Best Oversold Consumer Stocks to Buy for 2026

Investors need to explore new areas next year.

Plenty of left behind companies present big opportunities.

Here are the best oversold consumer stocks to buy for 2026.

We’ve been on record about the rotation occurring under the surface of the market. Last week we made the case to own high-quality small caps in 2026.

And in our macro 2026 outlook, we highlighted 7 signals that will shape next year’s market leaders.

Yes, we are preparing for a change in market behavior. Which means, be open to oversold names that aren’t currently on investors’ radar.

That brings us to discretionary stocks, primarily with a consumer focus.

Today we’ll highlight 3 of my favorite high-quality stocks with the potential to turn things around in 2026.

Prior growth-heavy leaders have reached levels that are not only interesting…they’re deeply in the discount bin.

Best Oversold Consumer Stocks to Buy for 2026

Not all stocks have enjoyed big gains like technology and AI companies.

Plenty of real-world companies have taken a backseat to a crowd craving high-momentum opportunities.

This is where value can be found.

I like to focus on healthy fundamentally sound stocks with heavy charts. Prior leaders can make a turnaround in the blink of an eye.

One way to spot potential shifts is by following money flows. Each day our process reveals our proprietary inflows and outflows in equities.

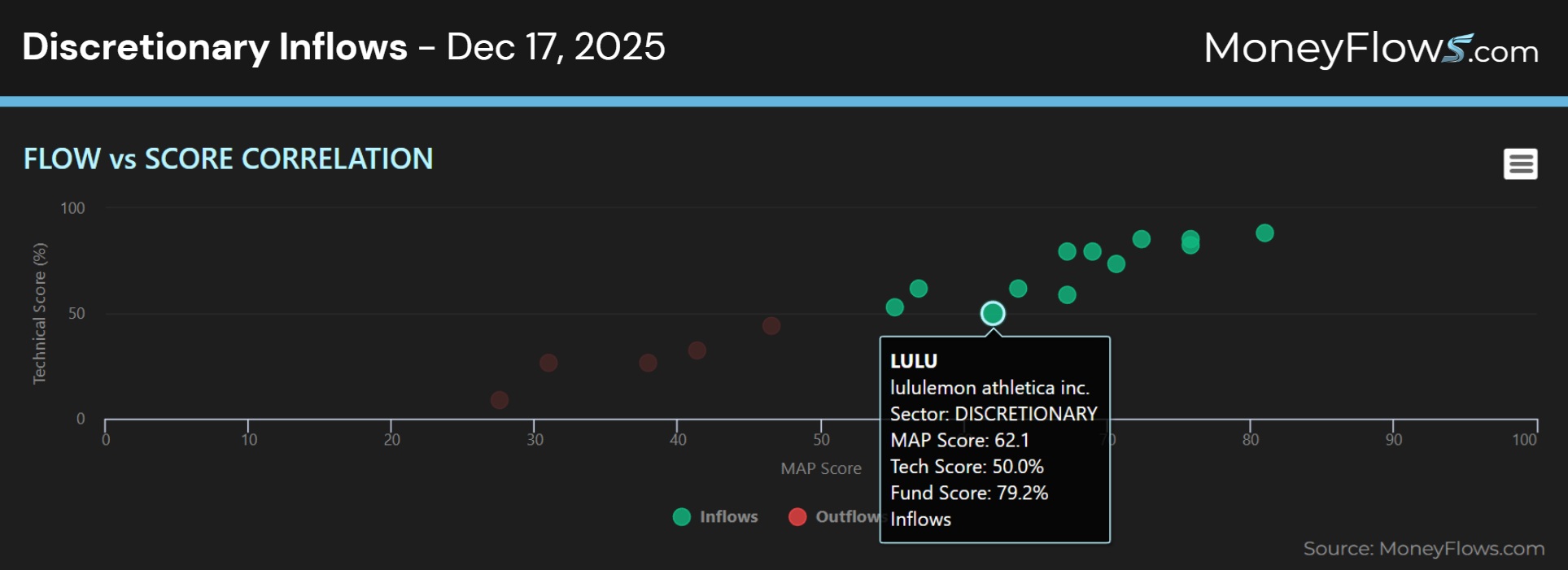

Here are yesterday’s flows in the discretionary space. 12 discrete names saw green while 5 recorded red flows.

I’ve highlighted our first oversold consumer stock, Lululemon Athletica (LULU). This $24 billion market cap company is a leader in athletic apparel and accessories.

Interestingly, LULU saw an inflow yesterday (Disclosure: I own shares of LULU in a personal account):

This green signal is actually the 6th inflow recorded recently.

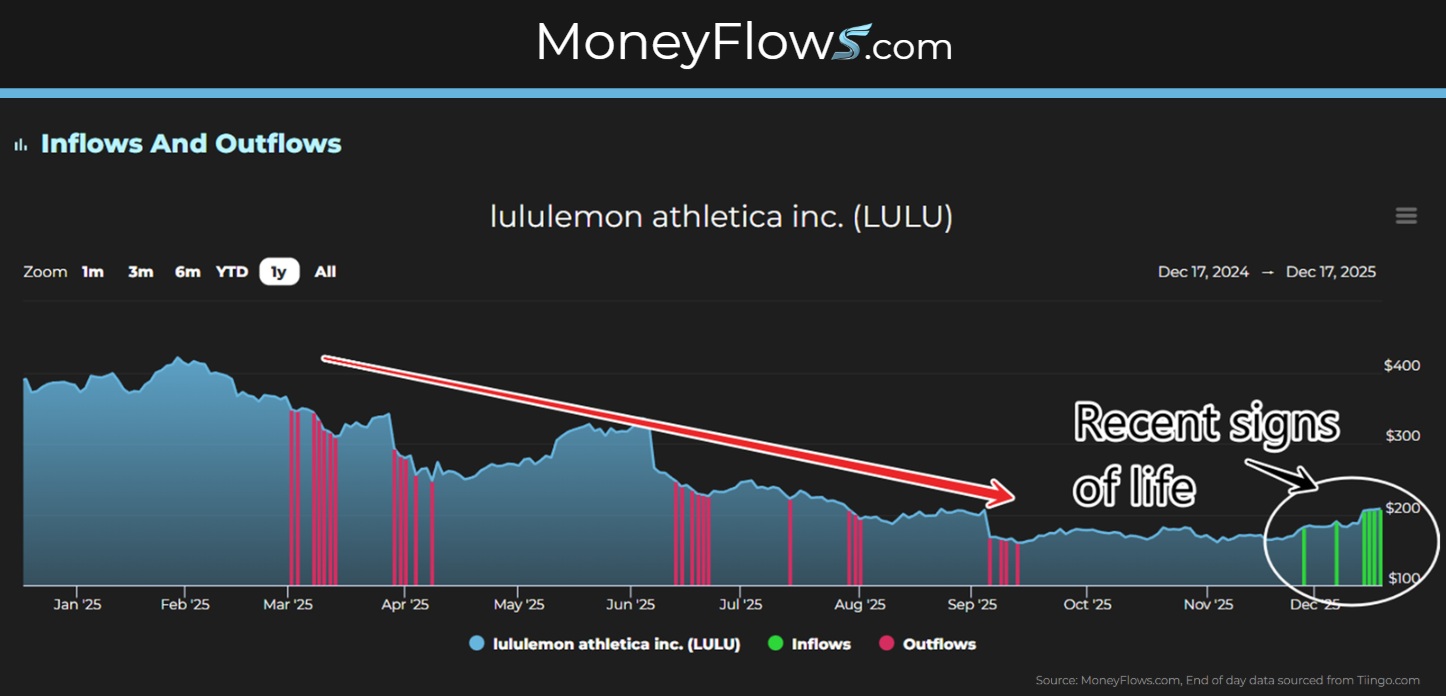

What makes it an interesting story is the fact that the stock has been beaten to a pulp over the last year, falling 44%.

Even better, the company recently announced better than expected earnings and the departure of CEO Calvin McDonald.

This is an inexpensive stock trading at a forward P/E of 16.49X.

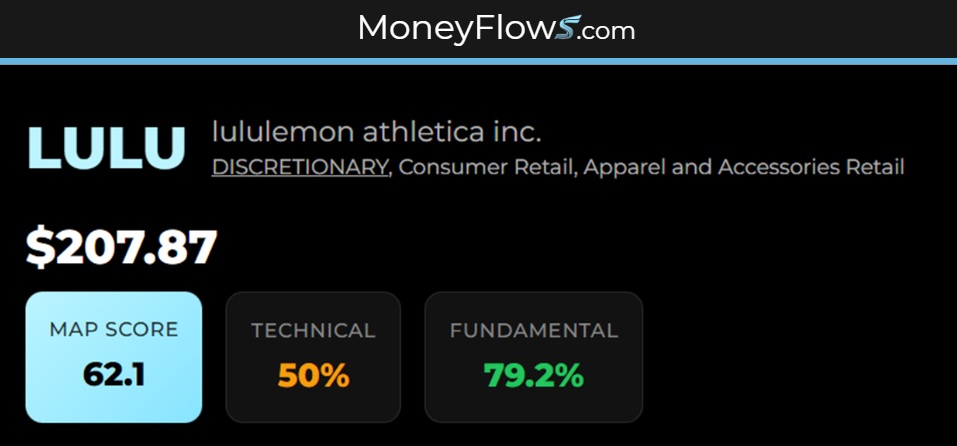

Notice through the MoneyFlows lens that LULU has an overall MAP Score of 62.1 which is broken down by a 50% technical score and rock-solid 79.2% fundamental score:

This reveals that the company is healthy and has been penalized technically.

Now here’s why this is our first oversold opportunity.

Over the past few sessions, our models picked up on outsized inflows, a complete change of character the past year:

Interestingly enough, this morning it was announced that Elliott Management built a stake of $1 billion in the company…we aren’t surprised to learn this!

Let’s keep going!

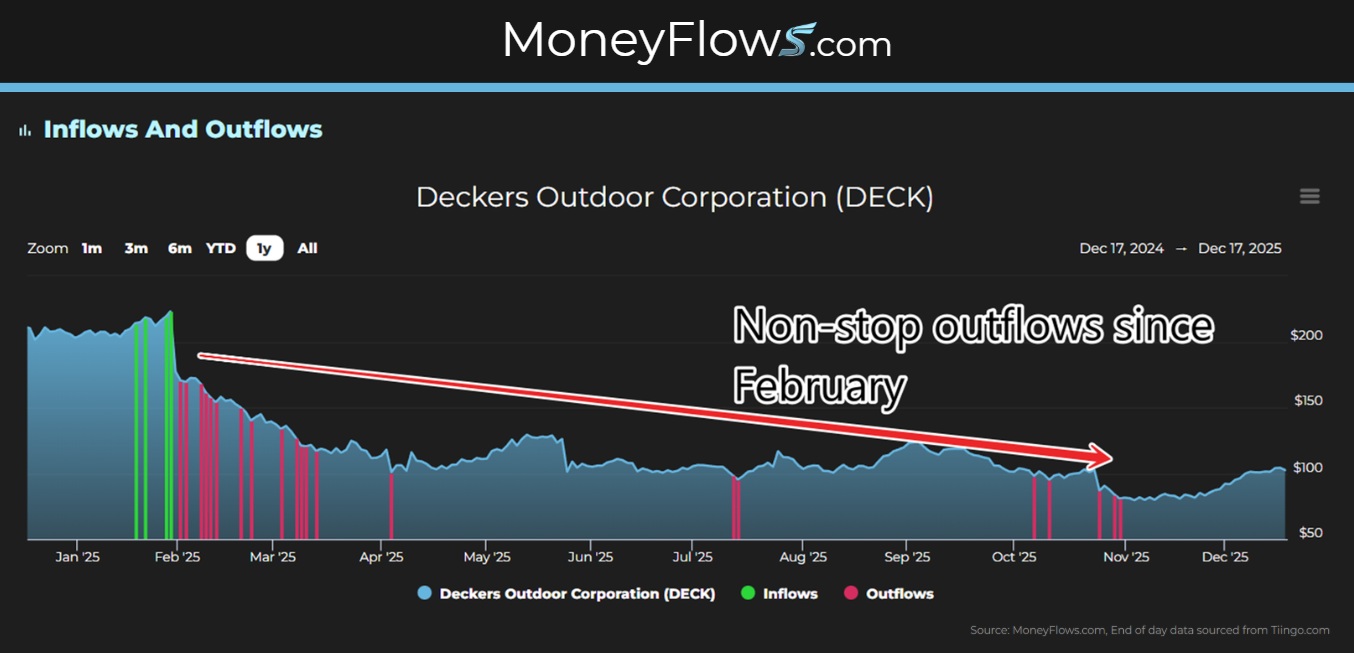

Our number 2 best oversold consumer stock is Deckers Outdoor Corp. (DECK).

Like LULU, Deckers operates in the apparel space, disturbing footwear and accessories. They have popular brands such as HOKA and UGG.

The stock has been under immense pressure the last year and is down 54% from highs.

Couple this with the fact that EPS is expected to grow 7% next year to $6.86 per share alongside revenue growth of 7.2% to $5.75 billion.

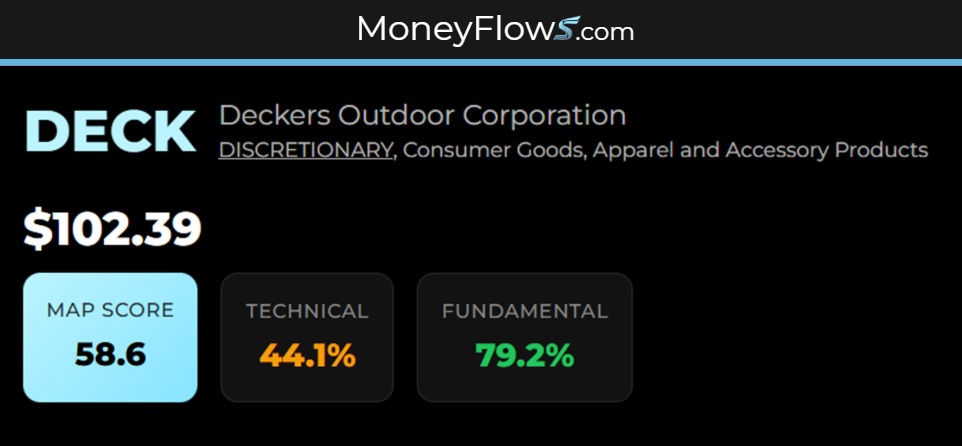

At the current price of $102.39 per share, the $15 billion market cap company trades at a reasonable forward P/E of 15.2X.

This healthy backdrop is why the company sports a MAP Score of 58.6, highlighting the ultra-solid fundamental score of 79.2%:

This positive fundamental view shows a divergence with our flows. Since February, non-stop outflows have sent the shares down hard…presenting the oversold opportunity.

It won’t take much positive news to turn this ship around:

Members are encouraged to keep an eye on DECK once green bars appear. That’ll be the signal that the stock is primed to turn things around.

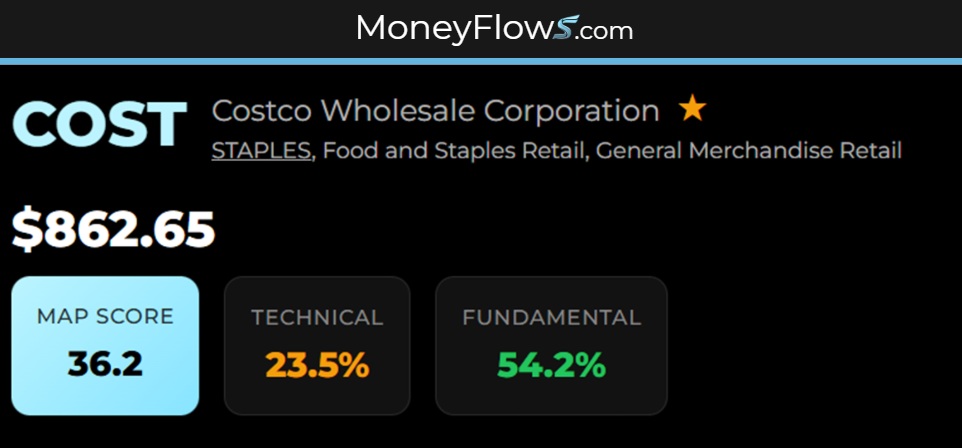

For our third oversold consumer stock, look no further than Costco Wholesale Co. (COST), which operates membership warehouses primarily in the US and Canada. (Disclosure I own COST in personal and managed accounts)

Costco is a $382 billion market cap company with storied history of outsized gains. On a 5-year basis the company has easily outperformed the S&P 500 with 148% returns vs 95% for the market.

Much of that has to do with top and bottom-line growth. In FY 2020, sales reached $167 billion and climbed to $275 billion in FY 2025.

Over the same period, EPS doubled from $9.02 per share in FY 2020 to $18.21 per share in FY 2025.

Throw in the fact that the company has been paying and raising dividends for more that 20 years, and you’re staring at an all-star stock.

Here we can note a rock-bottom MAP Score of 36.2 mainly due to a 23.5% technical score. On the fundamental side, 54.2% is well into the green:

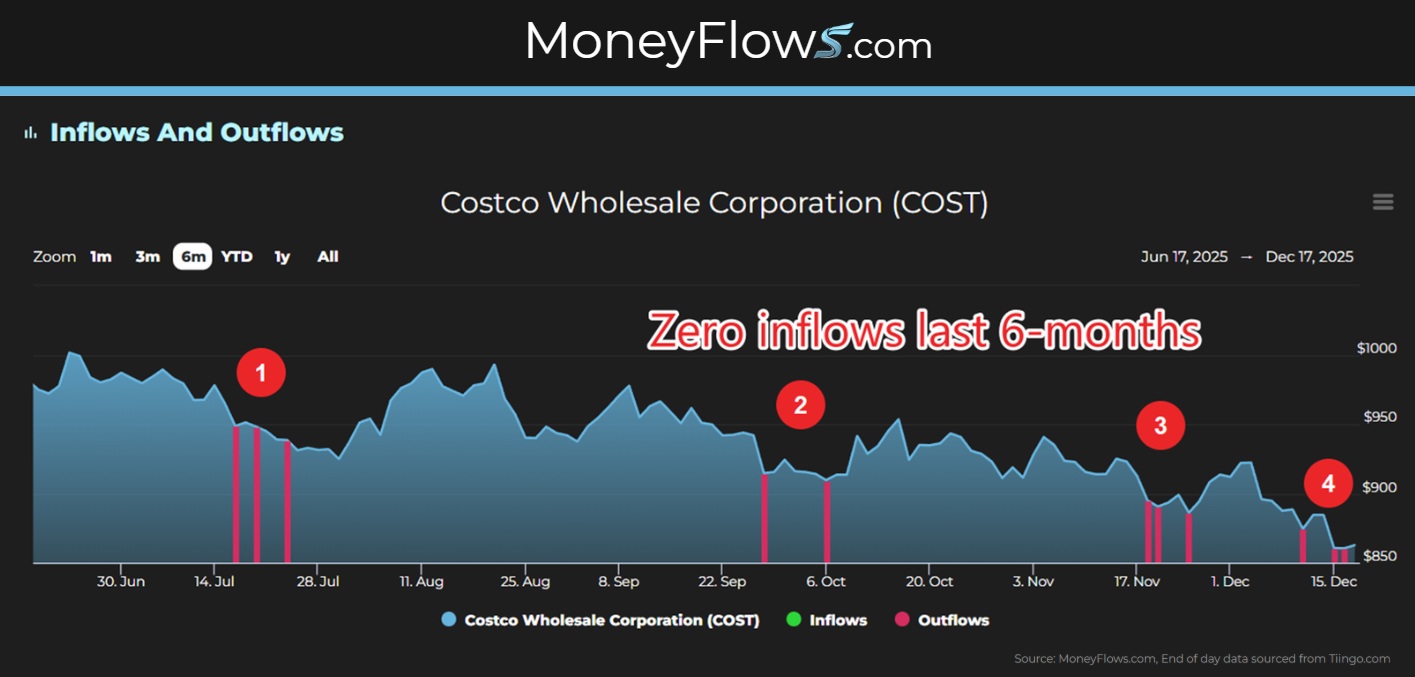

What makes COST an oversold opportunity is the fact that shares have slid 11% over the past 6-month period.

Additionally, only outflows have been recorded with the latest one earlier this week:

Sometimes looking outside of popular themes can present alpha.

Keep the discretionary space on your radar as we head into 2026. We believe plenty of new winners will reveal themselves…and you’ll find them by following the money flows!

January is a wonderful time to sharpen your investing toolset as rotations tend to occur early in the year.

Our Outlier 20 report reveals our highest ranked stocks under institutional accumulation…this is the list where every single outlier is found.

…like NVIDIA (NVDA) in 2015, Super Micro Computer (SMCI) in 2022, Celestica (CLS) in 2023, AppLovin (APP) in 2024, and Agnico Eagle Mines (AEM) in 2024.

Become a PRO subscriber today and gain access to our top stocks each day.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

Lastly, check out our latest video discussing the Next Trillion Dollar Opportunity in the stock market.