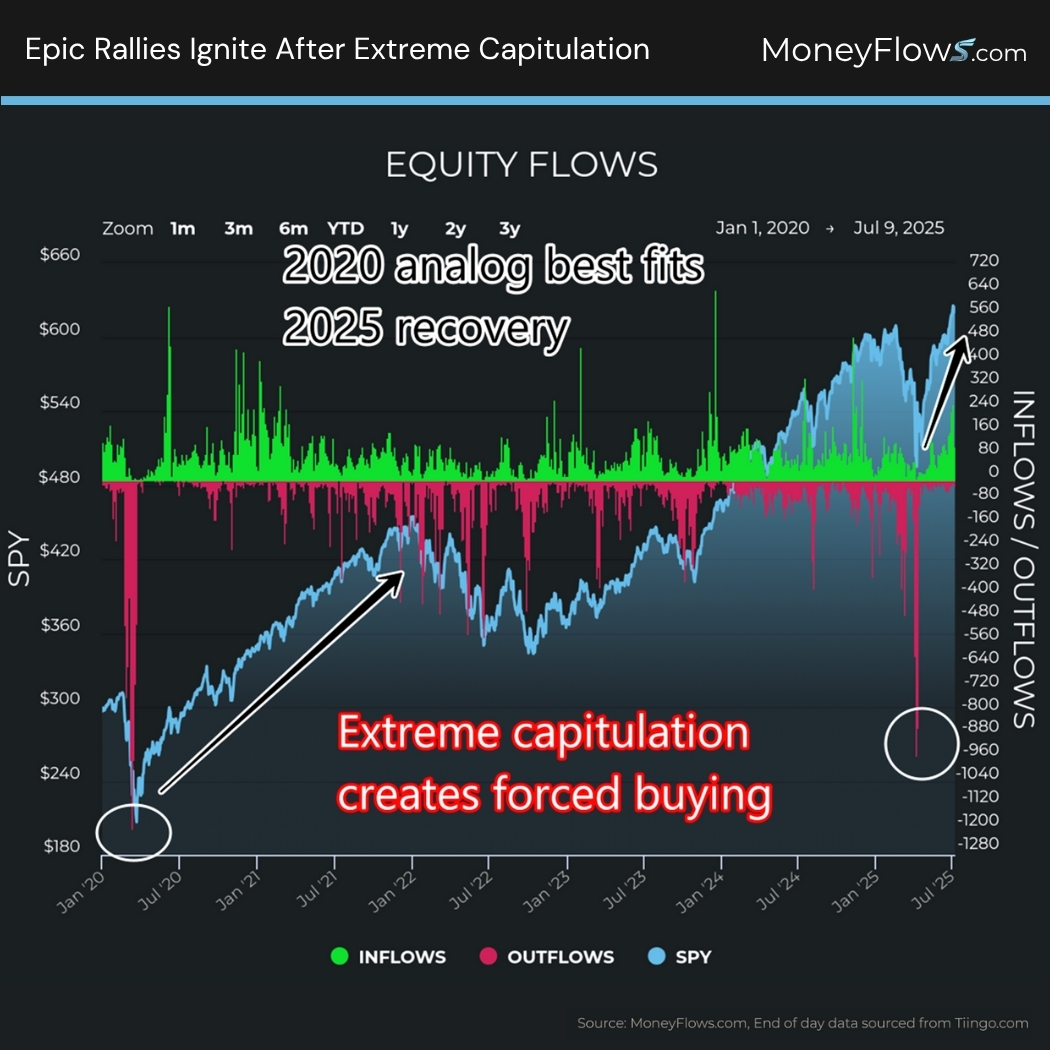

The Tariff crash in 2025 saw the most equity outflows since the COVID-19 bottom. We all remember the breath-taking rally that followed the March 2020 bottom.

We’ve learned time and time again that extreme capitulation of this level:

- Rarely lasts long

- And it kickstarts a crowd-stunning rally

Below is our daily equity flows chart. Epic rallies are ignited when the crowd violently dumps stocks:

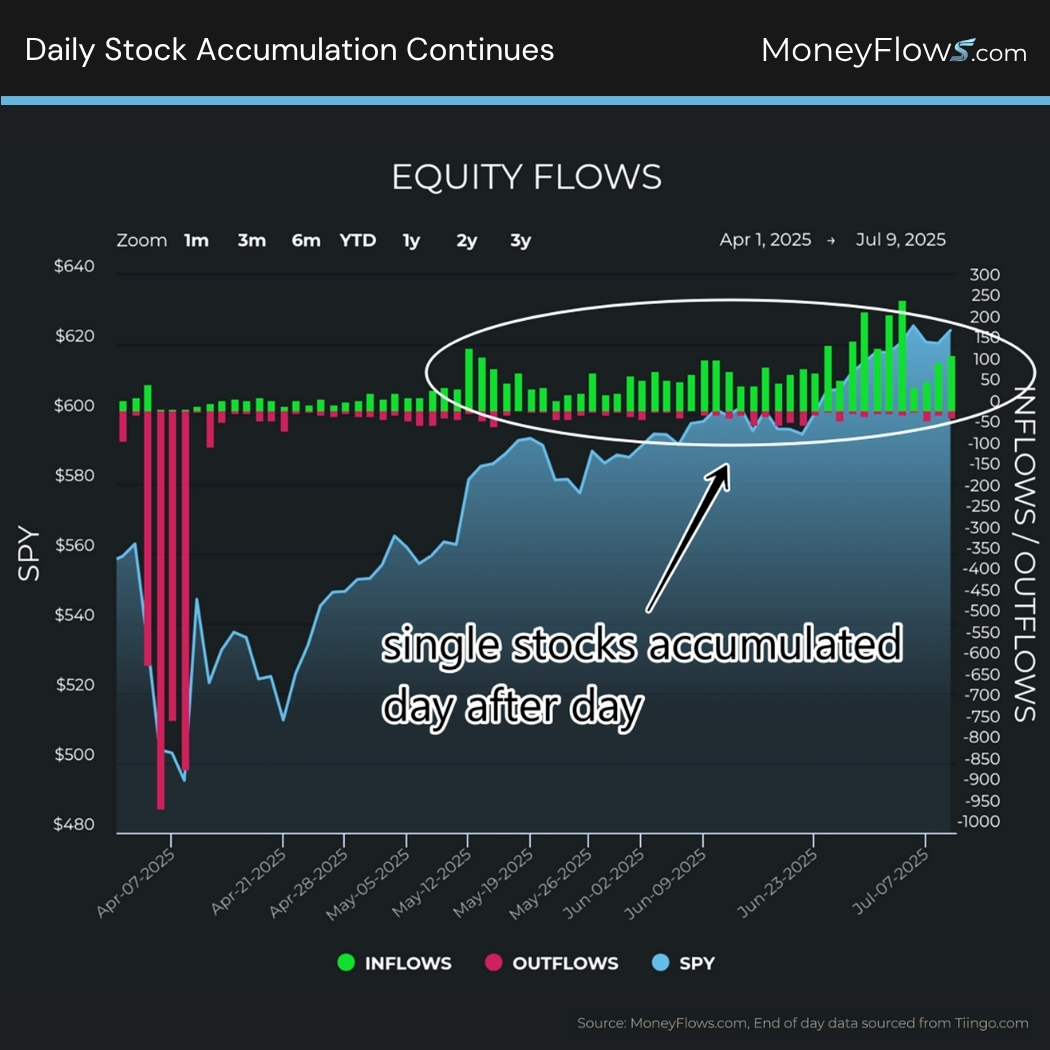

9 weeks ago, we told you to expect forced buying…all of those tall green bars are discrete stocks being scooped day after day.

Money is being put to work.

Given such a powerful backdrop, I want to clue you in on how we use mounds of data to uncover outlier stocks in real time.

This is the holy grail of investing.

Top 2 Outlier Stocks in 2025

Most know us as market breadth experts. What you may not realize is we score thousands of stocks and ETFs every single day.

We use a 29-factor model that ranks every company based on fundamentals like earnings growth expectations, sales estimates, and other forward-looking datapoints.

The technical factors incorporate momentum and obviously the quality of money flow signals.

But here’s why it’s powerful.

When you sift through hundreds of stocks each week under accumulation, and sort stocks from highest score to lowest score, you find outliers.

Our Outlier 20 report isolates the 20 highest ranked inflows each week. This is the report that found NVIDIA in 2015…and Super Micro Computer (SMCI) in 2022.

All of our daily flows are single stocks where a handful are getting bought day after day:

Sitting on institutional trading desks taught us to respect money flows…especially all-star stocks.

The number 1 Outlier stock in 2025 is Agnico Eagle Mines (AEM). This under-the-radar gold exploration company has seen earnings explode.

In 2023 net income stood at $1.94 billion. Estimates peg that number to soar to $3.33 billion in FY2025.

With expected earnings growth of this magnitude, it should come as no surprise that institutions were all over this company over the past 12-months.

Again, our process is built to find tomorrow’s winners early.

Below reveals each time AEM made our Outlier 20 report…that’s the stairway to heaven!

We learned of this name when it traded for a fraction of the size.

This little-known company has benefited from a surging net income picture. Remember, institutional investors hunt for outsized expect profits.

In 2024, SRAD saw net income reach $37 million. Expectations are that this number will more than 3X to $166.4 million in FY 2026.

This is why bets have been made continuously on SRAD the past year.

All outlier stocks in our data have this rare inflow pattern:

So let’s drive this all home.

Understanding the money flows picture is paramount. That’s the market North Star.

Also understand that forced buying reveals tomorrow’s winning stocks…today.

Now that the 2nd half of 2025 is here…this is one of the best environments for picking stocks that are NOT on the lips of the media.

If you are a money manager or an advisor looking to add MoneyFlows research to your platform, learn about our Advisor solutions here.

Finally, I had a chance to catch up with an RIA yesterday and we discussed current market conditions and so much more. Check it out on X here.

Also, if you’d like to read our research commentary at the market bottom in April, we posted it word for word here.