High Quality Stocks are the Big Opportunity Right Now

The crowd is chasing high-beta homeruns.

The rally off the April lows has left high quality stocks behind as speculative names have outperformed.

High quality stocks are the big opportunity right now.

Despite strong fundamentals, “best of breed” stocks like Apple, Visa, Coca-Cola, Eli Lilly and Costco have lagged, while unprofitable AI, robotics, quantum and nuclear momentum plays have soared.

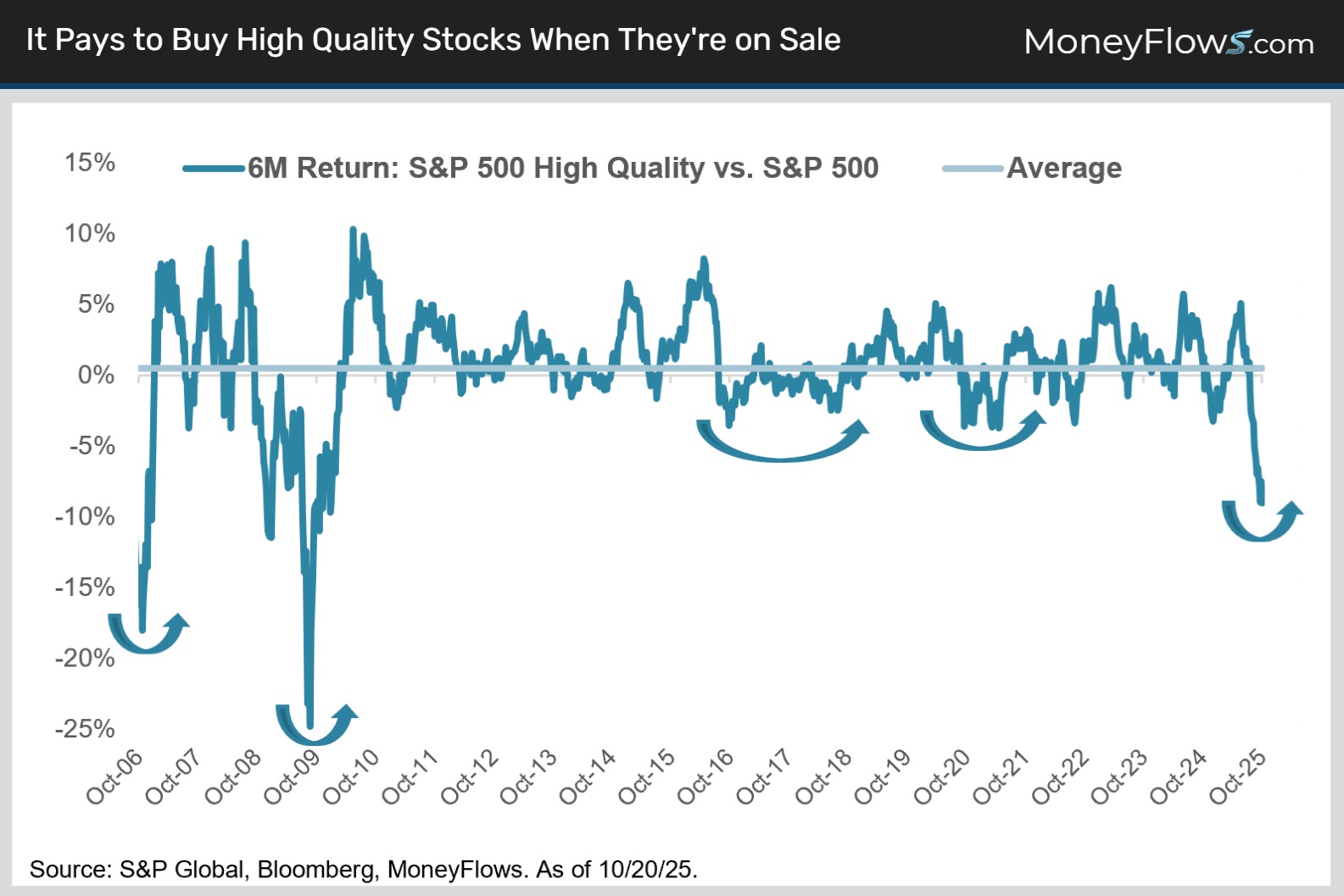

The S&P 500 Quality Index tracks the 100 highest quality S&P 500 names as measured by their S&P Quality Ranking. It’s trailed the S&P 500 by 9% over the last 6 months, marking one of its weakest stretches of underperformance ever.

Today, we’ll show you why it’s time to buy the dip in high quality stocks. Then we’ll show you why the quality factor’s sector composition offers a winning combination of offense and defense that’s well suited to current market conditions.

Finally, as a bonus, we’ll wrap up with a sector diversified list of 25 high quality names seeing big money buying.

High Quality Stocks are the Big Opportunity Right Now

Quants define high quality stocks as those with the following fundamental attributes:

- High returns on equity

- Stable year-over-year earnings growth

- Low financial leverage (debt)

With positive attributes like that, it’s no surprise quality never goes out of style for long.

Buying the dip in high quality blue chips has consistently paid off since 2005:

To bring home how important it is to buy quality when it goes on sale, check out this next chart.

If you’re not buying quality on weakness, don’t expect to beat the market:

Not Just Another Bet on Big Tech

Bull markets rotate as they rise with numerous leadership handoffs throughout the cycle.

Recent action is a case in point as quality defensive names in health care, energy, staples and real estate have finally perked up as long-standing cyclical leaders in tech, financials, utilities and industrials consolidate their massive gains.

Market rotation will benefit the quality trade because it’s much more diversified than the broader S&P 500.

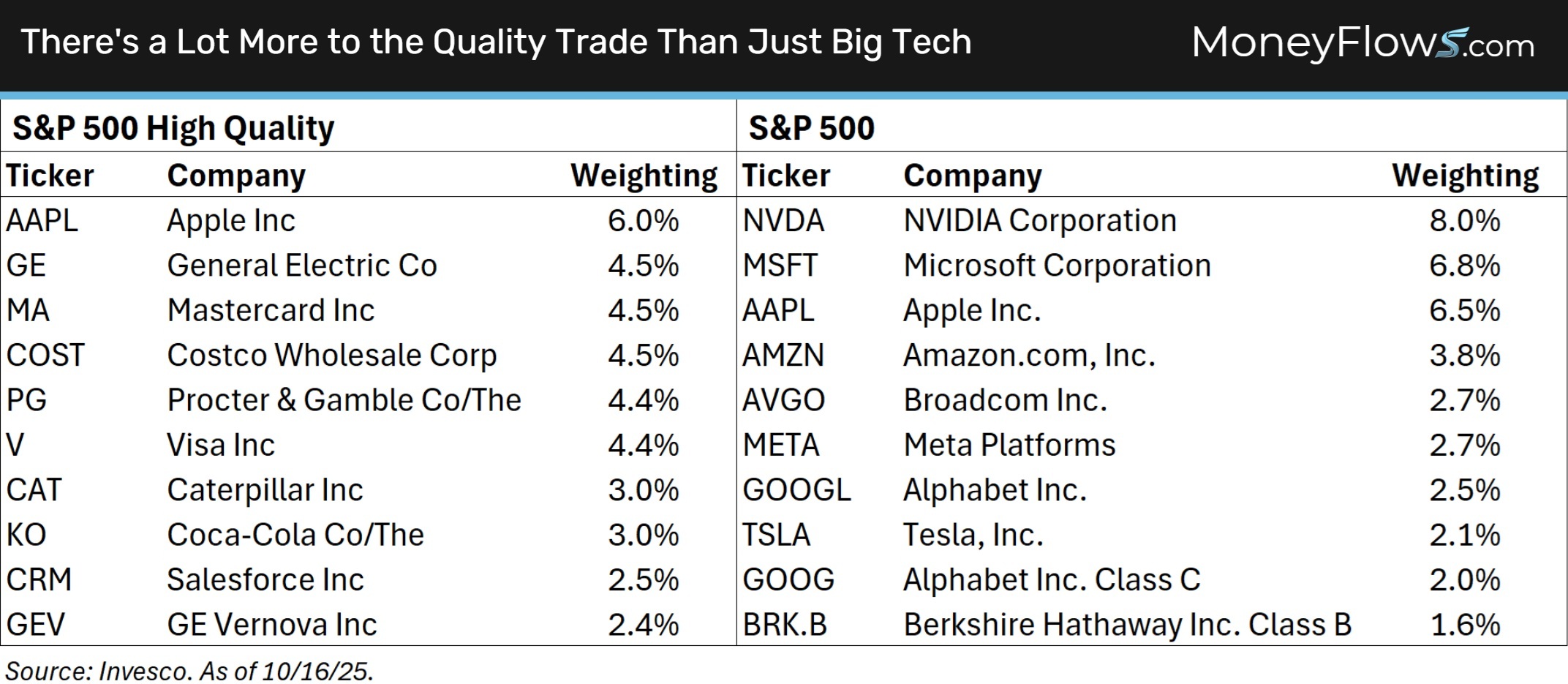

A quick look at the top 10 highest weighted companies in each index tells the story.

In the S&P 500, all but one name in the top 10 isn’t a tech company, Buffett’s Berkshire Hathaway.

By contrast, the top 10 list of the high-quality index includes just two technology companies, Apple and Salesforce, neither of which trade in nosebleed territory.

Two financials, three staples, and three industrial stocks round out the top ten:

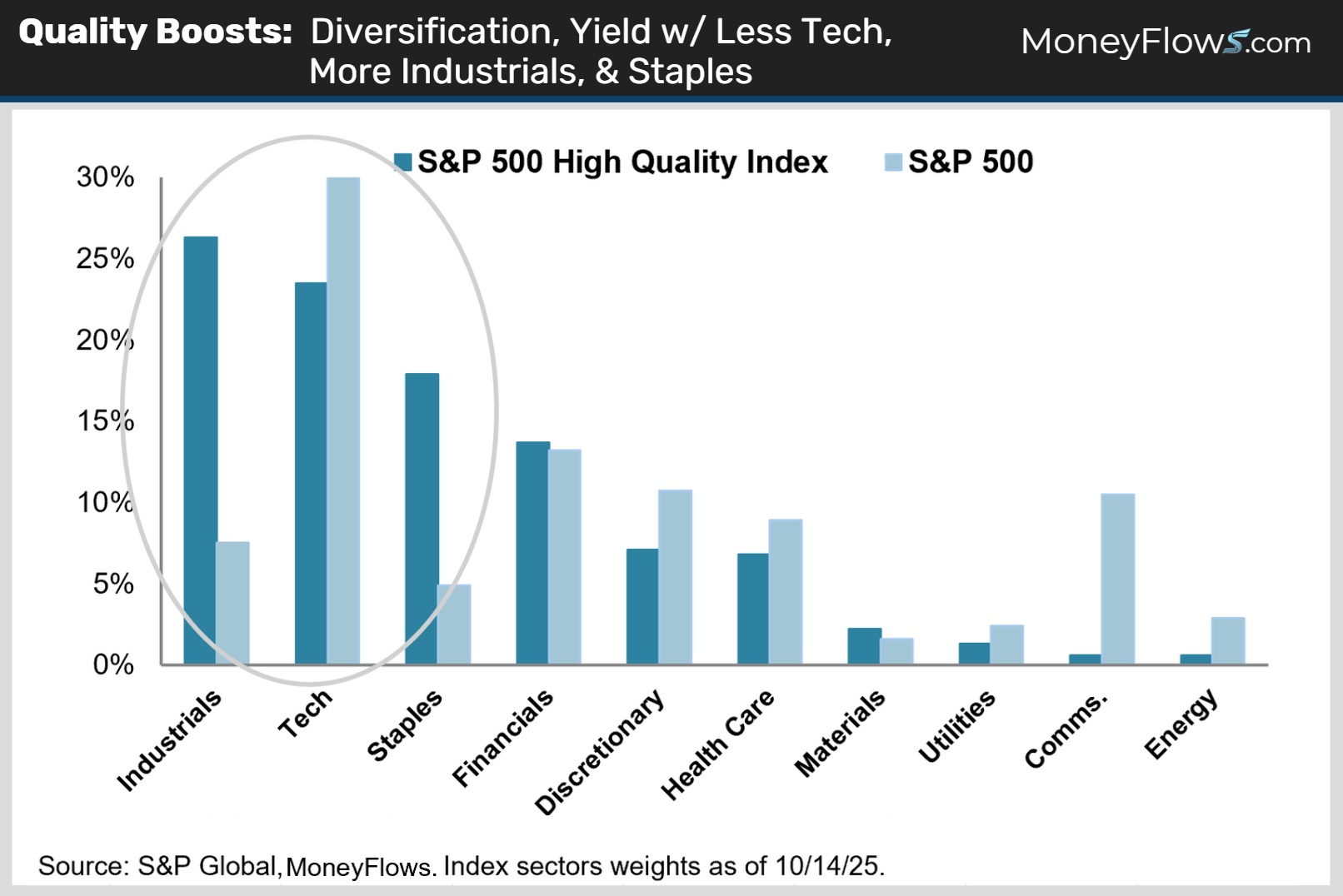

Digging deeper, a look at sector differentials between the two indices tells a similar tale.

Notice how tech, while well-represented, makes up just 23% of high quality vs. 36% of the S&P 500.

Meanwhile, staples, health care and industrials have a combined weight of 51% in quality vs. a paltry 22% in the S&P 500:

The result is a more balanced sector distribution than the S&P 500 with defensives owning a larger share.

That said, tech’s still healthy 23% allocation keeps quality’s returns competitive in strong up markets.

Think of quality as a higher yielding portfolio that still captures 94% of the S&P’s upside over the past decade with only 95% of the volatility. And if you buy it when it’s on sale, you can beat the S&P to boot!

That’s a powerful 1-2 punch!

How to Play It

Below is a sector diversified list of our favorite 25 high quality outliers as ranked by our proprietary MAP Score.

In anticipation of a continued rotating bull market, today’s list features a barbell sector approach to quality with both cyclical and non-cyclical exposures.

Where most research houses got it wrong the last 6 months, MoneyFlows got it right.

Good things happen when you follow the data instead of the crowd!

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get access to our proprietary indicators and learn how our approach finds the best stocks in the market.

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here.

This time, be early.

Go with the flows!

This article is accessible to Pro memberships.

Continue reading this article with a Pro Subscription.

Already have a subscription? Login.