How to Find All-Star Dividend Stocks

Markets rotate, sending stocks up and down over time.

Strategies shift in and out of favor.

But dividend-growth investing constantly compounds.

Here’s how to find all-star dividend stocks.

Dividends are simply a share of profits that companies pay investors simply for holding their shares.

You’ve heard Warren Buffett describe dividend growers as the secret sauce to monster gains…and he’s 100% right.

Today, we’ll look at why dividend growers need to command a slice of your portfolio. We’ll even prove how this select group of stocks will dampen volatility.

Then I’ll show you the formula for how to pick the best dividend companies… and the traits to focus on.

…while adding an elite list of 20 dividend growth stocks.

Money is rushing into dividend stocks right now…and this will be a big theme as we head into 2026.

Fed Rate Cuts Make Money Market Rates Less Attractive

Let’s discuss why now is a wonderful time to hunt for dividend growth stocks.

The Fed is cutting interest rates with more on the way.

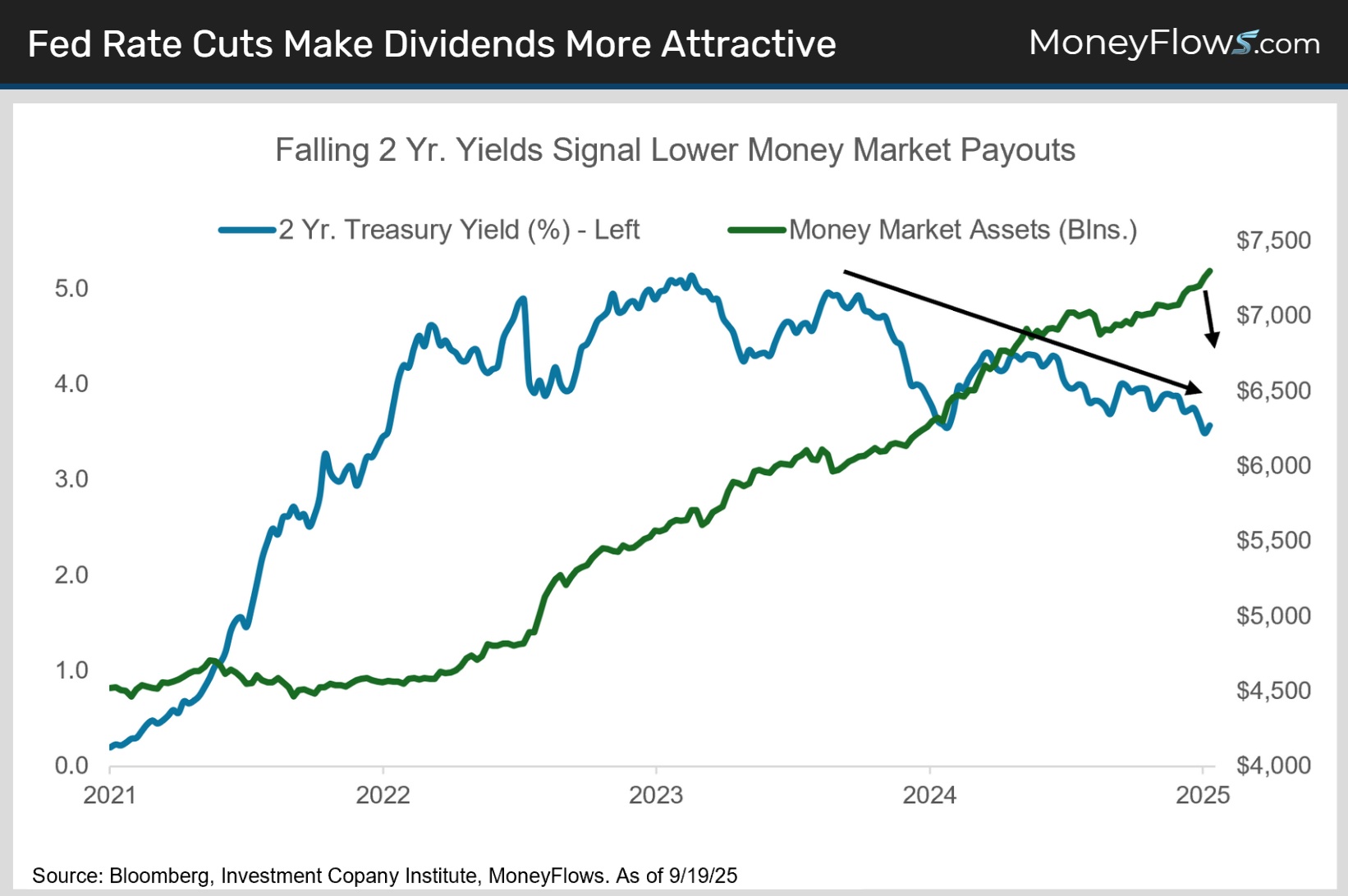

Back in 2022 when the Fed began hiking interest rates, a surge of capital rushed into money markets for safe payouts.

At last measure, the amount of cash parked in money market products is right at $7.5 trillion earning north of 3.5% yield.

As the Fed cuts rates, those juicy yields will decline, making money markets less attractive. The latest 2-year treasury yield sits right at 3.6%:

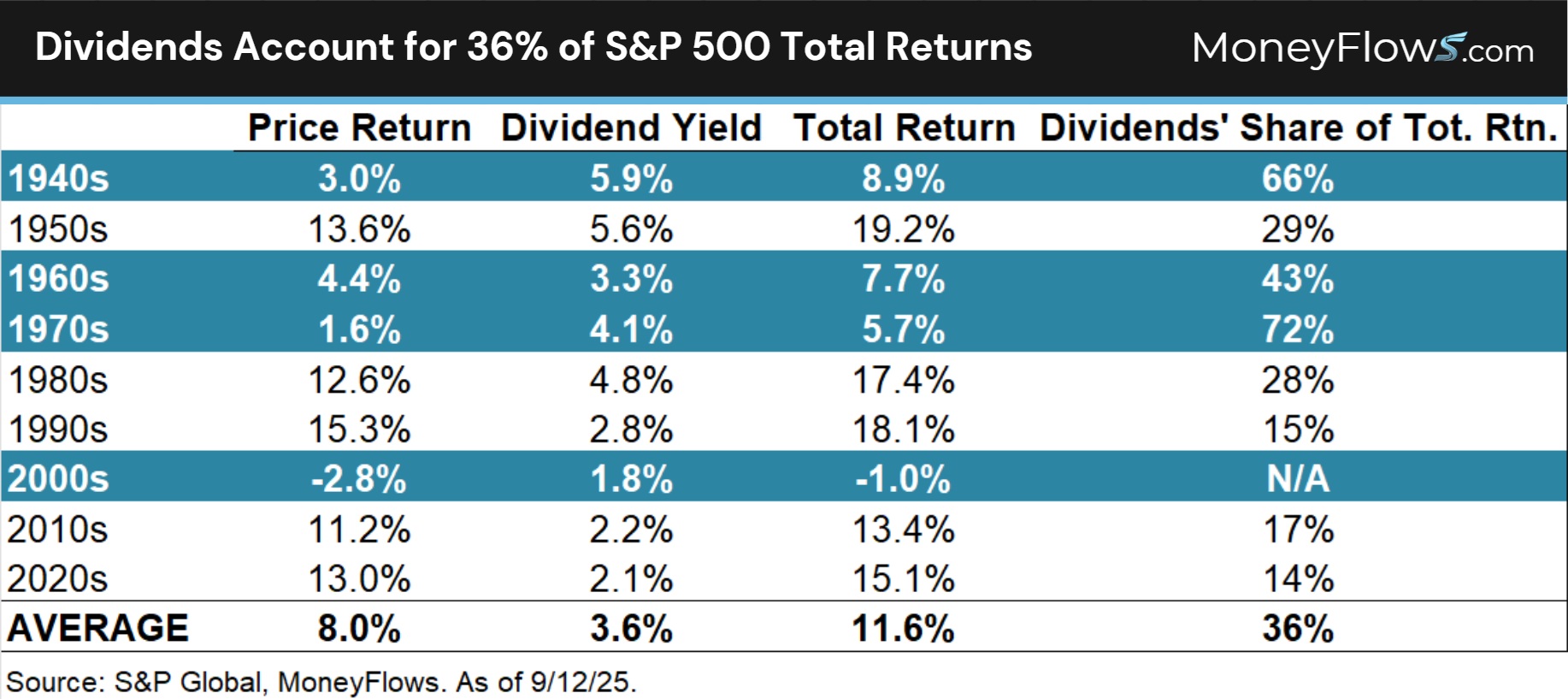

And it’s not like dividend investing is a new game…dividends have been a massive part of the S&P 500’s total return spanning decades.

Since the 1940s, dividends are responsible for over 1/3rd of the market’s total return. Good luck investing without them!

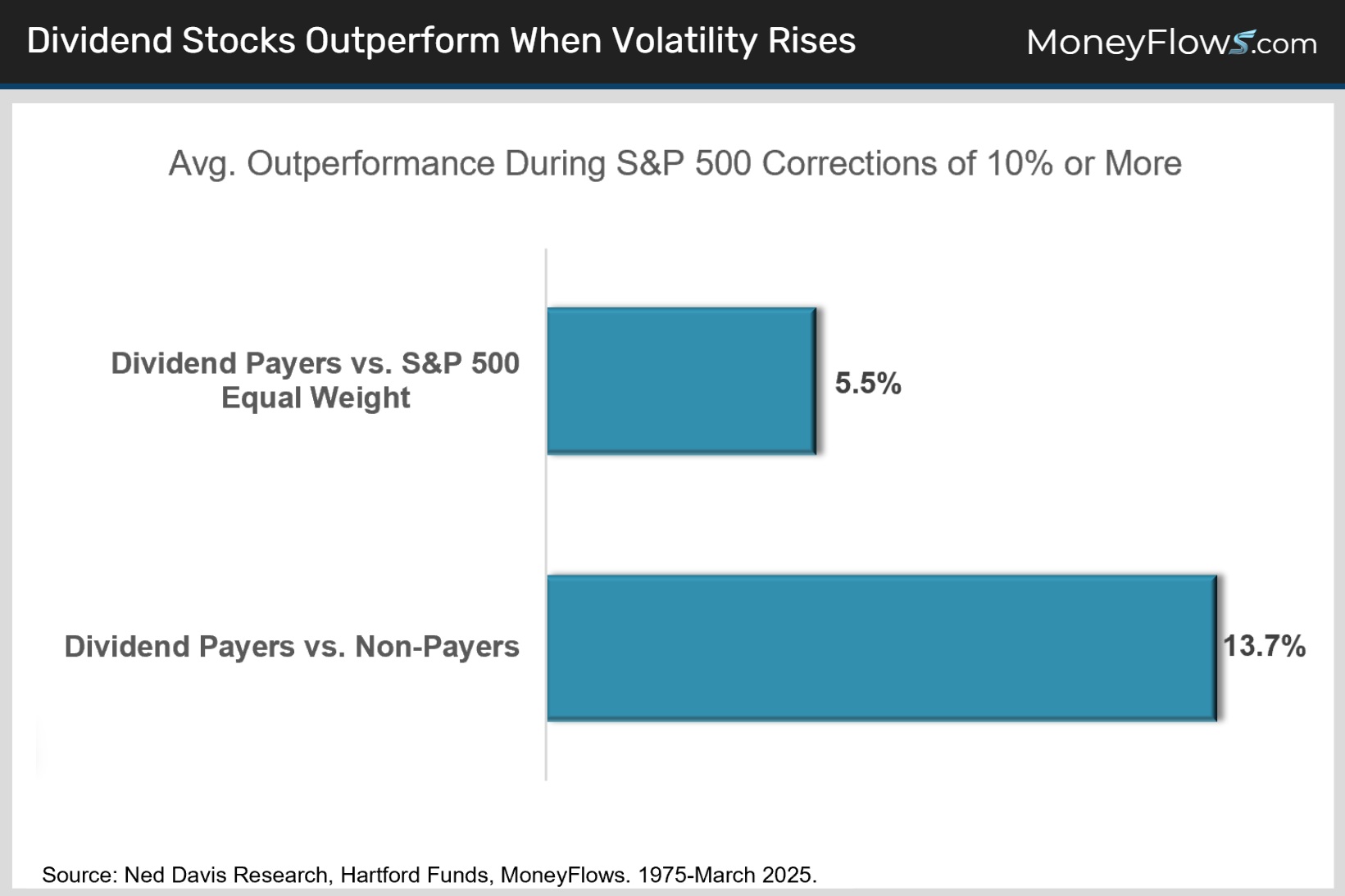

And as it relates to 2025, everyone seems to be worried about a coming correction.

Now we know markets don’t go up in a straight line. From time to time, stocks correct and fear presses equities lower.

Here’s where dividend stocks offer an edge. From 1975, whenever the S&P 500 experiences a correction of 10% or more, dividend paying stocks outperform the S&P 500 Equal Weight index by 5.5%.

Even more impressive, dividend payers crush non-payers by a whopping 13.7% during heightened volatility:

You can’t afford NOT to own dividend stocks.

Just be choosy on the actual stocks you buy.

The holy grail of investing is owning high-growth stocks that constantly increase their payouts year after year.

How to Find All-Star Dividend Stocks

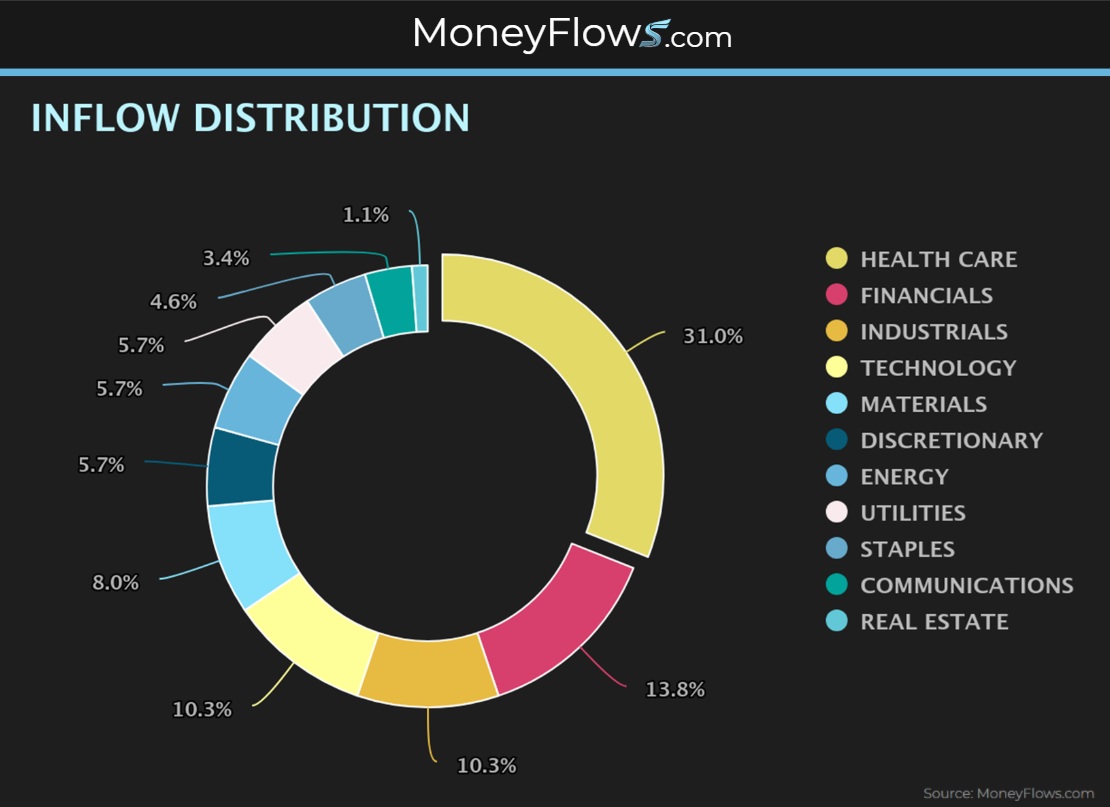

They say the trend is your friend. This is especially true when it comes to money flows.

Each day, we are able to spot the money movements into thousands of stocks. Recently, there has been a thrust into dividend-growth areas like Health Care, Financials, and Energy.

Each of these groups sport yields of 1.61%, 1.4%, and 3.23% respectively. Those tower above the S&P 500’s yield of 1.09%.

Here’s yesterday’s inflows broken down by sector. Health Care was the runaway leader with 31% of inflows. Financials ranked 2nd with 13.8% of inflows:

These aren’t new trends. They’ve been in the works for weeks.

Let’s zero in on Health Care as it’ll help us uncover a true all-star stock.

Yesterday’s flows saw 31 flows broken down by MAP Score (our proprietary ranking). The top inflow was Eli Lilly (LLY) which commands high MAP Score of 82.8:

Now why would Eli Lilly have such a high score? It comes down to 2 metrics: Fundamental traits and institutional demand.

Let’s unpack the fundamental qualities of Eli Lilly and how it relates to their dividend profile.

The $963 billion market cap drug-maker saw revenues surge to $45 billion in 2024. Estimates peg sales to climb to $63.3 billion in 2025 and $75 billion in 2026.

More impressive, its net income for 2024 stood at $10.6 billion in 2024. Analysts peg net income to surge to $21.2 billion this year and jump to $28.2 billion in 2026.

Why this is important is simple. Extremely well-run companies often share a piece of profits with investors in the form of dividends.

The greatest companies on Earth boost those payouts year after year, creating a compounding effect.

The holy grail of investing involves spotting the few companies that continually reward investors with growing payouts.

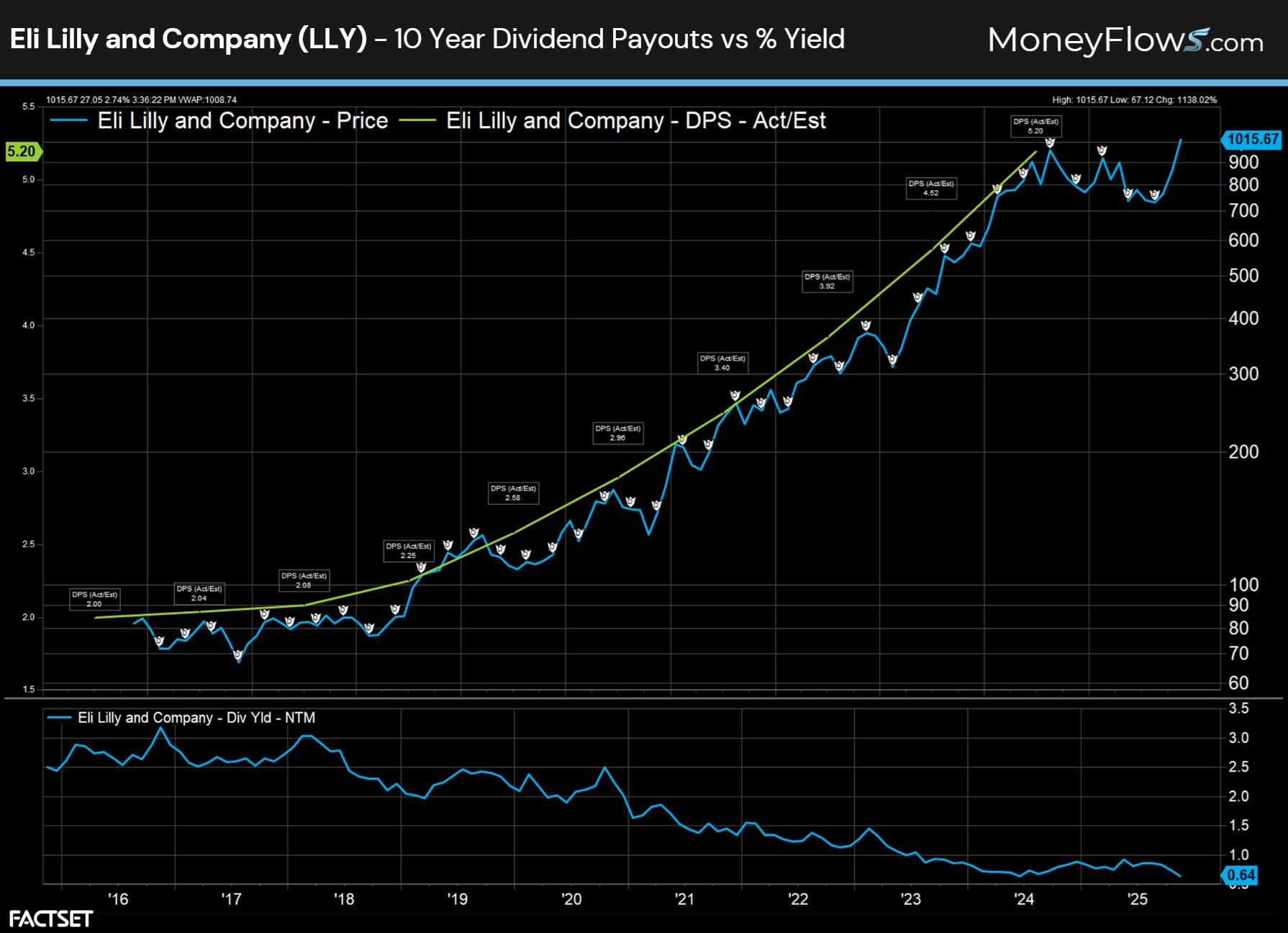

Below is a 10-year chart of LLY. On the top, I’ve overlaid the dividend payouts that are increasing year-after-year.

Notice on the bottom how the dividend yield of .64% has been shrinking as stock appreciation has been aggressive the last decade.

This is a powerful combination to build wealth:

Many new investors focus on chunky yields for their dividend stocks. Don’t do that.

Isolate companies with growing businesses, low payout ratios, and bigger payouts year after year.

Try and focus on payout ratios below 40%...as this allows a lot of room for management to lift payouts even when times get tough.

Now how can you find these stocks early?

Simple.

Follow the institutional buy pressure.

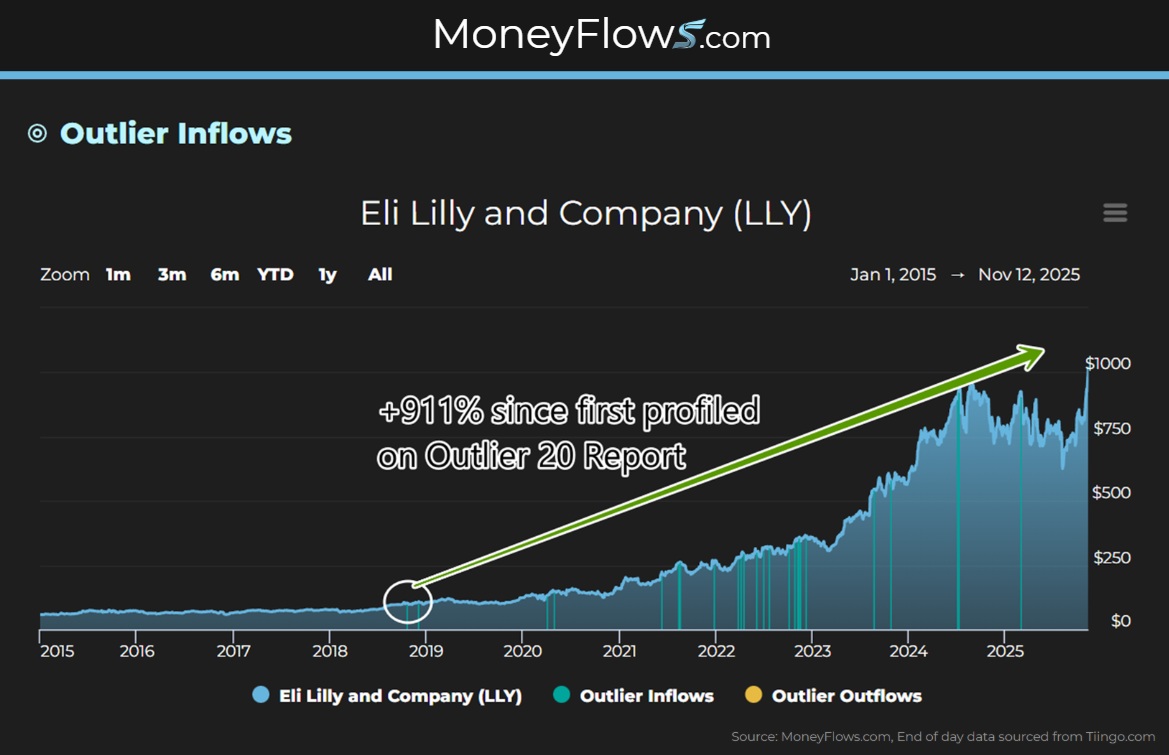

At MoneyFlows, we not only spot flows day after day. We also create a weekly Outlier 20 report which outlines the top-ranking stocks with strong institutional demand.

As you’d imagine, Wall Street latches onto the best companies in the world, pushing their shares higher and higher.

Here’s the 10-year picture of LLY through the lens of MoneyFlows. These blue bars indicate the times when LLY shares were one of our top names.

Few companies have charts like this…that’s why it’s mission critical to hop on board the biggest money flow trends early.

Eli Lilly shares have gained 911% since its first appearance on this rare report:

To find all-star dividend stocks, focus on all-star businesses loved by institutions.

As the Fed lowers rates into next year, prepare for dividend-growth companies to perform well.

You’ll want to ride that wave.

Below I’ve listed 20 all-star dividend growth stocks that offer compelling dividend growth, low payout ratios, and long-term institutional demand.

Make sure your portfolio is armed for success into yearend and beyond.

Become a PRO subscriber and gain access to this report and gain access to our PRO level research. You’ll even be able to search flows on the stocks you care about most.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

Don’t wait for the media to blow the bull whistle on dividend stocks.

This time, be early.

Our process helps investors “be early” to trends.

Go with the flows!

***December 1 – 3rd, join co-founder Jason Bodner LIVE at the MoneyShow Masters Symposium in Sarasota, FL. As he presents: Quantitative Intelligence: The Best Stocks to Own for 2026.

You don’t want to miss this! Click the image below to register now.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.