Fed Easing Favors Dividend Stocks

Dividends are easy to overlook when the market’s ripping higher. That’s a mistake.

Lower interest rates are a boon for equity income strategies.

It’s simple. Fed easing favors dividend stocks.

Today, we’ll cover why the current macro set up favors equity income.

We’ll unpack four eye-opening studies covering the power of dividend compounding, why dividend-payers deliver higher risk adjusted returns, and why they’re a great substitute for a slice of your core fixed income allocation.

Finally, we’ll compare dividend growth and high dividend ETFs and wrap up with a diversified list of our favorite long-term, dividend compounders seeing big money buying.

Grab a coffee and enjoy!

Fed Easing Favors Dividend Stocks

With inflation under control and the labor market softening, the Fed is finally back in easing mode.

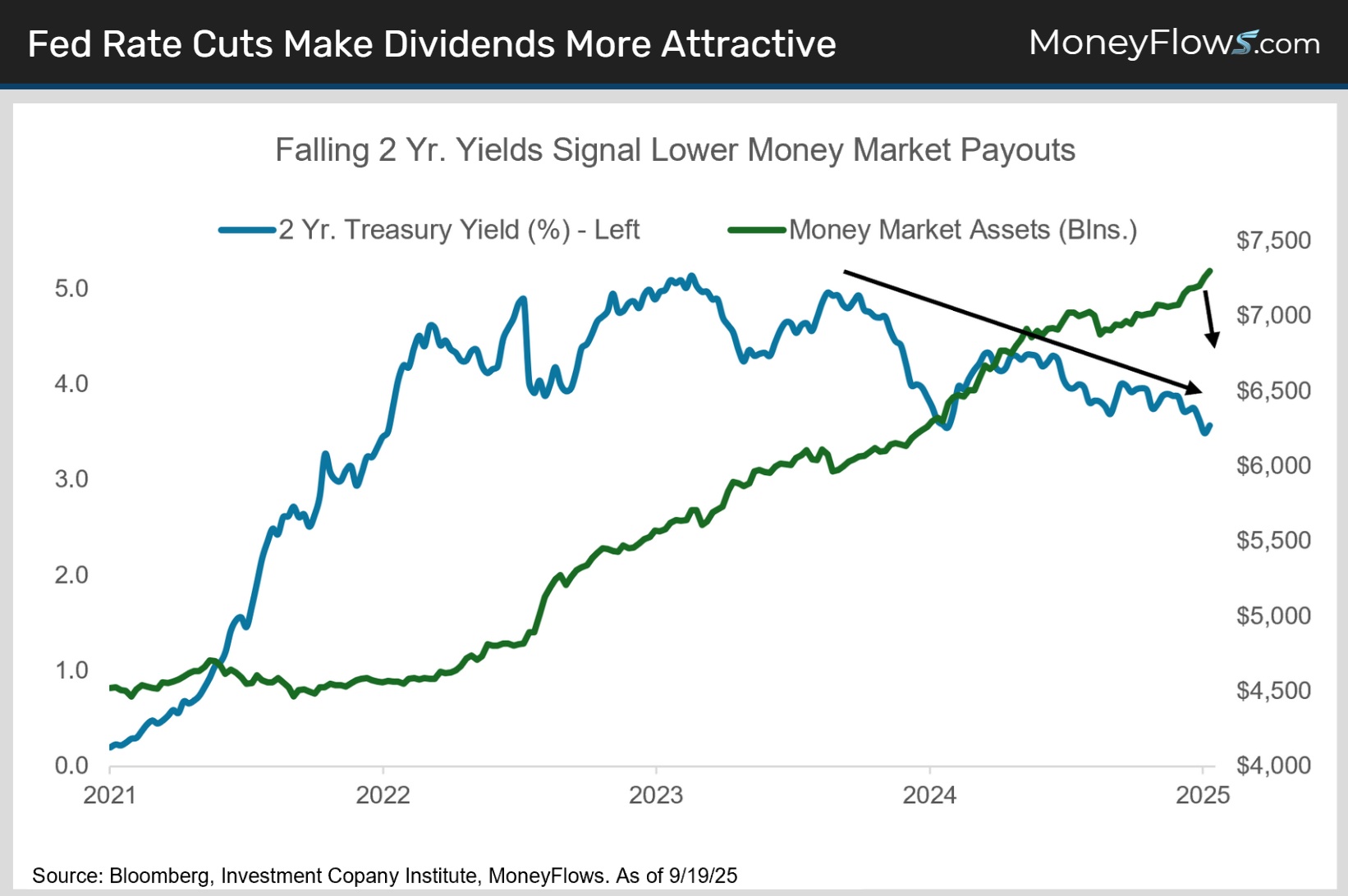

The 3.6 % two-year treasury yield implies additional rate cuts with the fed funds rate still up at 4.13%.

With money markets still averaging a juicy 4% yield, it’s no surprise their assets just hit an all-time high of $7.3 trillion (chart).

Much of this money sits in emergency funds and isn’t going anywhere no matter how low rates go.

But some of this cash is rate sensitive. There’s a big difference between earning 4% and 3% or 2.5%.

As the Fed continues easing, outflows from money markets should offer a nice tailwind for equity income.

In addition, dividends are taxed at 15%. This helps drive outflows from money markets as interest is taxed at higher ordinary income tax rates.

One Third of Market Returns Come from Dividends

Albert Einstein once described compound interest as the “eighth wonder of the world.” He was 100% right.

When you reinvest your dividends, you’re investing a growing amount year after year. S&P 500 dividends have compounded at a 7% annual clip since 2000.

It adds up faster than you think. In 2025, S&P constituents are forecasted to pay out a record $685B in dividends, up 403% from the $136B paid in 2000.

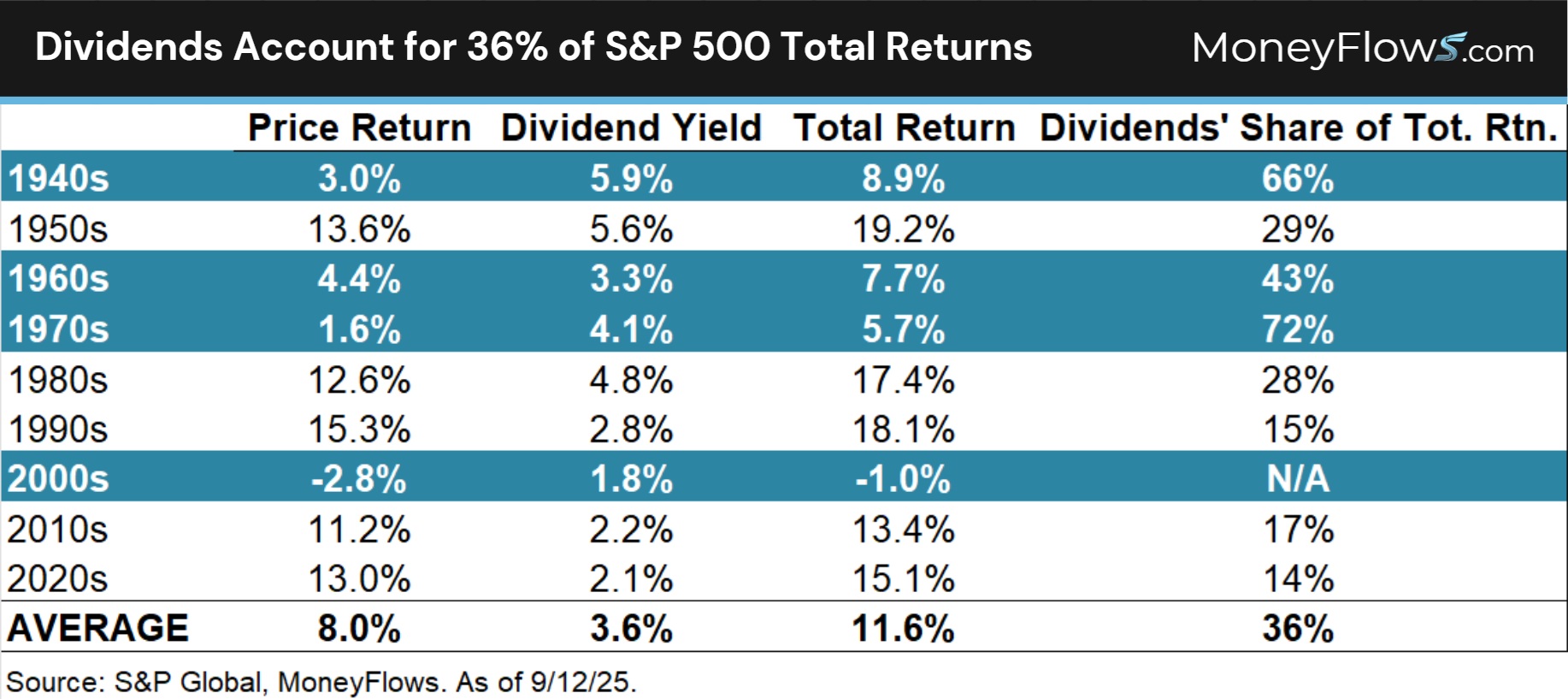

Thanks to the wonder of compounding, dividends account for a stunning 36% of long-term S&P 500 total returns.

The S&P 500 has returned 8% a year without dividends vs. an 11.6% average total return when reinvested dividends are included (chart).

Below you can see how dividends have helped returns over time, especially in weaker markets in the 1940s, 1970s and the 2000s. They’ve often acted as a shock absorber when overall returns were low or negative:

Dividends Offer Less Risk and More Reward

Higher risk adjusted returns are the holy grail of investing.

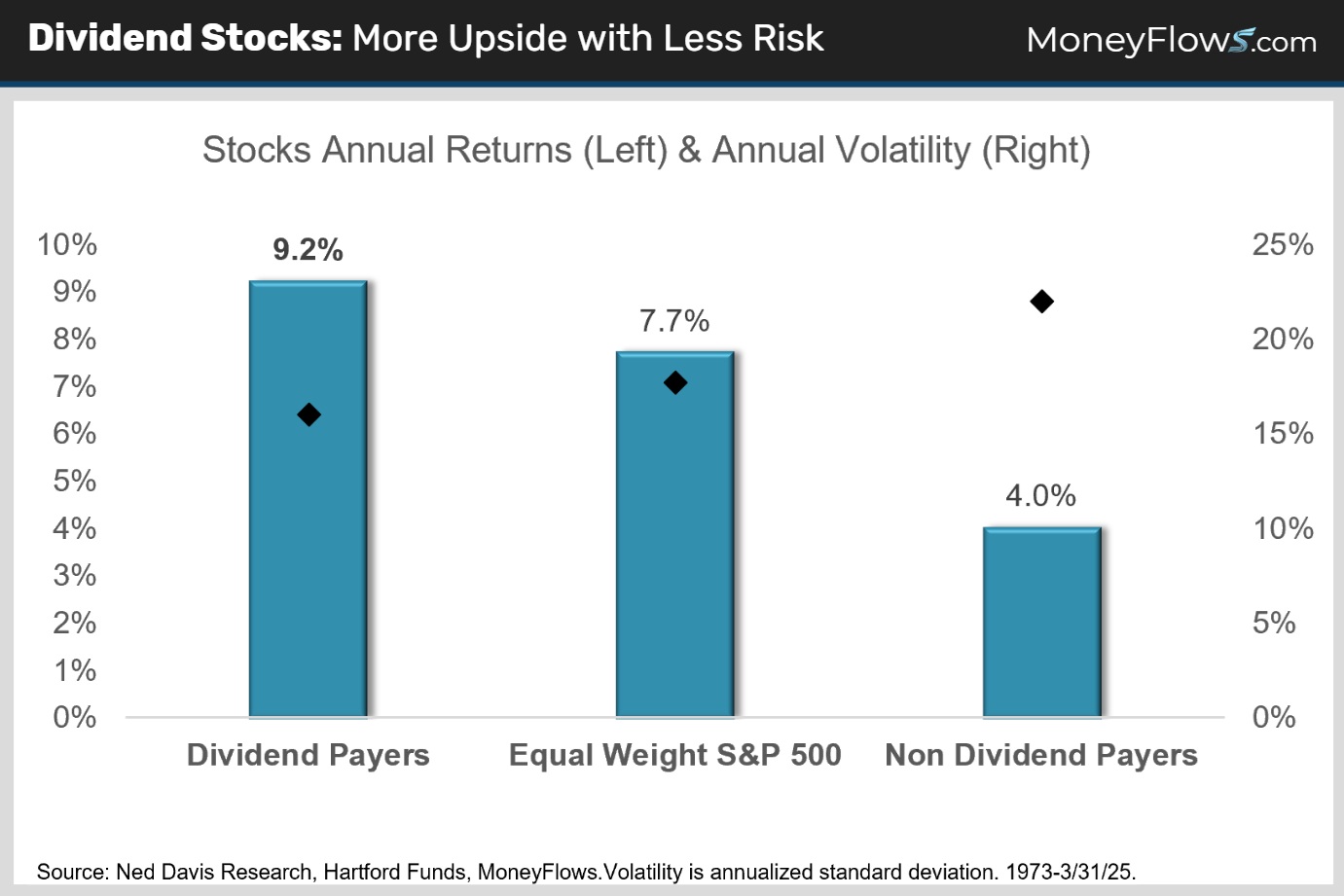

Dividend stocks don’t just throw off a growing income stream, they also outperform with less risk.

Regularly returning income reflects a well-established business with a strong market footprint.

It’s no surprise a recent study by Ned Davis Research shows that, since 1973, dividend paying companies significantly outperformed non-dividend payers while also being notably less volatile:

That’s a powerful 1-2 punch!

Dividend Stocks Outperform During Market Corrections

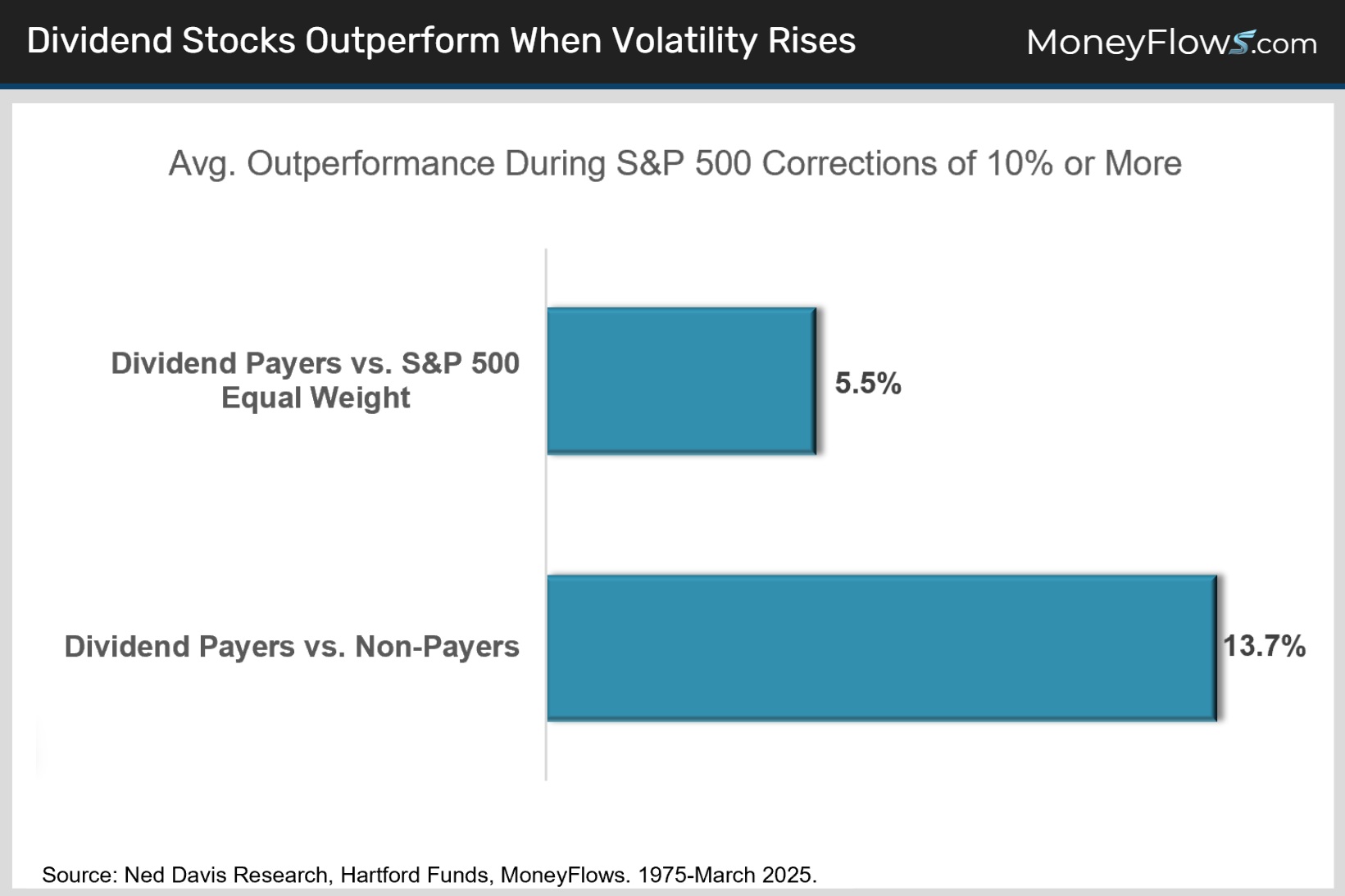

Typical dividend payer attributes like financial strength, disciplined management, and a strong track record, are especially valuable when markets turn rocky.

During S&P 500 drawdowns of 10% or more, dividend-paying stocks have held up better than companies that don’t pay dividends.

Since 1975, dividend-paying stocks declined by 14.4% during major market drawdowns. By contrast, the equal-weighted S&P 500 Index fell by 19.9%, and non-dividend-paying stocks were down even more sharply, falling an average of 28.2%.

In other words, while all three cohorts experienced losses, dividend-paying stocks registered smaller declines - outperforming non-dividend payers by 13.7% and the equal-weighted S&P 500 Index by 5.5% (chart).

Dividend Stocks are Superior to Bonds

Bonds play a critical risk management role in investment portfolios. Treasuries can zig higher when stocks zag lower - usually when recession fears threaten corporate earnings.

We’re not suggesting eliminating your bond exposure. But times have changed, and smart investors need to change with them.

After a 40-year bull market that saw long-term rates collapse from over 10% in the 1980s to less than 1% by 2020, rates have been rising for the last five years and show no signs of heading sustainably lower.

Blame record deficits and unprecedented political partisanship.

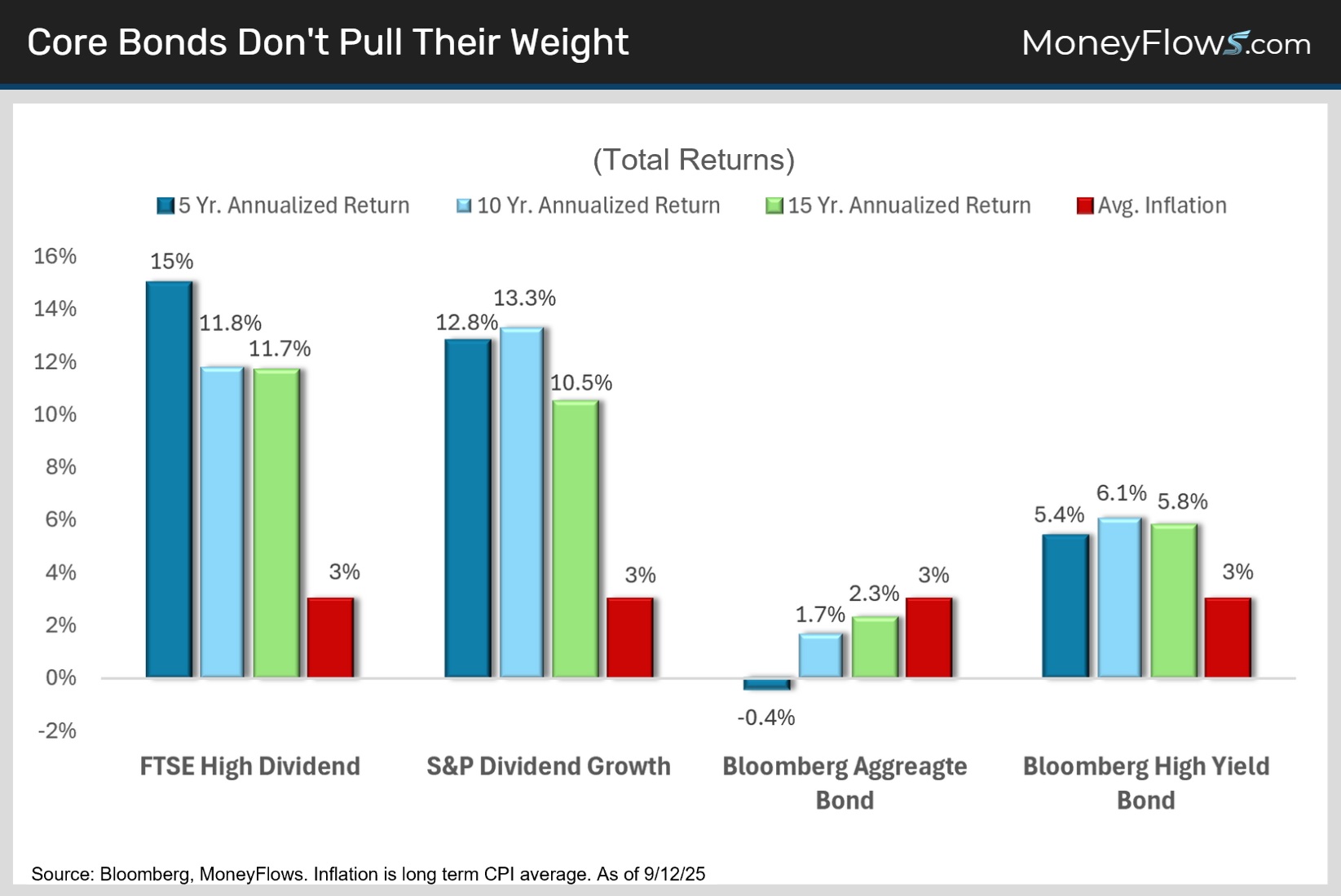

The Bloomberg US Aggregate Bond Index – the leading core US fixed income benchmark – has produced just -0.4%, 1.7% and 2.3% annualized total returns, over the last 5, 10, and 15-years, respectively.

That’s not even enough to match average long-term inflation (chart).

Meanwhile, high yield bonds have done better with returns in the 6% range, but they don’t offer core bonds’ portfolio diversification because their credit risk boosts their economic sensitivity and correlation to stocks.

What’s an investor to do? In a word, diversify!

High quality dividend stocks are a great alternative for a slice of your core bond allocation.

Check out how they’ve crushed bonds and inflation since 2010:

What This Means for Your Portfolio

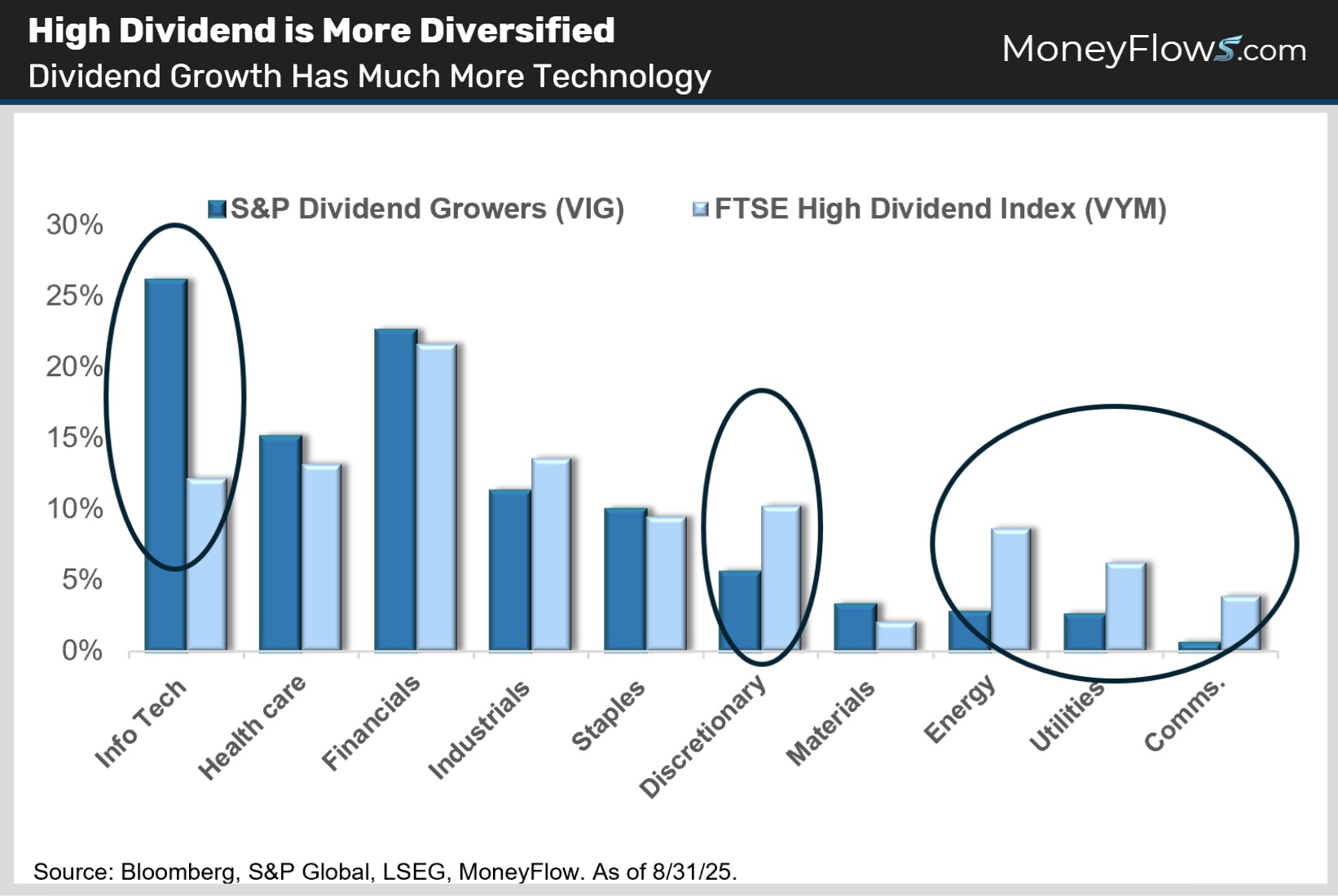

Dividend strategies focus on either high yields or dividend growth. Both have similar long-term performance.

The leading high dividend ETF is VYM. It yields 2.4% with a relatively low beta to the S&P. It’s well diversified across all sectors (chart). It’s seeing lots of big money buying, its MoneyFlows MAP Score is 59.

The leading dividend growth ETF is VIG. It yields a lower 1.6%, but its payout grows much faster. The strategy is more concentrated in technology, boosting its beta to the market. Its MAP Score is 60 and it’s also been under heavy institutional accumulation.

Both ETFs are from Vanguard and have ultra-low 0.06% expense ratios, over $75B billion in assets and strong investment merits.

Most equity income investors own ETFs and stocks in both categories.

Where most research houses got it wrong the last 6 months, MoneyFlows got it right.

Good things happen when you follow the data instead of the crowd!

As the Fed keeps cutting rates, lean into compounding dividend payers favored by institutions to outperform.

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get access to our proprietary indicators and learn how our approach finds the best stocks in the market.

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here.

Below is a sector diversified list of our favorite 30 dividend compounders across both dividend growth and high dividend strategies as ranked by our proprietary MAP Score.

We see this as an all-weather list for a dividend portfolio.

This time, be early.

Go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.