Buy Small-cap Stocks Aggressively in 2026

There is a revival occurring in markets.

After the Federal Reserve cut interest rates, one area is surging…and rightly so.

History proves you’ll want to buy small-cap stocks aggressively in 2026.

We all learned about motion and forces in grade school. Isaac Newton’s First Law of Motion states how, Objects in motion tend to stay in motion.

In markets, this power law can be described as momentum. If you’ve been investing for any amount of time, you know that trends tend to persist once stocks form a breakout.

Usually these momentum thrusts are triggered by a macro event like earnings acceleration or in today’s case, lower interest rates.

Back in July we made the case that small-caps are a good bet once the Fed cuts rates.

Today we’ll reinforce this stance because a rare power thrust signal just fired.

When it’s happened in the past…stocks unleashed breath-taking rallies.

Buy Small-Cap Stocks Aggressively in 2026

Sometimes you need to look backwards to see the future.

Back in August, we showcased 2 rare signals that will power small-caps to all-time highs.

At the time, this was not a consensus idea. But we made this bold claim after 2 setups occurred:

First, the S&P Small Cap 600 surged 3.8% in a session on August 22nd.

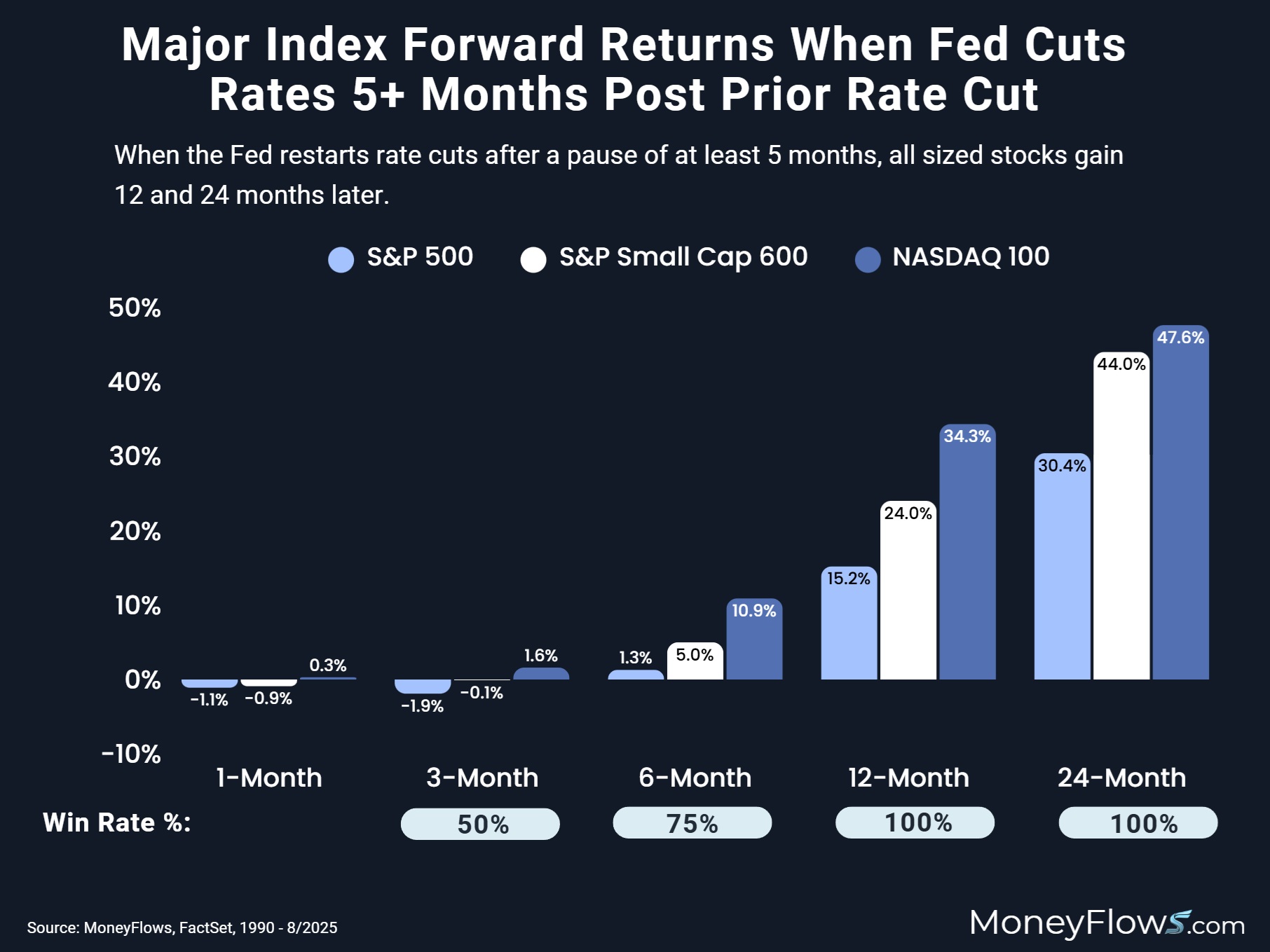

Second, we noted that rate cuts will restart after a 5+month pause from a prior cut. Here’s that signal study as it is still very relevant to today:

Notice how strong overall market returns are in the 6 – 24-month timeframe…especially for small-caps.

What this reveals is that we are in the middle of a significant small-cap bullish signal. And today’s signal study will take our constructive stance a step further.

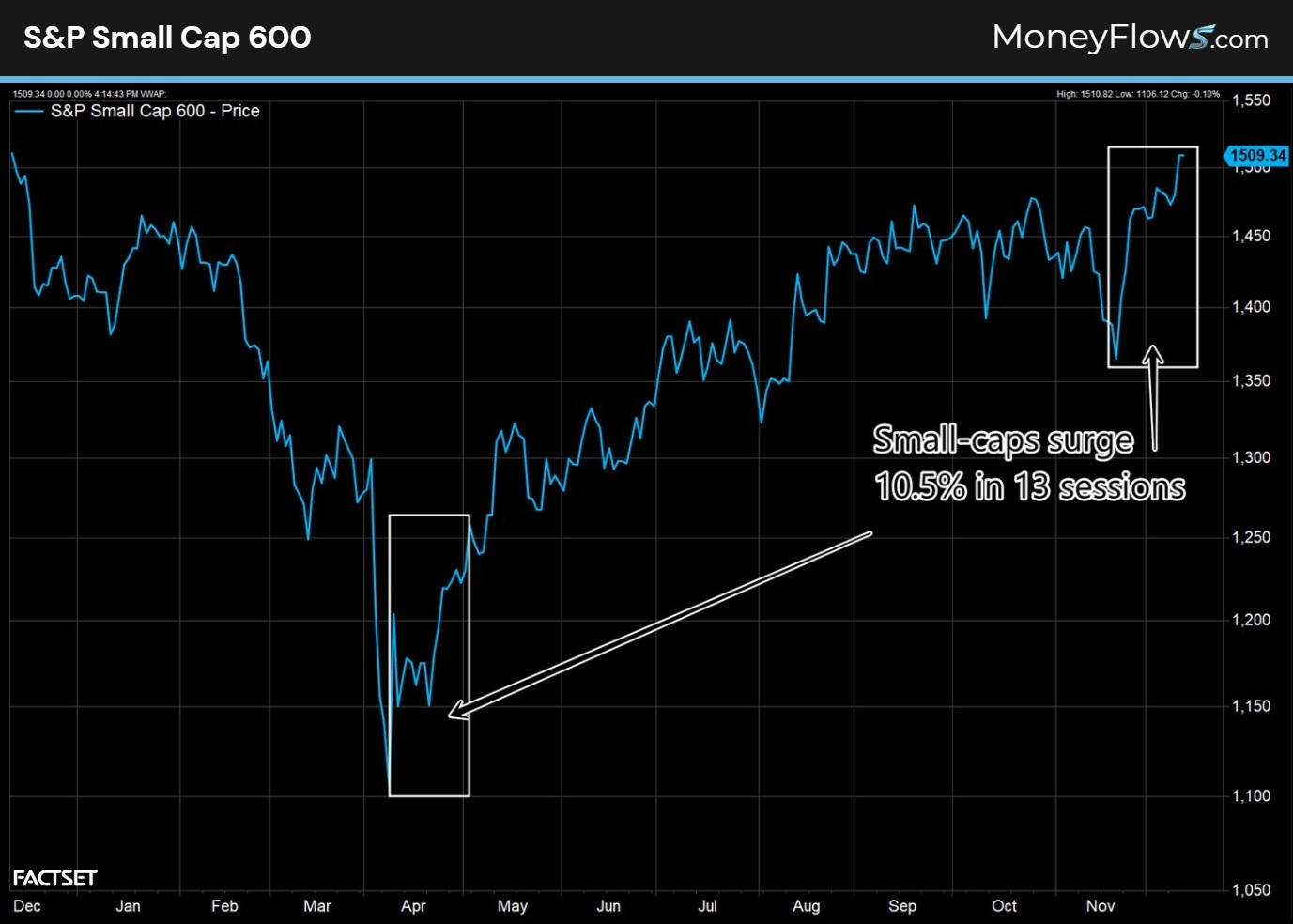

Over the past 13 sessions, the S&P Small Cap 600 has surged a crowd-stunning 10.5%. Incredibly, the last time we saw a similar gain over the same time frame was coming out of the Tariff crash:

Now, using the eye-ball test we can visually note how in April small-caps continued powering higher after this double-digit surge.

But we don’t rely on eye-balls for our signals at MoneyFlows. We study history and evidence.

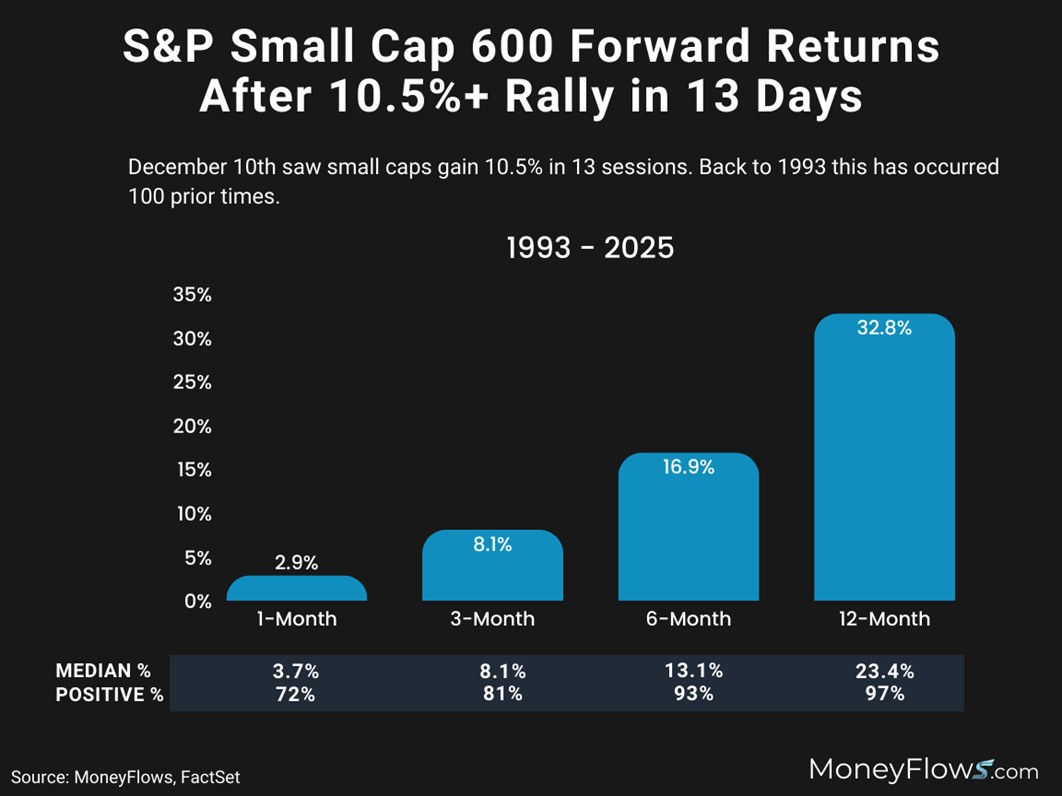

Back to 1993, we found 100 instances where the S&P Small Cap 600 gained 10.5% or more in a 13 day span.

Here’s why you’ll want to buy small-cap stocks aggressively in 2026:

- 1-month later small-caps jump 2.9%

- 3-months later small-caps leap 8.1%

- 6-months later small-caps power higher 16.9%

- 12-months later they surge 32.8% on average

Stick the following graphic on the refrigerator:

The time to prepare for new leadership is now. Given next year is a mid-term election year, expect a change in character.

Value-oriented dividend growth areas can thrive.

Yesterday’s monster rally saw the largest daily inflows since August:

And when you dive into yesterday’s flows by market cap, it’s easy to see where institutions are betting.

Of the 190 discrete stocks attractive capital, 80% or 153 equities were below market caps of $50 billion:

And for members, I’ll be showcasing the sector today that amounted to over 33% of those rare flows.

And history signals double-digit gains for this specific area.

As we approach 2026, you’re going to want to tilt your portfolios with smaller stocks. Lower interest rates mean new leadership and all-star opportunities not found on the lips of the media.

Rotations bring opportunity.

You just need a map to see it!

Become a PRO subscriber today and gain access to our top stocks each day. You can search flows on the stocks you care about most and gain access to our weekly Outlier 20 report.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

And just this week, catch me discussing the recent selloff in Utility stocks. It’s a great signal study highlighting a rare oversold signal that few are discussing.