Volatility Crashed to New Lows in 2025

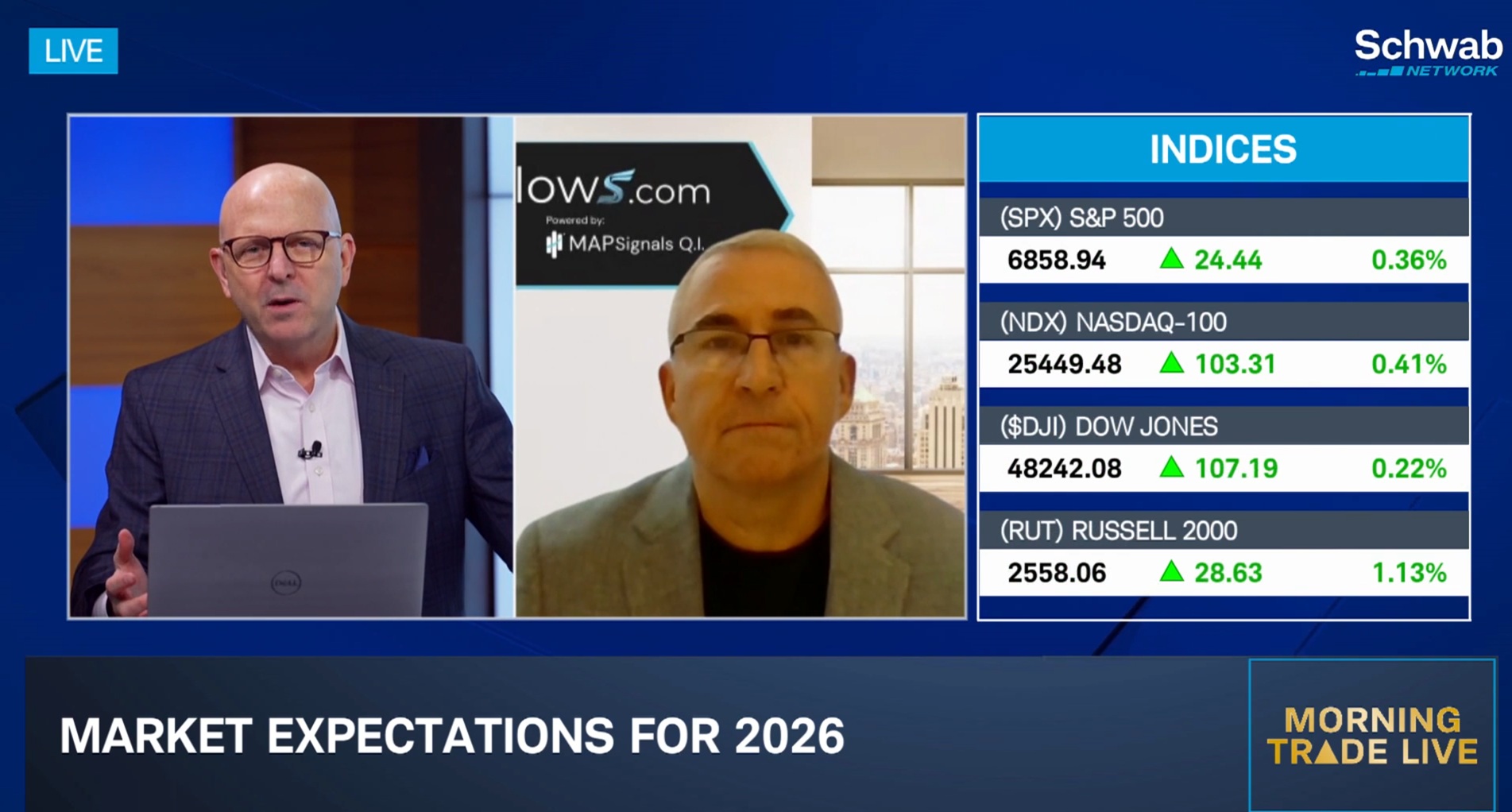

Stocks are bringing joy this holiday season. The uptrend quietly notched a new high for the S&P 500 yesterday. And that wasn’t the only stocking stuffer for investors. Volatility crashed to new lows in 2025. This year is proof that investors should always prepare for the unexpected as it relates to markets. We all dealt… Read more »