Epic Rallies Kill Recession Odds

Bears are finally having a moment. They deserve it, they’ve had a really tough few months.

And there are plenty of them - bears outnumbered bulls by 16% in the mid-August AAII sentiment survey.

I guess misery loves company.

Hug a bear because today, we’re adding another positive to our stock market outlook – the equity rally itself.

Turns out, epic rallies kill recession odds.

Pundits love to discuss the “R” word and how economic doom is around the corner.

We’ll take the other side.

This view dovetails nicely with our prior constructive market calls over the past few months, ranging from Fed easing to corporate tax cuts, better than feared tariffs, rising capex, deregulation and accelerating M&A.

We’re highlighting two contrarian studies showing how huge rallies usually precede both strong economic growth and further gains for stocks.

Then, we’ll show you some new sectors to buy on weakness as this rotating bull charges ever higher.

As a bonus, we’ll give you a sector diversified list of high quality, long-term outliers to buy on sale.

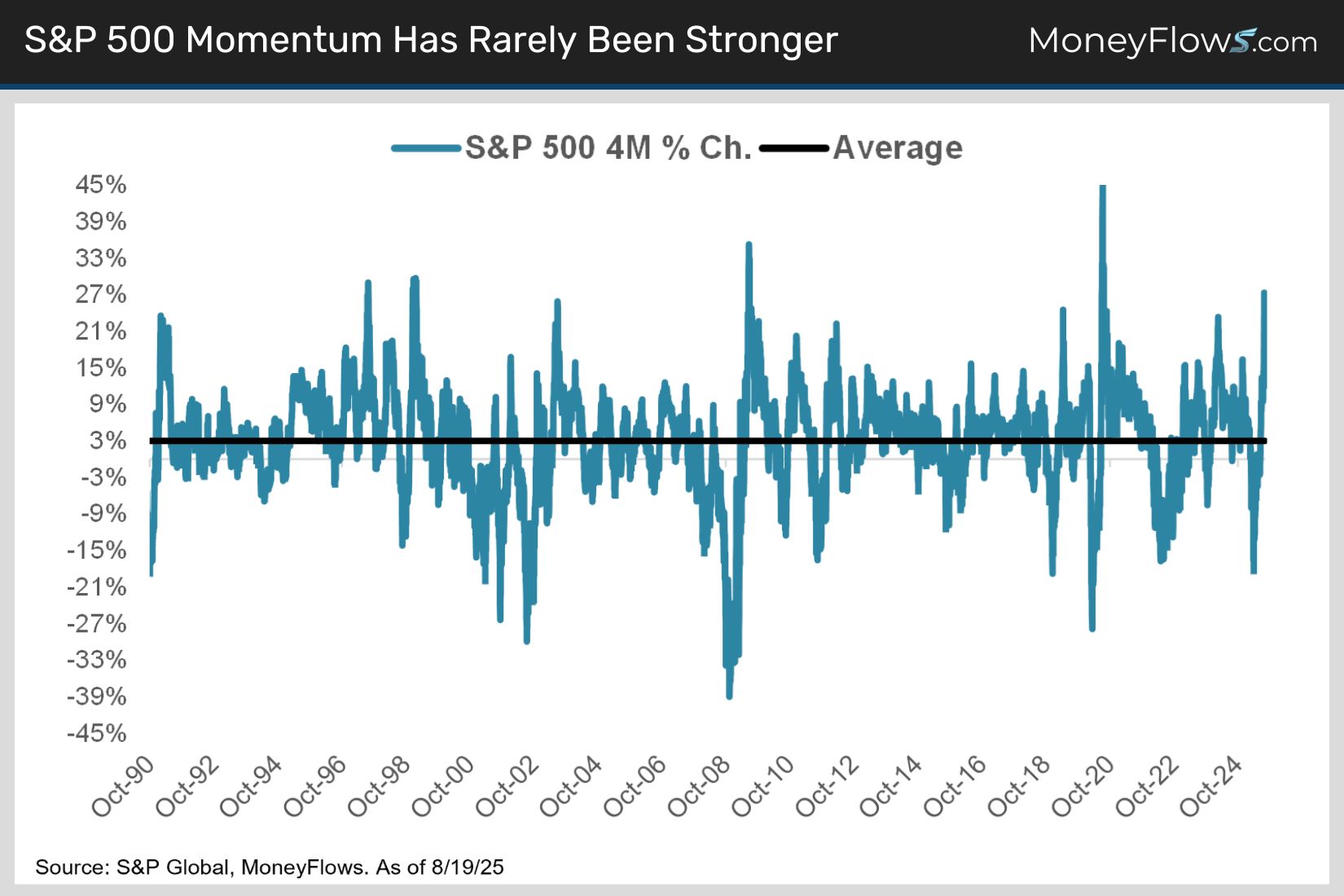

S&P 500 Momentum has Rarely Been Stronger

Even in the wake of recent profit taking, the S&P 500 is still up a staggering 28% since its early April lows.

This epic run is really rare. Rallies this big have only happened a handful of times over such a short time (chart).

If you’re expecting some bear brigade lurking around the corner, think again.

It’s the opposite.

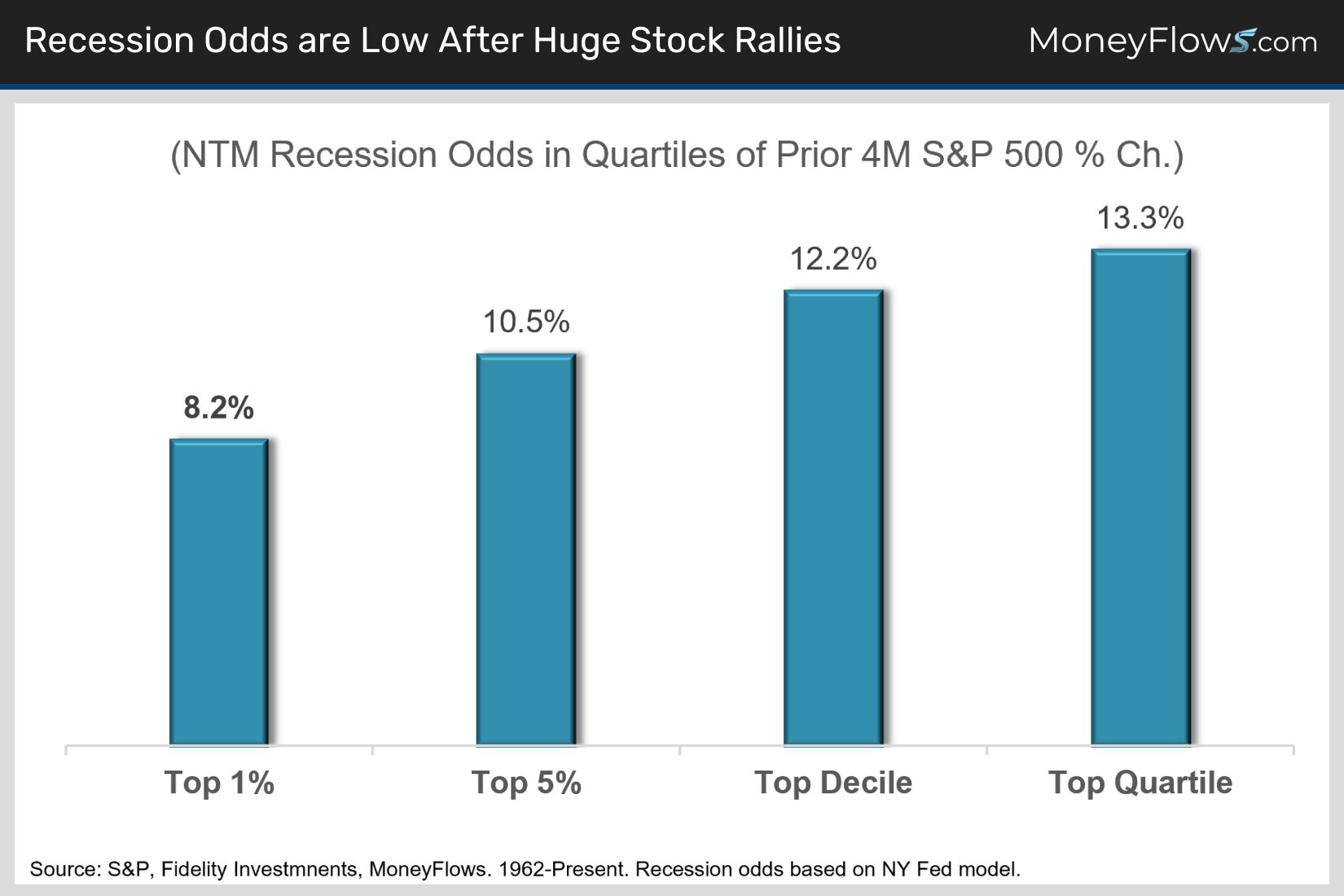

Epic Rallies Kill Recession Odds

Markets often figure out what the future holds in advance. Big rallies tend to happen before the outlook improves - not after.

This is why MoneyFlows data often contradicts prevailing narratives.

Stocks don’t wait for good headlines. They anticipate better conditions before economic data confirms it.

When stocks rally sharply like they have in 2025, recession odds usually drop.

The New York Fed’s model - which uses the yield curve to estimate recession odds - has historically shown declining risk in the year following powerful market surges.

The odds of a recession are only 8% in years following top percentile rallies like the one we’re enjoying now (chart).

Tune out the doomers.

Get constructive.

Turns out huge rallies aren’t just great for economic growth. They’re good news for stocks too.

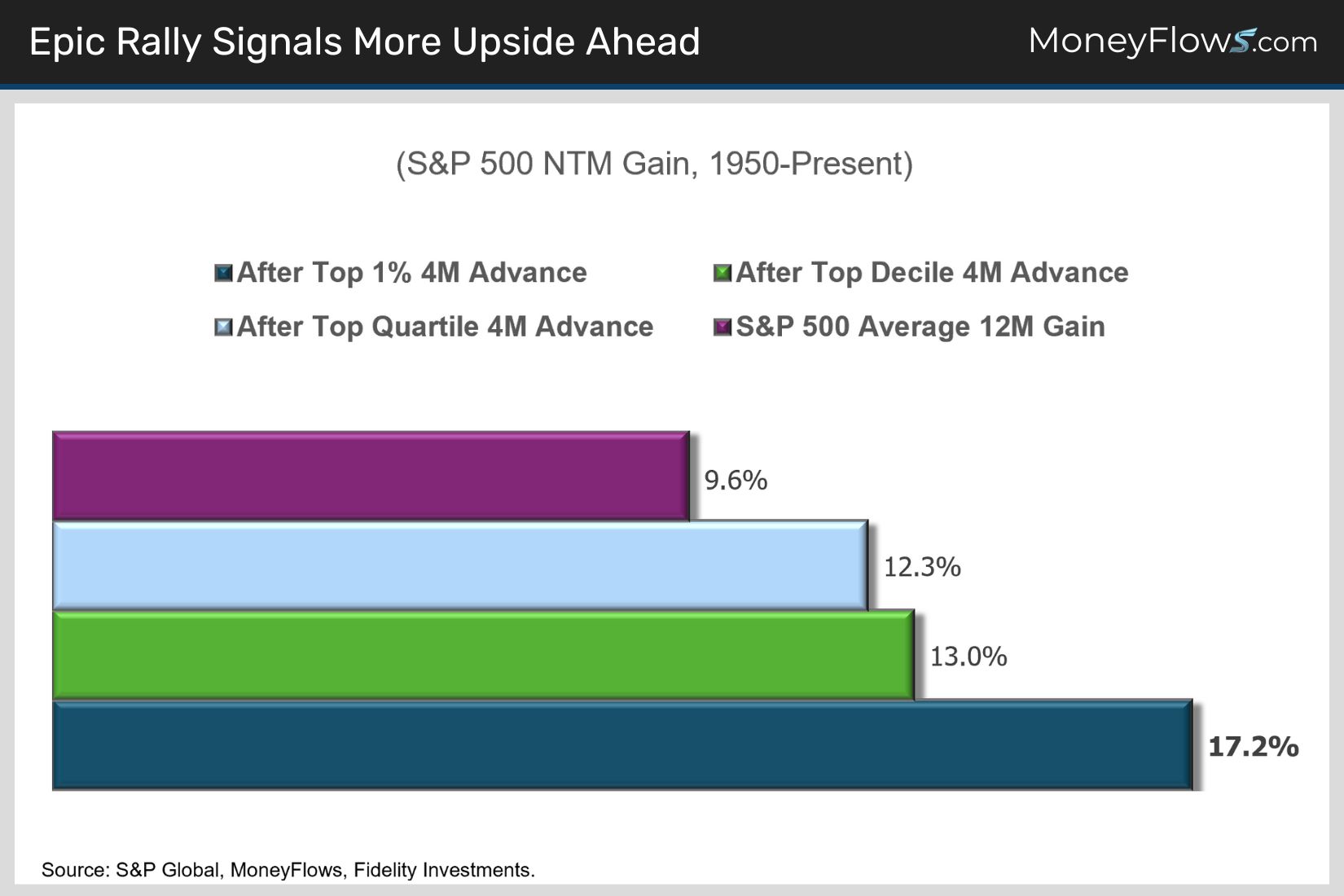

Buy Stocks During High Momentum Periods

The bigger the rally, the better the forward returns.

Statistically speaking, each percentage jump in the size of this rally should shift investors away from worrying about what could go wrong toward considering what could go right.

Top percentile rallies like 2025 have historically preceded average 12-month gains of 17% with positive returns occurring 100% of the time.

The average NTM gain drops to 13% and 12.3% after top decile and top quartile advances, respectively, both of which still tower over the S&P 500’s typical 9.6% long-term average annual gain (chart).

If you think we’ve come too far, too fast, history suggests the opposite. These surges don’t happen randomly – they tend to follow periods of below-average returns like April’s near bear market.

Put simply, huge upside momentum is often a catch-up trade, not a sign of irrational exuberance.

What This Means for Your Portfolio

We’ve explained why market momentum is a reason to buy, not sell. Now, let’s tackle portfolio construction.

As our bullish macro thesis keeps expanding to incorporate fresh drivers, we’re casting a wider sector net too.

We’re sticking with our three long-time favorites, tech, financials and industrials. But after huge gains, they’re taking a healthy breather. We’d buy this tactical dip.

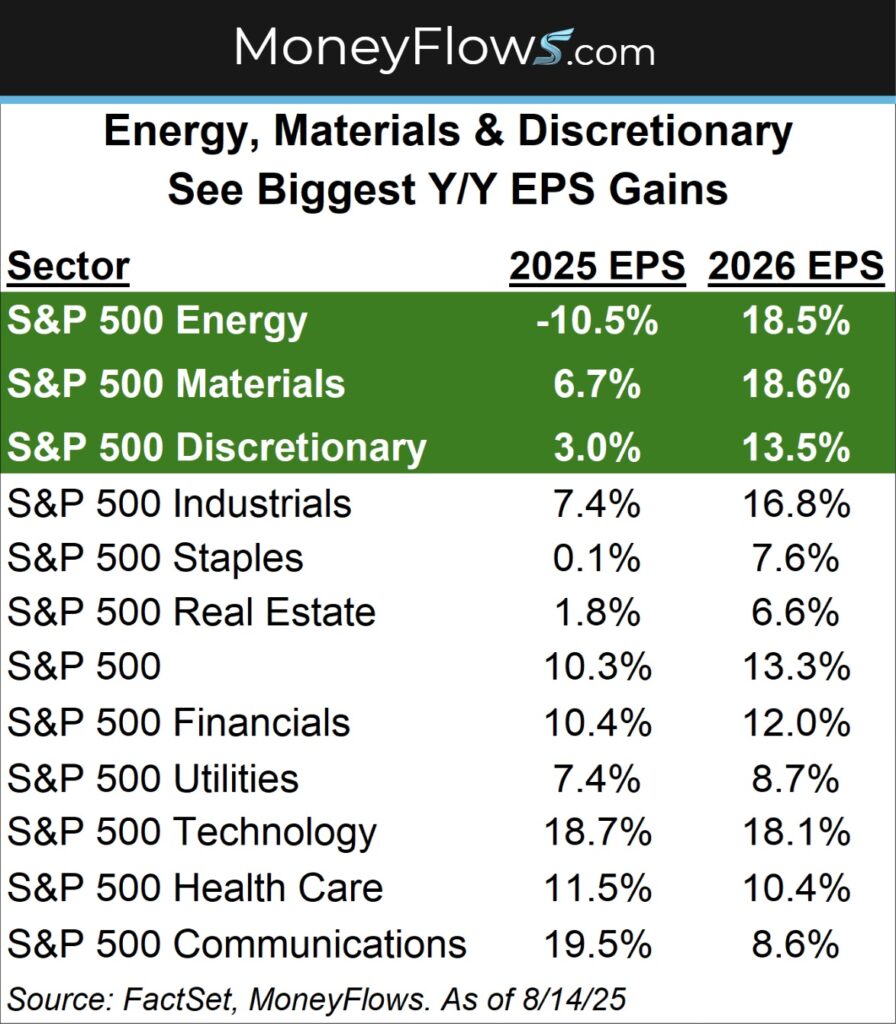

We think the cyclical winners circle will broaden out as the macro-outlook continues to improve heading into 2026.

Discretionary, materials and energy have all notably underperformed the S&P 500 YTD. We see them doing better moving forward. They are forecast to post the biggest Y/Y earnings growth improvements in 2026 (chart).

Where most research houses got it wrong the last four months, MoneyFlows got it right.

Below is a list of the top stocks ranked by our proprietary MAP Score in these three cyclical, sleeper sectors.

To get access and make even more from this call to action, sign up for a PRO membership.

If you’re a money manager or RIA, our Advisor Solution will unpack our unique data on your portfolios...keeping you winning in 2025.

Don’t wait for the media to sound the bull whistle.

By then the train will have left the station.

Many of the stocks below have been massive winners for us this year.

Improving momentum can be seen in the following:

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.