2025 AI Investor Handbook

After a nasty Spring swoon, stocks are on a roll.

AI momentum has tech leading the charge, up 21.4% QTD – more than double the S&P 500’s 8.6% gain.

Our May 5 call to Buy Mega Cap Tech Stocks is humming.

But there’s a lot more to like about the “AI trade” than just the Mag 7.

MoneyFlows’ 2025 AI Investor Handbook will guide you through the big equity opportunities.

As AI drives broader productivity gains across the economy, its disruptive impact will be felt across every sector, creating huge opportunities for savvy investors.

You need to think about AI as a bullish macro overlay on the case for stocks. It’s a secular game changer.

Below, we’re unpacking the AI boom. What’s driving it?

How quickly will it change the game?

What are the long-term macro implications for the economy and stocks?

To wrap up, we’ll arm you with a sector diversified list of 50 big near and long-term AI winners.

The AI Arms Race Kicks into High Gear

There was a moment in February when the "AI trade" felt saturated and stale.

But then, Microsoft (MSFT), Alphabet (GOOGL), Nvidia (NVDA), Amazon (AMZN) and Meta (META) - the largest companies in the world - reminded us on their Q1 earnings calls that AI isn’t a trade - it's a structural shift reshaping technology, capital allocation and ultimately the nature of competition.

As AI has become increasingly advanced and accessible, interest and investment have followed.

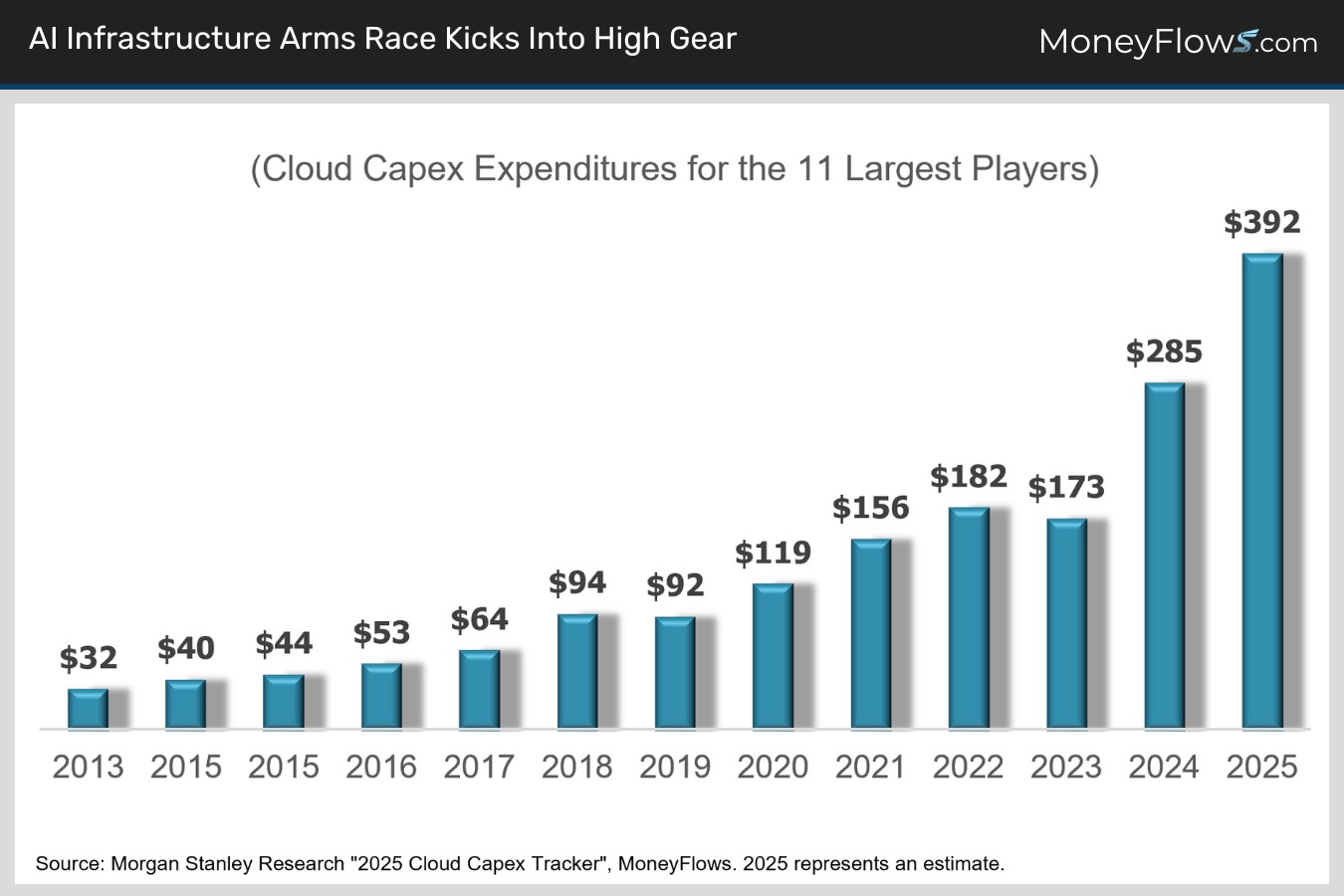

Microsoft, Alphabet, Amazon, Meta and others confirmed their 2025 AI capex will rise to a record $392 billion as they chase AI infrastructure dominance (chart).

Despite mounting geopolitical and trade related supply chain pressures, Big Tech is translating AI investments into revenue growth and margin expansion as they shift from experimentation to monetization across their cloud and advertising platforms.

Better profitability is why the Mag 7 keep outperforming. They continue to have the fastest earnings growth in the S&P 500.

AI is only accelerating this trend.

But it isn’t just the mega-caps that are benefiting.

To quote Warren Buffett, a rising tide lifts all boats.

AI Spillover Beyond Big Tech

While big tech companies have been early adopters and beneficiaries of AI, productivity improvements are expected to spread far and wide.

Already, 40% of S&P 500 corporations cited “AI” on Q1 2025 earnings calls, according to FactSet.

Gartner forecasts 2025 global investment in AI will total $644 billion— up 76% from $365 billion in 2024.

As AI investments continue to ramp, efficiency benefits will contribute to stronger economic growth, helping boost productivity across a wide array of sectors from finance to logistics to health care and consumer.

Here’s how AI helps companies in every sector:

- Automation: AI can automate repetitive and time-consuming tasks like data entry, scheduling, logistics and basic customer inquiries, freeing employees to focus on more complex work.

- Physical AI: Robotics can automate physical tasks across industries.

- Improved Decision-Making: AI can analyze large datasets to identify patterns, predict trends, and provide insights that help leaders make more informed decisions.

- Enhanced Collaboration: AI-powered tools can improve team communication, facilitate brainstorming, and streamline project management.

- Increased Efficiency: AI can optimize resource allocation, improve scheduling, and enhance overall workflow efficiency, resulting in significant time savings and increased output.

- Improved Accuracy: AI can minimize errors in data entry and analysis, reducing rework.

- Personalized Experiences: AI can personalize customer interactions and product recommendations, leading to increased customer satisfaction and engagement.

- Faster Scientific Advancement: AI can accelerate scientific research by automating tasks, analyzing complex data, and making new discoveries.

- Enhanced Writing and Editing: AI can assist with drafting, editing, and proofreading documents, saving time and improving the quality of written content.

These all are net positives for productivity…

…for everyone embracing technological change.

Productivity on Steroids

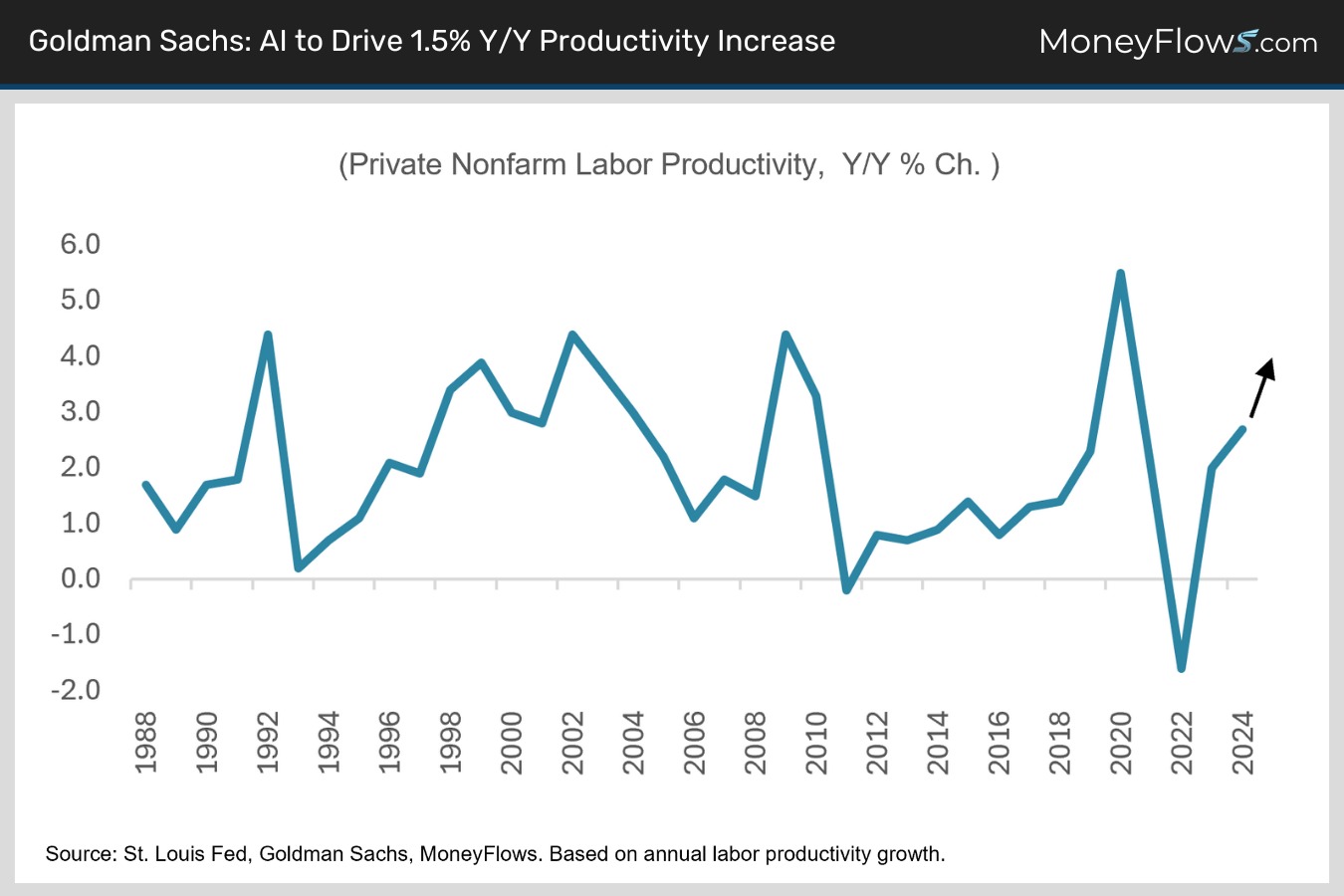

Productivity is already on the rise. It grew a healthy 2.7% in 2024 (chart).

Goldman Sachs estimates generative AI could raise annual US labor productivity growth by just under 1.5% over a 10-year period following widespread adoption.

To receive Full Access to the 2025 AI Investors Handbook and receive a diversified list of 50 AI companies that will massively benefit from technological innovation, become a PRO subscriber today. This will also get you access to our cutting edge research that has been bullish from the depths of the April tariff crash.

Many worry about job loss but I see that as misguided.

The combination of significant labor cost savings, new job creation, and a productivity boost for non-displaced workers raises the possibility of a labor productivity boom like those that followed the emergence of earlier innovations like the electric motor and the personal computer.

These past experiences offer two key lessons.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.