Extreme Overbought Conditions

Growth stocks are making highs daily.

One of the greatest risk-on environments is unfolding before our eyes.

You need to prepare for extreme overbought conditions.

Today’s message is simple: Not only are new all-time highs coming for markets, the evidence points to a sustained rally ahead.

Let’s rewind the tape.

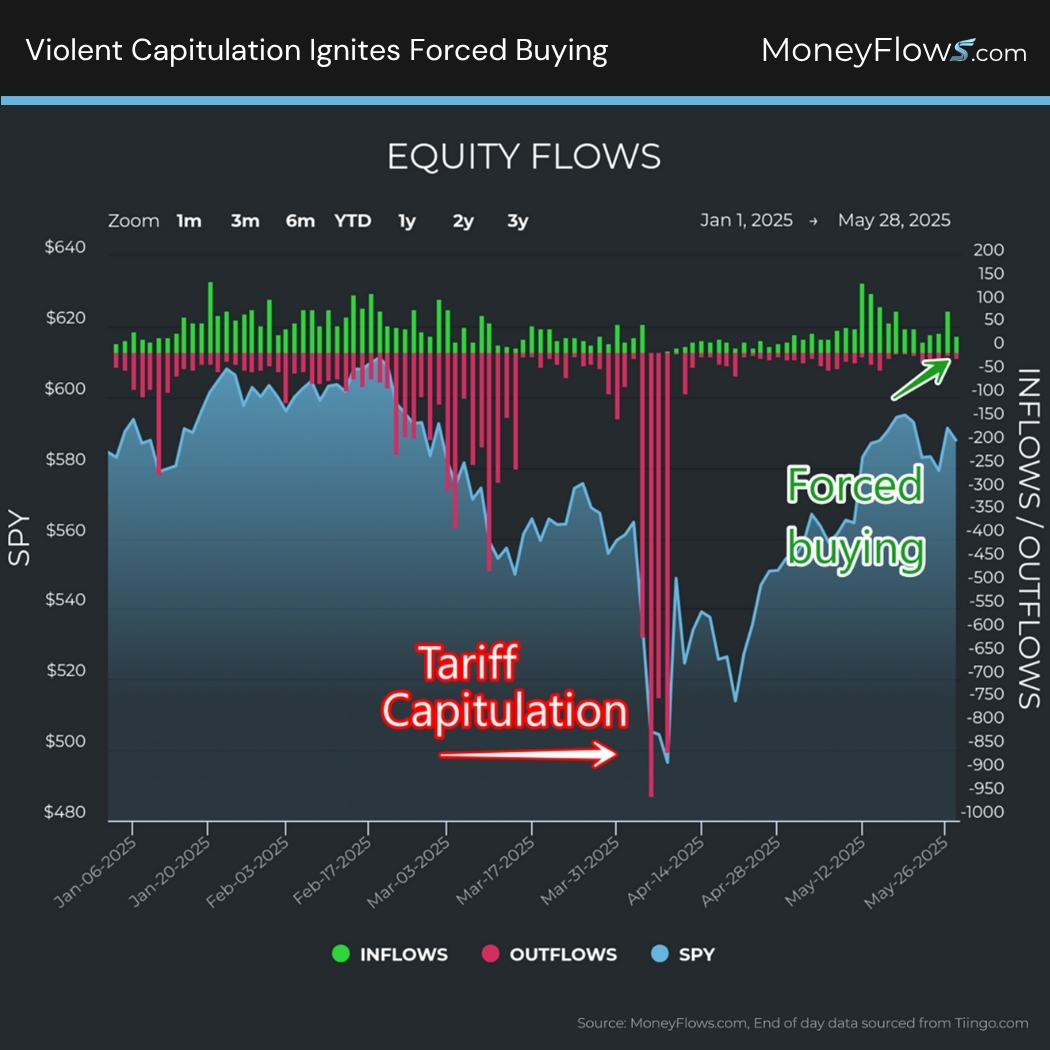

One month ago, I warned you that forced buying is coming. Extreme capitulation prefaces breath-taking rallies.

Back then, I made the case that today’s environment mimics the COVID-19 crash and the late 2018 crash. Both of which gave birth to monstrous inflection points.

I’ll be taking that bullish playbook a step further today.

It’s a wonderful time to be invested in market-leading stocks.

Companies leveraging transformative technologies like A.I. and robotics are leading the recovery.

…and our money flows data has been all over it.

Markets are Approaching the Red Zone

The number 1 power law of investing is supply and demand.

It’s that simple.

When supply falls and demand increases…markets explode higher. And it’s happening faster and faster these days given the rapid rise of automated trading.

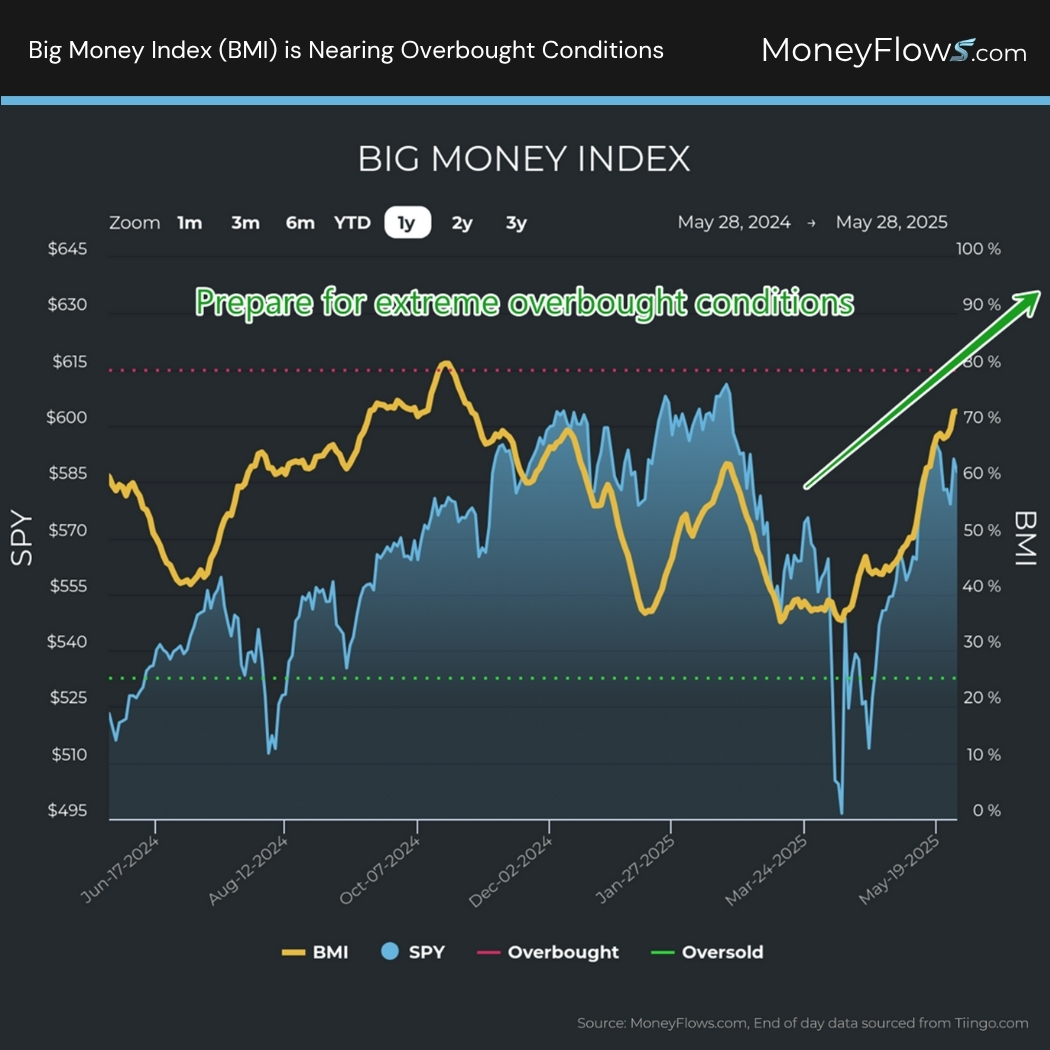

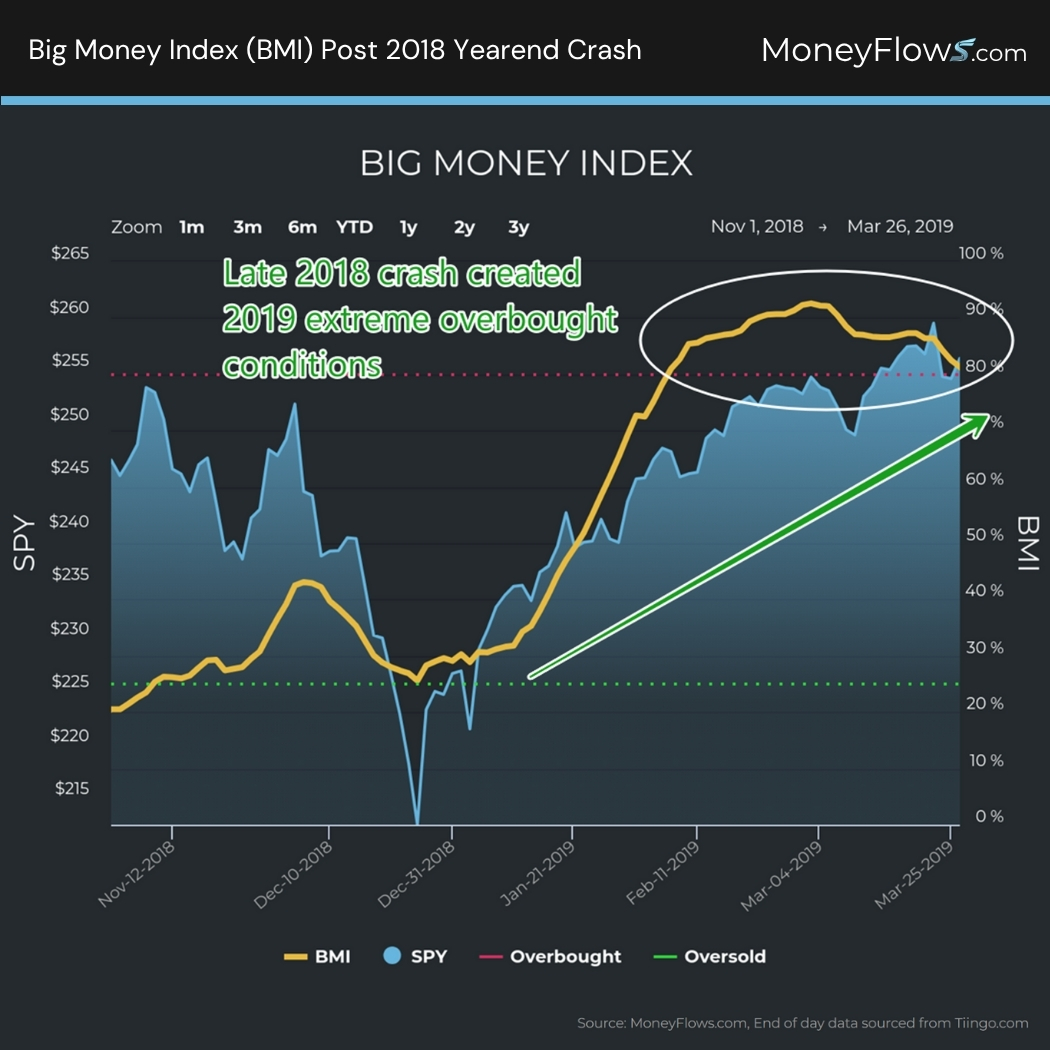

Here’s our Big Money Index (BMI) which tracks real-time demand for thousands of equities. From the April lows, our data has signaled UPSIDE:

That red zone horizontal line is a reading of 80%. That’s the official overbought zone.

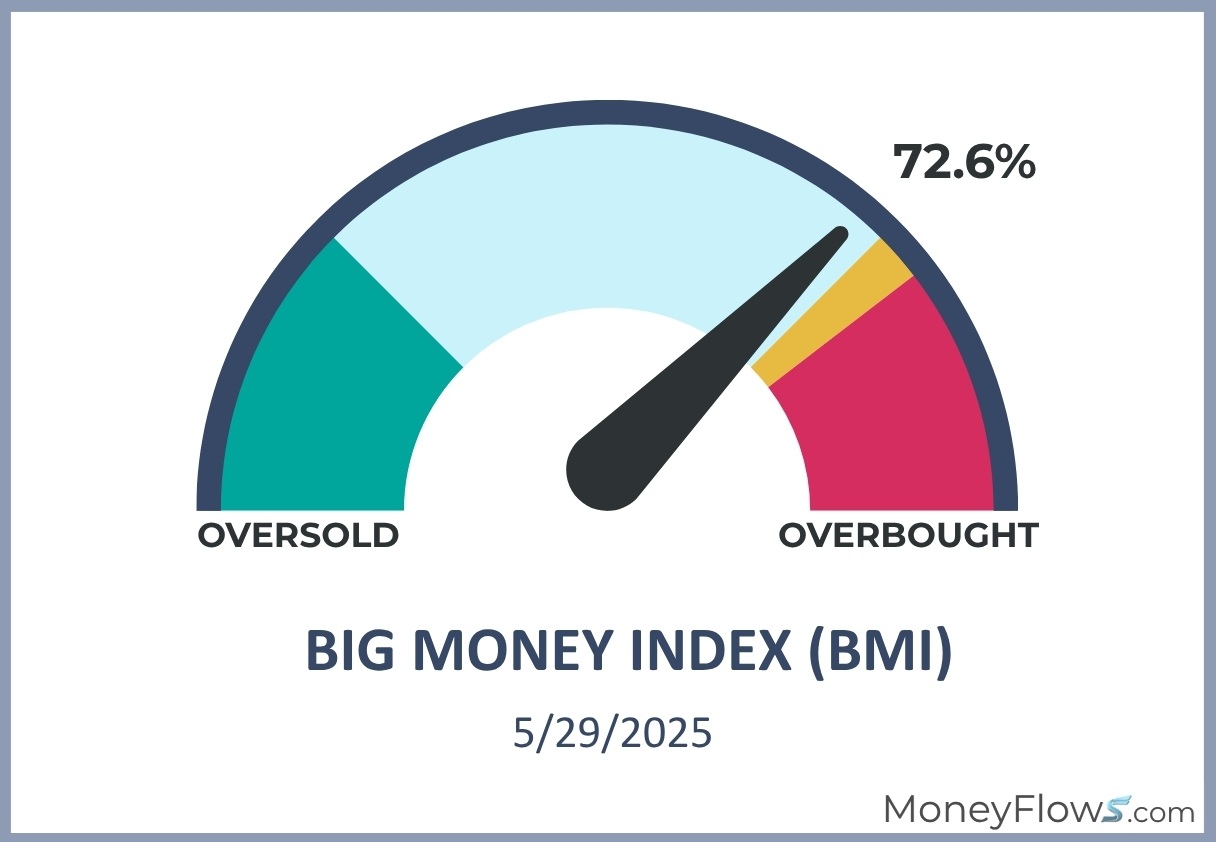

Below showcases where we are in relation to it:

On the surface, it may appear that reaching the red-zone is a great time to take profits.

However, given the extreme capitulation we witnessed in April, there’s a high likelihood that we’ll hang in the red zone for a prolonged period.

Here’s why.

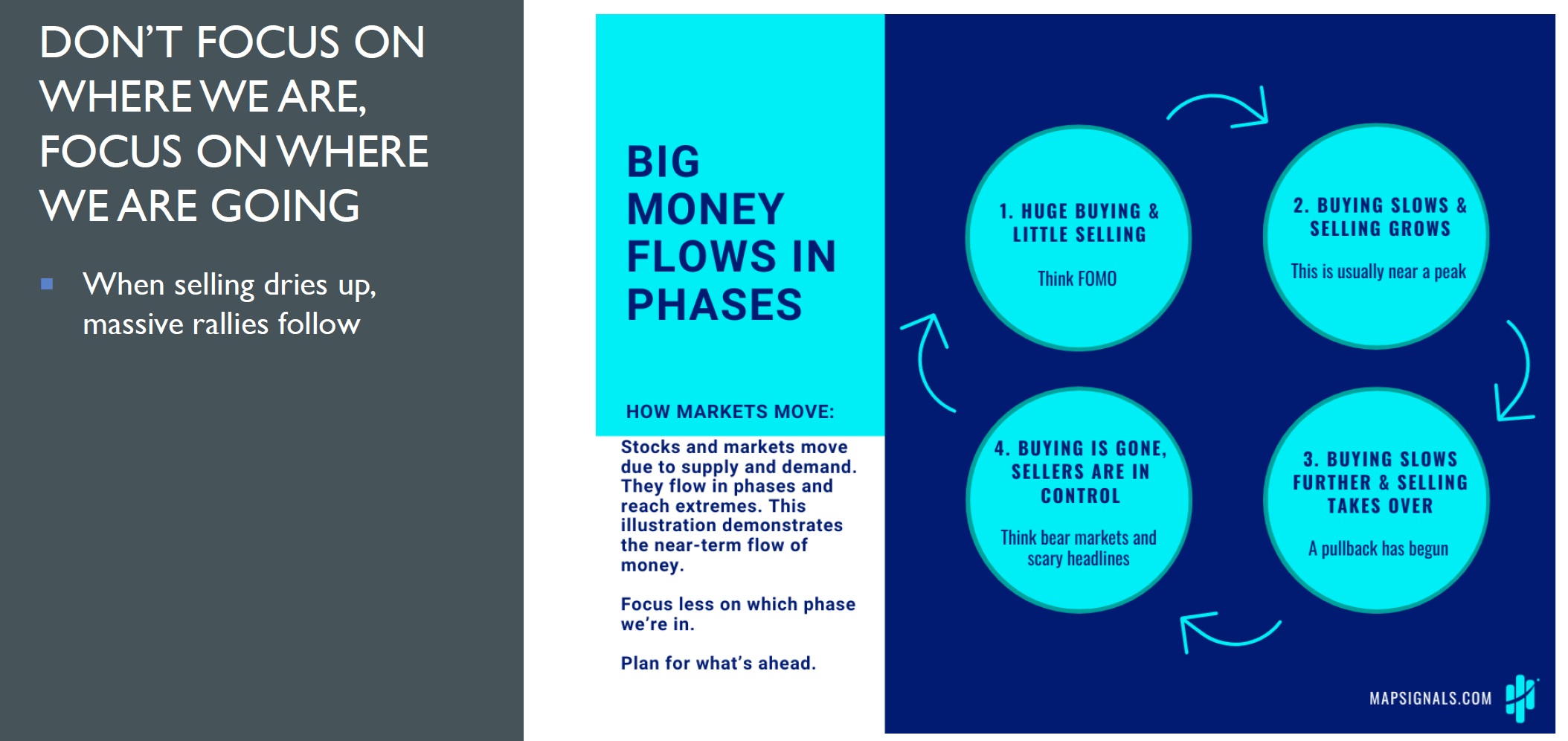

At the market low, I shared 15 extreme charts for April including the Big Money phases chart.

Here it is again. Six weeks ago we were in the Phase 4, which is the rare extreme capitulation zone.

Those brief windows of opportunity often ignite extreme risk-on positioning indicated by phase 1:

What’s occurring today in markets isn’t a fluke.

We’ve seen this repeatable pattern time and time again.

Now let me explain why we could be looking at a prolonged period of higher equity prices.

Prepare for Extreme Overbought Conditions

Analogs are fun when you get them right.

Social media had a field day comparing 2025’s selloff to the GFC crash of 2008 and even worse was the comparison to 1929.

Let’s just say the entertainment value was high on those charts!

The better analogs for today’s environment are much more recent:

- The COVID-19 crash and recovery

- Late 2018 crash and recovery

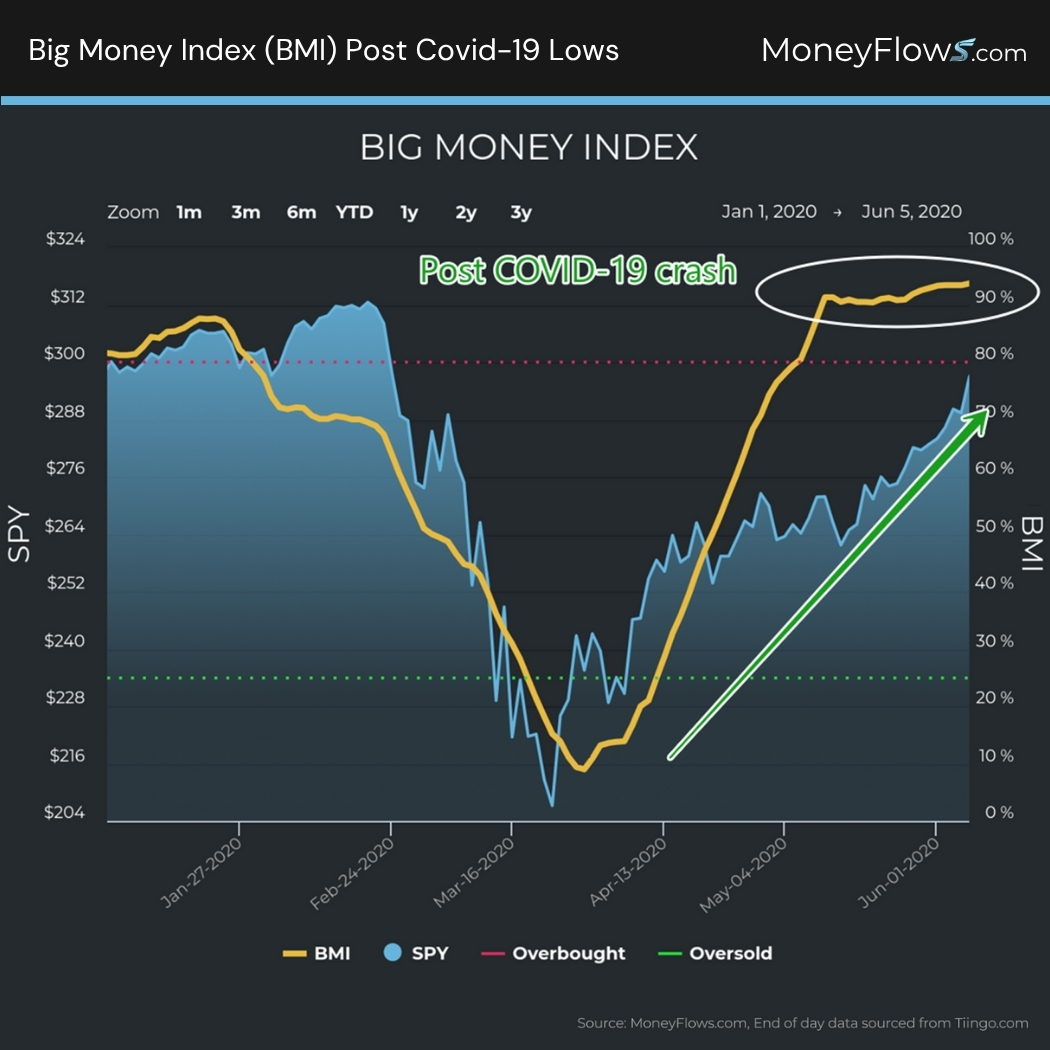

Both periods saw wicked prolonged periods in the overbought zone. Here’s the COVID-19 BMI analog.

Notice how the steep BMI from the lows pierced the red zone and flatlined there for weeks:

A similar setup occurred in late 2018.

The big reason for extreme overbought conditions was simply due to the large investors re-positioning back into equities after being blown out at the bottom:

That’s what I suspect is coming to a market near you.

That repeatable pattern can be seen today. Violent capitulation ignites forced buying which we are seeing the beginnings of now:

And the amazing opportunity for investors lies in the actual companies seeing constant inflows.

Those green bars are single stocks that are loved by institutions. They are companies that have world-changing technologies, healthy earnings growth, and powerful themes.

PRO members can click-through and see the exact stocks every single day, ranked by score.

***Join co-founder Jason Bodner, July 15th–17th LIVE at Caesars Palace in Las Vegas, as he presents: Finding Stocks and ETFs to Own in the New Economic Liberation at the MoneyShow Masters Symposium.

Get access to tomorrow’s leading stocks, today.

Receive PRO level updates walking you through our highest conviction stocks under heavy institutional accumulation.

Don’t wait for the headlines to give you the green light.

Be early…go with the flows.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.