Fed Rate Cuts Ignite Vicious Sector Rotation

The stock market is at all-time highs.

But many stocks aren’t holding up.

Fed rate cuts ignite vicious sector rotation.

Yesterday the Fed cut rates by 25 bps as expected. In general, lower rates are to be celebrated.

Reduced interest rates allow for lower debt costs and easier access to capital.

However, Fed Chair Jerome Powell made it clear that a December rate cut is far from certain. This language pressured tons of stocks…especially those leveraged to interest rates.

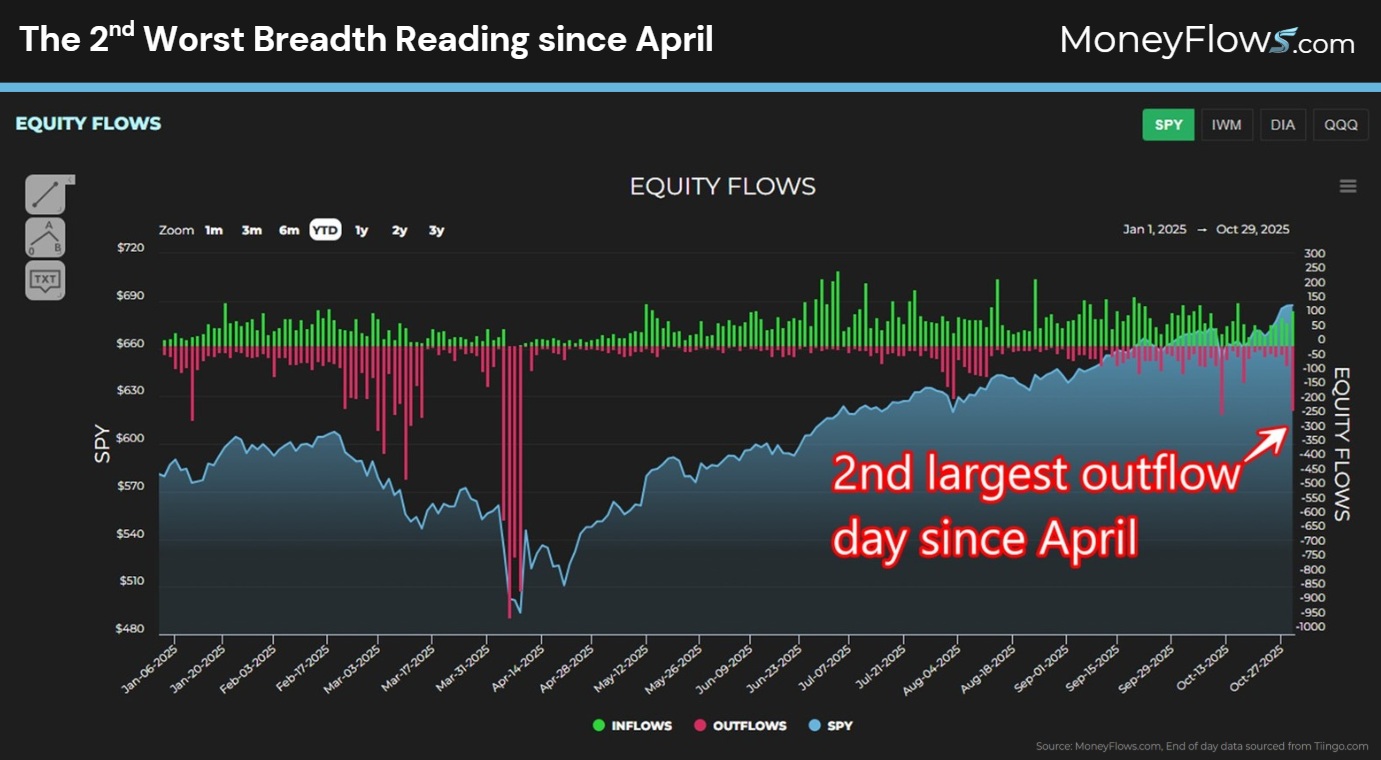

In fact, yesterday saw the 2nd largest day of equity outflows since the April crash bottom.

The money flows picture illuminates what’s truly occurring under the surface.

The gap between winners and losers is widening. This is why it’s paramount to be on the right side of capital flows.

Today, we’ll do deep dive into where the buyers and sellers live, unpacking the violent sector rotation.

It’s a great time to be stock picker…when you’re on the right side of the Big Money.

Fed Rate Cuts Ignite Vicious Sector Rotation

There’s one single power law in markets: Supply and demand.

This drives all trends.

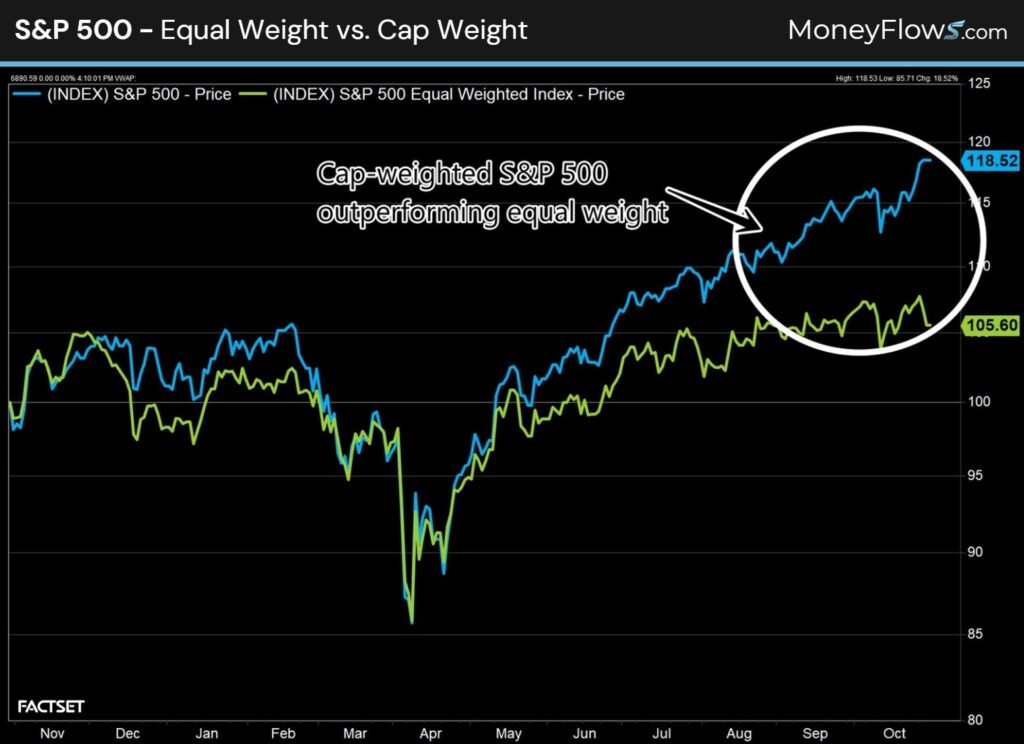

On the surface, the cap-weighted S&P 500 is flourishing while the S&P 500 Equal Weight basket lags.

Below illustrates the dichotomy in markets. The S&P 500 is up 18.5% the last year while the average stock in the basket has gained just 5.6%.

Given that the top 10 stocks in the S&P 500 make up 40% of the index, more and more capital is flowing into a handful of stocks:

But let’s dive deeper and unpack the finer details.

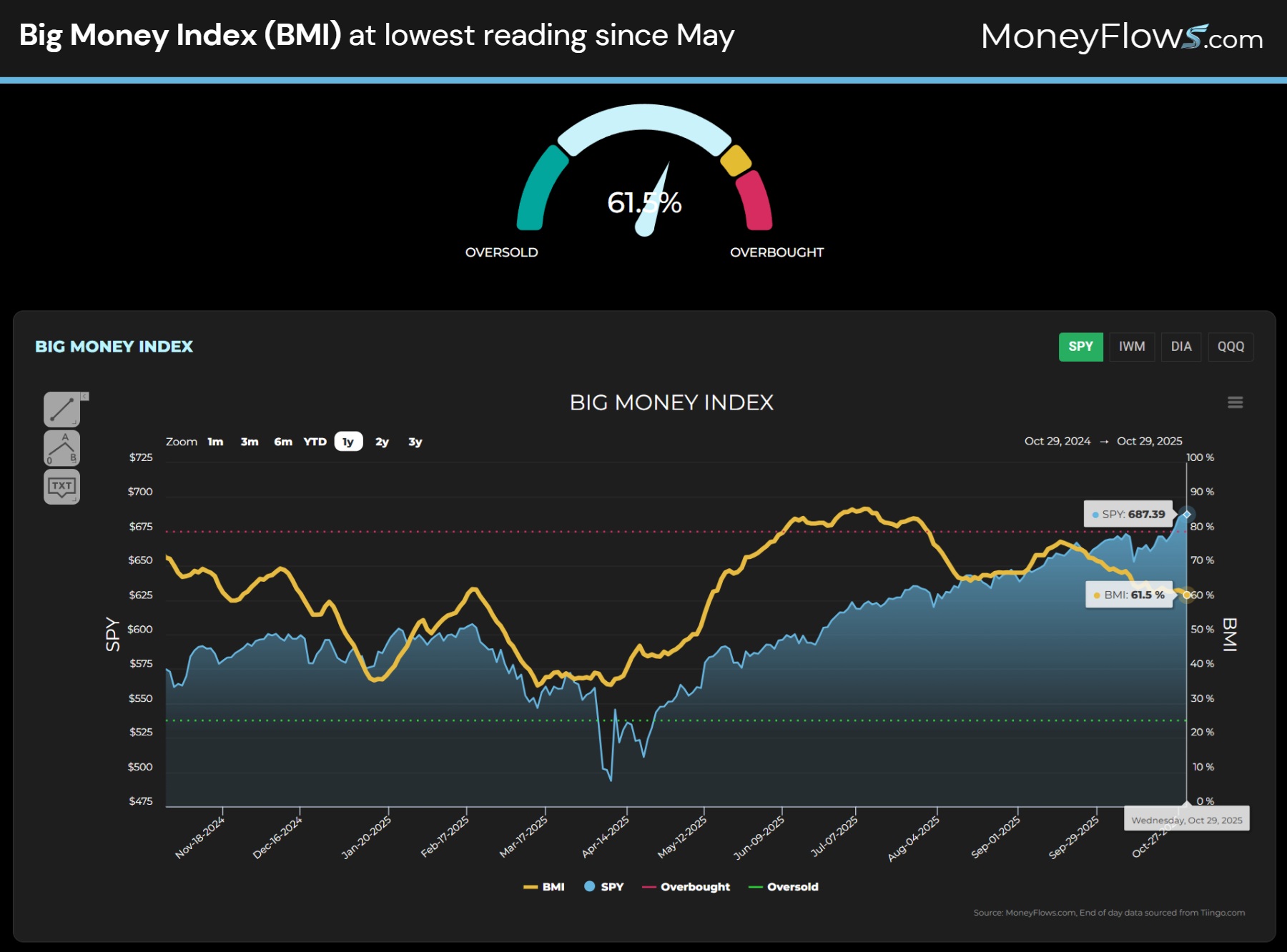

Let’s get a gauge of the overall money flows picture. To start, the Big Money Index (BMI) which tracks flows on thousands of stocks has been in steady decline for 6 weeks.

It’s at the lowest reading since May at 61%:

If the BMI is heading lower, it indicates that outflows are increasing. And they are!

Yesterday’s Fed rate cuts unleashed a powerful sector-wide rotation. Note that 122 stocks saw inflows while 224 stocks saw outflows.

That’s the 2nd worst breadth reading since April:

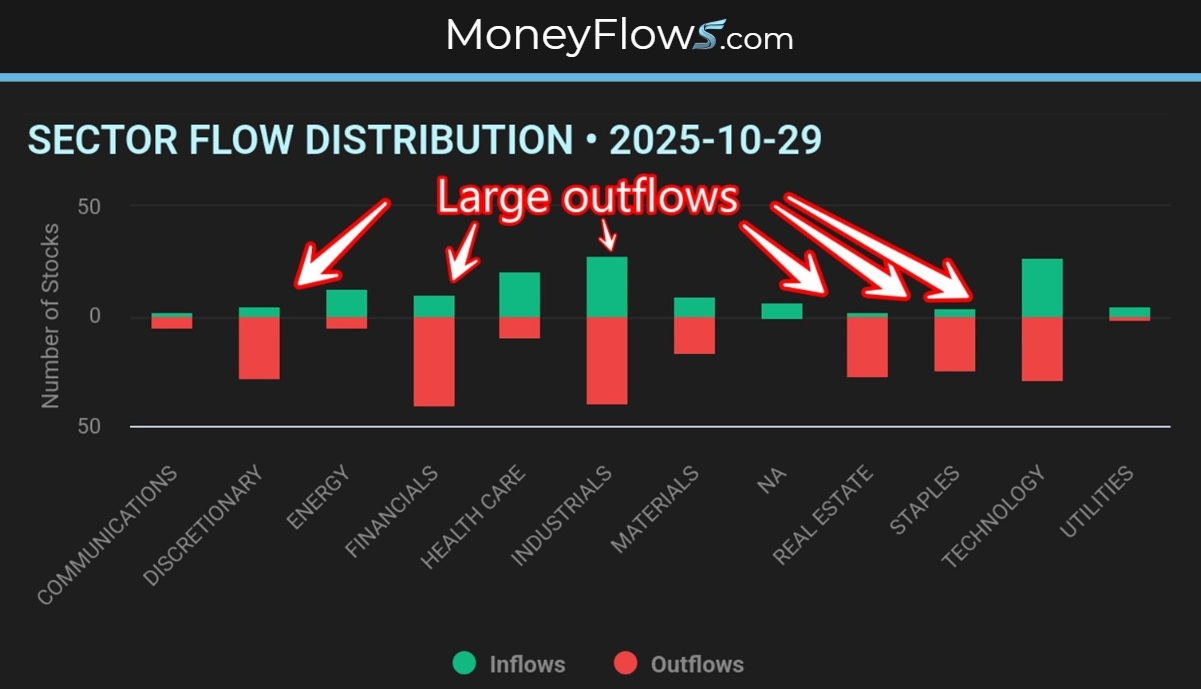

But let’s keep going! There’s a sector picture to be aware of.

The outflows were distributed heavily in Discretionary, Financials, Industrials, Real Estate, Staples and Technology:

This is where being armed with data comes into play. Most of the green and red you see above are trends that have been in place for months.

Typically, when large money managers pile into and out of stocks, they do so for weeks and sometimes months.

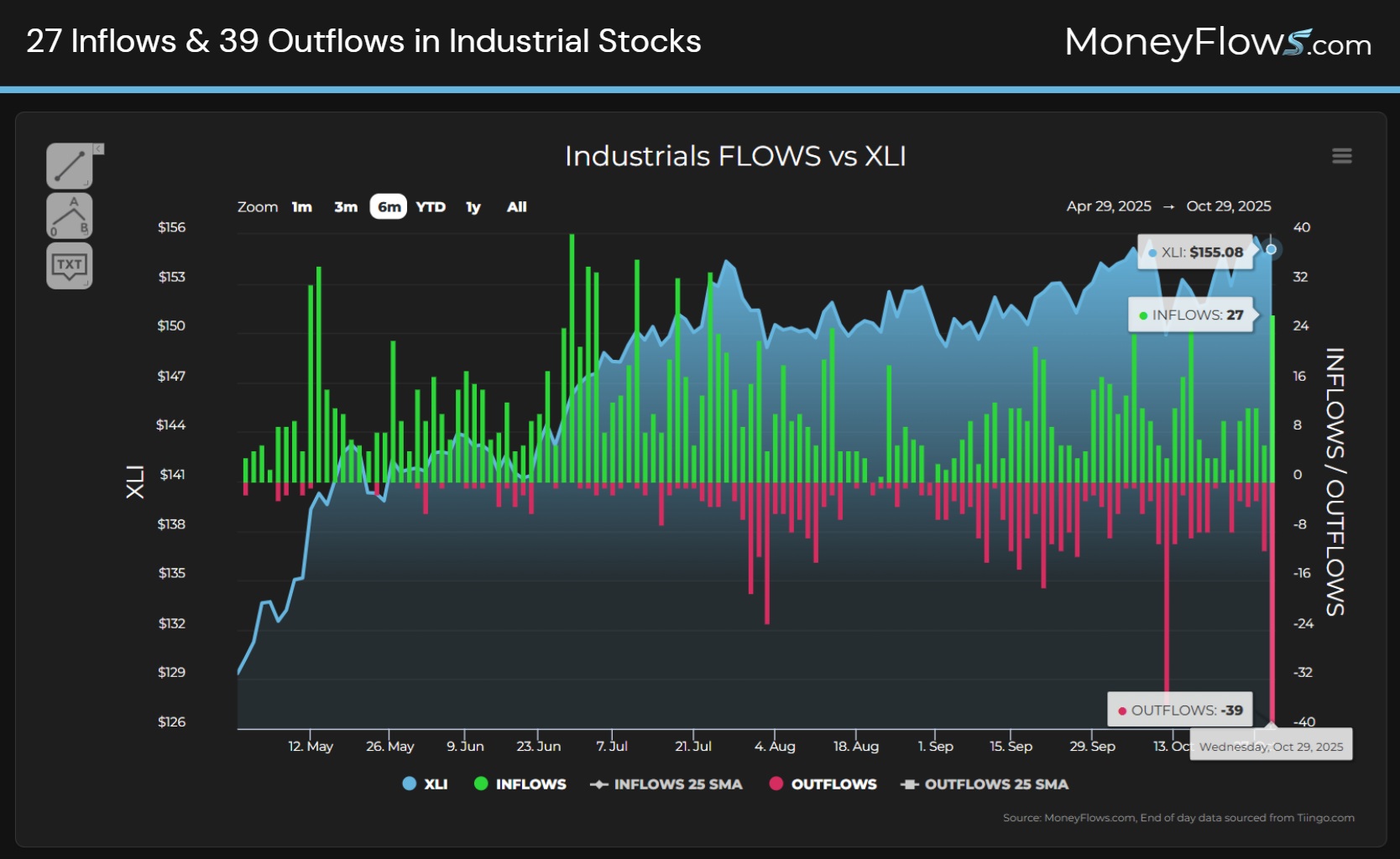

Let’s use the Industrial sector as an example. Here we can see that yesterday was nearly evenly split between stocks under accumulation and distribution.

27 discrete stocks saw inflows while 39 saw outflows (the most in 6-months):

These flows may appear as random…but they’re not. Those green bars are many of the same stocks jumping week after week.

The red bars include stocks being sold week after week.

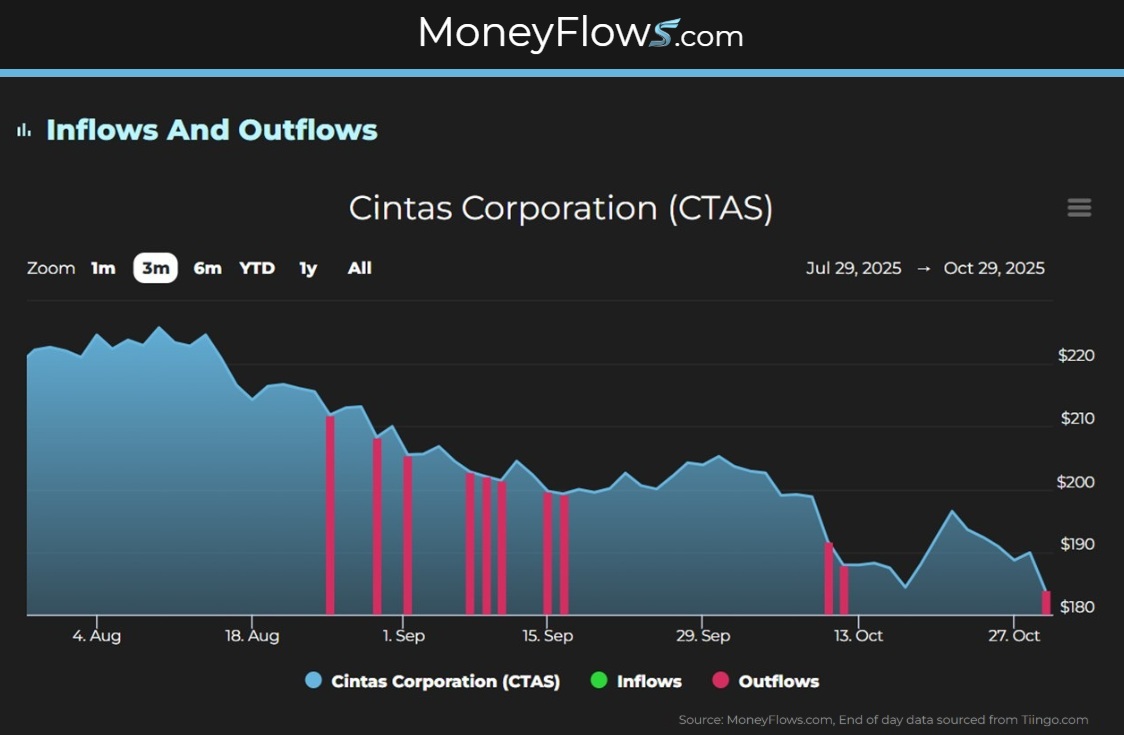

Let’s do an example. Cintas (CTAS), a maker of business supplies including uniforms, has seen nothing but outflows the last 3 months:

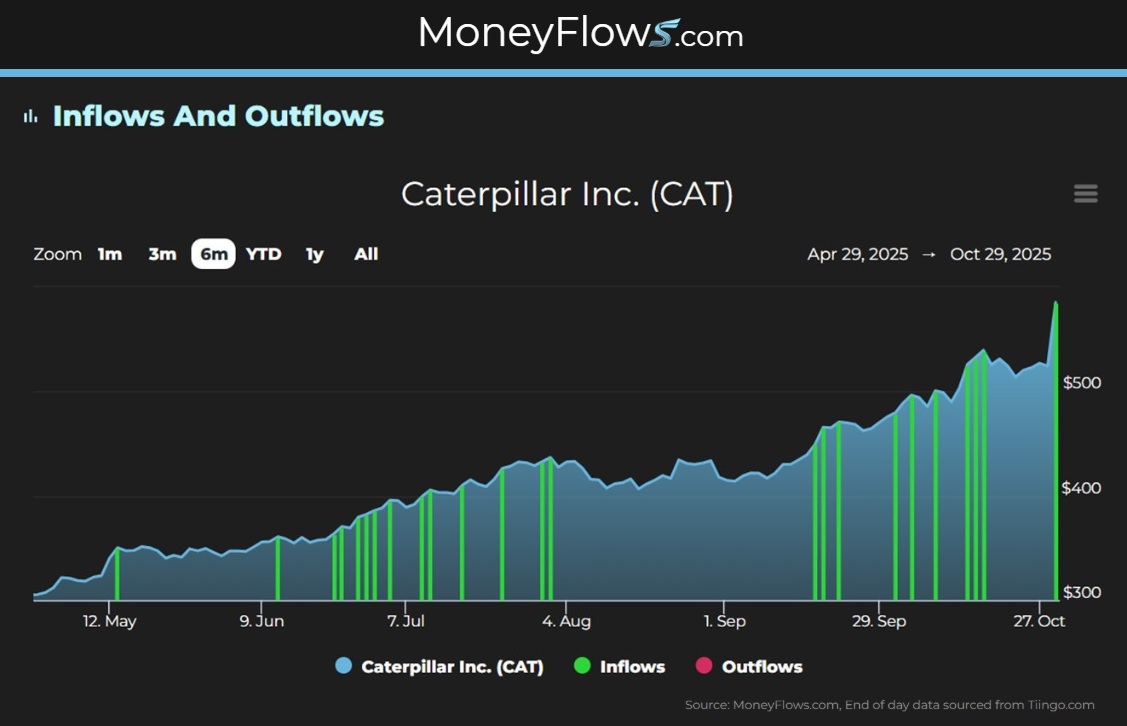

On the flip side, Caterpillar (CAT) which is a supplier of large industrial machinery blew away sales and earnings earlier this week.

Reading the news headlines, you may assume this is new information…but our data shows that it’s been a heavily accumulated stock for 6 months.

If you want to see the power of being on the right side of the Big Money, take a look:

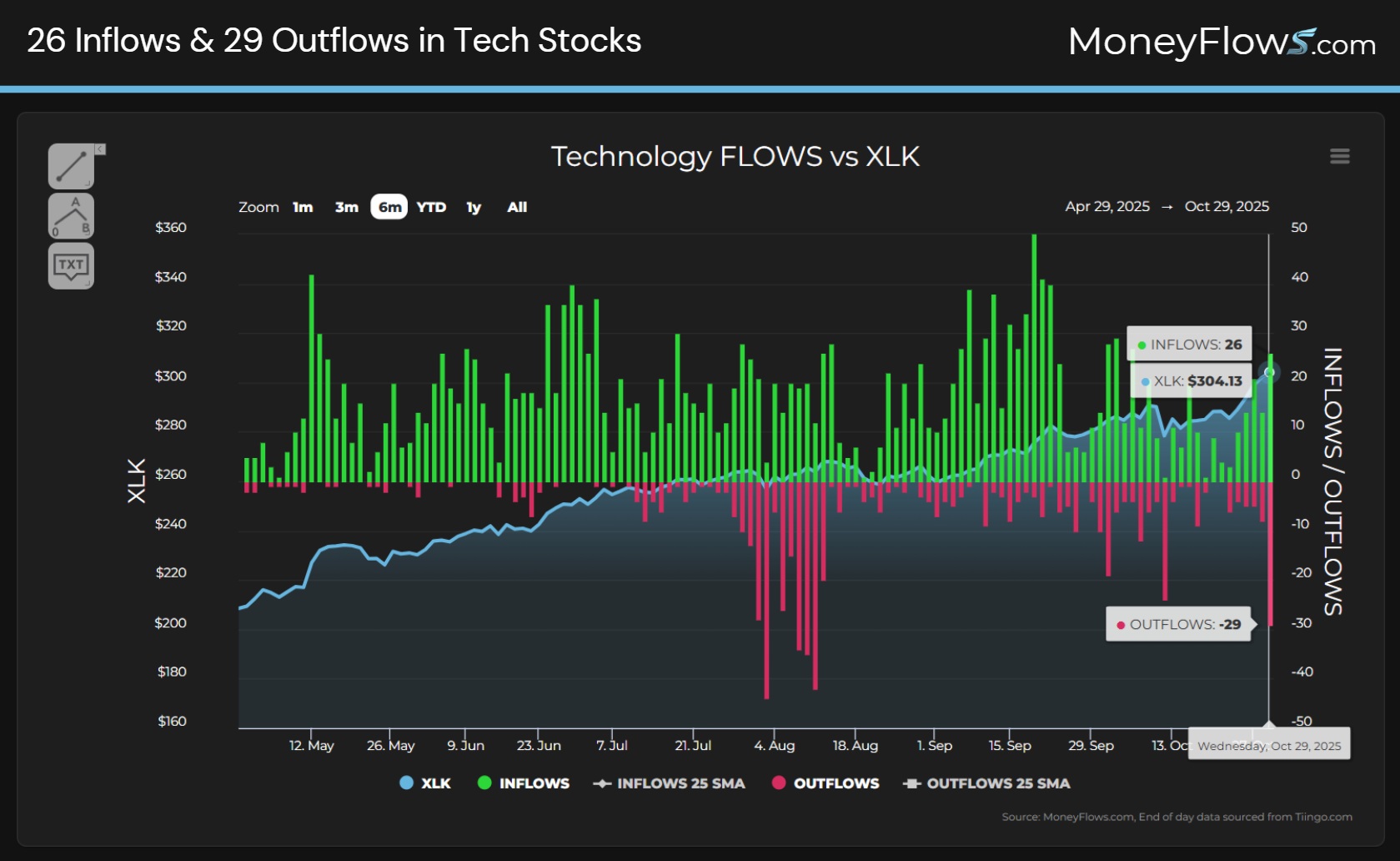

Let’s do another example in the Technology space to drive home this message.

Yesterday saw 26 inflows and 29 outflows highlighting a bifurcated sector:

Again, these flows aren’t random. They are trends that have been in place for months.

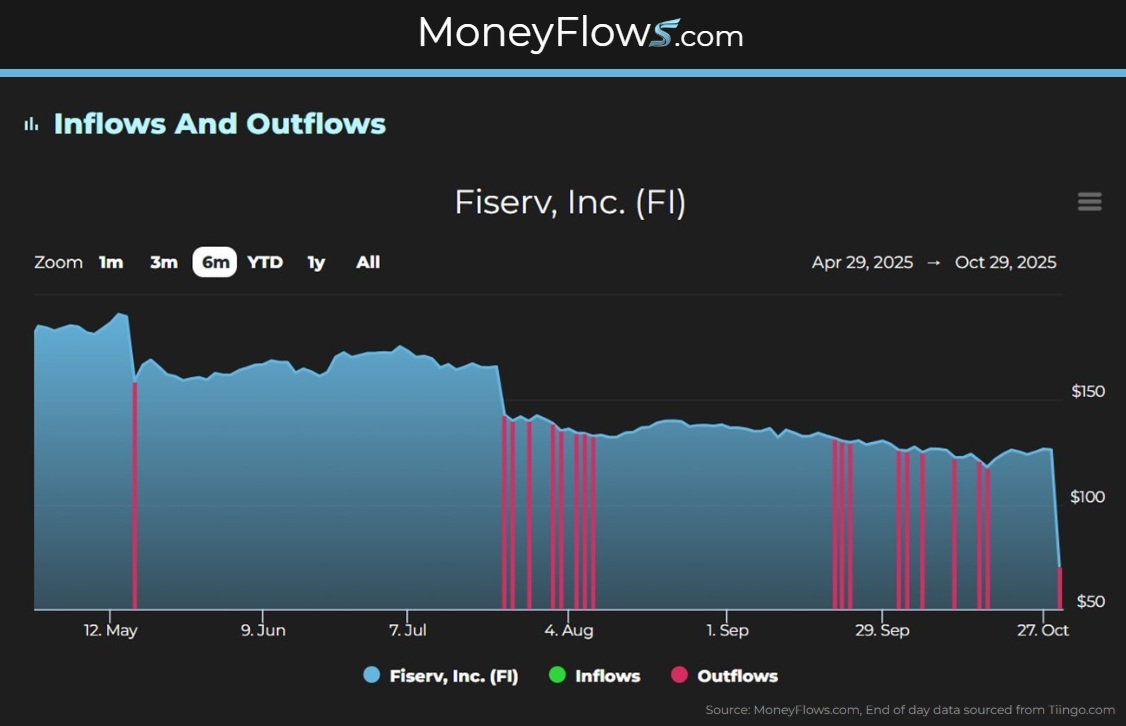

Yesterday Fiserv (FI) missed earnings badly and guided lower amidst management changes.

Now clearly we didn’t know the stock would plummet 44% yesterday. But what we did know is the stock has been for sale for 6 months:

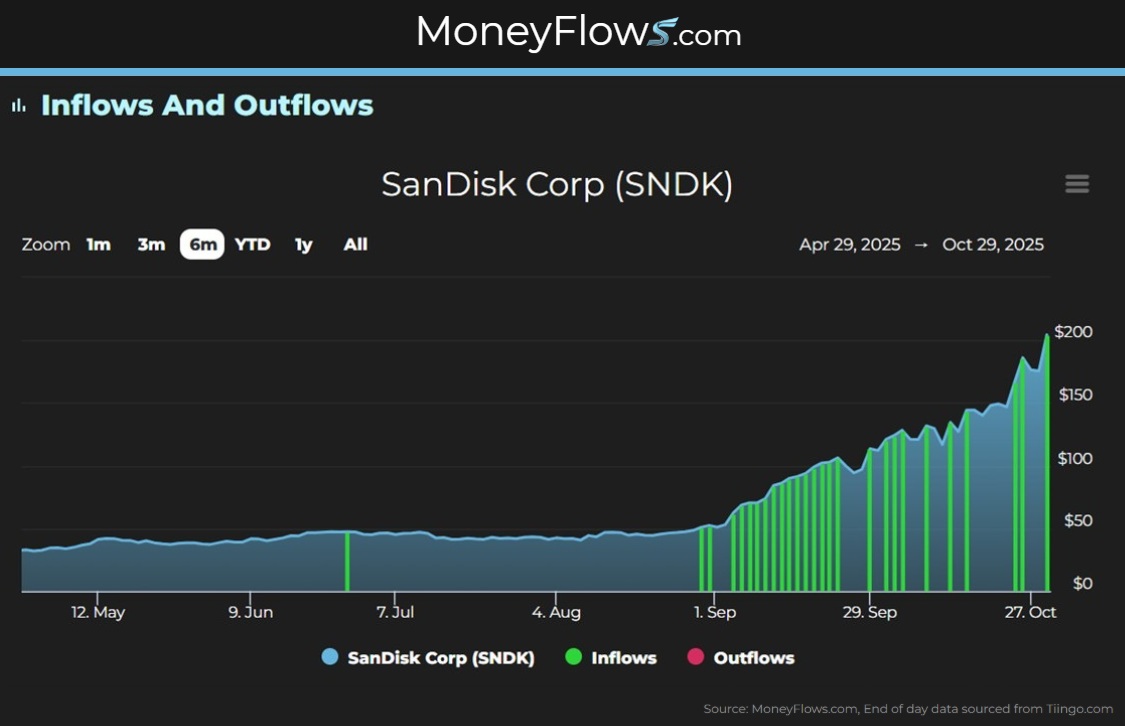

On the flip side there’s huge money flowing into SanDisk (SNDK) which manufactures storage devices.

We discussed this theme 2-week ago and it’s still in play.

Outsized demand for the shares is pushing the stock higher and higher:

So, while the Fed cut rates, it caused a lot of pain and gain under the surface.

MoneyFlows brings you the alpha to help you outperform.

Every week we showcase our top stocks receiving inflows. We call it the Outlier 20 report.

It’s the report that spotted outliers like Celesta (CLS), Super Micro Computer (SMCI), and NVIDIA (NVDA) early in their infancy…

…before they were on the lips of the media.

Don’t let the big sector rotation scare you out of leading stocks. Tomorrow’s leading stocks can be found today.

You just have to go with the flows.

Become a PRO member today and learn our top-ranked stocks. Get the money flows picture on your favorite stocks too.

Professional money managers and RIAs looking for powerful portfolio solutions please reach out about our Advisor solution and Emerging Advisor Program.

Can you outperform without MoneyFlows data?

Possibly.

I just can’t recommend it!

***Lastly, join co-founder Jason Bodner LIVE, December 1 – 3rd, at the MoneyShow Masters Symposium in Sarasota, FL. As he presents: Quantitative Intelligence: The Best Stocks to Own for 2026.

You don’t want to miss this! Click the image below to register now.