Middle East War & Stock Market Projections

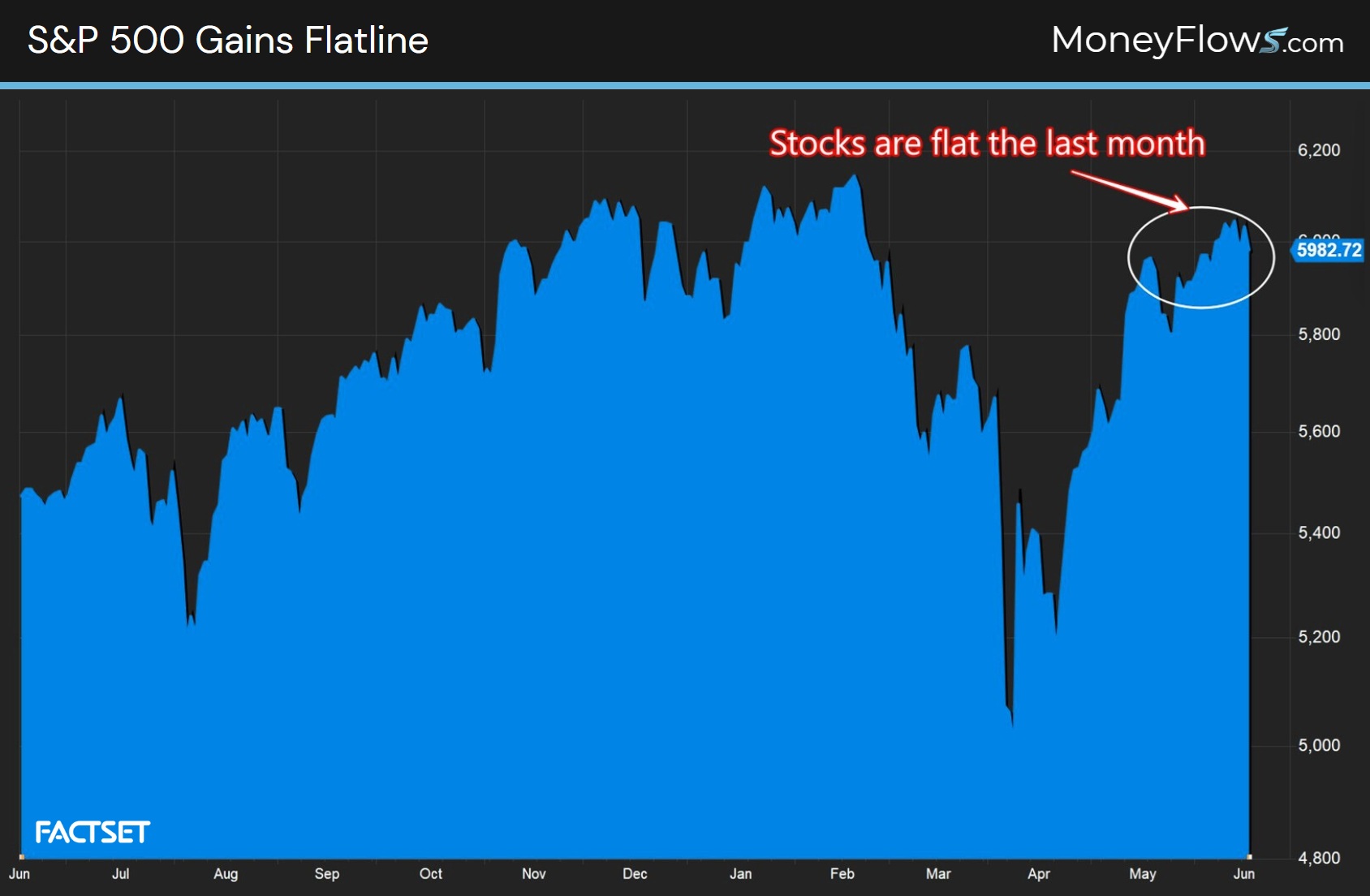

Stocks have gone nowhere in the last month.

Much of this lackluster performance may be attributed to the Israeli conflict with Iran.

Let’s unpack a Middle East war & stock market projections playbook.

Geopolitical events are never fun to sit through. Whether it’s wars, debt downgrades, tariffs, or rate shocks – uncertainty is unsettling.

And while the future is unknown, at MoneyFlows we’ve come to learn that overreacting often proves costly.

We discussed a geopolitical playbook back in April 2024 after the Iran attack on Israel. Our message then was to study history for guidance.

Bailing out of stocks would’ve proved costly given the 18.6% rally in the S&P 500 ever since.

In a similar vein, today we’ll offer up a robust geopolitical signal study, looking at dozens of geopolitical events and market returns.

Then we’ll study a handful of prior Middle East tensions for clues.

Finally, we’ll offer up a top-quality nuclear company that’s under heavy accumulation…and it’s setting up for large gains ahead.

Geopolitical Events and the S&P 500

Stocks have been rangebound lately with the S&P 500 flatling.

Some of this could be due to overbought conditions.

…Or the latest Middle East skirmish between Israel and Iran.

Markets have gone nowhere in the last month:

To me, it’s clear that the uncertainty around the Middle East conflict is creating volatility.

But should investors hit the sidelines?

Maybe.

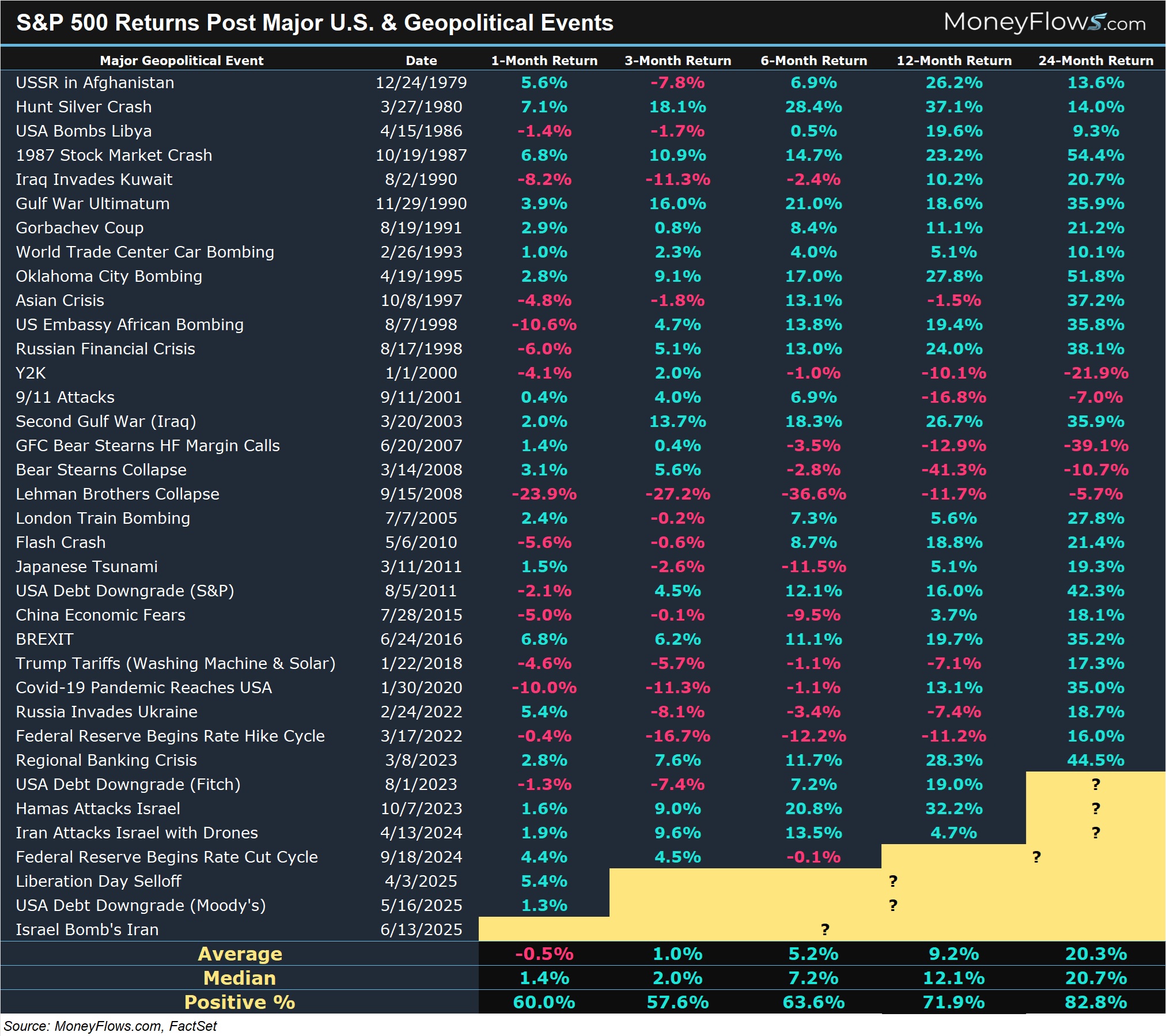

But a historical lookback at 35 prior geopolitical events proves otherwise.

Below I’ve culled together dozens of major geopolitical events and the average S&P 500 performance.

These events include the 1987 stock market crash, Y2K, wars, USA debt downgrades, regional banking crisis and even the Liberation Day tariff situation.

Here’s why you shouldn’t overreact to geopolitical events. The S&P 500 tends to show modest declines near-term, before recovering months later.

Here’s how the S&P 500 performs after major geopolitical events since 1979:

- 1-month average declines of -.5%

- 3-month average gains of 1%

- 6-month gains of 5.2%

- 12-month gains of 9.2%

- 24-month returns of 20.3%

With this geopolitical framework in hand, let’s take it a step further and study similar situations to now.

Middle East War & Stock Market Projections

All Middle East conflicts are different. We can’t be completely certain about the outcomes.

That said, we can learn a thing or 2 from history.

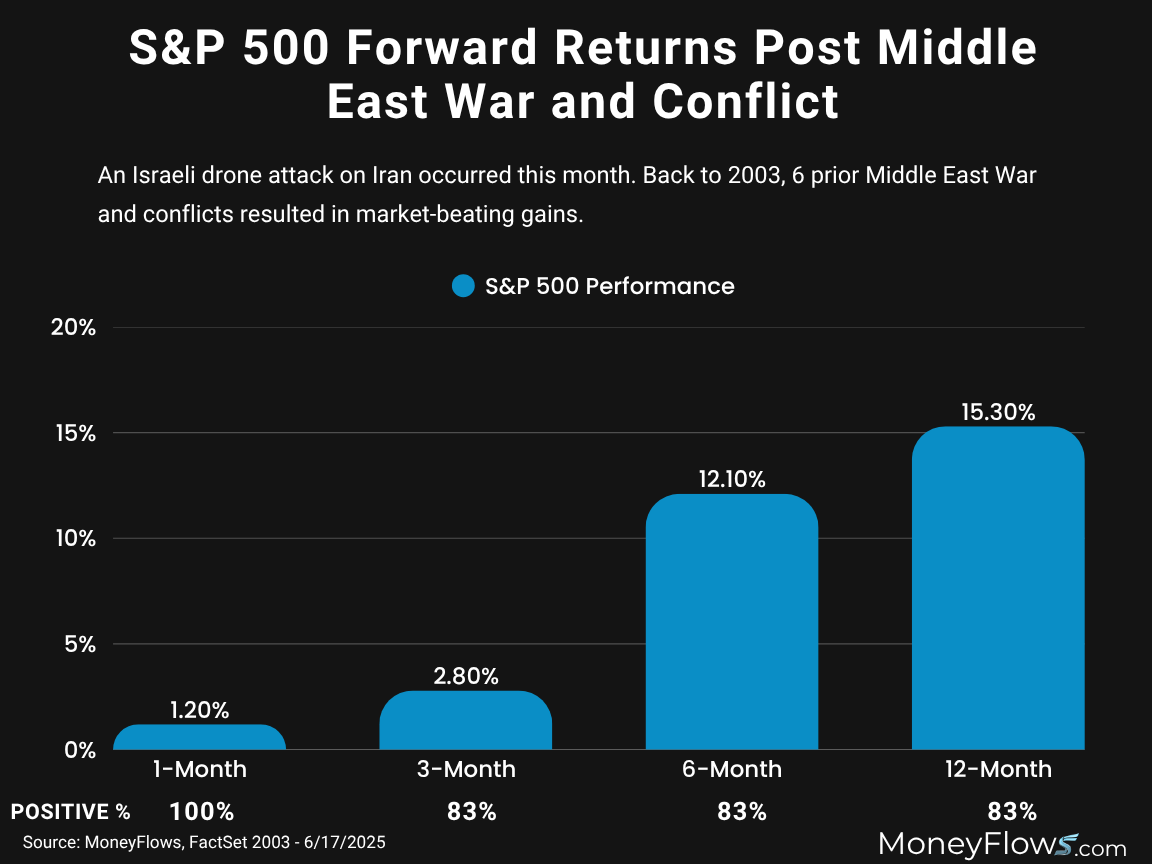

I took the above geopolitical study and singled out 6 specific Middle East conflicts including:

- The Second Gulf War (Iraq 3/2003)

- Israel/Hezbollah War (7/2006)

- Soleimani Assassination (U.S./Iran 1/2020)

- Israel/Gaza Conflict (5/2021)

- Hamas Attacks Israel (10/2023)

- Iran attacks Israel (4/2024)

While the following study is limited, note how strong equities tend to perform after these shocks.

Here’s how the stock market performed post prior Middle East conflicts:

- 1-month later the S&P 500 gains 1.2%

- 3-months later the S&P 500 jumps 2.8%

- 6-months later the S&P 500 climbs 12.1%

- 12-months later the S&P 500 climbs 15.3%

Given this evidence-based study, what’s an investor to do?

Easy.

First, you don’t want to overreact. You should monitor market conditions with powerful indicators like the Big Money Index.

If stocks are a bad bet, the BMI will alert you to a change in money flow trends.

Second, and likely more important, focus on outlier stocks thriving under the surface of the market.

We’re in the midst of a massive bull market with plenty of under-the-radar names climbing day-after-day with institutional sponsorship.

One the biggest themes in markets right now is nuclear energy. To be clear, there’s a ton of fluff in this space.

However, one stock in particular has recently shown up on our Outlier 20 report due to its healthy fundamental outlook and constant Big Money inflows.

We see this name as one of the clear leaders in the nuclear space. Get access to this high-ranking company below by becoming a PRO member.

Learn why serious investors and money managers rely on data-driven analysis for their edge.

Our Outlier 20 report has had plenty of outstanding growth names recently.

But one name in particular should be on your radar today.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.