Best Large-Cap Stocks to Buy Now for December 2025

As markets rotate, leaders emerge.

Follow the money to find them.

Here are the best large-cap stocks to buy now for December 2025.

Right now, we’re in a powerful green zone for markets.

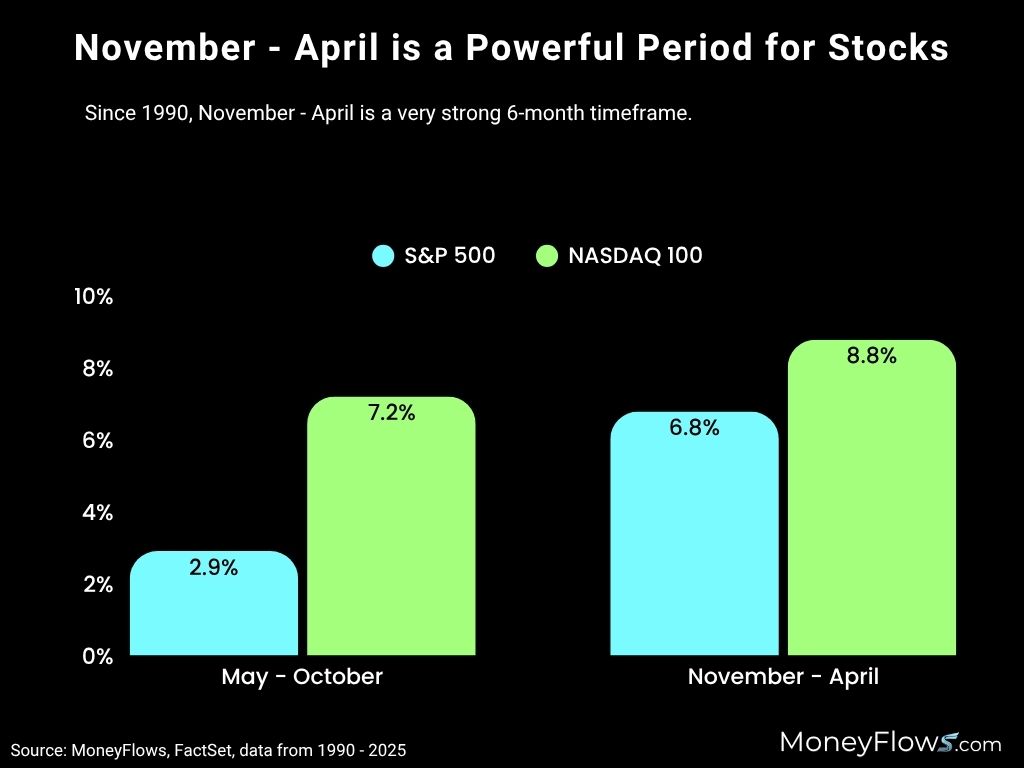

Back to 1990, the 6-month period of November – April has generated an average gain of 6.8% for the S&P 500 and 8.8% gain for the NASDAQ 100.

(November through April is a strong period for stocks)

This is a tailwind for all-star stocks. Just follow the money to find them early.

Best Large-Cap Stocks to Buy Now for December 2025

To find the best large-cap stocks, look where institutional interest is surging: Technology stocks levered to A.I.

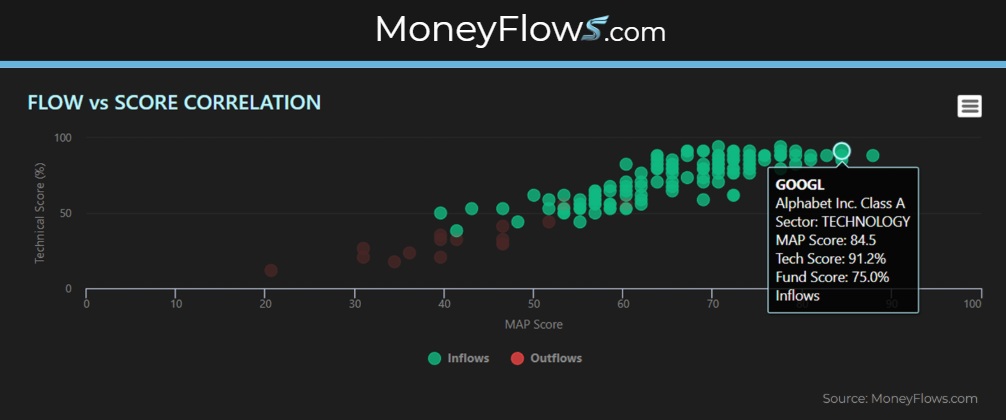

Every day, our models showcase the handful of stocks under heavy money flows.

Here we can note that Alphabet (GOOGL) was in demand earlier this week. The green dot signals heavy trading in GOOGL shares while the stock lifted higher:

As I’ll show you, this action isn’t random and often these power flows lift the stock higher and higher before the company is mentioned in the mainstream media.

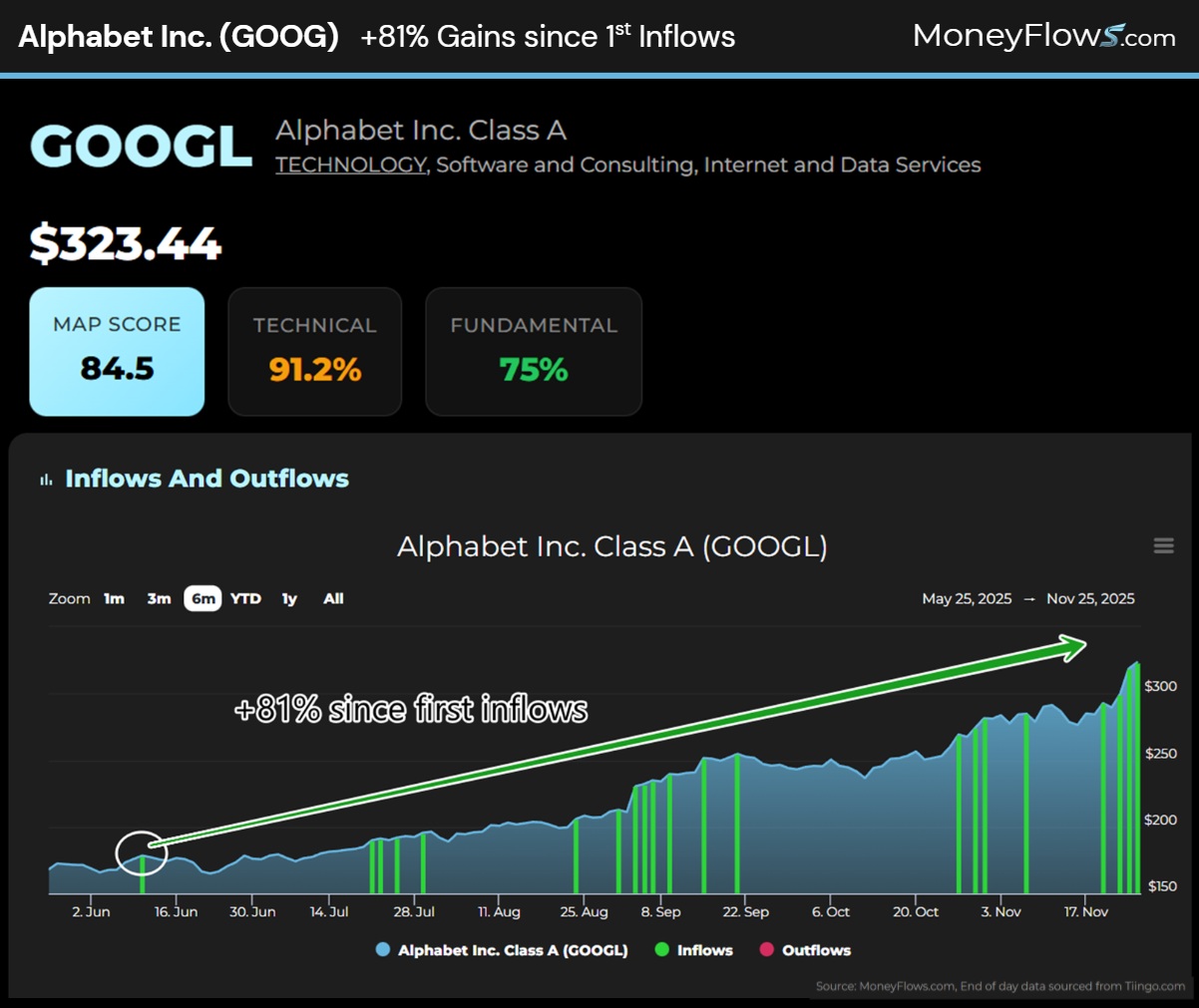

The number 1 best large cap stock for December 2025 is Alphabet Inc. (GOOGL). Disclosure I hold a long position in GOOGL shares in personal and managed accounts.

Recent news of Google’s latest TPU chip push has sent the stock flying. Reports of Meta Platforms (META) seeking out a large purchase of these TPUs has sent Google shares near the $4 trillion market cap mark. (Disclosure: I hold a long position in META in a personal account.)

But what makes GOOGL attractive here isn’t just the news headlines. It’s the fact that the shares have been heavily in demand for the last 5-months.

Below shows this beautifully.

There’ve been more than a dozen inflows into GOOGL shares since June. This one-way train of money has amounted to an 81% gain in the tech giant’s stock.

One look at our proprietary MAP Score of 84.5 highlights how Alphabet is firing on all cylinders:

Fighting the flow of money is a losing game.

Recently, Wall Street analysts have revised next year’s EPS and revenue estimates higher. For 2026, Alphabet’s sales are estimated to balloon to a staggering $454 billion with net income ramping to $135 billion.

Now we know why non-stop capital has been rushing into Google. The outlook keeps getting better and better.

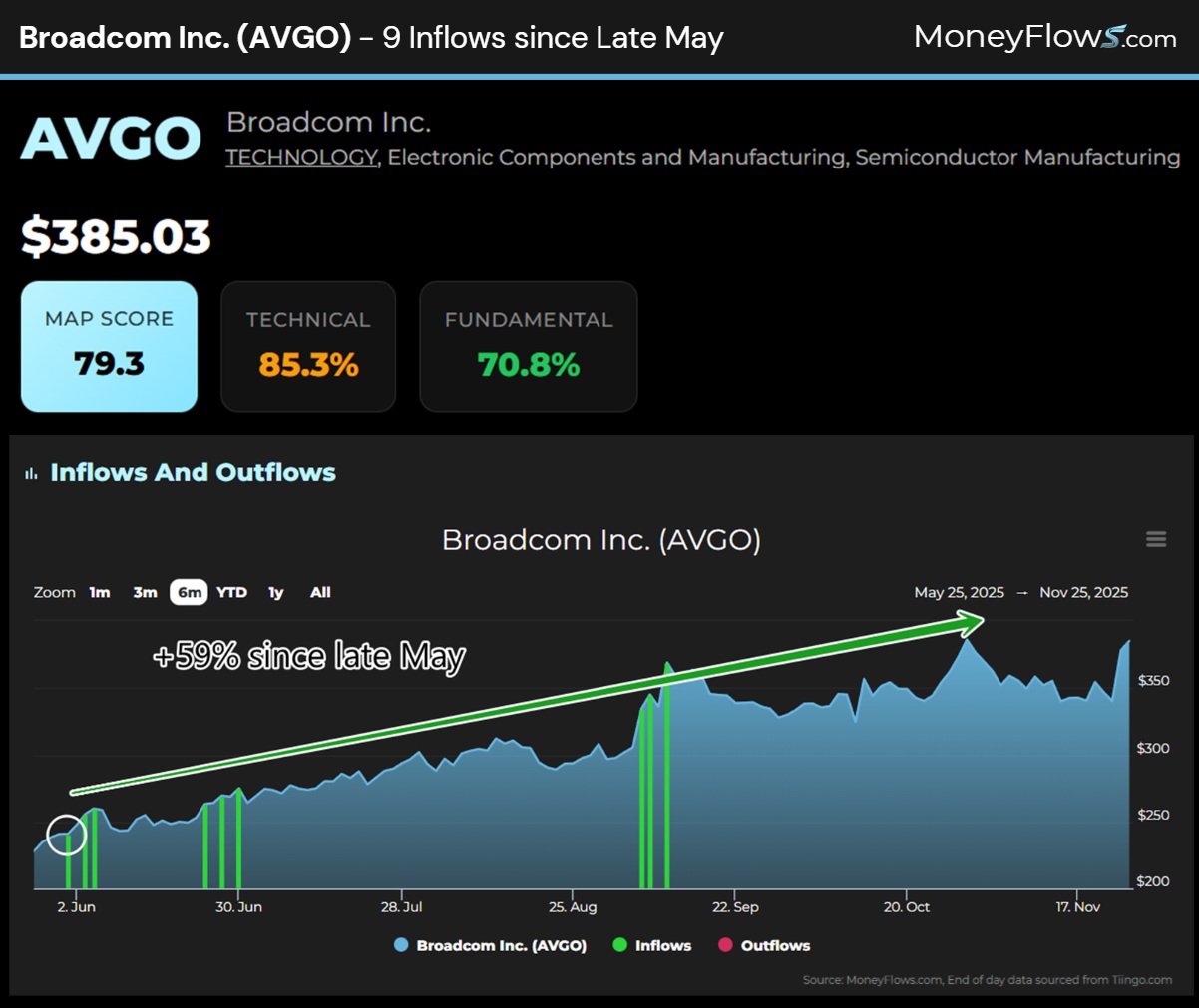

The number 2 best large cap stock for December 2025 is chip giant Broadcom (AVGO).

Incredibly, this chip giant is nearing the $2 trillion market cap club. With their AI, cloud, and data center position increasing, this has been an all-star stock lately.

Estimates for 2026 see Broadcom’s sales surging to $87.4 billion, which would amount to ~70% growth from 2024.

Those strong estimated sales are projected to create 2026 free cash flow (FCF) of $42.3 billion, highlighting how profitable their business truly is.

That’s why the stock has seen 9 inflows since late May, amounting to a 59% gain in the stock.

Note the 79.3 MAP Score highlighting the amazing technical and fundamental picture:

The key to successful investing is to find tomorrow’s leaders early. Institutions have the resources that the retail crowd lacks.

That’s why following the flows is critical in this day and age.

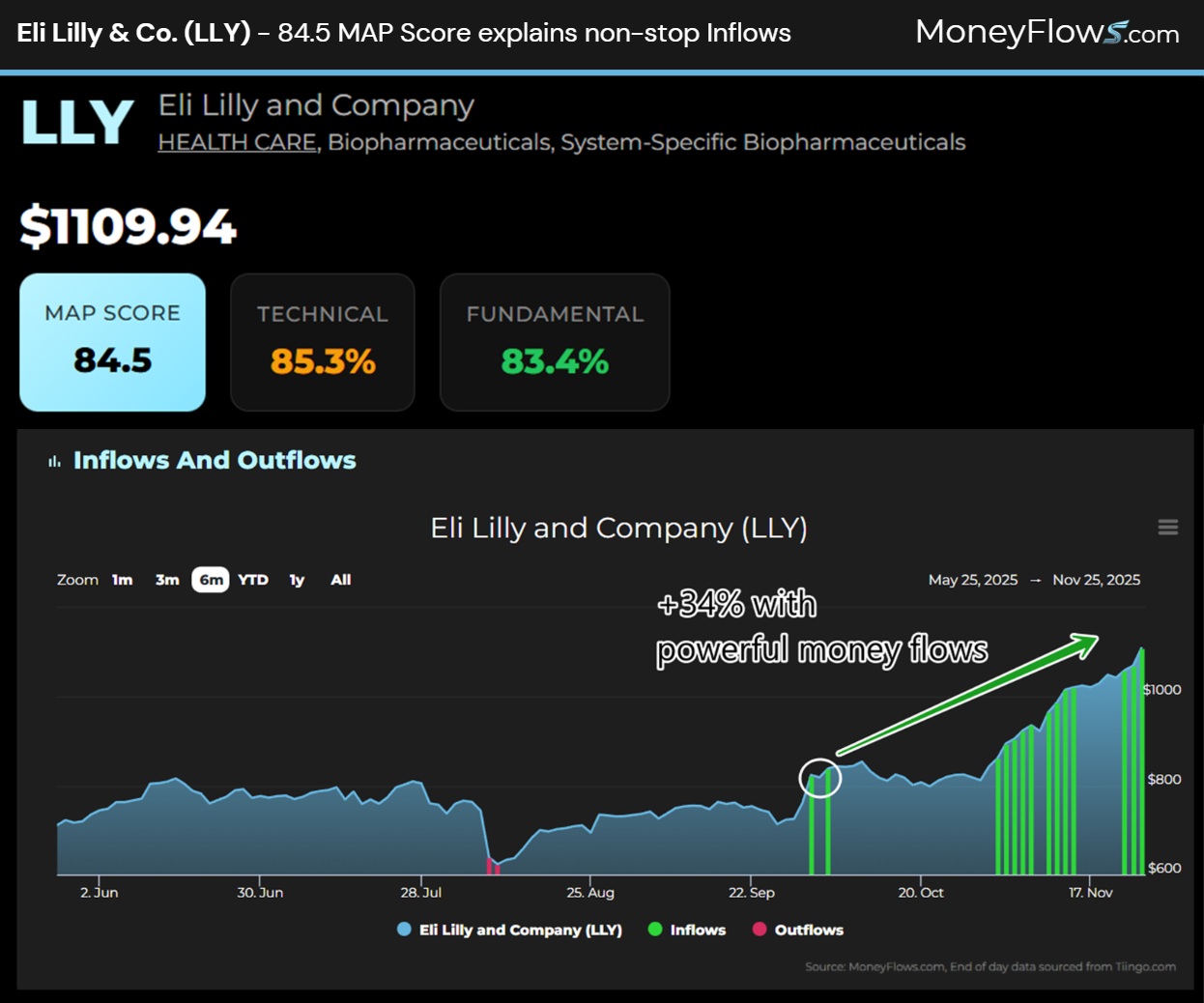

The number 3 best large cap stock for December 2025 is pharma giant Eli Lilly (LLY).

The weight loss pharma giant recently joined the $1 trillion market cap club…and we aren’t surprised.

Eli Lilly saw revenues surge to $45 billion in 2024 and are estimated to soar to $75 billion in 2026.

Net income will also jump to $28.2 billion in 2026. This level of profitability has made LLY shares an elite dividend growth company.

Unsurprisingly, LLY has been a benefactor of non-stop inflows since October. The stock has rallied 34% in less than 2 months.

The all-star MAP Score of 84.5 easily explains the demand picture for the stock…few companies of this size are delivering on growth metrics like Eli Lilly:

As we approach yearend, keep your trading approach simple.

Follow the money for success.

Don’t waste time buying low quality stocks without a proven track record.

There’s a playbook of success…you just need a map to see it!

Become a PRO subscriber today and gain access to our top stocks each day. You can search flows on the stocks you care about most and gain access to our weekly Outlier 20 report.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

And just this week, catch Jason and I discussing if deleveraging is over for markets. It’s a great deep dive into our process and what’s driving all of the recent volatility.

Lastly, for a limited time, new PRO (Annual) subscribers can join for 30% off the regular price!

Just use CYBER30 at checkout.

Go into 2026 with confidence and market-beating insights you can’t find anywhere else.

These selloffs create a valuable window that won’t last long.

Happy Thanksgiving to you and your family!