Sloppy September

September is seasonally bumpy.

In fact, since 1990 it is the weakest month of the year with only 40% of Septembers since then finishing the month with positive returns.

Should we stress over a potentially sloppy September?

The answer, as always, lies in the data.

Sloppy September?

A quick look under the hood shows us what we might expect going forward…

The Big Money Index (BMI) measures the 25-day moving average of inflows vs. outflows. It is composed of 25 individual days of inflow/outflow ratio data.

Simply put, if there is even one more inflow signal than outflow on a given day, obviously inflows outnumber outflows.

Looking at the daily ratios, or the individual days that comprise the BMI, we can measure what percent are above 50% quite easily to determine when inflows have the upper hand.

It turns out since 1990, looking at over 8,959 trading day observations, 6,705 were above 50%. That’s 74.8% of the time tracking a market that is in uptrend a majority of the time since 1990.

That checks out.

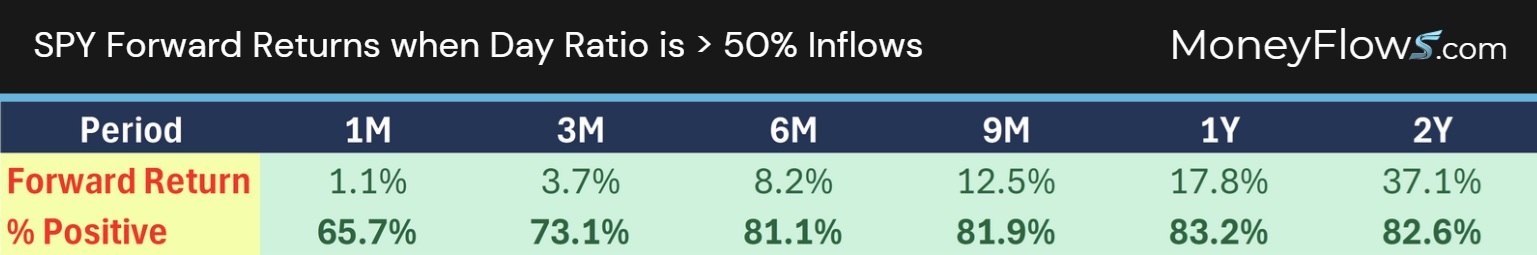

SPY began trading on January 29th, 1993. Since then, on the days those inflows outnumbered outflows by even just 1, forward returns for 1-, 3-, 6-, 9-months, 1- and 2-years afterwards were solid with a high win rate:

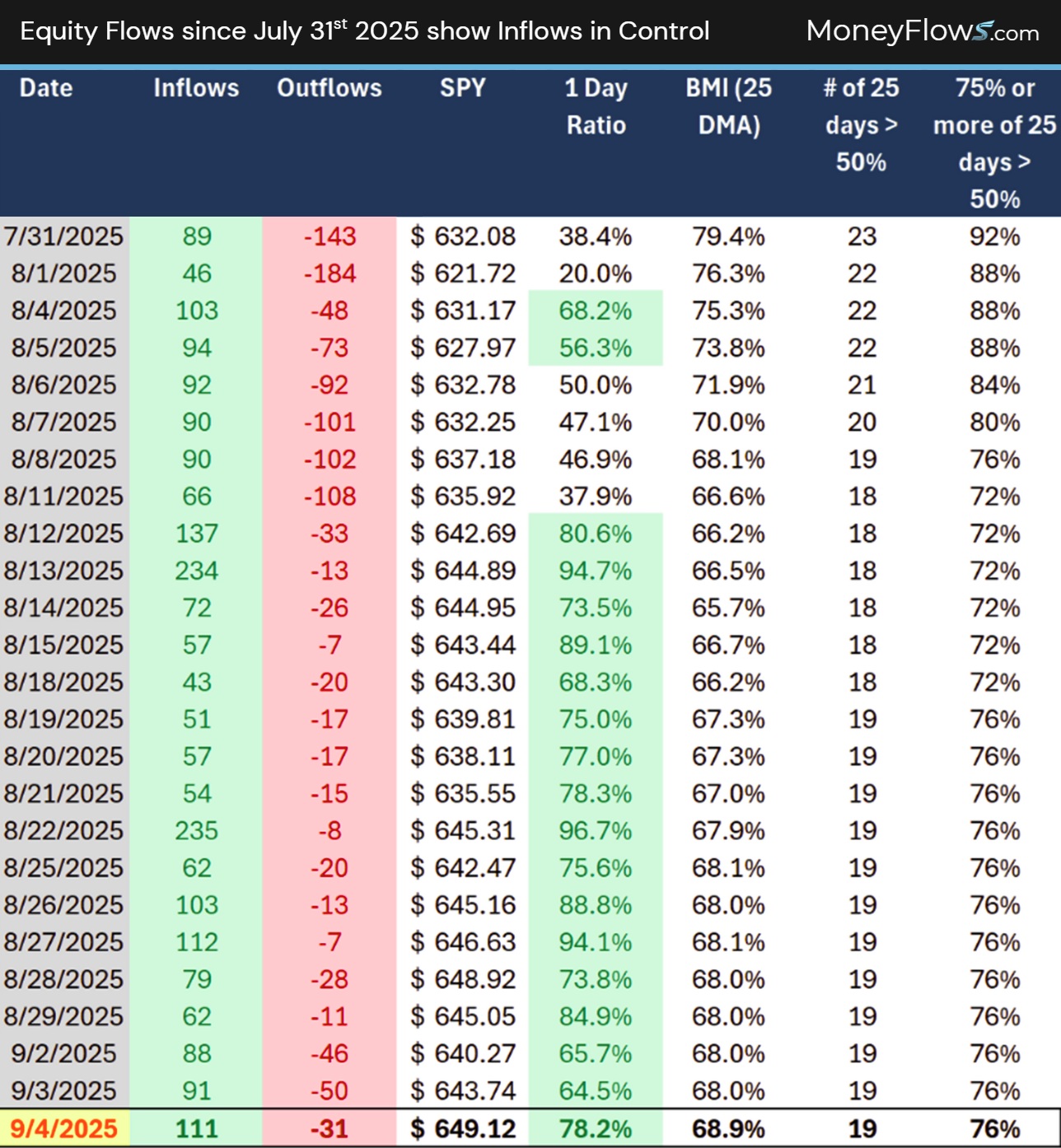

Since July 31st of this year, which marked the beginning of early August weakness, 76% of the 25 trading days have had the daily inflow/outflow ratio over 50% – meaning inflows outnumber outflows.

This is how things shake out over the last 25 trading days:

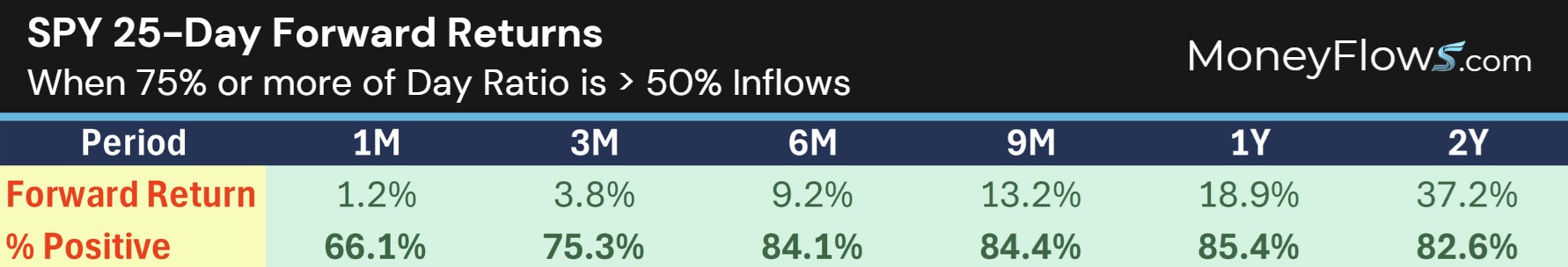

When we look back historically for 25 day rolling periods where 75% or more of the days were above 50% inflows/outflows, just like now.

We identified 4,144 times this happened.

This is just 46.2% of history, substantially lower in percentage terms than day ratios above 50%.

The returns look even stronger with a higher win rate:

History says prepare for a turbulent September, but the current data says the market may just shrug off what history says it is supposed to do.

Stay data dependent my friends!

If you want to learn more about our proprietary indicators and how we find the best stocks in the market, check out our PRO subscription.

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here.

***Also, join me LIVE in Orlando at the MoneyShow TradersExpo, Oct. 16th -18th, as I present: Using MoneyFlows to Identify Winning Investments.

Click the image below to register now. You don’t want to miss this!