Best AI Stocks to Buy Now for November 2025

We’re living in a raging bull market.

It’s defied the critics…and it’ll keep rising.

Here are the best AI stocks to buy now for November 2025.

Given it’s November, let’s add a little fuel to the fire. Did you know that November kicks off an extremely bullish period for stocks?

It’s true.

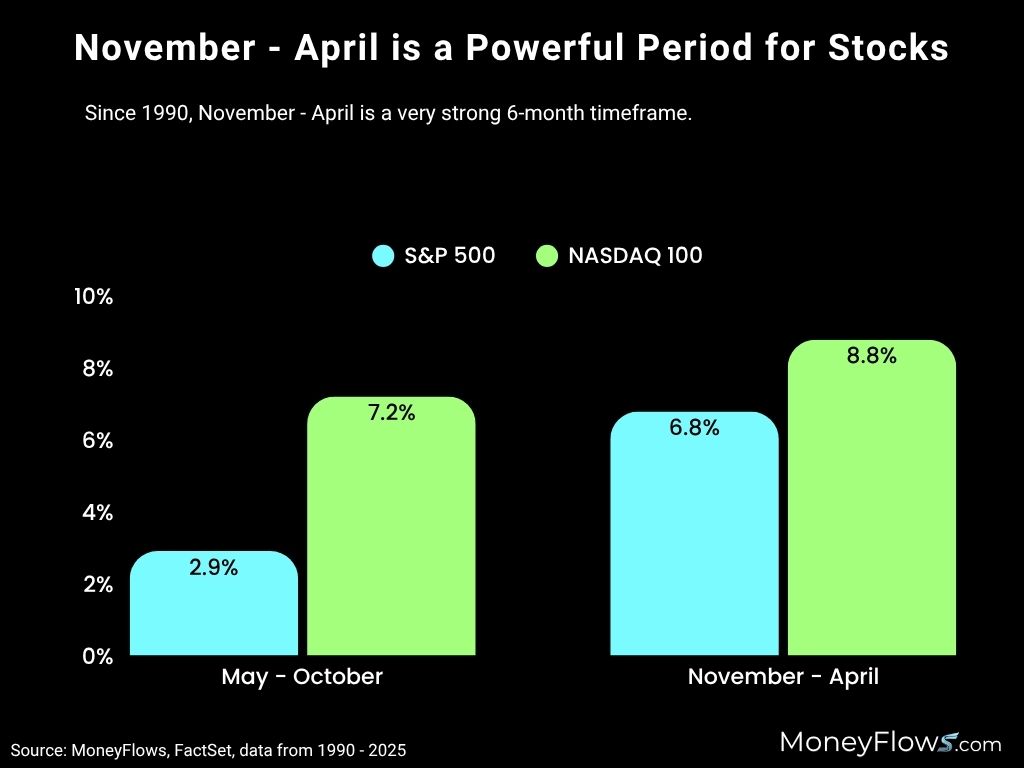

Going back to 1990, the 6-month period of November – April has amounted to an average 6.8% gain for the S&P 500.

That’s more than double the average of 2.9% in the months of May – October.

And this November uptrend can be seen in the tech-heavy NASDAQ 100 too with average gains of 8.8%:

With this powerful tailwind beginning now, let’s focus on some of the highest rated stocks under heavy institutional accumulation.

The MoneyFlows process finds them early.

Best AI Stocks to Buy Now for November 2025

To find the best AI stocks, we’ll use the same process we illustrated to find the best technology stocks.

We want to see repeated inflows coupled with high-growth potential.

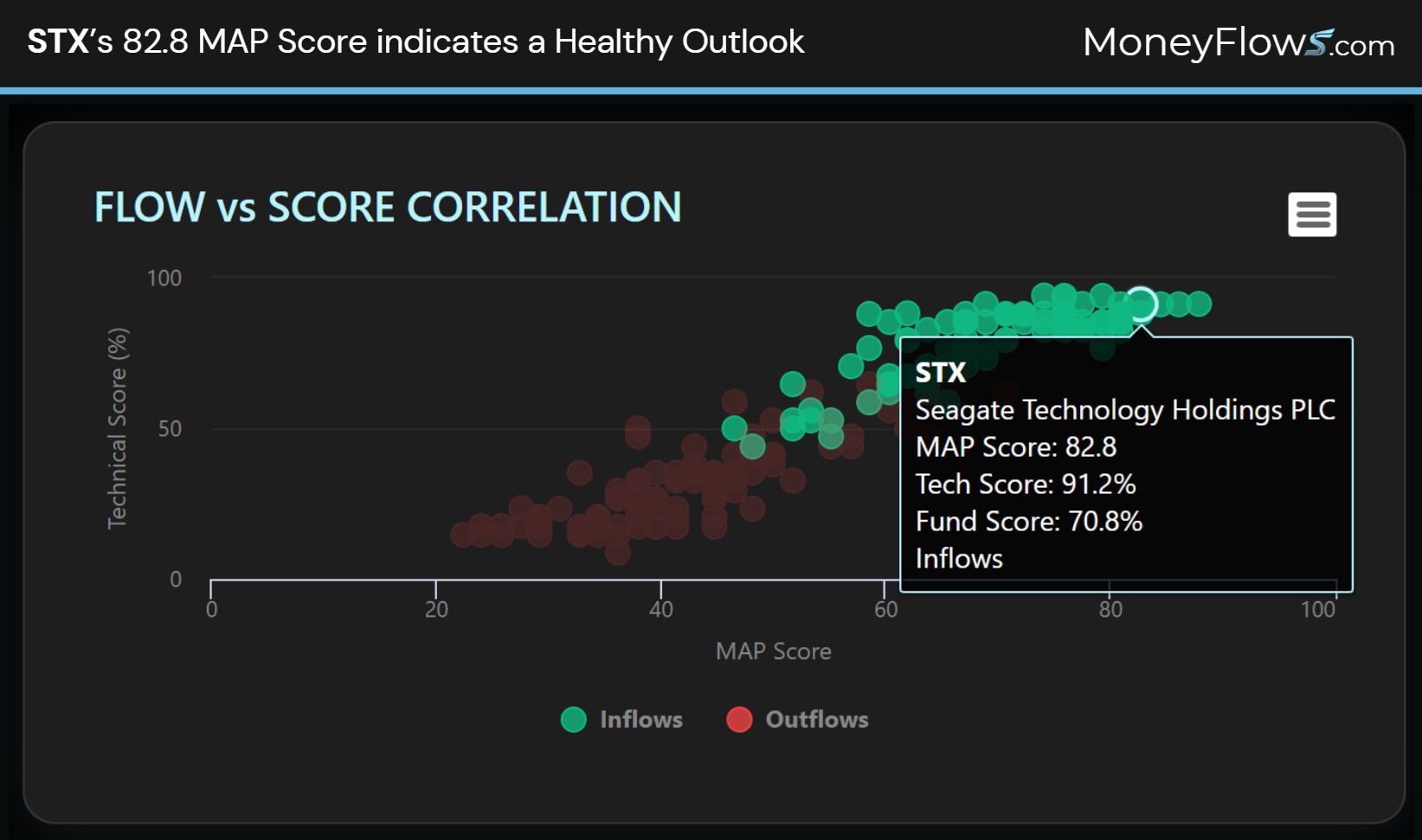

Each day we can see the actual stocks under accumulation. Here is yesterday’s data where I highlight Seagate Technology.

Here you can see the MAP Score is super strong coming in at 82.8, indicating a healthy outlook.

The number 1 best AI stock for November is Seagate Technology (STX). This $53B market cap company focuses on data storage products and solutions.

This hard-drive maker sited strong AI/Cloud demand on its latest earnings call. For Q2 the company guided revenue to $2.7 billion and EPS of $2.75 per share…both above consensus.

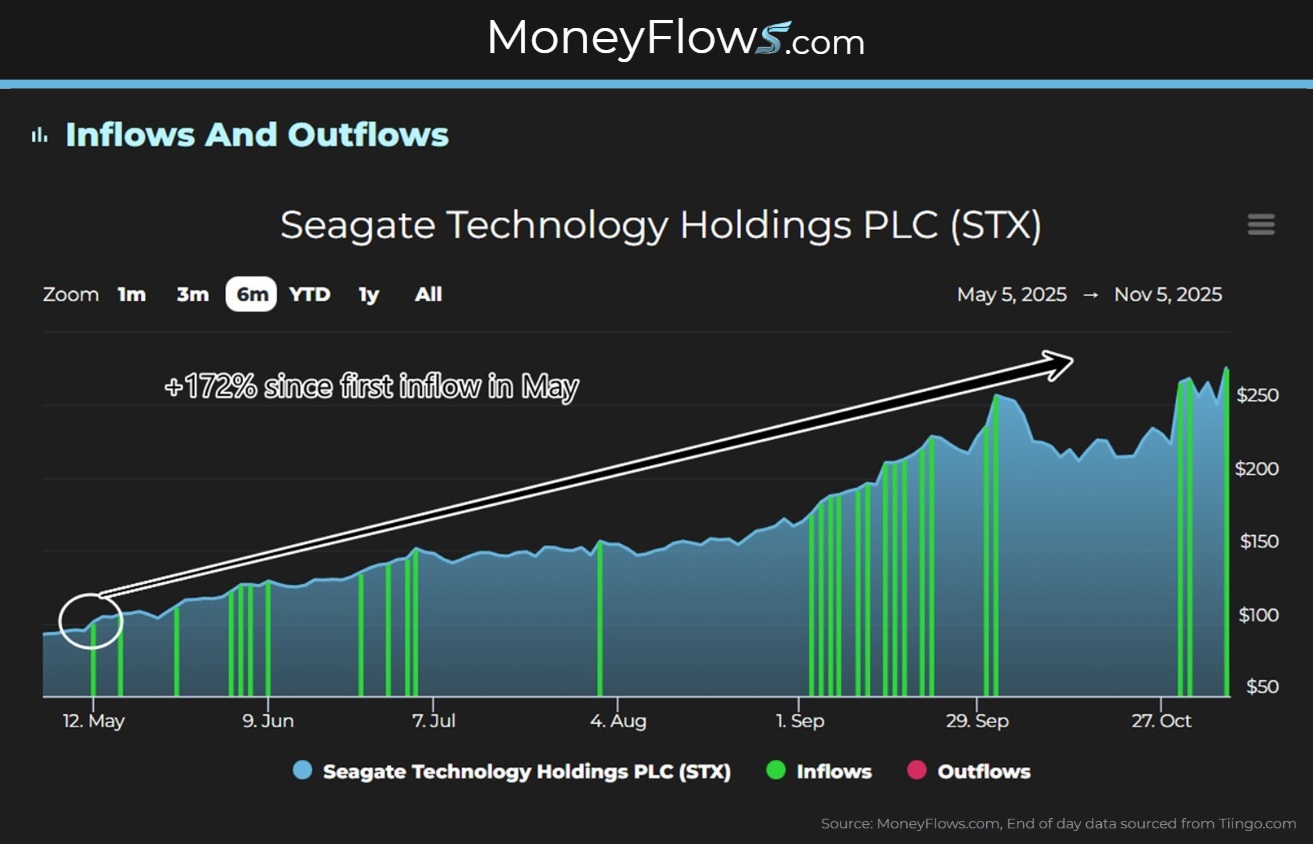

But what makes this company super unique is the steady inflows in the shares.

Over the past 6 months, STX shares have seen dozens of green flows. This has resulted in huge performance with shares surging +172% since the first signal.

Few stocks have charts like this:

It pays to be on the right side of the Big Money.

Let’s keep going!

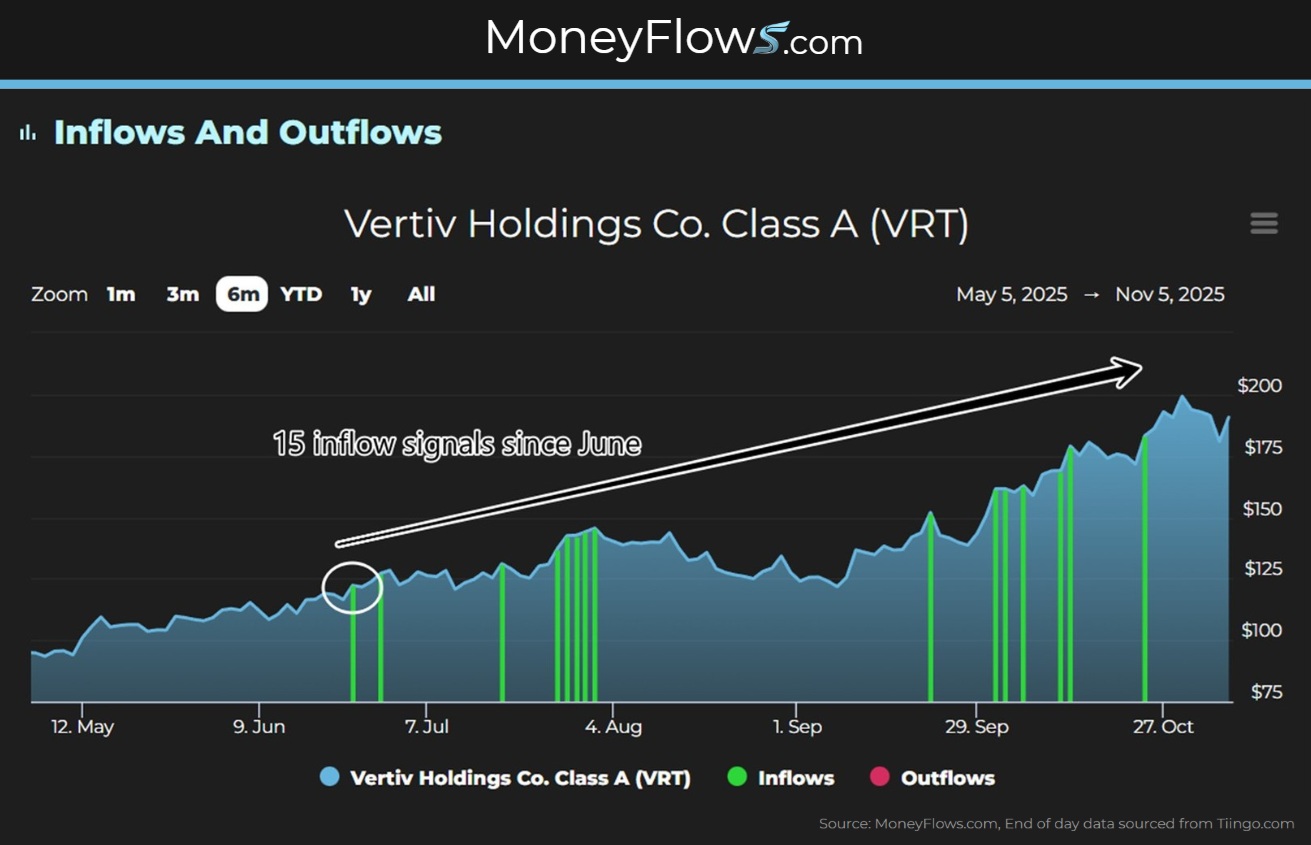

The number 2 best AI stock for November is Vertiv Holdings (VRT). The $73 billion market cap company focuses on cooling systems crucial for data centers and more.

Their lates earnings call was a beat and rise on the top and bottom line.

For Q3, revenues clocked in at $2.68 billion with EPS reaching $1.24 per share. These were ahead of Wall Street consensus.

For Q4, Vertiv signaled EPS at the mid-point of $1.26 and revenues at the midpoint of $2.85 billion…again ahead of estimates.

Like Seagate, this company has been under heavy buy pressure for months. Below reveals how the shares are climbing as non-stop inflows persist.

This is the stairway to heaven!

Now let’s focus on another darling in our data.

Energy needs are a priority for the AI Supercycle. Our next name is part of this theme.

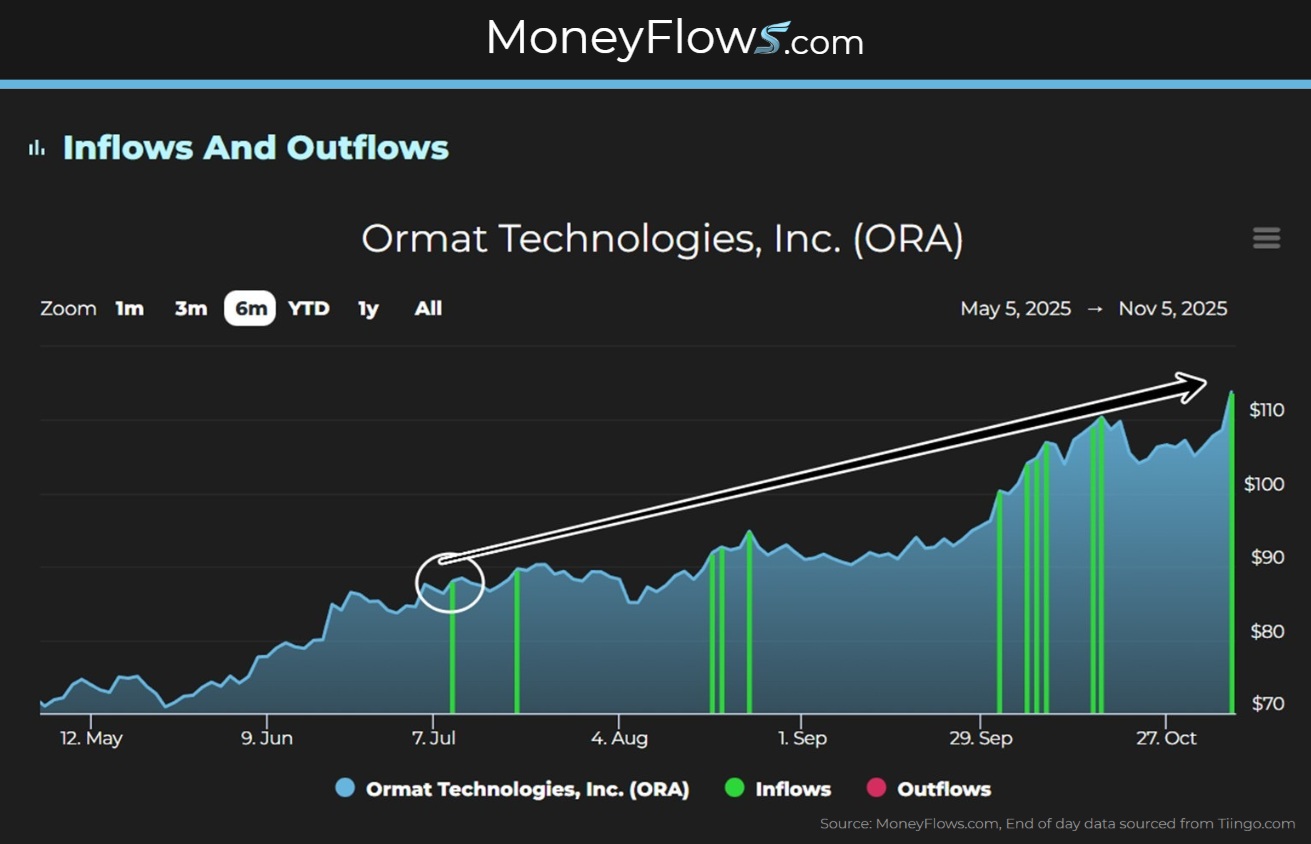

The number 3 best AI stock for November is Ormat Technologies (ORA).

Ormat is a small $7 billion market cap utility firm serving environmentally sound electricity and power needs.

On the latest earnings call, Ormat alluded to multiple hyperscaler Power Purchase Agreements expected in the next few months.

The fundamentals back up the flows. In 2025, sales are expected to reach $967 million with net income of $132.2 million.

For 2026, revenues are estimated to jump to $1.11 billion with net income of $153.6 million.

As you’d imagine, institutions have been along for the ride with healthy inflows pushing the stock higher and higher for months.

With November signaling big upside for markets, focus on elite stocks.

Our process alerts you to the best stocks…early.

Make sure your portfolio is armed for success into yearend and beyond.

Become a PRO subscriber and gain access to our top stocks each day. You can search flows on the stocks you care about most.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

Don’t fly blind in this bull market.

Be early.

And always go with the flows.