2026 Outlook: 7 Signals Highlight New Market Opportunities

Equities’ resilience in 2025 stunned just about everyone.

In rare fashion, the S&P 500 overcame a massive spring tariff tape bomb and near bear market to find itself on the verge of its third big up year in a row.

We see further upside in equities but with a change in character as 7 signals highlight new market opportunities.

Before we discuss the future, it’s important to step back.

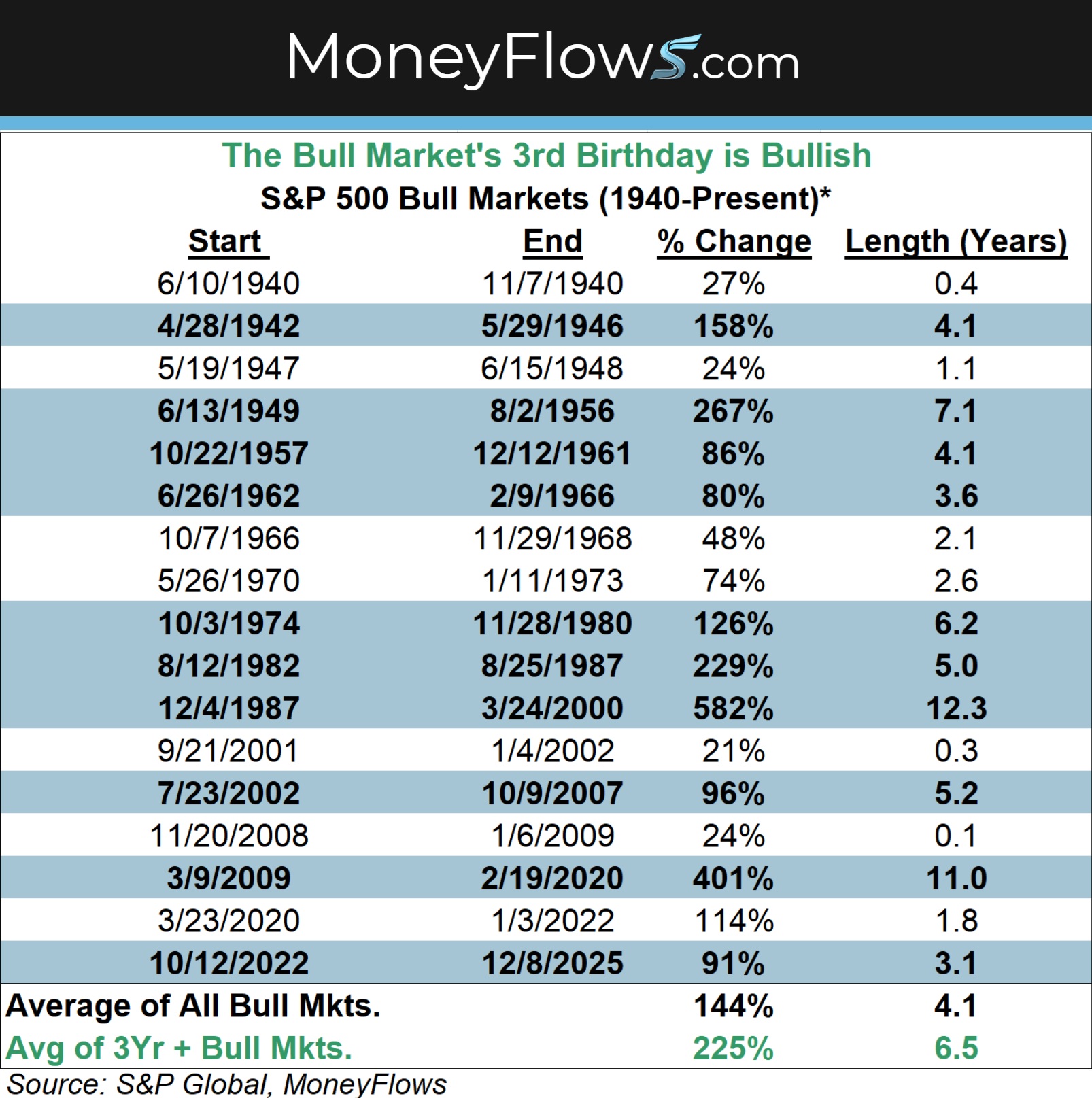

The current bull market is up an impressive 91% since it began in October 2022.

Three years ago, we were bold to suggest stocks can be a good bet in 2023. Recession fears dominated the tape. We didn’t buy into that doom-loop.

Fast forward to today and we have plenty of evidence-based reasons that 2026 will be another good year, just with different players.

You’ll need to cast a wider net to win.

Our writeup includes our favorite factor and two contrarian, sleeper sectors to play the next leg of this rally.

As a bonus, we’ll throw in a list of our favorite outliers for the new year.

2026 Outlook: 7 Signals Highlight New Market Opportunities

Let’s start with what history can tell us about what to expect next year.

This bull market turned three on October 12. This is a big deal.

The #1 reason we’re positive on stocks heading into 2026 is that whenever bull markets make it to their 3rd birthday, it’s a bullish signal.

Happy 3rd Birthday to the Bull Market

Here’s an unappreciated fact: If a bull market survives to three years old, on average, it goes on to last 6 1/2 years, posting gains of 225%. With this bull market up 91%, history says it has a long ways to run.

Long-lasting bull markets are created when the 3-year mark is reached. Don’t expect that trend to shift in 2026.

Now let’s unpack positive macro tailwinds that will be responsible for the climb.

Policy Tailwinds Favor Companies and Consumers

Stocks will enjoy many government policy tailwinds in 2026.

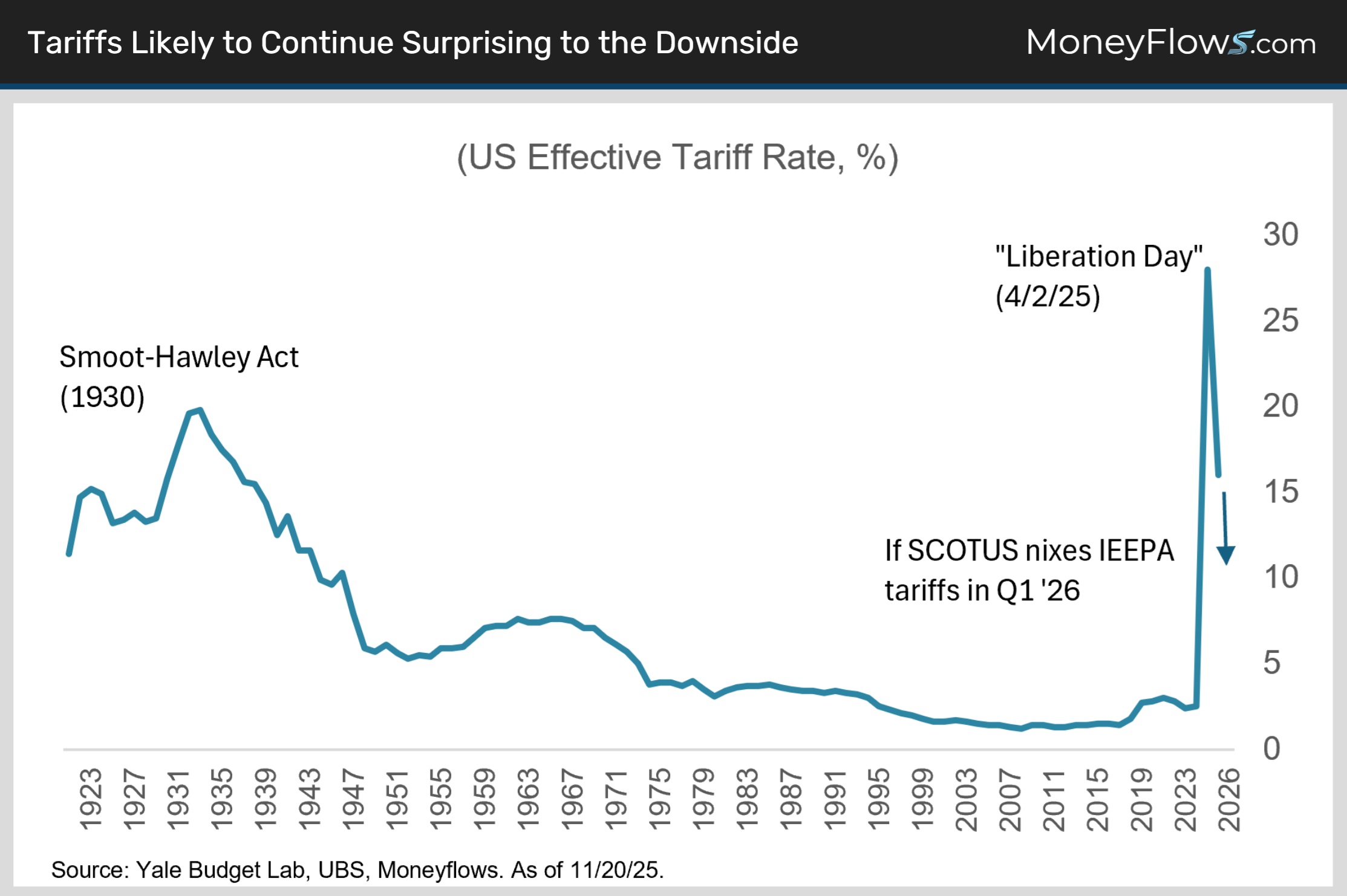

Let’s start with the 2nd reason we’re bullish - trade policy.

In our 2025 Outlook we told you Trump’s tariff bluster is likely just a negotiating ploy on the way to economic policies that are milder than feared…The market’s biggest pain point could surprise to the upside, sparking a relief rally.

Fading tariff fears worked really well in 2025 so we’re sticking with it but for legal reasons this time.

In Q1, we think the Supreme Court is likely to rule that the president lacked the authority to impose country-specific so-called “reciprocal” tariffs under the International Emergency Economic Powers Act of 1977.

Many SCOTUS justices have already signaled skepticism about the legality of tariffs under IEEPA during oral arguments last month.

The law requires an emergency and trade deficits aren’t an emergency – they’ve existed for years!

If the court strikes the tariffs down, expect the administration to cobble together alternative tariffs under different laws.

However, these tariffs could raise less revenue than current tariffs and such a ruling could necessitate substantial refunds to U.S. companies that have already paid the tariffs.

This scenario would boost economic and earnings growth in 2026, all while lowering inflation.

That’s what I call a serious stock market tailwind!

Let’s shift gears to reason #3 - monetary policy. The Fed cut rates three times in 2025 dropping the fed funds rate to 3.63%.

The FOMC is currently split. Half want to keep easing to shore up a stagnant job market while the other half worries further rate cuts will worsen the risk of tariffs reigniting inflation.

We expect the doves to win the day in 2026 for two reasons:

First, if we’re right and SCOTUS severely dilutes Trump’s tariffs the case for additional cuts will be much stronger as inflation risks recede.

Second, a new Fed Chair will take over in May. All the leading candidates from Hasset to Waller to Warsh, are much more dovish than Jay Powell.

The outlook for rates is lower not higher. That’s stimulative for equities broadly.

OK now let’s tackle our 4th bullish driver - fiscal policy.

The One Big Beautiful Bill Act (OBBBA), extends the 2017 personal income tax cuts, provides for full expensing of business spending on equipment and R&D, substantially increases state and local tax deductions, raises defense spending, and reduces Medicare outlays.

The OBBBA is boosting demand in phases.

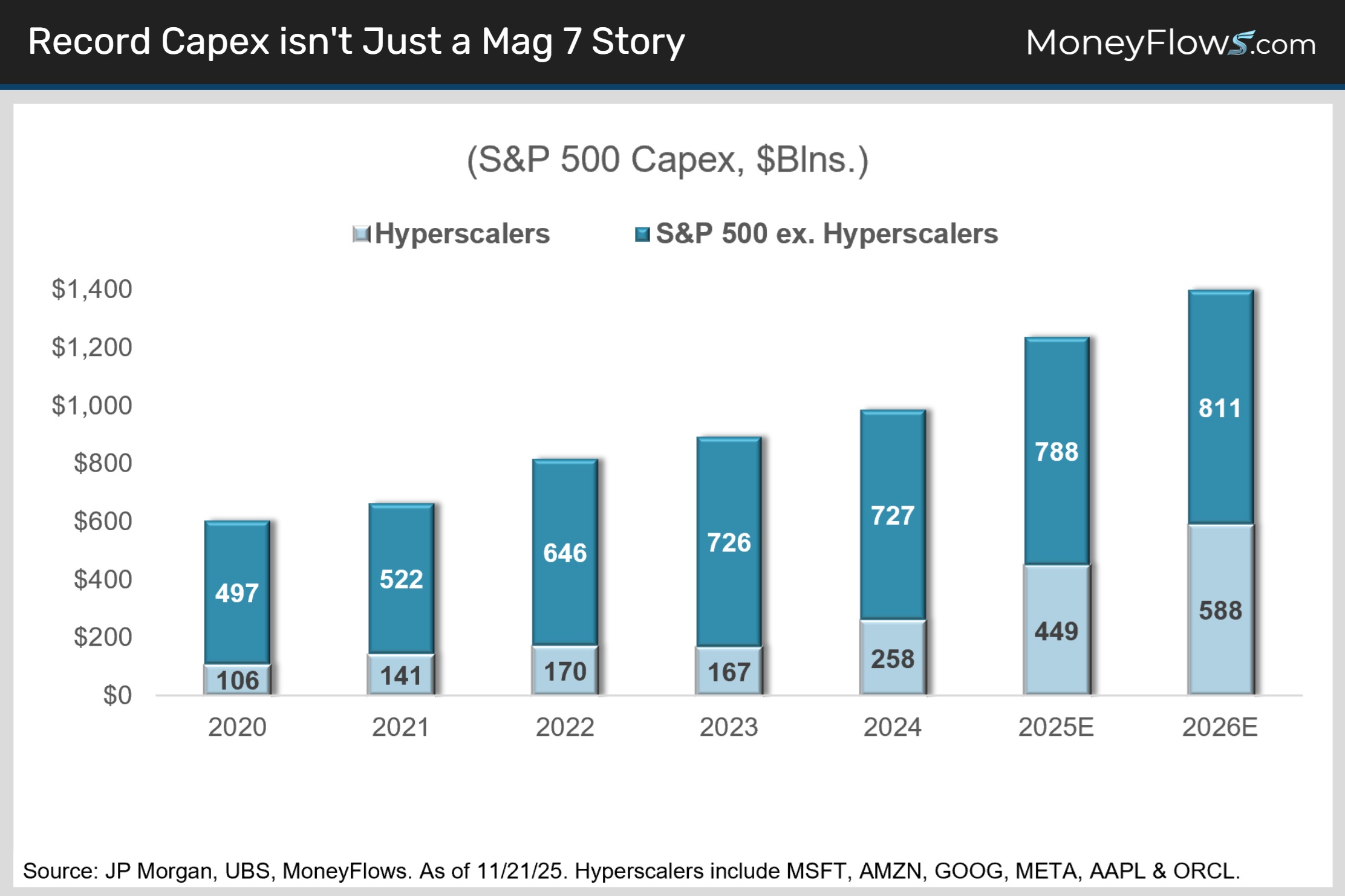

In 2025, the stimulus came largely from the bill’s corporate investment incentives. As a result, capex is surging and it’s not just big tech doing the spending (chart).

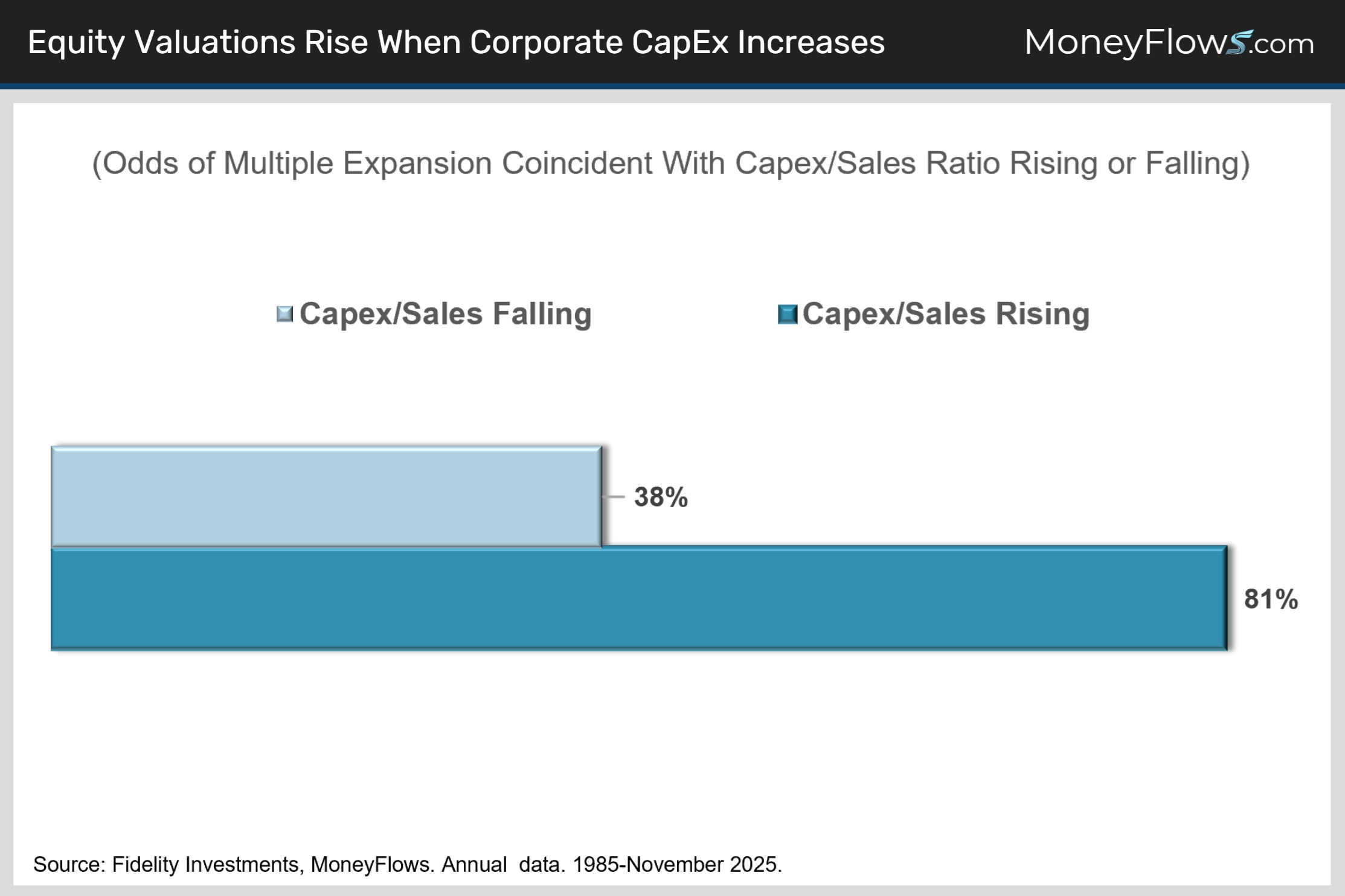

Here’s the best part. Rising capex is usually accompanied by multiple expansion (chart).

If you’re concerned that we’re priced for perfection, think again.

Expensive doesn’t mean capped – it means confidence in the future.

History says to prepare for even higher valuations ahead because rising capex means higher productivity, margins and earnings down the road.

Since 1985, there’s an 81% chance that multiples will expand due to rising Capex:

Let’s shift gears to how consumers are benefiting from the OBBBA.

Tax breaks for households became effective at the start of 2025 and should show up as a bumper crop of tax refunds in 2026.

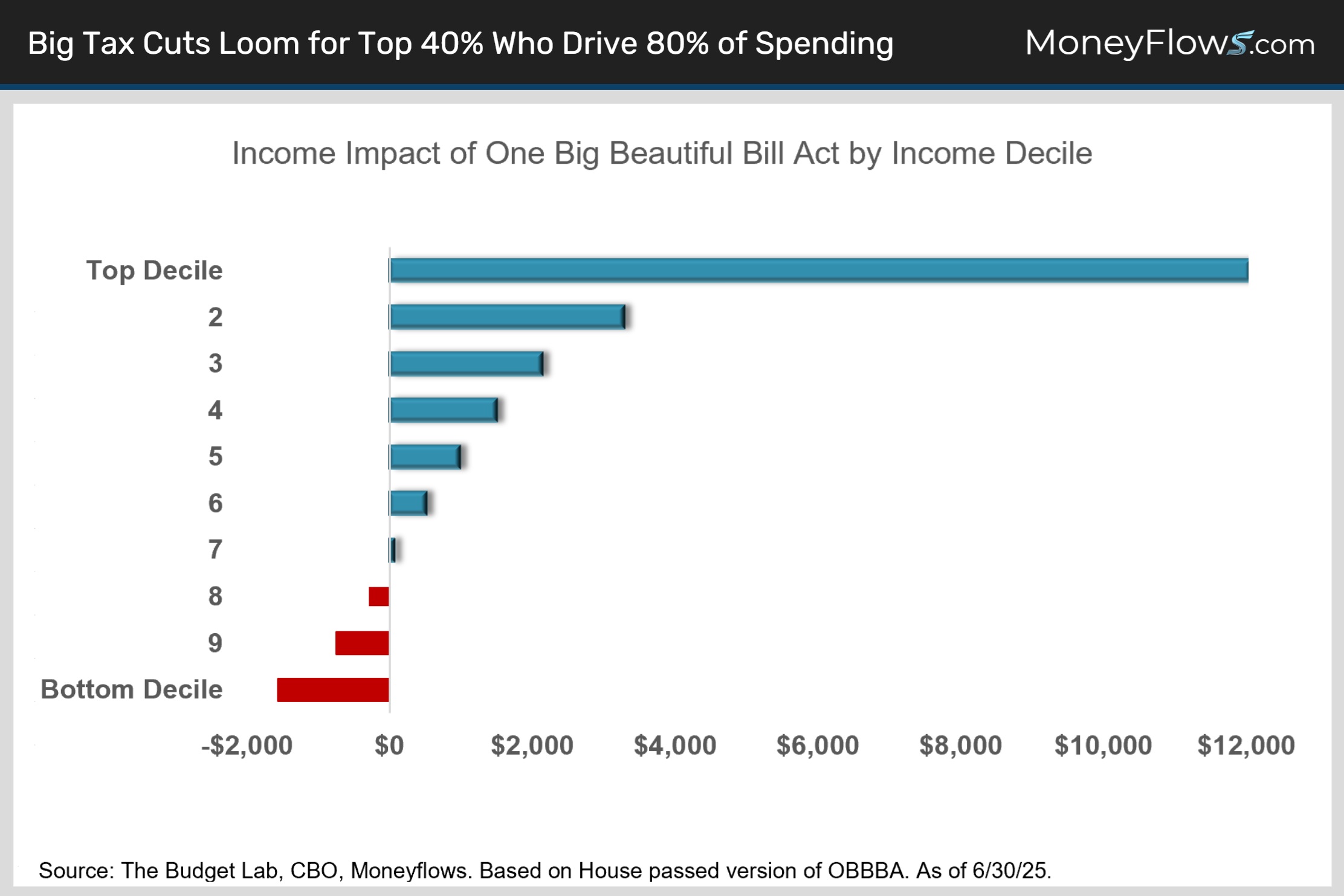

Higher income consumers will see the lion’s share of tax cuts.

The top 40% of households by income drive 80% of total spending. They will be the biggest beneficiaries of the OBBBA (chart).

With the consumer representing roughly 70% of economic activity, flush high-end shoppers should keep the “recessionistas” at bay again in 2026.

Note the large income impact for top decile earners:

OK let’s pivot to reason #5 to remain bullish - corporate earnings.

Strong Earnings Momentum Justifies Valuations

U.S. earnings growth is on pace for 12% year-over-year growth in 2025. Not bad relative to the 7% long-term average.

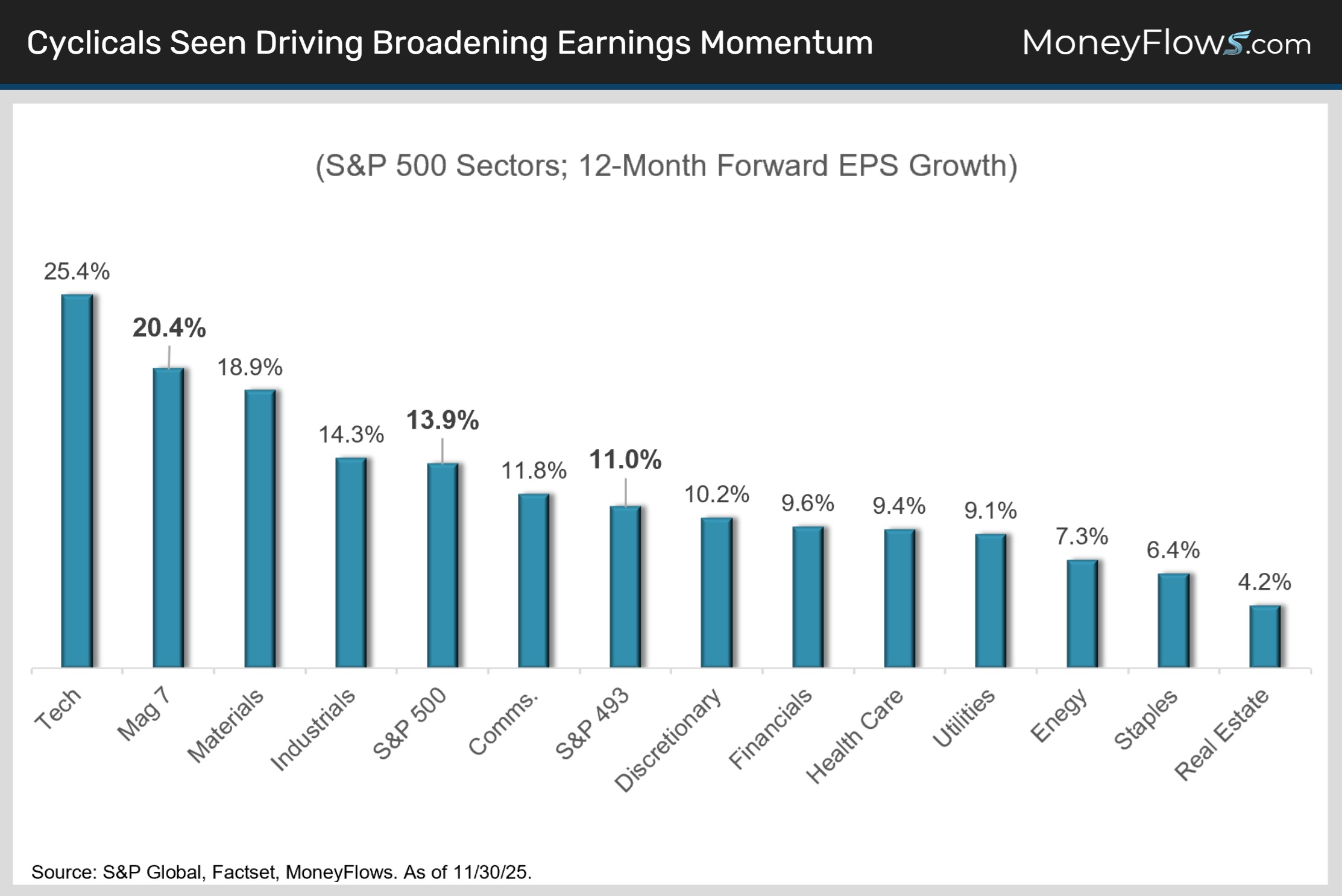

Amazingly, the pace is seen accelerating and broadening in 2026 thanks to the constructive policy mix and AI-driven efficiency gains, all of which are driving positive operating leverage.

The FactSet consensus forecasts 14% S&P 500 EPS growth in 2026 led by technology, materials and industrials sectors.

The Mag 7 are seen posting 20% profit growth vs. a respectable but still lagging 11% for the S&P 493.

However, growth is broadening - every sector except staples, real estate and energy is forecasted to grow its profits at least 9%.

Defensive sectors are seen lagging with utilities, health care, staples and real estate, all forecasted to grow earnings less than 10% next year (chart):

As long as earnings are working, stocks will keep pacing up and to the right.

Let’s check in on reason #6 we still like stocks - valuations.

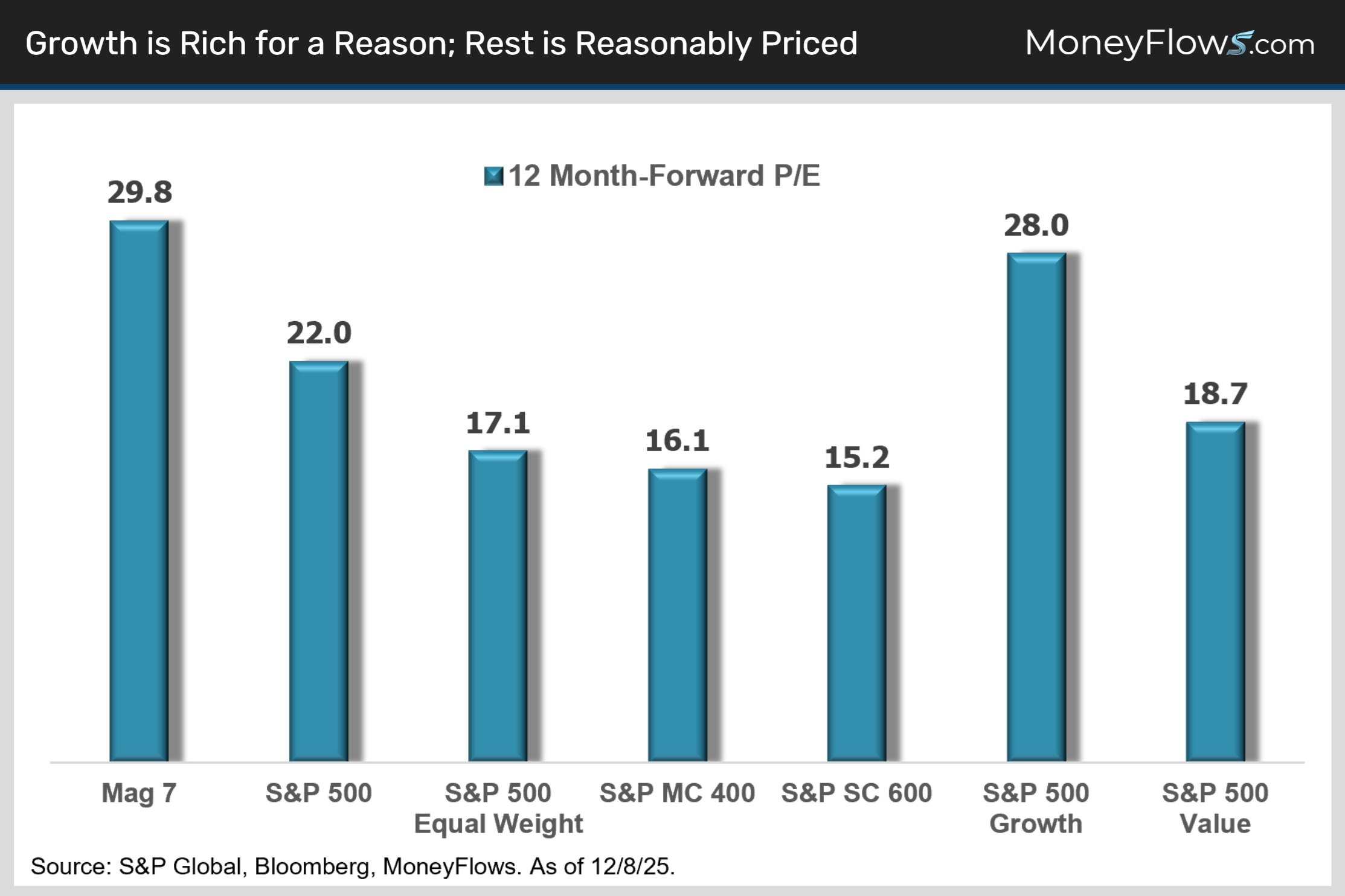

Bubble talk is everywhere and we view that as misguided.

At MoneyFlows, we never look at valuations in a vacuum. We always analyze it relative to earnings growth.

Strong profit momentum justifies higher valuations. It’s that simple.

Looking across the broad US equity universe, valuations remain reasonable across most equity sub-asset classes (chart), especially considering EPS growth is finally starting to broaden out beyond just big tech.

Large cap growth stocks, led by the Mag 7, definitely sport elevated valuations but they reflect world-leading 25%+ net profit margins and 20%+ EPS growth.

Reasonable valuations exist in the Equal Weight S&P 500 at 17.1 forward P/E. Even better are mid-caps trading at 16.1Xs and small-caps priced at 15.2Xs:

This valuation spread presents new market opportunities.

That brings us to reason #7 this bull market’s not over – investor positioning.

Cautious Investor Sentiment Signals Upside

Bull markets are born on despair, mature on skepticism, bloom on optimism, and finally die on euphoria.

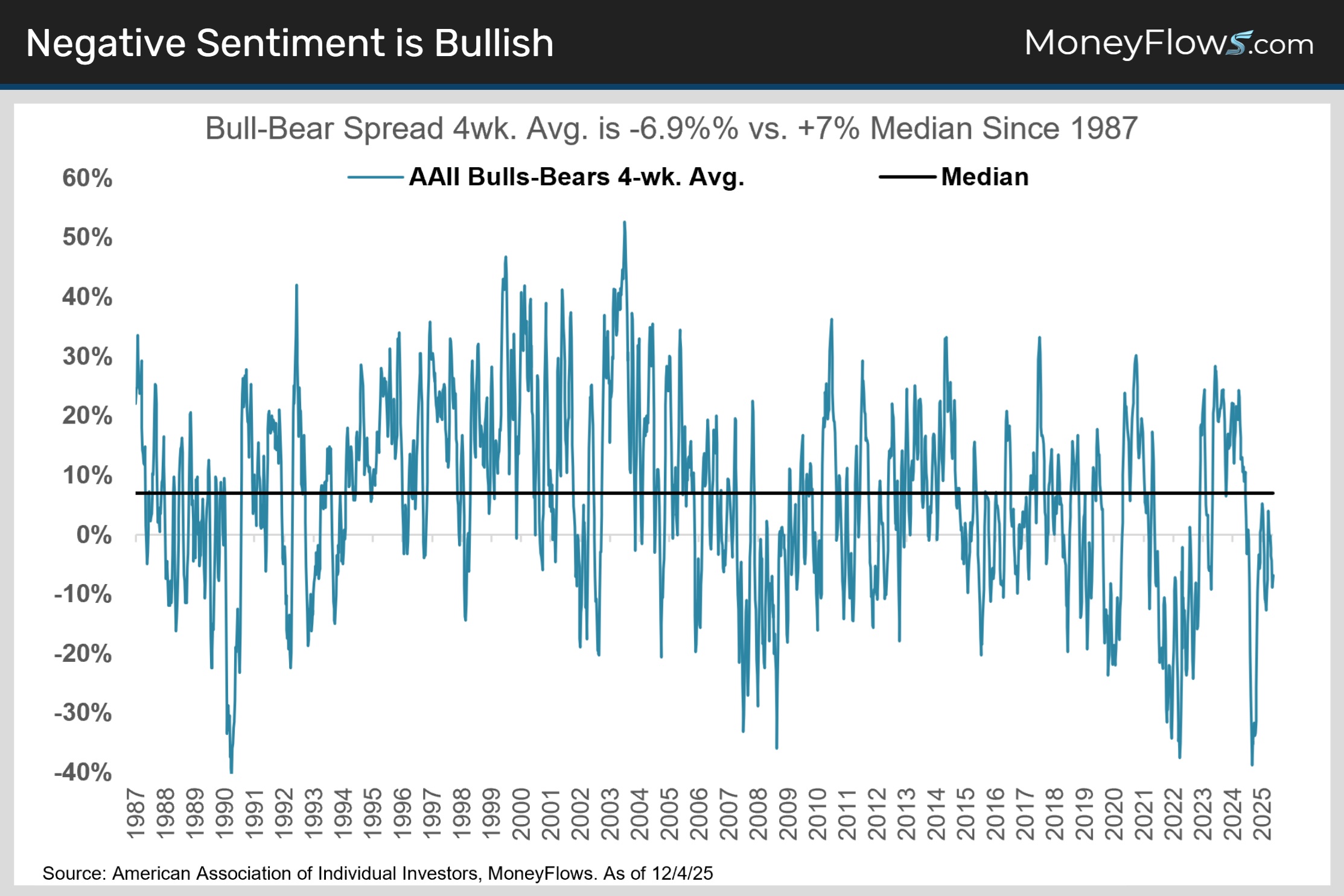

Despite three years of strong equity gains, the latest investor sentiment surveys prove widespread euphoria is still a long ways off.

The American Association of Individual Investors (AAII) surveys its 2 million members to see how they’re feeling about stocks.

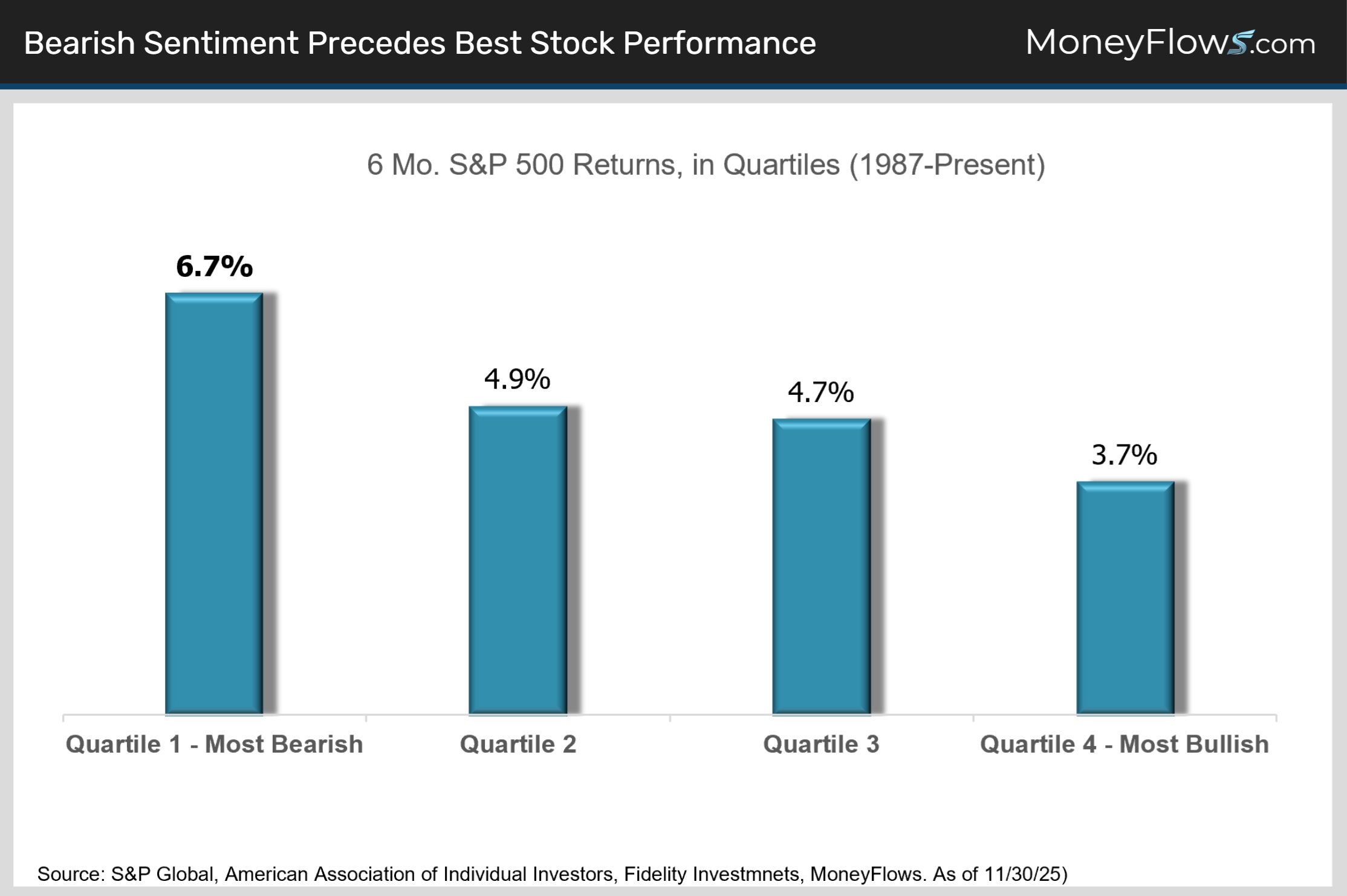

It can be a volatile series week to week, so we track the 4-week average of bullish minus bearish investor sentiment readings. The median reading is +7% since 1987 highlighting that there are usually more bulls than bears around.

That’s not the case today.

The latest reading has bulls trailing bears by 6.9%. That’s a bottom quartile reading, 14% below the long-term median:

Next time someone yells signs of froth are here, show them this chart!

Here’s the best part. The more bearish sentiment gets, the better the historical odds for future gains.

Why? Markets are much more likely to peak on optimism than pessimism.

None of this guarantees smooth sailing – and there are always exceptions - but history suggests that when sentiment hits top quartile bearish readings, the odds tilt toward opportunity (chart).

The S&P 500 averages 6-month returns of 6.7% post the lowest quartile sentiment reading.

So, while headlines keep feeding the wall of worry, the data argues that climbing it remains the more probable path:

What This Means for Your Portfolio - Expect Higher Volatility

Before we get into our 2026 asset allocation recommendations, let’s step back and set the stage.

The S&P 500 has enjoyed 21.5% annualized total returns (including dividends) over the last three years through December 5.

That’s double their long-term average annual total return!

After a run like that, you don’t have to be Nostradamus to know that higher volatility is in the cards. If you expect it ahead of time, it’s easier to stay the course and not get shaken out with the crowd.

The bottom line is while we see equities rising again next year, we expect a choppier ride.

Check out this next chart. Multiple annual 3% to 10% drawdowns are the norm, not the exception:

In terms of what’s most likely to drive more chop, AI uncertainty tops the list.

Big tech dominates the S&P 500 with a near 50% weighting.

With uncertainty rising about who will be the AI winners and losers, tech performance dispersion is up sharply.

Look no further than the Mag 7, only Nvidia (NVDA) and Alphabet (GOOGL) are beating the S&P 500 YTD through early December.

Uneven tech performance means a more volatile S&P 500. It’s as simple as that.

Focus on Quality in 2026

With volatility on the rise, we’re recommending a quality overlay as an overarching theme in 2026.

Quality over-indexes to high ROE, low debt, and stable earnings growers.

It’s paid to buy quality on the rare occasions it’s deeply on sale like it is now. Note how drawdowns rarely last forever:

There are other powerful reasons to like quality.

We expect the rally to broaden out mirroring earnings growth.

Market broadening will benefit the quality trade because it’s much more diversified than the S&P 500.

That’s thanks to a 28% combined weighting to tech and communications vs. the S&P’s 46%. It also has more than double the S&P’s industrials and staples exposures.

Add it all up and quality is a bit cheaper, less volatile, and higher yielding than the overall market. And history says when you buy it deeply on sale, you’ll likely beat the market to boot!

OK let’s talk sectors.

Expect Tech Dominance to Fade in Catchup Trade

We’ve been out front on the tech trade for years. But we expect leadership to shift elsewhere.

That doesn’t mean that technology stocks will decline, but you’ll have to pick your spots to win big. Broad sector alpha is unlikely.

The low quality, “everything AI” rally is over.

Don’t worry, MoneyFlows has you covered. We’re built to pick stocks. We have a proven track record of finding big outliers early.

There’s lots of other sectors to like in this market. Here are two contrarian sleepers for 2026.

Overweight Discretionary Stocks

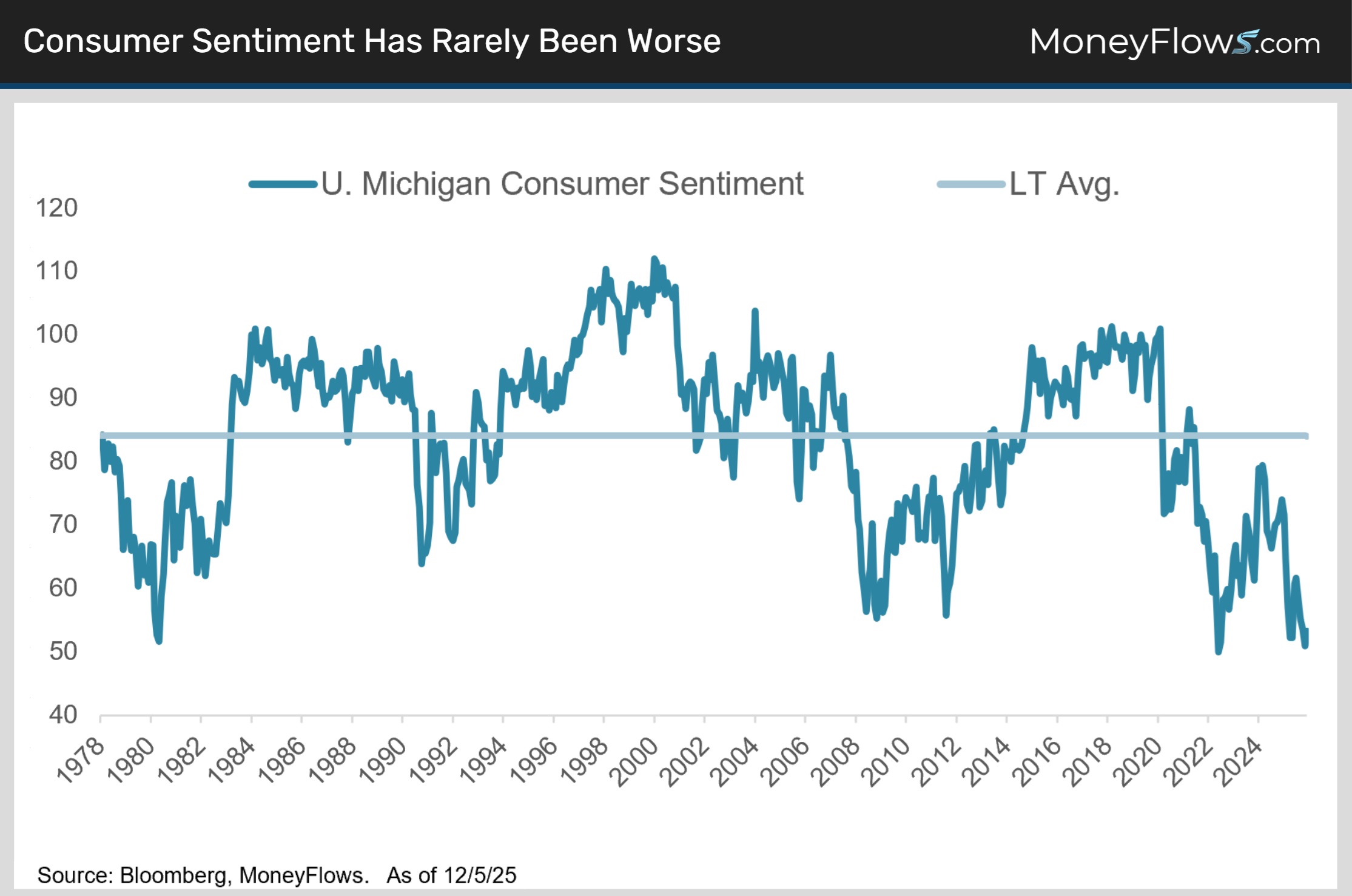

Consumer sentiment keeps sinking, the latest University Consumer Sentiment reading is one of the lowest on record:

Fear not, history is full of indicators that appear concerning at the time but often precede opportunity.

The consensus assumption that poor sentiment signals weak future spending and continued discretionary underperformance is misguided.

There are two things the crowd misses:

First, while most consumers in surveys are under pressure or pulling back, the high-end shopper is spending freely, supporting overall consumption. The K-shaped economy is alive and well.

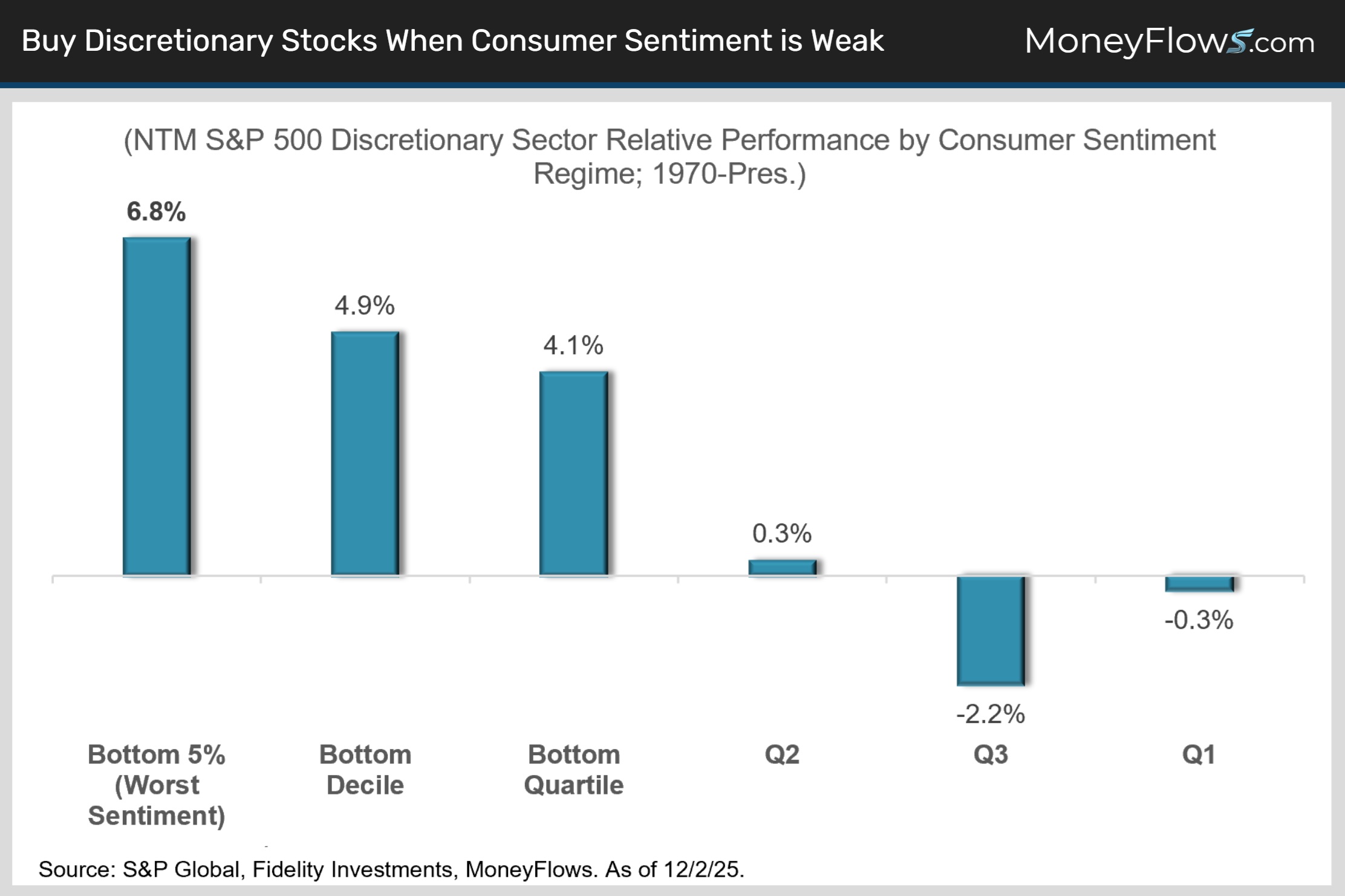

Second, and more importantly, the worse sentiment has been, the more likely the consumer discretionary sector has been to outperform in the future.

When sentiment falls into its worst bucket, where we are now, discretionary stocks have outperformed by an average of 6.8% over the next year, with a 75% hit rate since 1970.

Here’s why: stocks usually see it coming first. Historically, by the time sentiment is terrible, discretionary has already lagged. 2025 is a case in point. Discretionary has underperformed the S&P by over 10% YTD.

There are plenty of discretionary names loved by institutions heading into 2026. And this isn’t the only non-consensus area to explore.

Overweight Energy Stocks

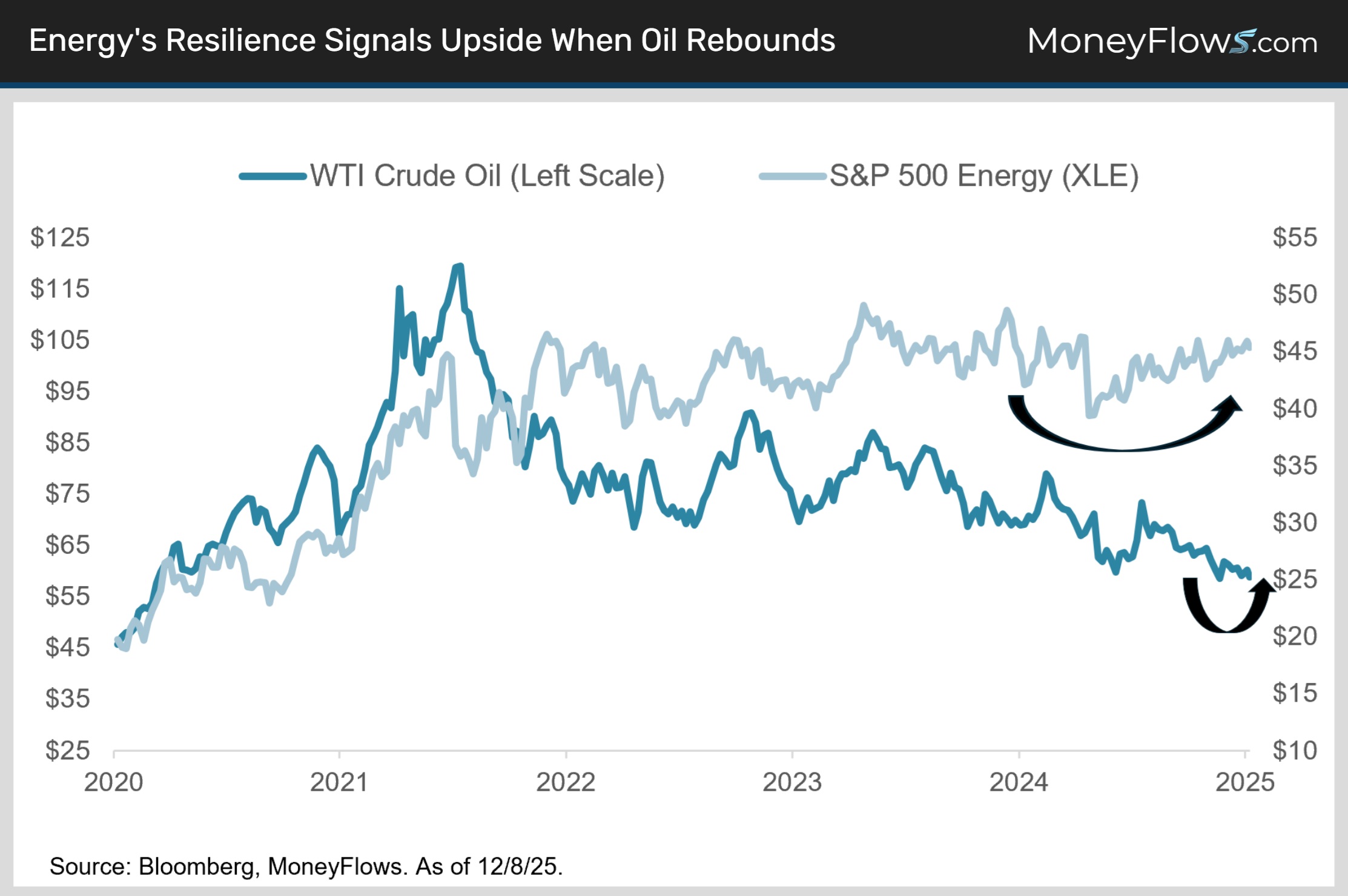

Everyone hates energy. It’s just 3% of the S&P 500. Few are overweight.

That’s despite energy being the cheapest sector, trading at just 15.9X 12-month forward consensus earnings estimates. It’s also the highest yielding sector with a juicy 3.4% payout.

What’s more, the energy sector’s earnings growth is seen rebounding to 7.3% over the next year from slight declines this year. And if oil rebounds, actual results will be far better.

But here’s the biggest reason to buy - when stocks don’t go down on bad news it’s a bullish signal.

The energy sector is just 9% below 2024’s record highs despite a 25% YTD oil price drawdown.

This impressive resilience tells us energy stocks should be owned:

Now for the best part.

Let’s wrap up with a diversified list of 40 high-quality winners for 2026. You’ll notice energy and discretionary are over-represented relative to their S&P 500 sector weights of 2.8% and 11%, respectively.

Where most research houses got it wrong the last 6 months, MoneyFlows got it right.

Good things happen when you follow the data instead of the crowd!

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get access to our proprietary indicators and learn how our unique money flow approach finds outlier stocks early.

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here.

This time, be early.

Our process helps investors “be early” to trends.

Go with the flows!

Below are 40 wide-moat stocks to own now. Most have strong momentum and high MAP Scores. Some are sleepers beginning to rebound as the rally broadens with improving fundamentals and healthy dividend growth.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.