High Valuations are Supported by Strong CapEx Growth

On the heels of an epic rally, stocks are finally taking a well-deserved breather on renewed growth jitters.

That’s not keeping the bears from griping about elevated valuations. You hear it everywhere.

Today, we’ll follow the data to debunk this popular misconception. When you study history, high valuations are supported by strong CapEx Growth.

We’ll show you two consensus-defying macro reasons to fade the valuation doomers. Then, we’ll show you the best sectors to buy ahead of this bull market’s next leg higher.

As a bonus, we’ll give you a sector diversified list of high quality, long-term outliers to buy on sale.

But first, let’s break down valuations. When you slice the pie, many areas aren’t trading at extremes.

High Valuations are Limited to Fast Growers

The idea that stocks are widely overvalued isn’t supported by the data.

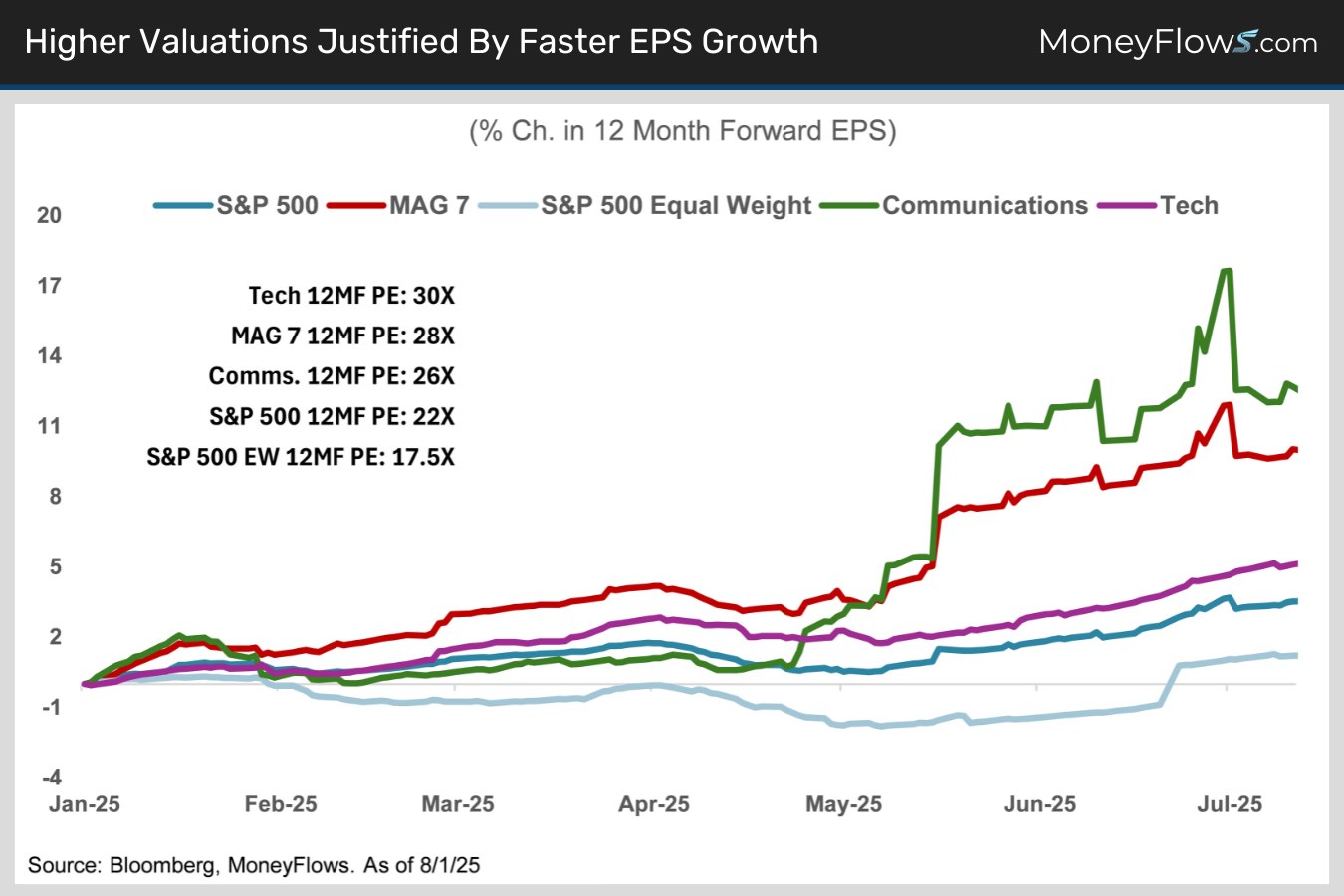

Never look at valuation in a vacuum. Always take EPS growth into account. If the growth is there, elevated valuations are not a reason to sell.

Excluding the uber-speculative corner of the market, the only stocks trading at premium valuations have the earnings growth to justify it (chart).

Think blue chip growth stocks in cyclical sectors like tech and communications. To a lesser extent, pockets of the industrials and financials sectors as well.

Thanks to their tremendous success, these winning sectors now dominate the S&P 500’s market capitalization with a hefty 60% combined weighting. This has inflated large-cap valuations to 22X.

That’s a big premium to its long-term average forward PE of 17X, when these star sectors were much smaller.

Big growth stocks are the reason Q2 S&P 500 EPS grew 10% vs. the 5% expected.

This is the 3rd consecutive quarter of double-digit growth, as Mag 7 profits grew 15.5% vs. just 4.5% for the S&P 493.

Meanwhile, overall S&P 500 Q2 sales are up 6%, while net profit margins stand at a tariff-defying 12.3%. This is vs. their 5-year average of only 11.8%, according to FactSet.

The S&P 500 Equal Weight, S&P Mid Cap 400 and S&P Small Cap 600 indices trade at just 17.7X, 16.7X and 15.6X, respectively, reflecting only middling forward earnings visibility relative to large-cap growth stocks.

The good news is there are several macro reasons to think profit momentum will broaden out:

- The labor market isn’t as weak as the crowd believes. The 4-week moving average of weekly initial jobless claims is only 221K vs. a 362K average since 1967.

- The “all in” effective tariff rate stands at 15.2%, much better than feared in April.

- Fiscal and monetary policy stimulus is on the way with Fed rate cuts and the One Big Beautiful Bill.

- Deregulation is accelerating, which will pave the way for a ramp in M&A activity.

OK let’s zero in on corporate CapEx. Bearish doom loopers need to understand history.

High Valuations are Supported by Strong CapEx Growth

We’ve been seeing a corporate CapEx recovery since the 2022 market lows - driven by data centers and hyper-scalers - the infrastructure fueling today’s digital economy.

Check out our 2025 AI Investor Handbook to review our Cloud CapEx Expenditures chart.

The real question is whether it continues and what that means for stocks.

Let’s first discuss tax cuts.

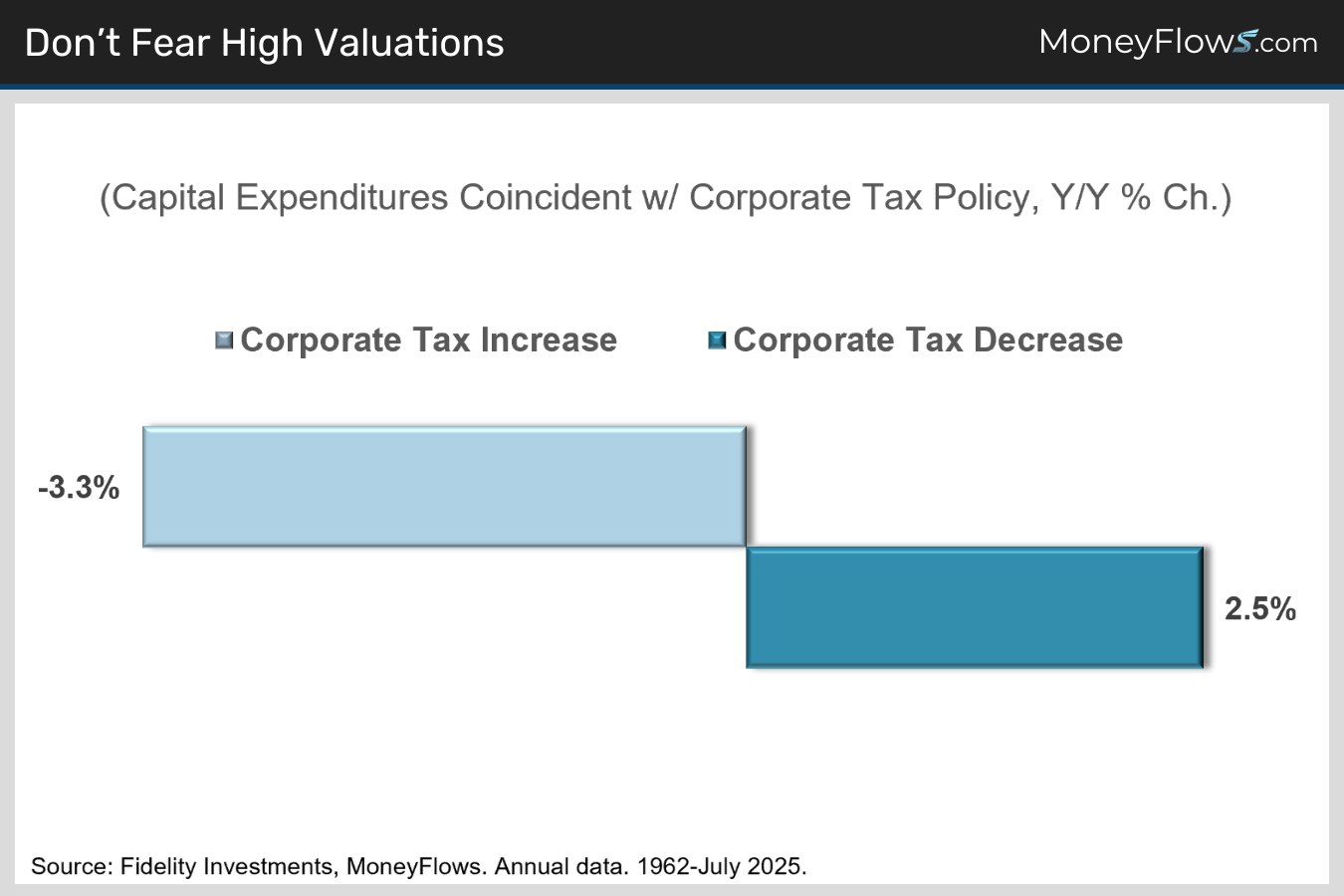

As corporate tax rates fall, businesses tend to invest more.

If history is any guide, the corporate tax cuts in the One Big Beautiful Bill Act point to a continued robust CapEx recovery.

Since 1962, capital expenditures have averaged a 2.5% year-over-year increase when corporate taxes fell:

So expect CapEx to remain healthy in the coming years.

Here’s how this relates to equity valuations.

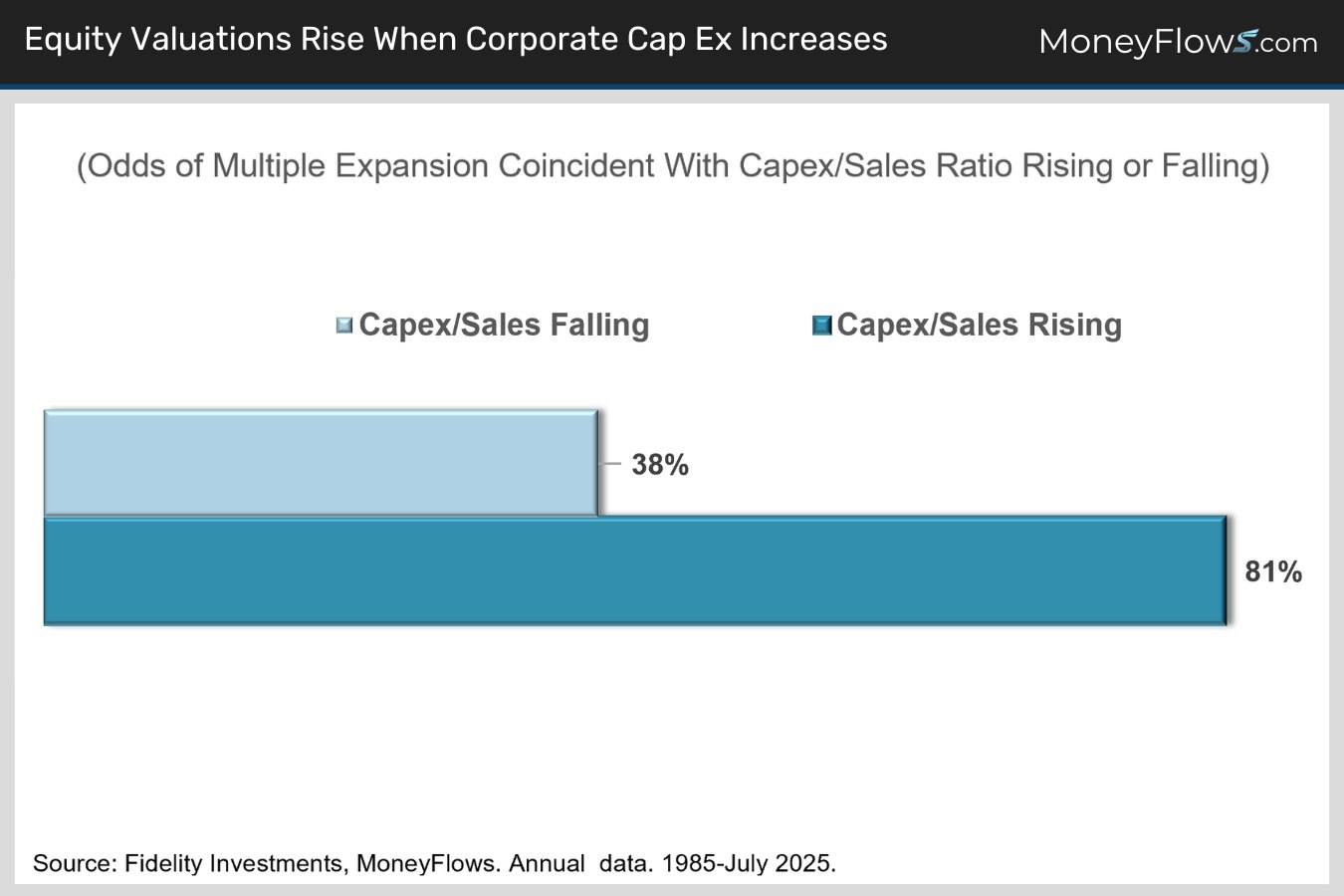

Since 1985, there’s been a very strong correlation between rising CapEx and P/E multiple expansion (chart).

Why? Because markets are forward looking. Higher capital spending is a sign of corporate confidence.

Stock prices often reflect higher profits before they materialize.

While that may make equities temporarily appear rich, valuations later normalize as the anticipated earnings growth comes through.

We’ve seen this dynamic happen over and over again with the Mag 7.

When companies are investing, equity valuations climb 81% of the time:

Now let’s dive into the best ways to play for upside.

What This Means for Your Portfolio

We’ve explained why valuations aren’t a big risk to stocks. Now, let’s tackle portfolio construction.

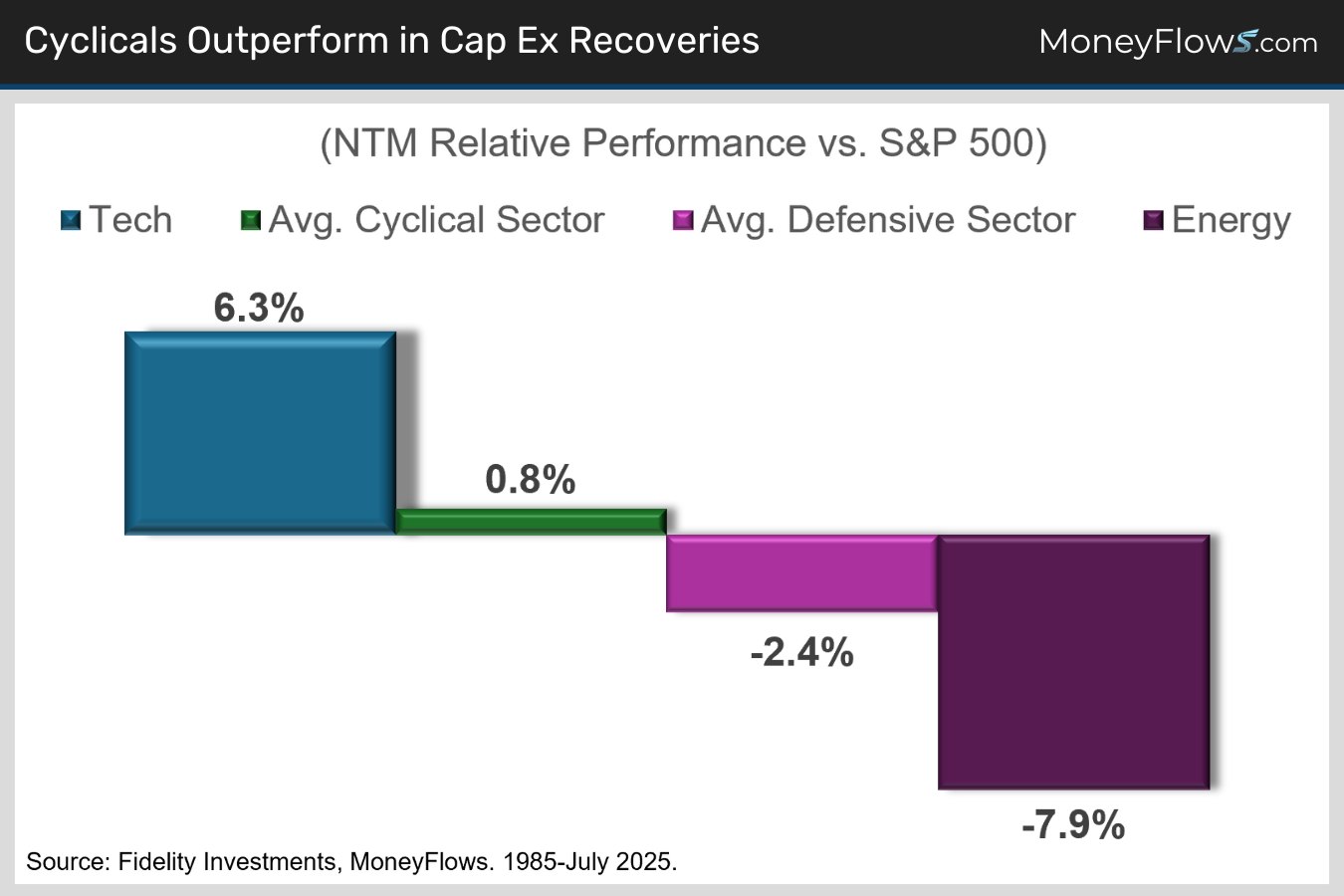

Our cyclical message on sectors isn’t changing but the list of reasons we’re bullish is growing.

It turns out that cyclicals outperform during CapEx recoveries. Their 12-month forward relative performance in years after CapEx increases has beaten the S&P 500 by 0.8% vs. -2.4% of defensive sector underperformance (chart).

That means buying any dips in tech, communications, financials, industrials and AI related utilities is supported by history. You’ll want to avoid bottom fishing in defensive areas like staples, health care and energy.

Sign up for a PRO membership to get access and make even more from this call to action.

If you’re a money manager or RIA, our Advisor Solution will unpack our unique data on your portfolios...keeping you winning in 2025.

Below is a list of the top stocks ranked by our proprietary MAP Score in our favorite sectors.

Where most research houses got it wrong the last four months, MoneyFlows got it right.

Our message remains the same, buy the dip.

Many of the stocks below have been massive winners for us this year.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.