Rapid Disinflation Will Send Equities Higher in 2026

Happy new year everyone!

As we kick off 2026, inflation still nears the top of the bears’ worry list.

Pundits profess that tariffs will keep prices high and Fed policy tight, leaving stocks ripe for a big drawdown.

Just don’t fall for it. The real risk is disinflation...not rising prices.

Today, we’ll show you why rapid disinflation will send equities higher in 2026.

Then, we’ll highlight which sectors stand to win and lose in the current pricing environment.

As a bonus, we’ll wrap up with a list of top institutional outliers in the best positioned sectors.

Rapid Disinflation Will Send Equities Higher in 2026

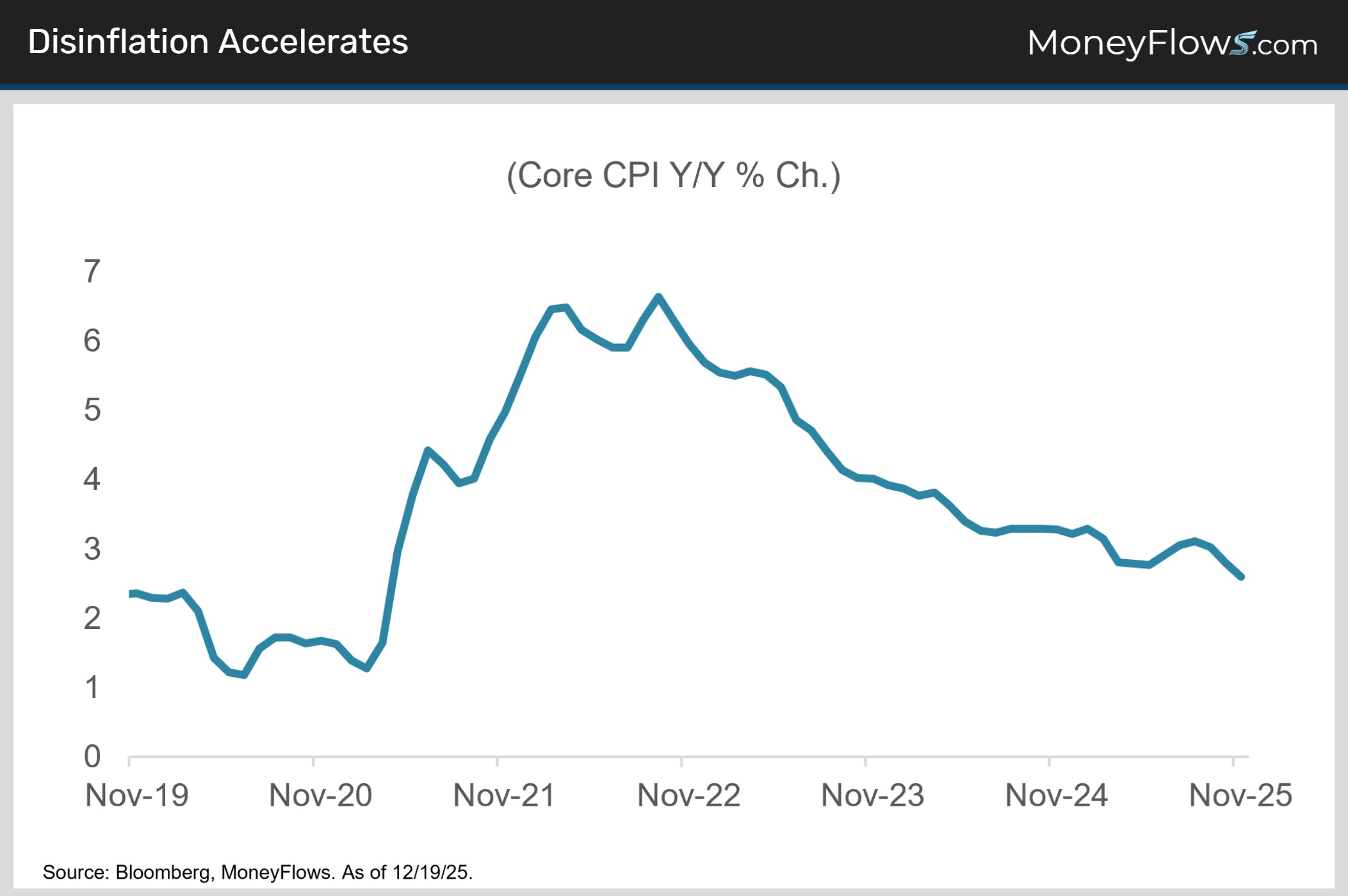

Inflation isn’t just falling, the pace of the decline is accelerating.

Core CPI rose just 2.6% year-over-year in November, marking the lowest reading since 2021 (chart). That compares to a 3.3% rise a year ago.

But thanks to tariffs, handwringing about an imminent inflation resurgence abounds. Many on the Fed share this sentiment.

All the noise is keeping many investors sidelined.

We’ve been calling for slowing inflation since COVID-19.

We’re sticking with the “under” on inflation.

Here’s why:

- As goods prices start lapping the onset of tariffs last spring, expect disinflation to continue.

- Owner occupied rent – a big component of core CPI – finally reflects the reality of a sluggish housing market after lagging for months due to government reliance on lagging, stale data.

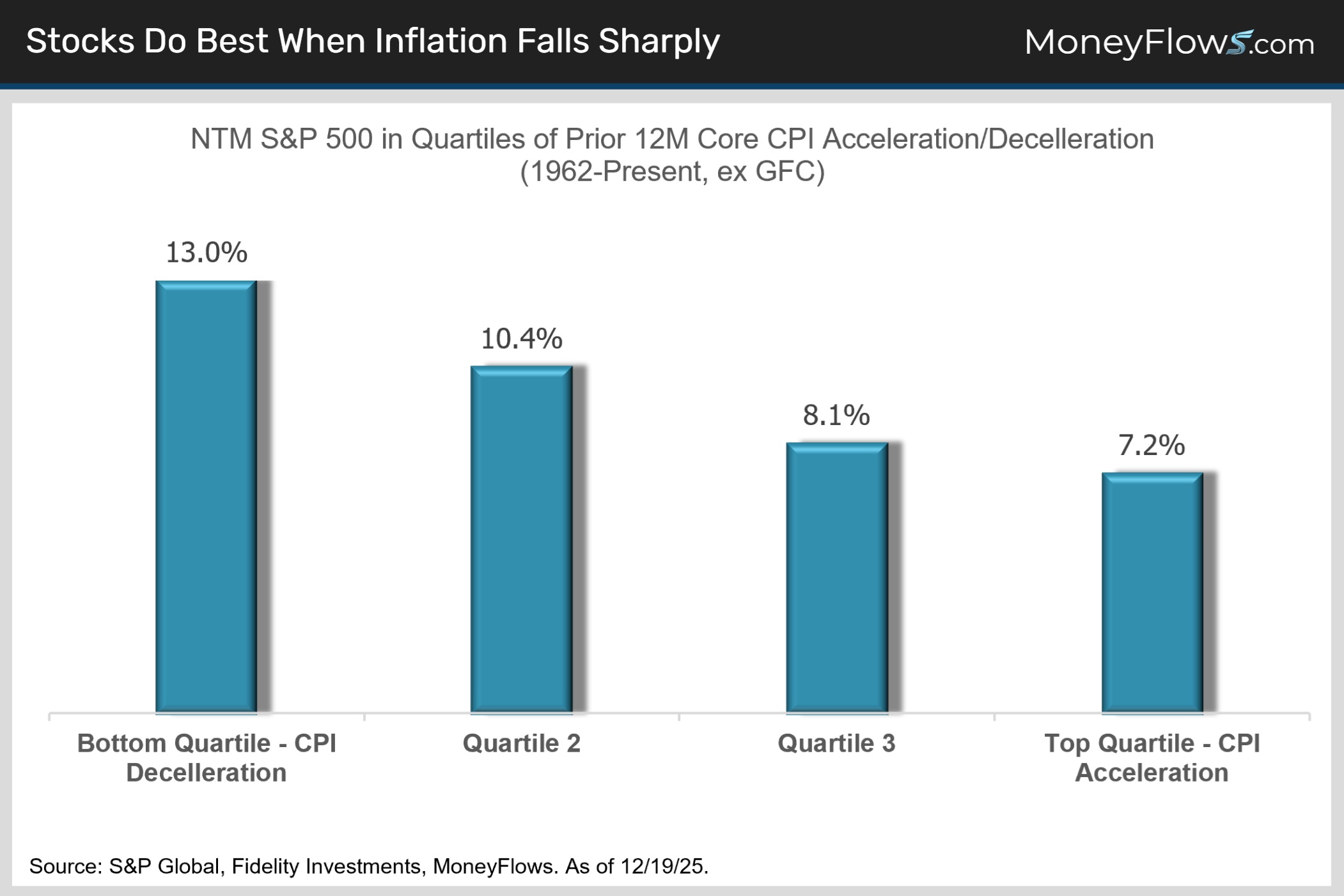

Historically, disinflation has been a clear tailwind for stocks.

We analyzed how stocks do in various inflation regimes.

Outside of a deflationary crisis like the Great Financial Crisis in 2008, the bigger the inflation slowdown, the better the equity gains tend to be over the next 12 months.

It turns out that when inflation decelerates sharply - as it has over the past year - the S&P 500 has averaged 13% gains over the following 12 months, almost double the 7% average gain when inflation rises (chart).

Here’s the bottom line.

If the disinflation trend holds, add it to the list of macro tailwinds that can drive stocks higher in 2026.

Falling Prices Favor Cyclicals over Defensives

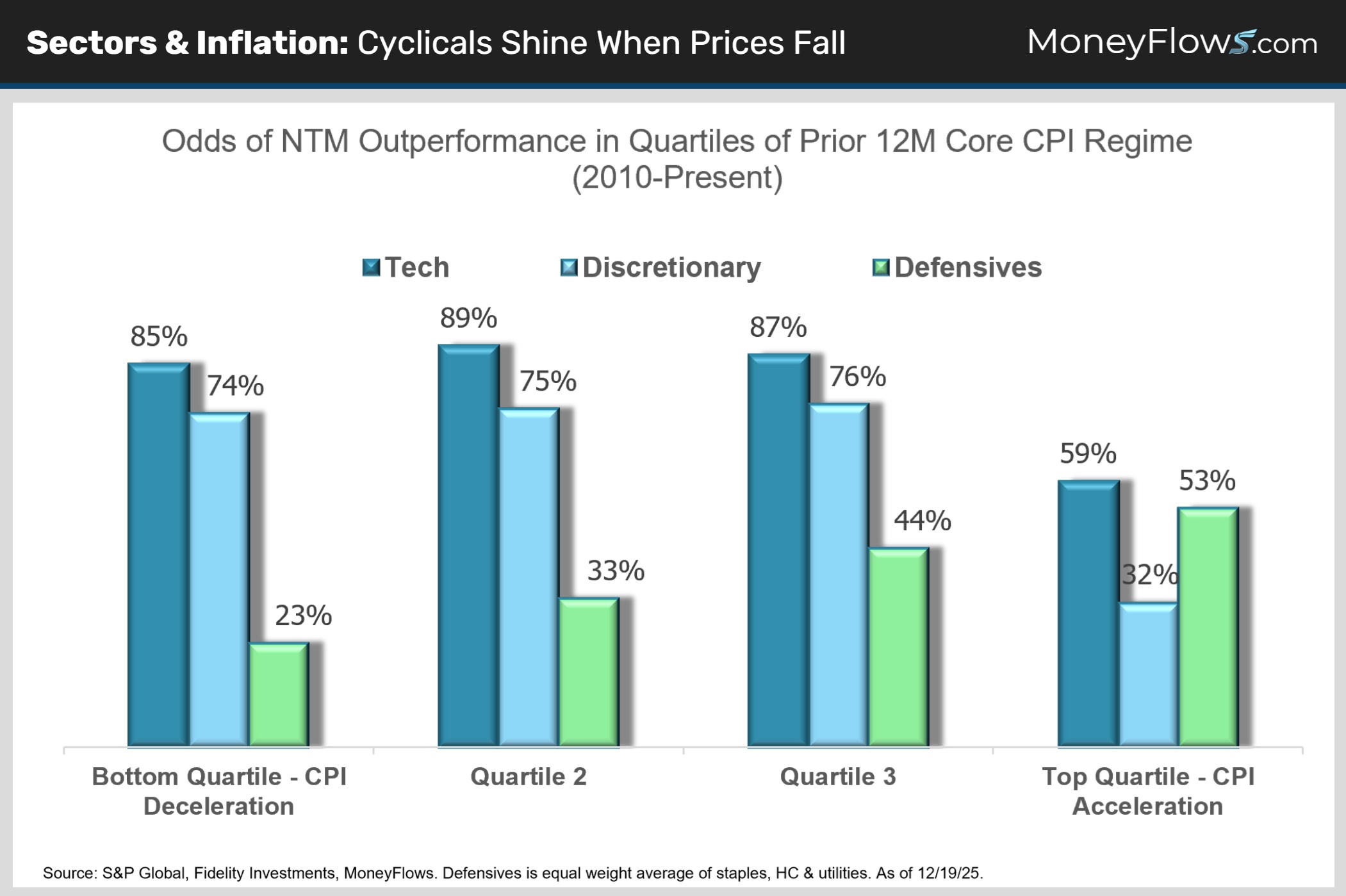

For the past 15 years, disinflationary trends have had clear sector implications.

They have tended to favor pro-cyclical areas, with Technology and Consumer Discretionary historically posting strong odds of outperformance, while defensives like Staples, Utilities and Healthcare have tended to lag.

If disinflation sticks in 2026, cyclical leadership looks likely yet again.

The setup has the potential to be more of the same - durable growth, slowing inflation, and a secular bull market that just refuses to quit.

This is an environment to be offensive rather than defensive:

Now for the best part.

Let’s wrap up with a list of disinflation winners in the technology and discretionary sectors.

Performance dispersion in these sectors is high right now, meaning there’s a big gap between winners and losers.

This is where the MoneyFlows process shines bright. Our data is built to find the outlier stocks ahead of the crowd.

Where most research houses got it wrong in 2025, MoneyFlows got it right.

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get access to our proprietary indicators and learn how our unique money flow approach finds outlier stocks early. Give it a shot!

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here.

Good things happen when you follow the data instead of the crowd!

This time, be early.

Our process helps investors “be early” to trends.

Go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.