Buy Semiconductors Over Silver in 2026

There have been huge moves in the market lately.

Precious metals and technology are on everyone’s mind.

We see a bigger opportunity in the latter.

We’ll make the case to buy semiconductors over silver in 2026.

New calendar years bring new leaders. Institutional investors deploy capital in hopes to outperform benchmarks.

This is one reason we tend to see wild market moves in early January.

Our unique data is laser-focused on outsized volumes…and there’s a lot happening under the surface right now.

Semiconductors, specifically those tied to the DRAM bottleneck, have attracted immense inflows for months.

Precious metals, specifically silver, have also climbed with powerful demand.

Today, we offer up studies on both assets…and the evidence points to a better bet for semiconductors in the months ahead.

Let’s unpack why.

Buy Semiconductors Over Silver in 2026

Let’s first tackle semiconductors.

If you’re surprised by the enormous rally in semiconductors lately, don’t be.

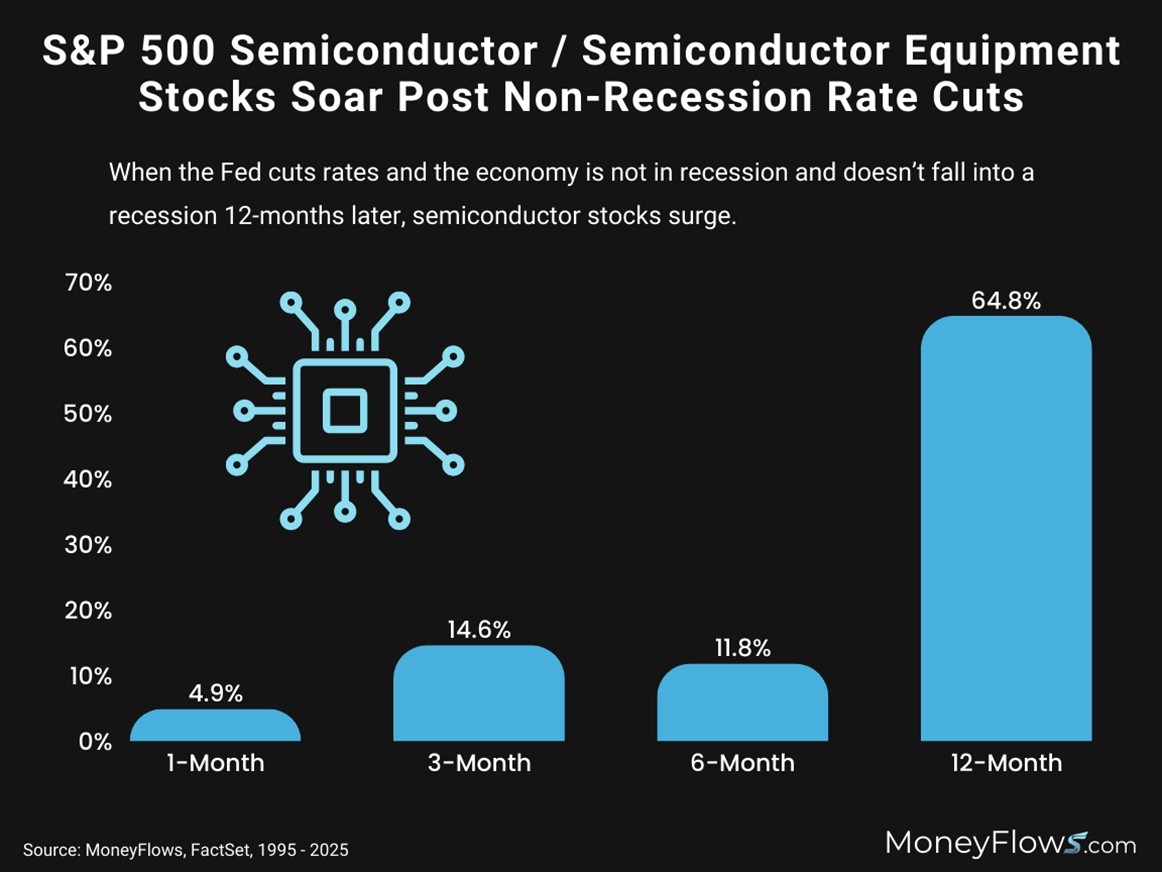

Back in September, we showed how Fed rate cuts will boost the group. In this post, we highlighted a powerful study on the S&P 500 Semiconductor / Semiconductor Equipment group.

Here you can see how semiconductors power higher when the Fed cuts rates and the economy isn’t in recession and doesn’t fall into recession 12-months later.

I’ve updated the study to current.

Cutting rates into a strong economy has been a major tailwind for chip stocks:

Couple this historical study with our money flows data and a beautiful picture emerges.

For months, money has been chasing chip stocks. And in 2026, the flows have been monstrous.

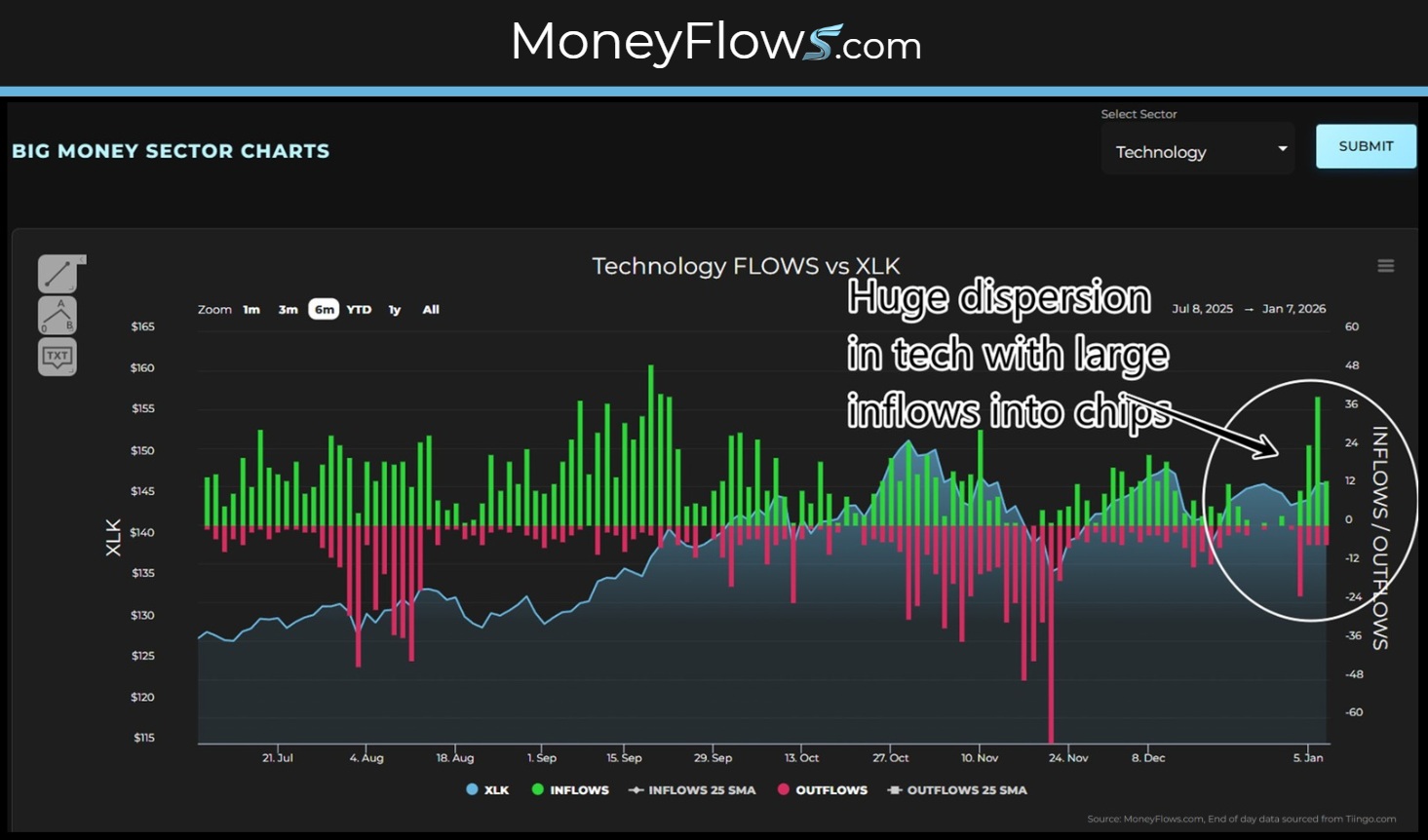

Below details the daily flow count of technology stocks. These are individual stocks under heavy inflows or outflows.

It may appear as random, but it isn’t. There are powerful continuous trends in play.

I’ve circled the large spurt of money YTD.

Technology stocks have recorded 130 flow signals in 2026. A total of 90 are green inflows, and of those flows, 59 are in the semiconductor space:

And inside of the semiconductor space, one group has been a runaway success – firms levered to memory chips including the DRAM bottleneck shortage.

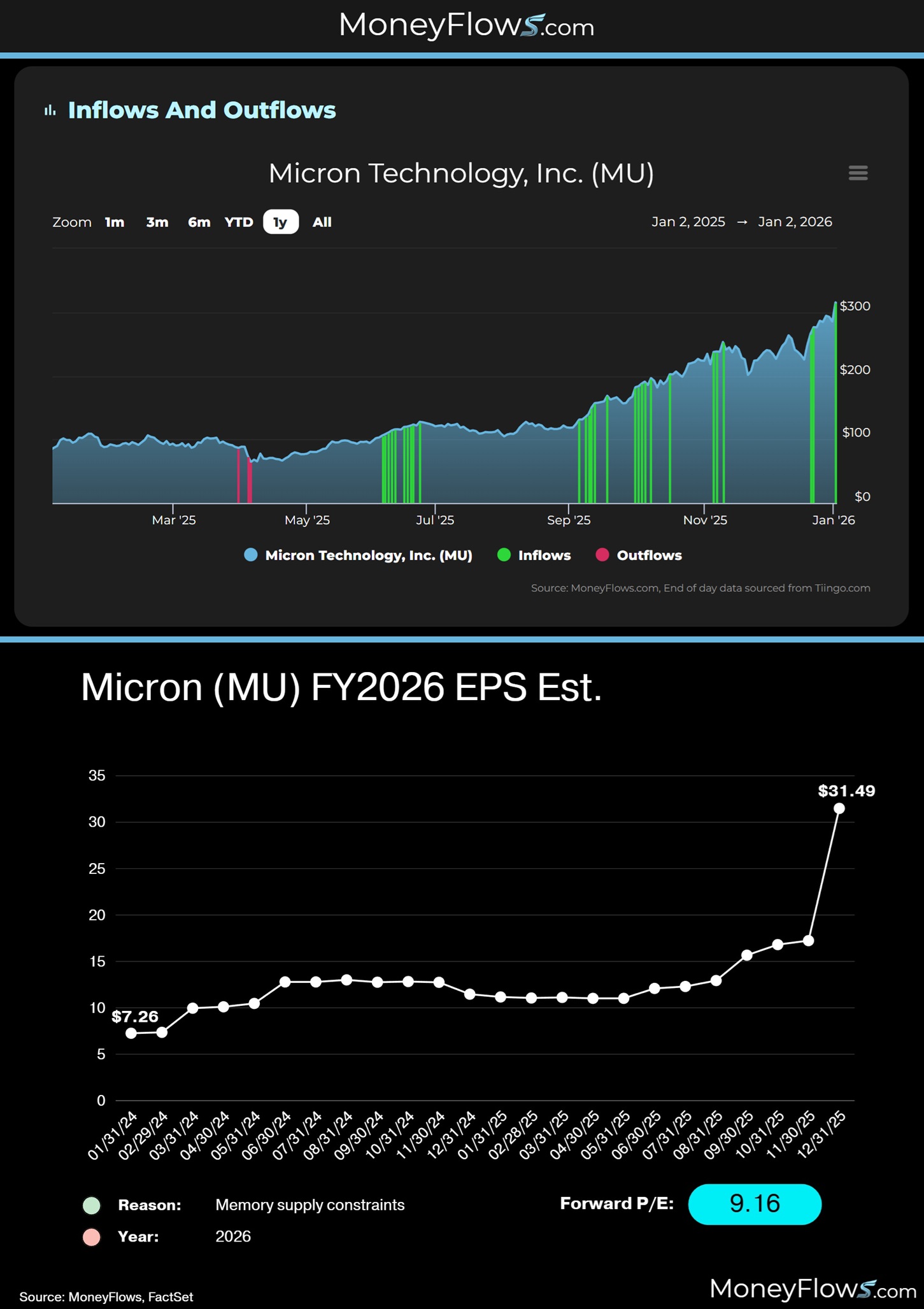

The poster child for memory chips is Micron (MU). If you recall, it was one of our top technology stocks for October 2025.

Notice below how inflows have been nonstop in this name since the summer…well before analysts hiked their FY 2026 EPS forecasts in December.

Micron’s FY 2026 EPS estimates were pegged at $17.24/share in November and surged to $31.49/share in December post earnings.

There are 2 important takeaways:

- First, earnings estimates are improving

- Second, smart investors positioned for this ahead of time as showcased by the green inflows in-play months earlier

So, while we like semiconductors, more specifically our data is focused on idiosyncratic stories inside the industry.

That’s the power of the MoneyFlows process.

We help investors find the biggest trends in the market before they become mainstream topics.

Now let’s pivot to precious metals. Silver has had an epic rise.

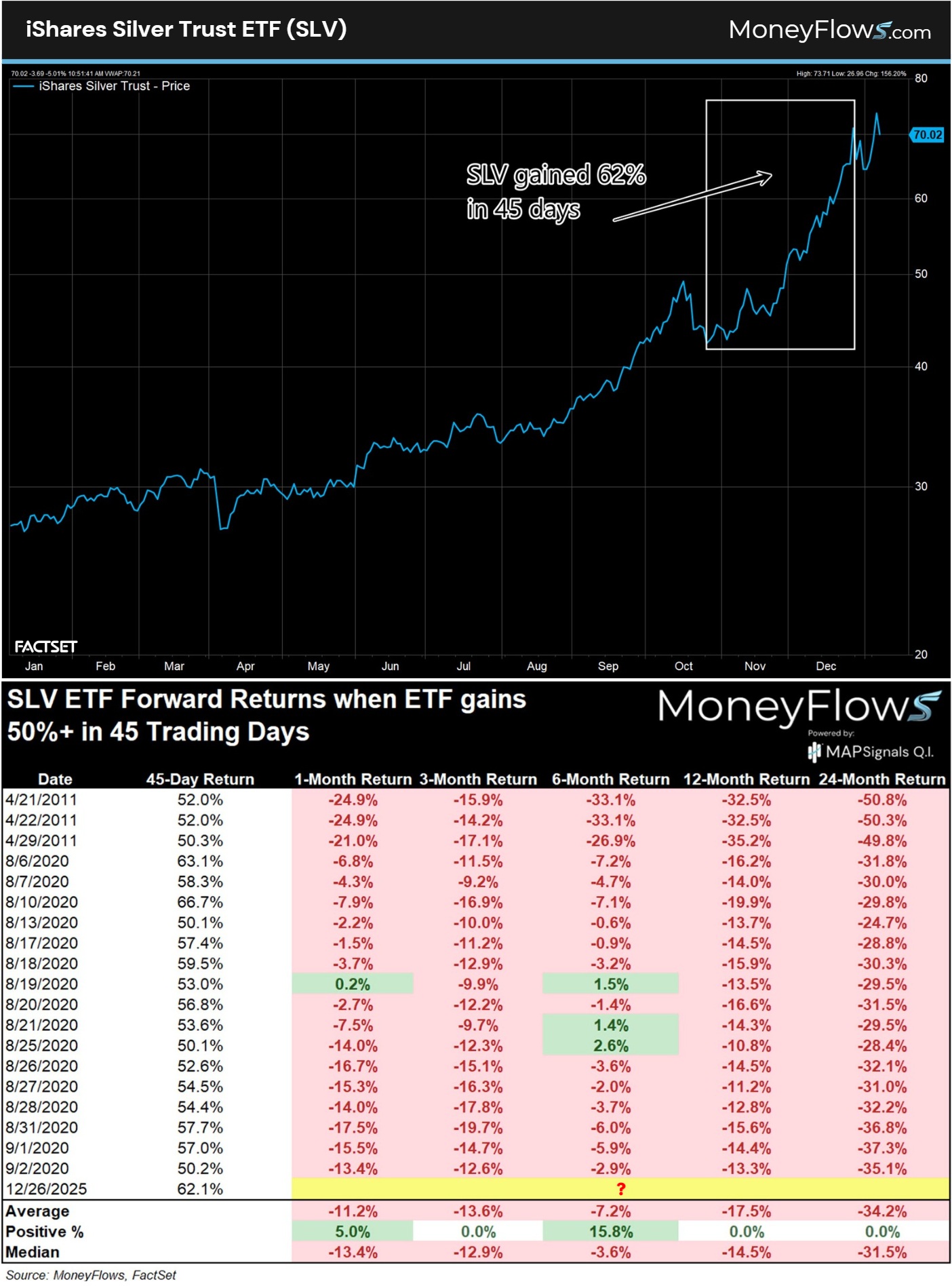

Without question, those along for the ride have been rewarded handsomely. The iShares Silver Trust (SLV) has gained an astonishing 159% over the past year.

Importantly, much of that gain has come recently.

One study in particular is flashing a red light for the commodity. History suggests that now is not a great time to buy the shiny metal.

Consider this: the SLV ETF jumped 62% in 45 sessions ending December 26, 2025. This is incredibly rare…and forecasts a negative outlook.

Here’s why: We were able to find 19 prior instances where SLV gained 50%+ in 45 sessions.

Similar thrusts occurred in 2011 and 2020.

Notably in all instances SLV was lower 12-months later with an average decline of 17.5%:

Could silver keep gaining from here? Of course.

But history suggests you’re likely to get a better entry point in the weeks and months ahead.

Conversely, semiconductors are sitting in the middle of a fat macro tailwind of healthy rate cuts.

Sizing up both overbought areas, high-quality semiconductors have the edge.

And our data continues to showcase the leading stocks leading charge week after week.

2026 is shaping up with new leadership. This is typical action found in January.

Understanding the flow of money will keep your portfolio positioned right.

Don’t miss a huge opportunity to outperform in 2026.

Our proprietary software allows PRO subscribers to spot our top-rated stocks every single day. We score each stock based on its fundamental outlook.

That’s how we find outliers over and over again…and you can too!

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

Make sure to check out Jason Bodner and myself discussing today’s insights in further detail here: