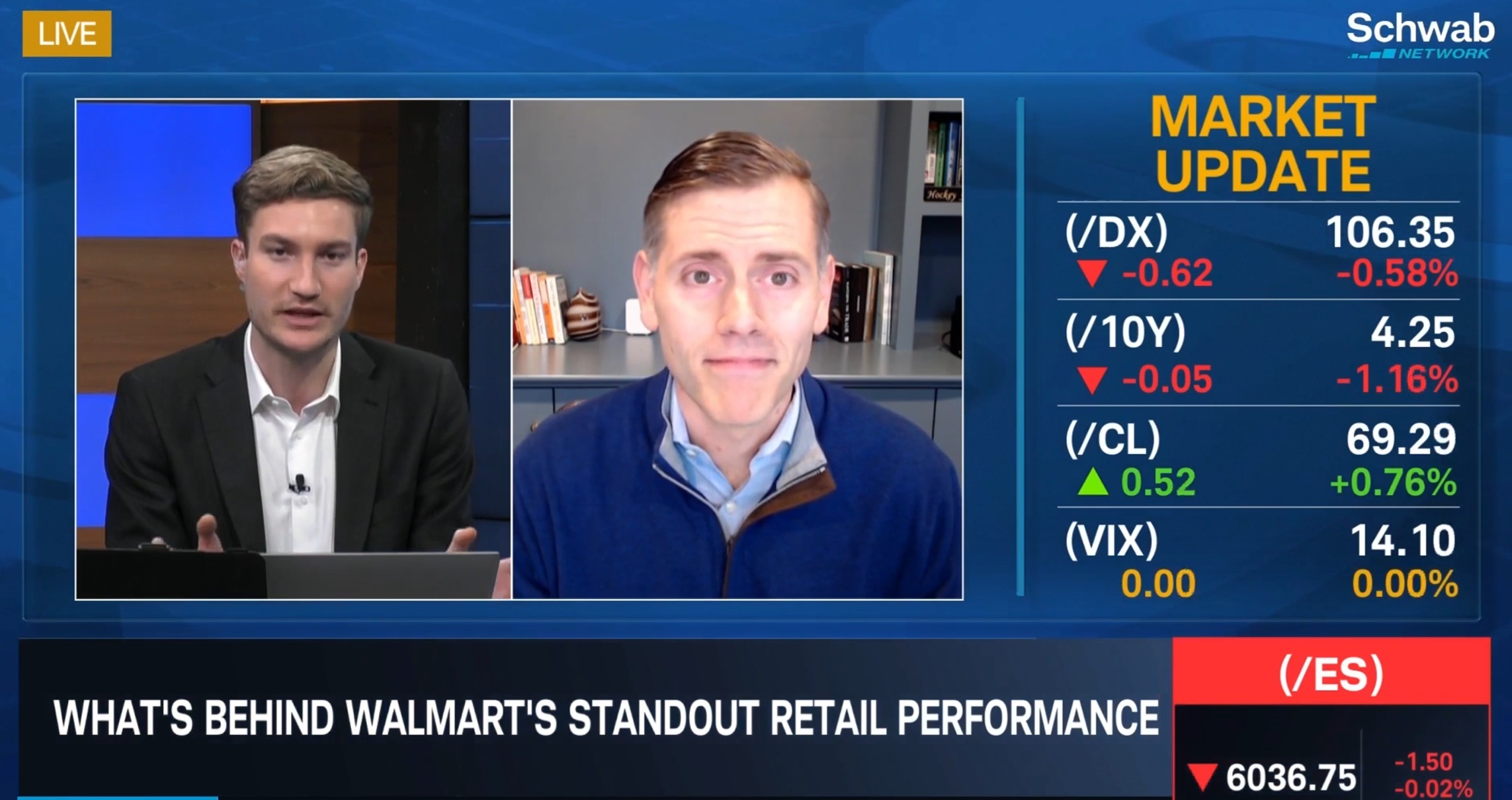

Eyes on the U.S. Consumer Ahead of Black Friday & Cyber Monday

Co-Founder Lucas Downey joins Schwab Network to discuss the U.S. Consumer ahead of Black Friday and Cyber Monday shopping days. WMT, WSM & Consumer Retail Ahead of Black Friday Here we discuss the popular K-shaped economy and ways to play that theme. Walmart (WMT) is working with the value-oriented consumer. Williams-Sonoma (WSM) is thriving with… Read more »