Big September Gains Signal Big 4th Quarter Returns

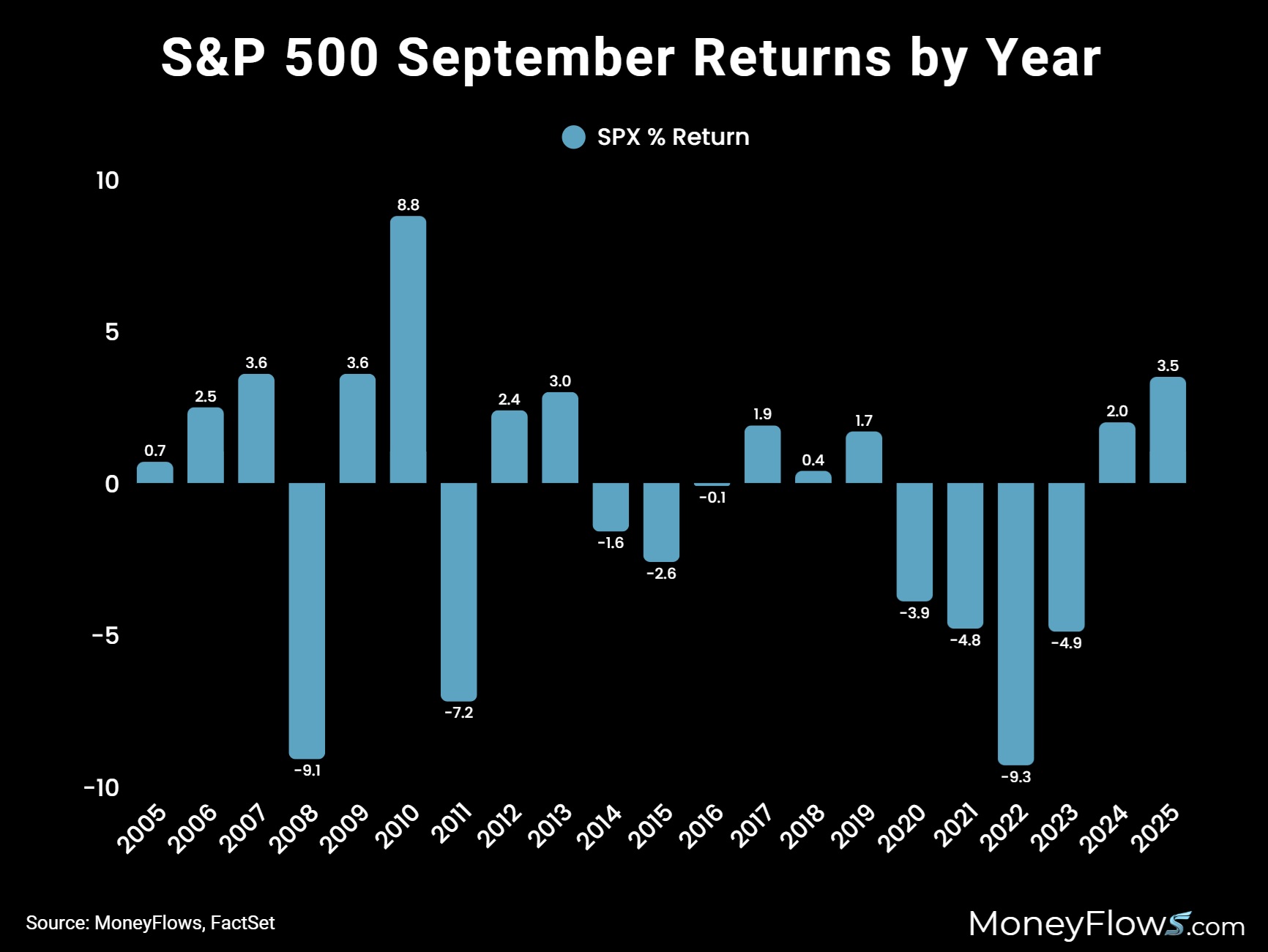

The S&P 500 closed out September with a 3.5% gain.

That’s the strongest September performance in 15 years.

History favors the bulls as big September gains signal big 4th quarter returns.

The bull market notched another all-time high yesterday. The S&P 500 closed above 6700 for the first time ever.

While the gains have been breath-taking to watch, it shouldn’t come as a surprise.

Back in May, we signaled how a surging S&P 500 leads to 18.7% gains 6-months later.

We’ve achieved that in just 5 months. Congrats if you’ve been bullish…we’re living through one of the best stock-picking environments in years.

So, what comes next?

Today we’ll unpack the unusually strong September and study what tends to follow.

The goods news is that more highs are likely ahead.

The bad news is that a big rotation kicked off yesterday. In fact, we saw the most equity outflows in months.

…proving you need to be on the right side of the Big Money right now.

Let’s first dive into the money flow picture. There’s a lot going on.

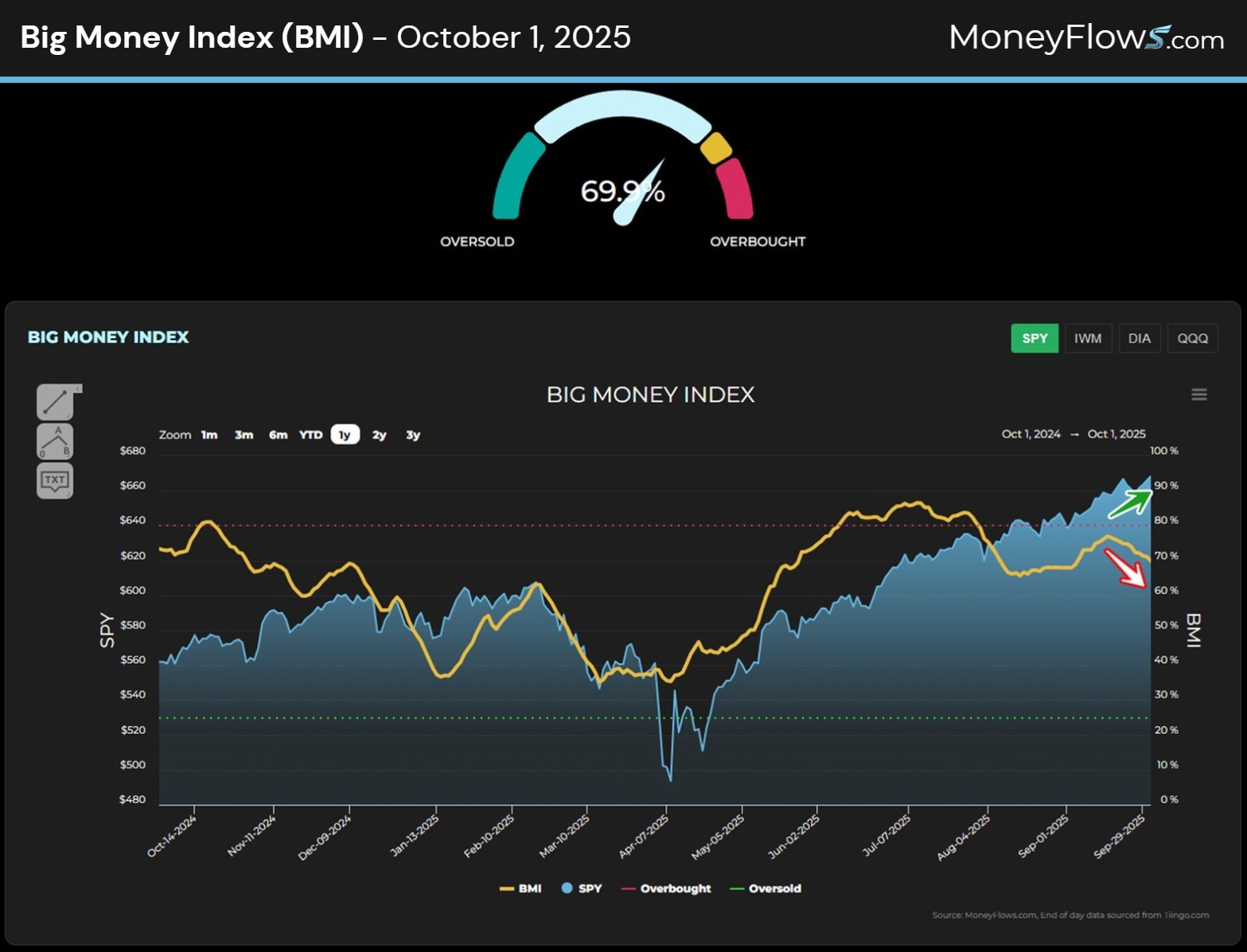

Big Money Index Suffers During Sector Rotation

On the surface, the stock market appears healthy as can be.

Daily, the S&P 500 climbs higher and higher.

But under the surface, many stocks are under pressure. It’s easy to visualize this dichotomy with our Big Money Index (BMI).

The BMI measures daily flows on thousands of stocks. When the line is rising, more equities are under accumulation.

When it falls, like now, it highlights how certain areas are getting sold. This morning the BMI fell to 69%:

Let’s visualize the tug-of-war by studying yesterday’s flows.

137 stocks saw green inflows while 98 were sold. Notably, that’s the most outflows since early August.

Below reveals how Healthcare, Industrials, and Technology (semiconductors) stocks were under accumulation.

Discretionary, Financials, and Technology (software) were sold.

Also note how 6 large-caps recorded inflows, easily explaining why the overall index is rising:

The gap between winners and losers is widening. Take the technology sector as an example.

Breath-taking rallies are found in all-star semiconductors while discrete software stocks find sellers day-after-day. Investors are betting big on the AI winners and losers.

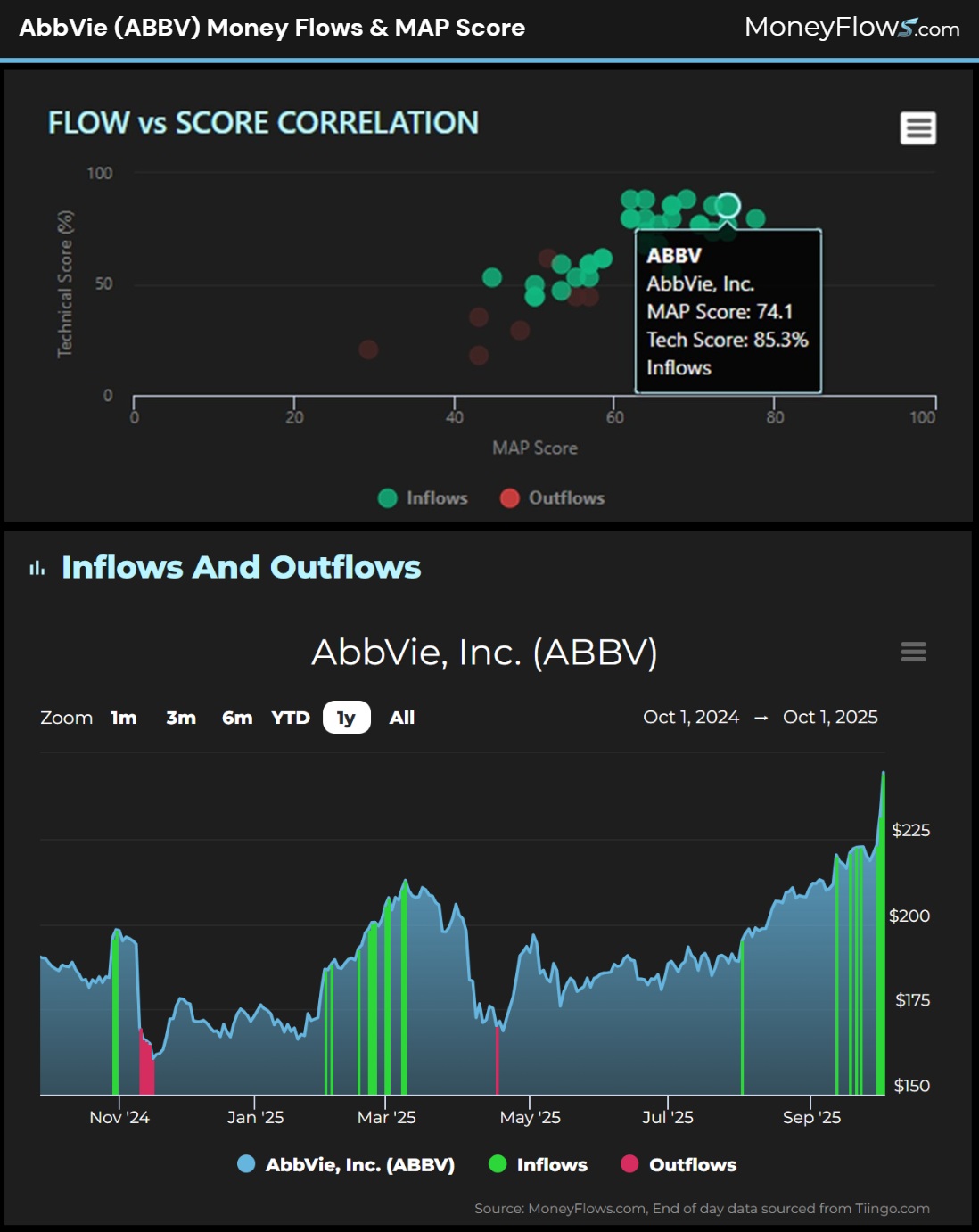

Additionally, large pharmaceuticals are heavily in demand…a trend that’s been in place for many weeks.

Here you can see the daily Health Care flows plotted by MAP Score. AbbVie (ABBV) continues to attract big inflows (Disclosure: I hold a long position in ABBV):

Stock picking is paramount in 2025. MoneyFlows keeps you on the right side of the current.

And the overall investment tide favors more upside.

Big September Gains Signal Big 4th Quarter Returns

Septembers are known for their seasonally weak record. Back to 1990, the 9th month of the year averages a -.7% return.

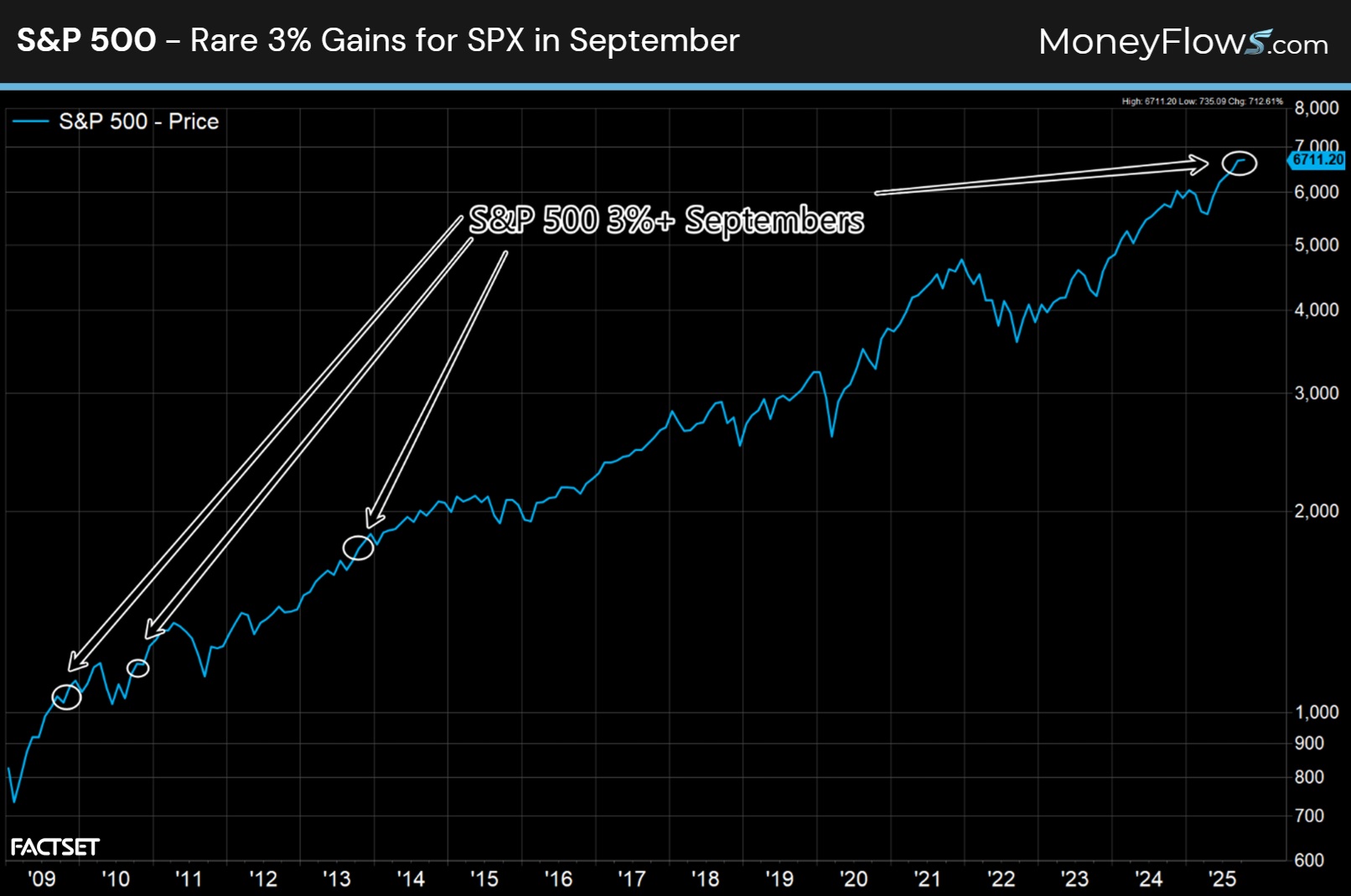

But September 2025 notched its best monthly return in 15 years, climbing 3.5%:

Big Septembers don’t come around often. In fact, back to 1990 just 8 instances saw a 3% or more jump in the nineth month.

Below I’ve circled a few big Septembers including 2013, 2010, and 2009:

To the naked eye, big September gains appear to be a bullish signal.

And they are!

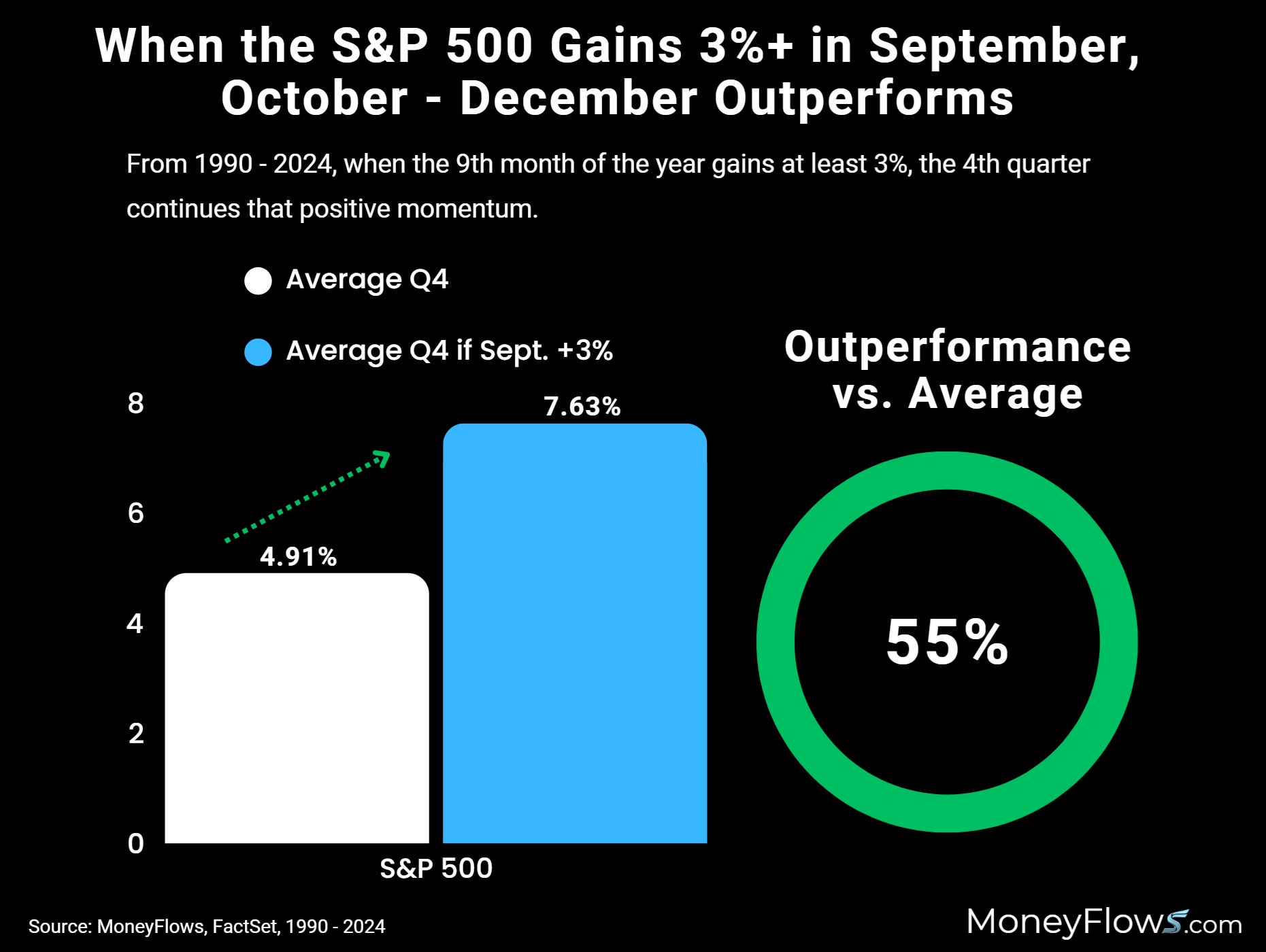

Check this out. Back to 1990, the S&P 500 averages a solid 4th quarter return of 4.91%.

However, when September gains 3% or more, Q4 averages gains of 7.63%…a 55% increase in outperformance:

Let’s all say it together: Big September gains signal big 4th quarter returns!

But keep in mind that rotational action will press winners higher and pound losers lower.

Get on the right side of the money flows!

That’s how you’ll outperform.

PRO subscribers get access to our daily stock flows and weekly Outlier 20 Report. This report showcases our best of breed equities surging with institutional support.

If you’re an RIA or money manager, receive unmatched portfolio solutions and ETF flows insights with our Advisor solution.

The 4th quarter is a great time to up your research!

Don’t follow the news.

Go with the flows!