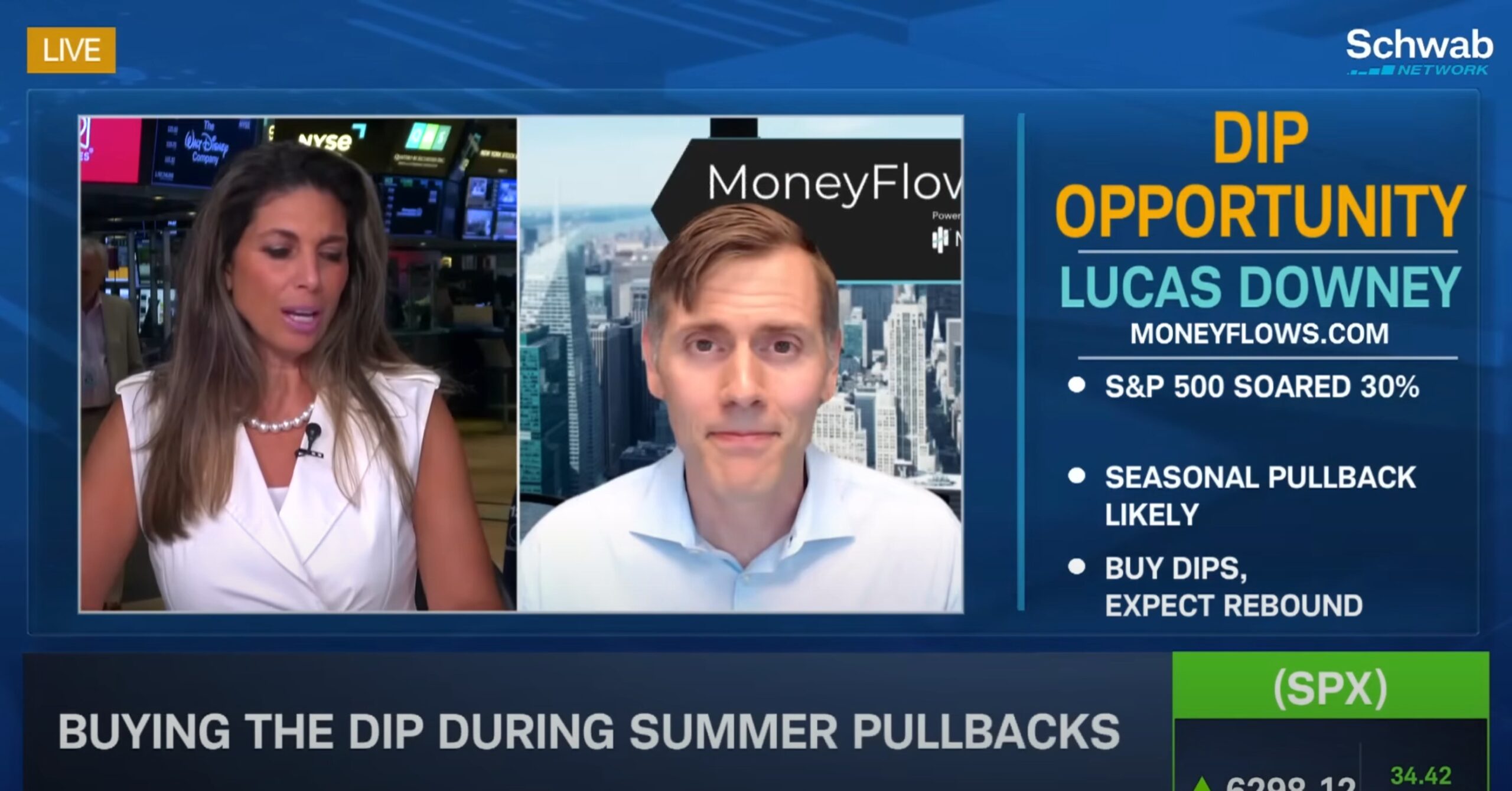

Buying the Dip During Summer Pullbacks

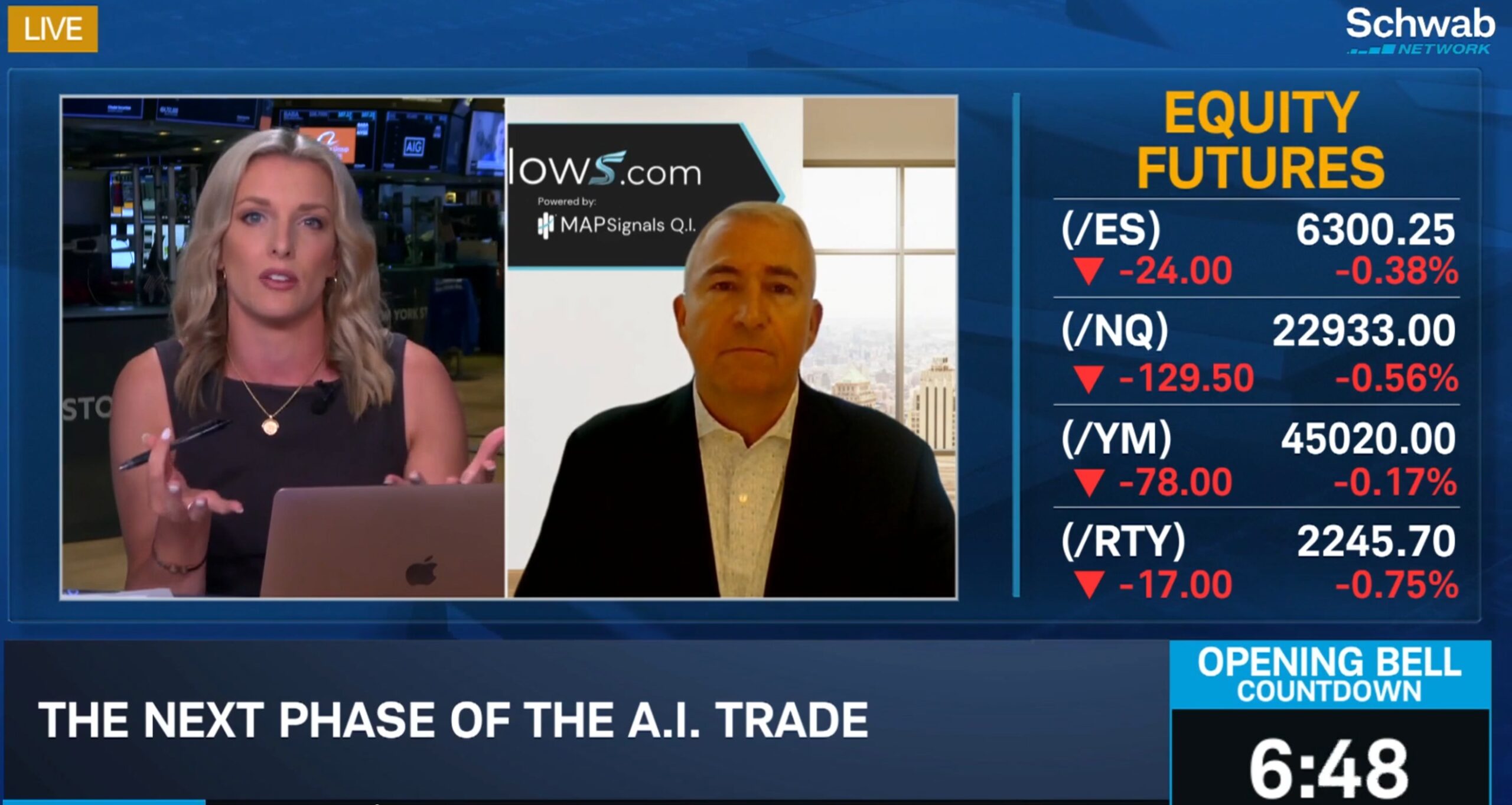

Luke joins Nicole Petallides with Schwab Network to discuss stocks to buy on a seasonal dip. Buy Seasonal Dips, META, TSM & LRCX Key A.I. Stocks Co-founder Lucas Downey expects a seasonal pullback after the steep SPX rally. He urges investors not to panic and instead buy on the anticipated dip. Read more »