3 Bullish Forces that will Drive Stocks to All-Time Highs

2025’s wild ride and trade tape bombs keep spooking investors.

Many sold out just to witness Spring’s ricochet rally.

It’s painful sitting on the sidelines…and given widespread defensive positioning, the bullish parade isn’t stopping.

The pain trade is higher.

Today we’ll highlight 3 bullish forces that will drive stocks to all-time highs.

We’ll start by debunking two popular pillars of the bearish doom loop. Then, we’ll showcase an under-the-radar top-down signal few are even talking about.

Finally, we’ll wrap up with the best sector to own right now and two to avoid.

As a bonus, we’ll offer a buy and sell list of stocks to best position your portfolio.

3 Bullish Forces that will Drive Stocks to All-time Highs

There’s a lot of handwringing going on about the rising yields, a weak US dollar, and falling oil prices.

Pundits tell you that these spell economic doom.

They couldn’t be more wrong. Let’s start out by debunking the popular bearish myth of rising yields and a weak dollar.

Rising Yields and a Weak Dollar are Bullish for Stocks Not Bearish

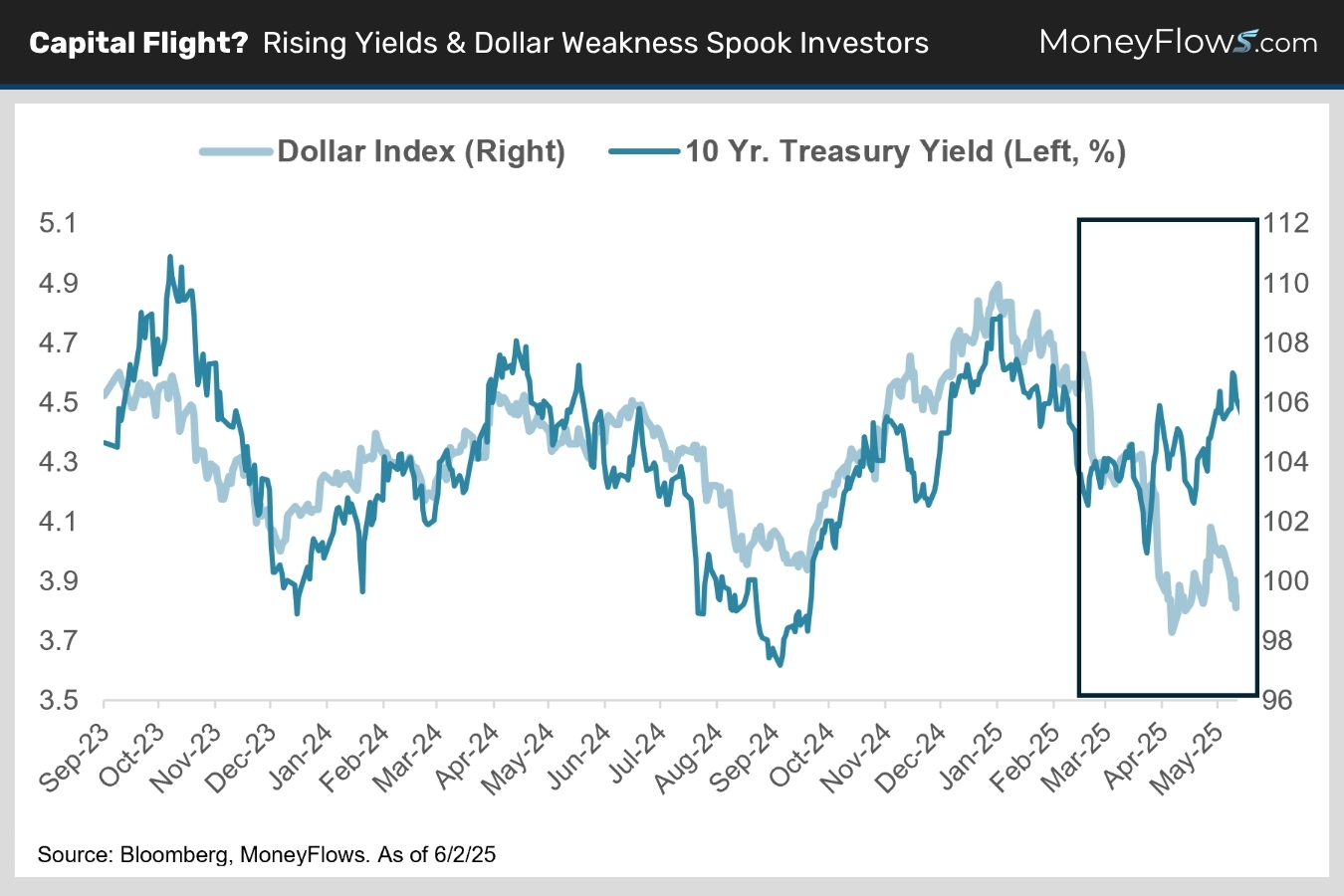

Treasury yields have been rising while the dollar falls (chart). This combination is relatively rare.

The divergence is making investors nervous. Buring questions come to mind:

Does it signal capital flight out of the US?

Is the dollar’s dominant global reserve currency status at risk?

Is US exceptionalism over?

Have a look:

My view is probably not to all 3.

If you zoom out, this divergence looks more like short-term noise than a structural shift.

Even if this unusual pairing sticks around, it’s not as rare – or as sinister – as it might seem.

Since the late 1970s, the trade weighted, US Dollar Index has fallen while yields rose just 16% of the time.

These rare situations happen.

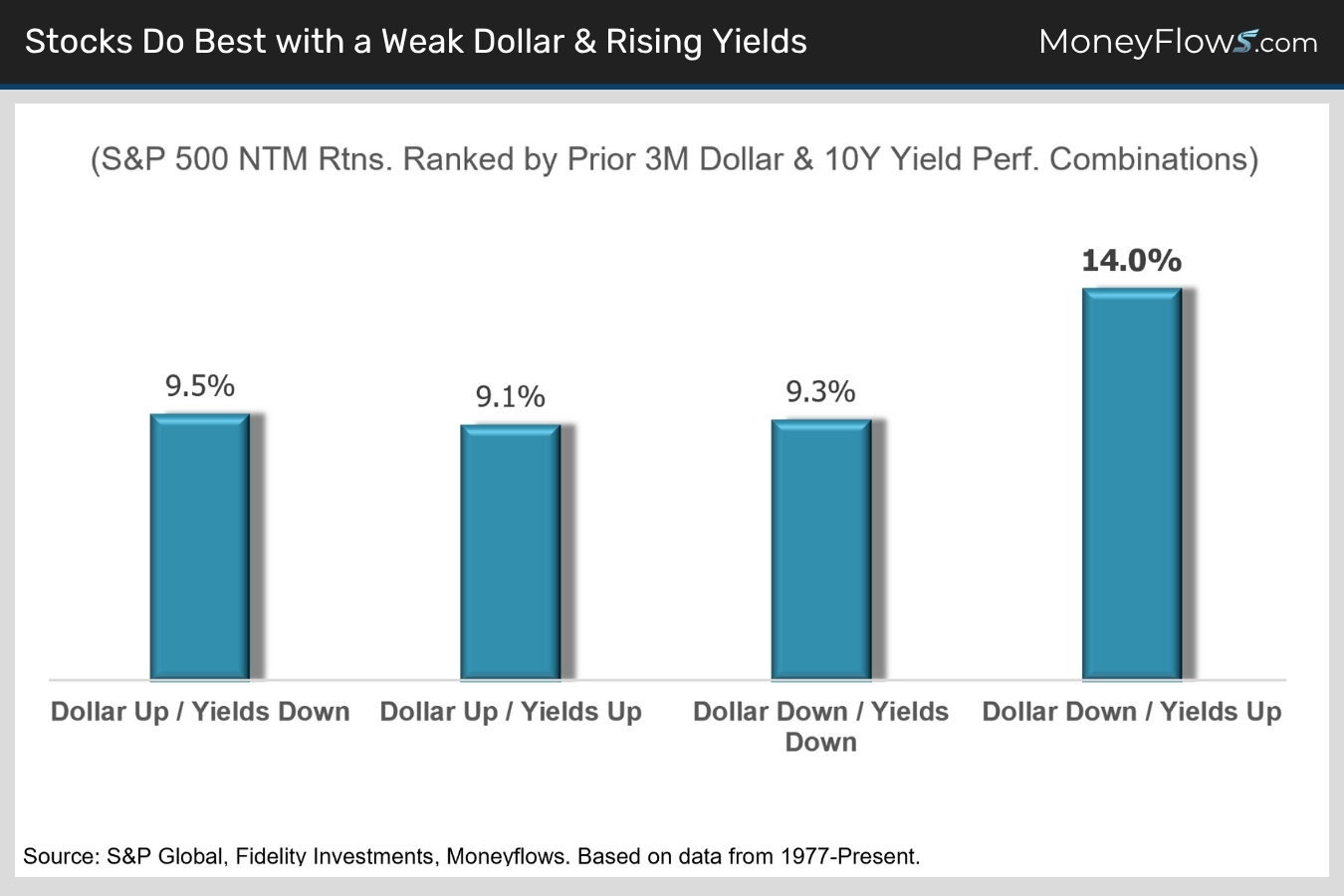

But here’s the kicker. Contrary to popular belief, stocks actually do best with higher yields and a weaker dollar.

Since 1977, the S&P 500 gains an average of 14% in years following three-month dollar declines and 10-Year yield increases (chart).

Why? With core PCE inflation a tame 2.5%, rising yields largely signal better than expected economic growth. Goldman Sachs and the Atlanta Fed both forecast Q2 real GDP growth above 3%. That’s good news for earnings.

As for a weaker buck, with roughly 40% of S&P 500 revenues coming from overseas, dollar weakness boosts profits as euros and yen convert back into more greenbacks.

Folks, it’s an equity tailwind, not a headwind.

OK let’s shift gears and check in on a hugely bullish, under the radar, macro driver.

Lower Crude Prices are Bullish for Stocks Not Bearish

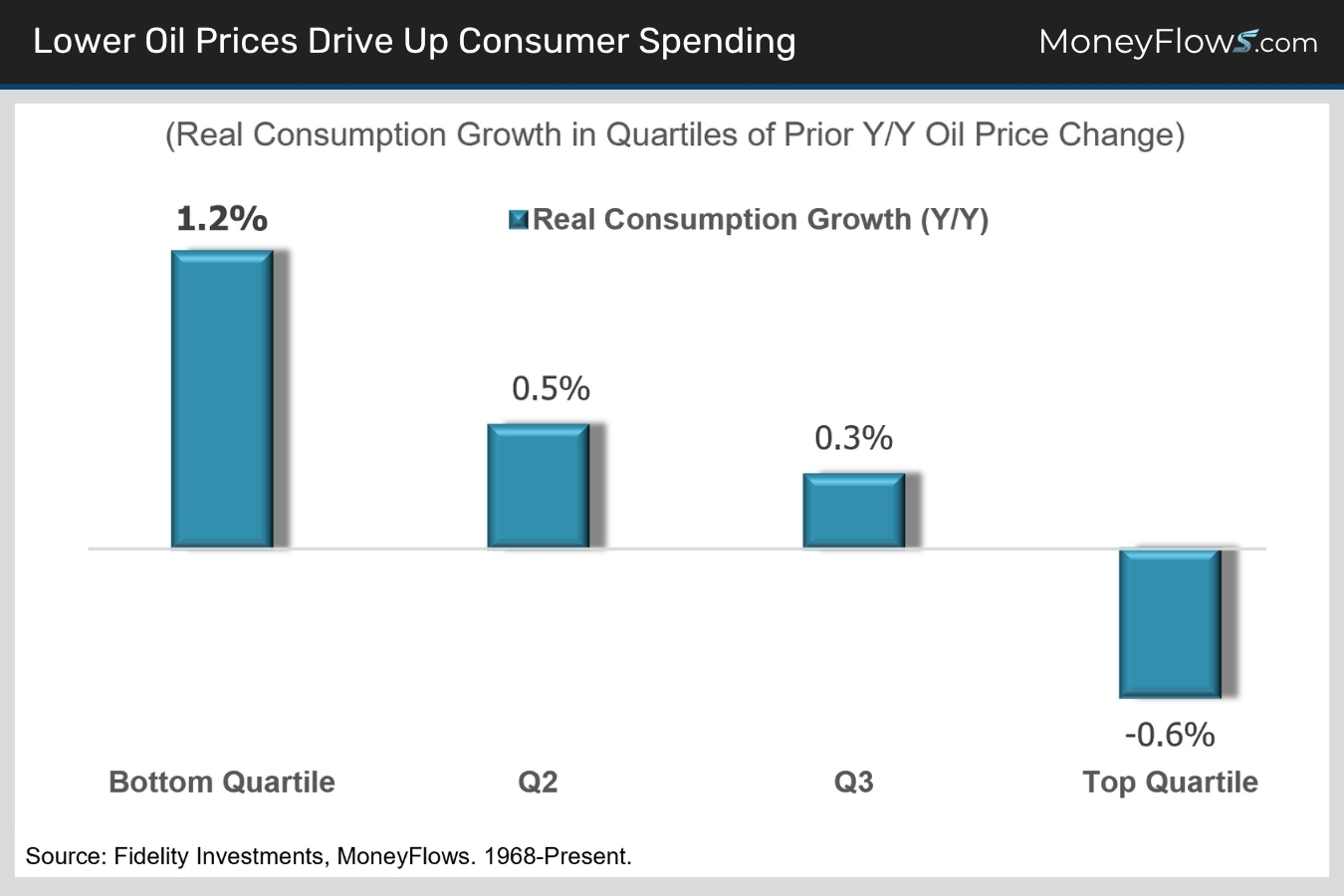

WTI crude oil is down 19% to $63 from $78 over the last 12 months thanks to ample US and OPEC+ supply and demand uncertainty.

Here’s why oil matters.

Check out this next chart.

Real consumer spending grows 1.2% in years following bottom quartile oil performance like we’re seeing today:

With consumer spending accounting for 70% of all economic activity, it’s no surprise that stocks react well to brisk spending.

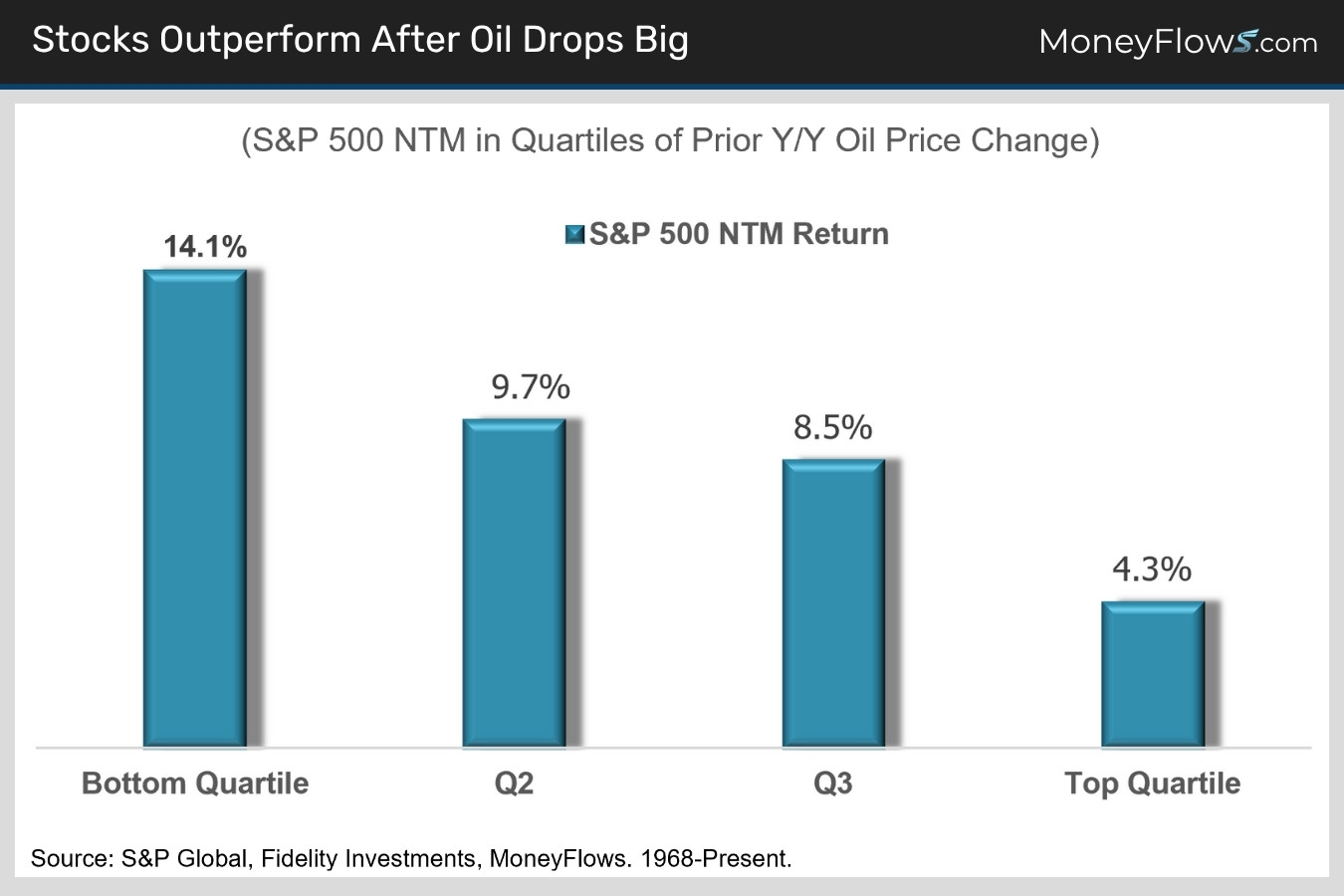

Check this out. Since 1968, the S&P 500 gains an average of 14.1% in years following bottom quartile crude oil performance:

These bullish tailwinds are why money has been flowing into stocks while the crowd sits and stares.

There’s a big opportunity for you NOW.

What This Means for Your Portfolio

We’ve made a contrarian bull case for stocks. Now, let’s tackle portfolio construction.

On May 5, we told you to Buy Mega Cap Tech Stocks. The call’s been a good one.

Here’s the great news: Big tech still has room to run.

Many investors are trimming cyclicals and leaning into defensives on worries stocks will give back much of their recent gains amid ongoing trade uncertainty.

We think that’s a mistake.

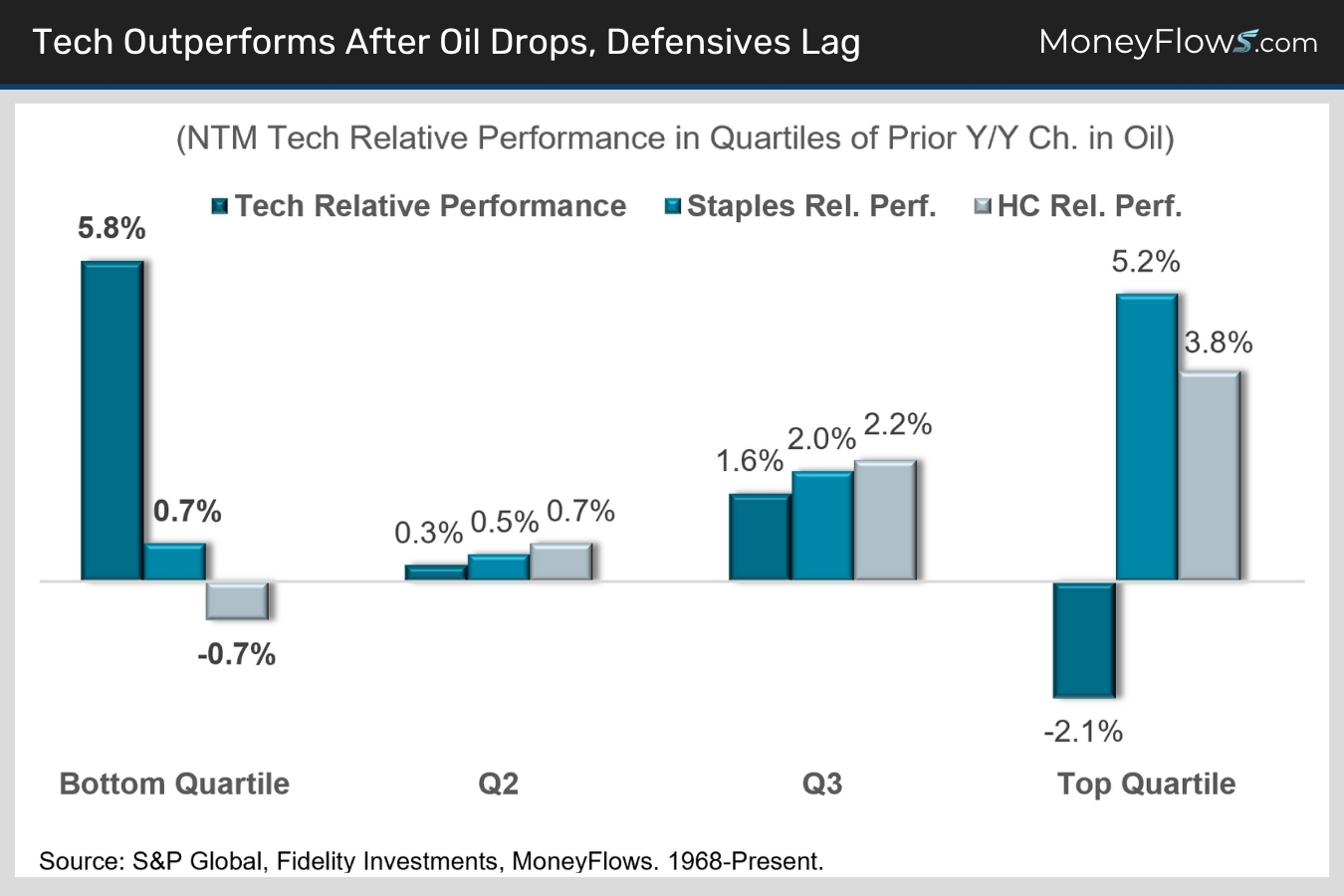

Check this out. Since 1968, tech outperforms by 5.8% in years following bottom quartile oil price performance. By contrast, defensives lag badly with staples and health care moving just 0.7% and -0.7%, respectively:

The message from the data is clear, expect a risk-on environment. That means favoring growth stocks, primarily from cyclical sectors and avoiding bottom fishing in defensive areas.

Where most research houses got it wrong the last 2 months, MoneyFlows got it right.

To get access and make even more from this call to action, sign up for a PRO membership. Learn why many RIAs, money managers, and serious investors are winning in 2025.

Below is a list of the Top 10 stocks ranked by our proprietary MAP Score in the NASDAQ 100, plus the 10 defensive names with the lowest scores to avoid.

Be early next time.

Go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.