Best AI Stocks to Buy Now for 2026

AI stocks have captivated everyone from Wall Street to Main Street.

There’s a lot of hype in this area, so choose carefully.

Focus on the biggest earnings growers loved by institutional investors.

Here are the best AI stocks to buy now for 2026.

Having a process is critical to finding leading stocks.

At MoneyFlows, we understand that supply and demand is the ultimate power law. This force is responsible for the long-term trajectory of stocks.

Datacenter, storage, and memory chip names have been the darlings of Wall Street for months.

We believe these trends are potentially the trade of 2026.

Today we will dive into 3 top-ranking AI stocks that are under heavy institutional support.

They have been the ultimate outlier stocks of 2025 and beyond.

Best AI Stocks to Buy Now for 2026

Every single day, stocks are bought and sold, revealing institutional footprints.

This information is powerful to uncover the best stocks in the market…early.

Back in October 2025, I showcased our Top Technology Stocks. Storage and memory chip names were under heavy accumulation.

That trend has only accelerated.

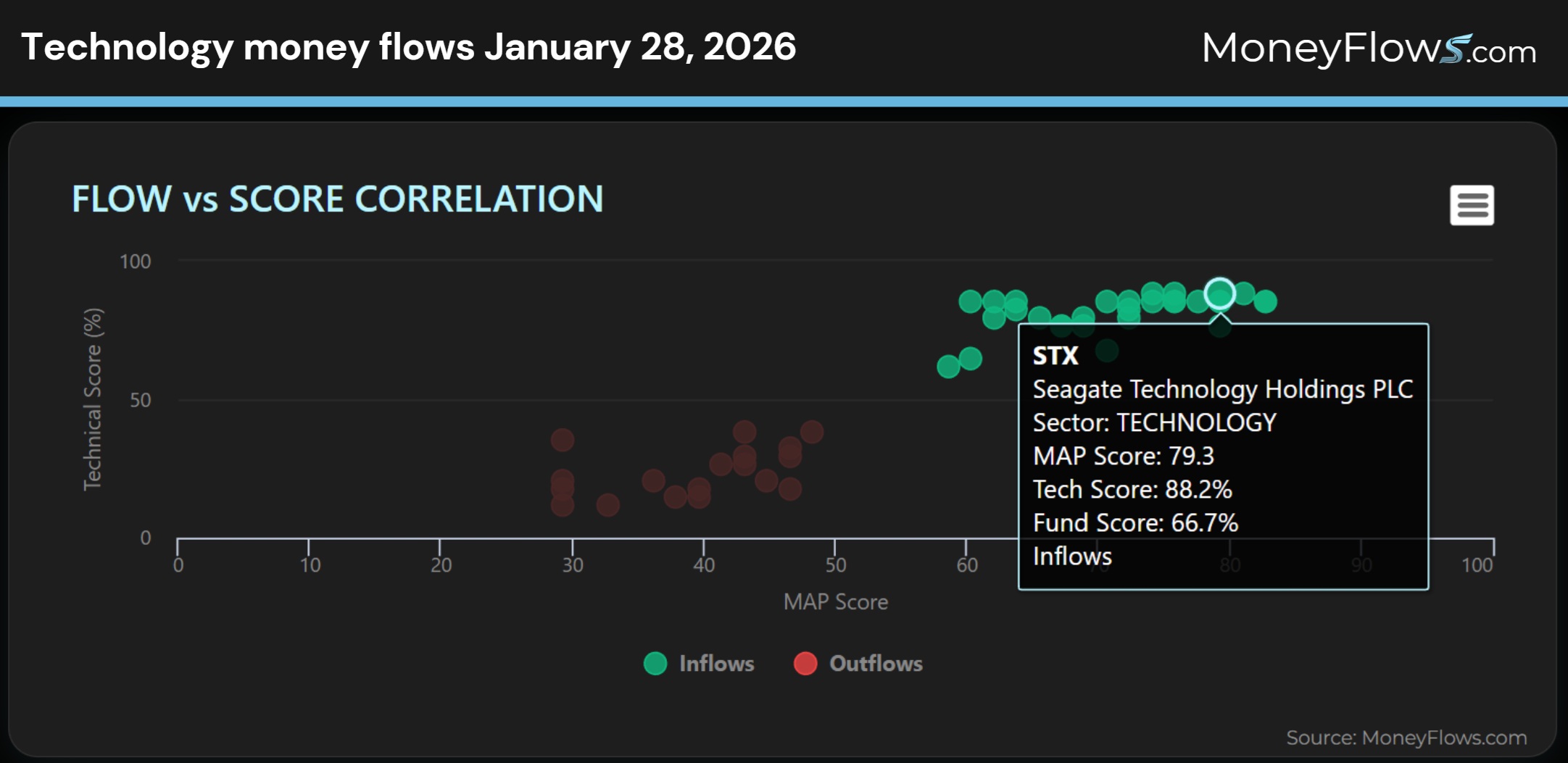

Below highlights all of the Technology inflows and outflows from January 28, 2026.

I’ve hovered over Seagate Technology (STX) and you’ll notice a breakdown of MAP Score, Tech Score, and Fundamental Score:

This is the process that helps us find the best all-star stocks before they are on the lips of the media.

Now let’s unpack our best AI stocks to buy now for 2026.

The number 1 best AI stock for 2026 is Seagate Technology (STX).

Seagate specializes in the development of data storage products including hard drives and solid-state drives.

The company recently reported earnings that beat expectations…more importantly they raised guidance for Q3.

The $94 Billion market cap company guided Q3 EPS at $3.40/share (+/- $.20) vs estimates of $2.99/share.

And they increased their Q3 revenue guidance to $2.9 Billion (+/- $100mm) vs estimates of $2.78 Billion.

Much of this improvement revolves around the tight supply-demand environment around storage…which implies that margins will only increase from here.

That’s rocket fuel for a stock.

Here’s where the opportunity unfolds.

When it comes to elite stocks, earnings follow stocks.

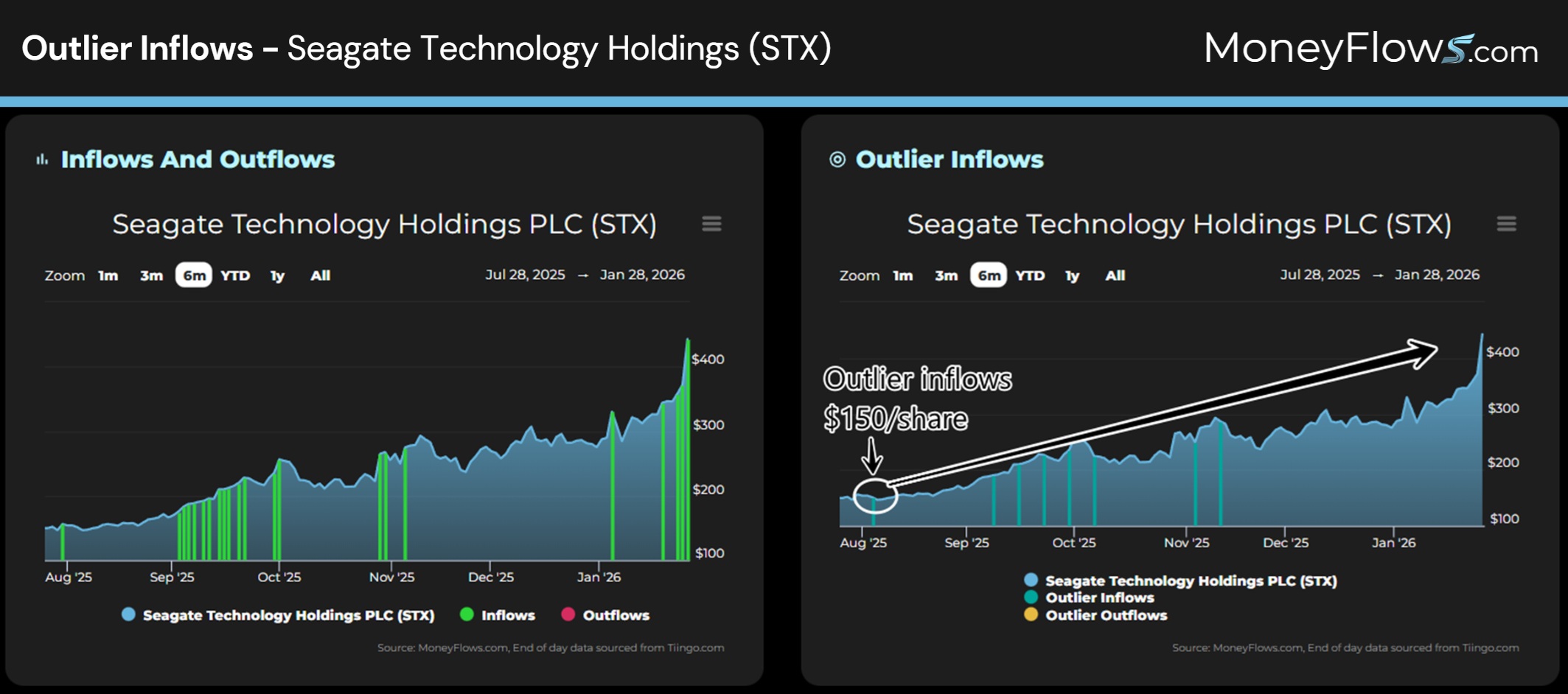

Check out the one-way flows for STX. On the left we have discrete daily inflows for the last 6 months which started in August.

On the right are Outlier Inflows. These are the best stocks in our research. The blue vertical lines showcase each time that Seagate (STX) was profiled as a top stock on our weekly Outlier 20 Report.

Since the first initiation, STX was $150 per share, and today is $442 per share:

Don’t make investing complicated. Follow the flows!

The number 2 best AI stock for 2026 is Micron Technology (MU).

Micron is a storage and memory manufacturer. The $500 billion market cap company has benefited immensely from the memory bottleneck that’s expected to last through 2028.

What turbo-charged this stock recently was the surprise Q2 guidance that occurred on December 17.

The company raised their quarterly EPS to $8.42/share at the mid-point, shattering analyst estimates of just $4.78/share.

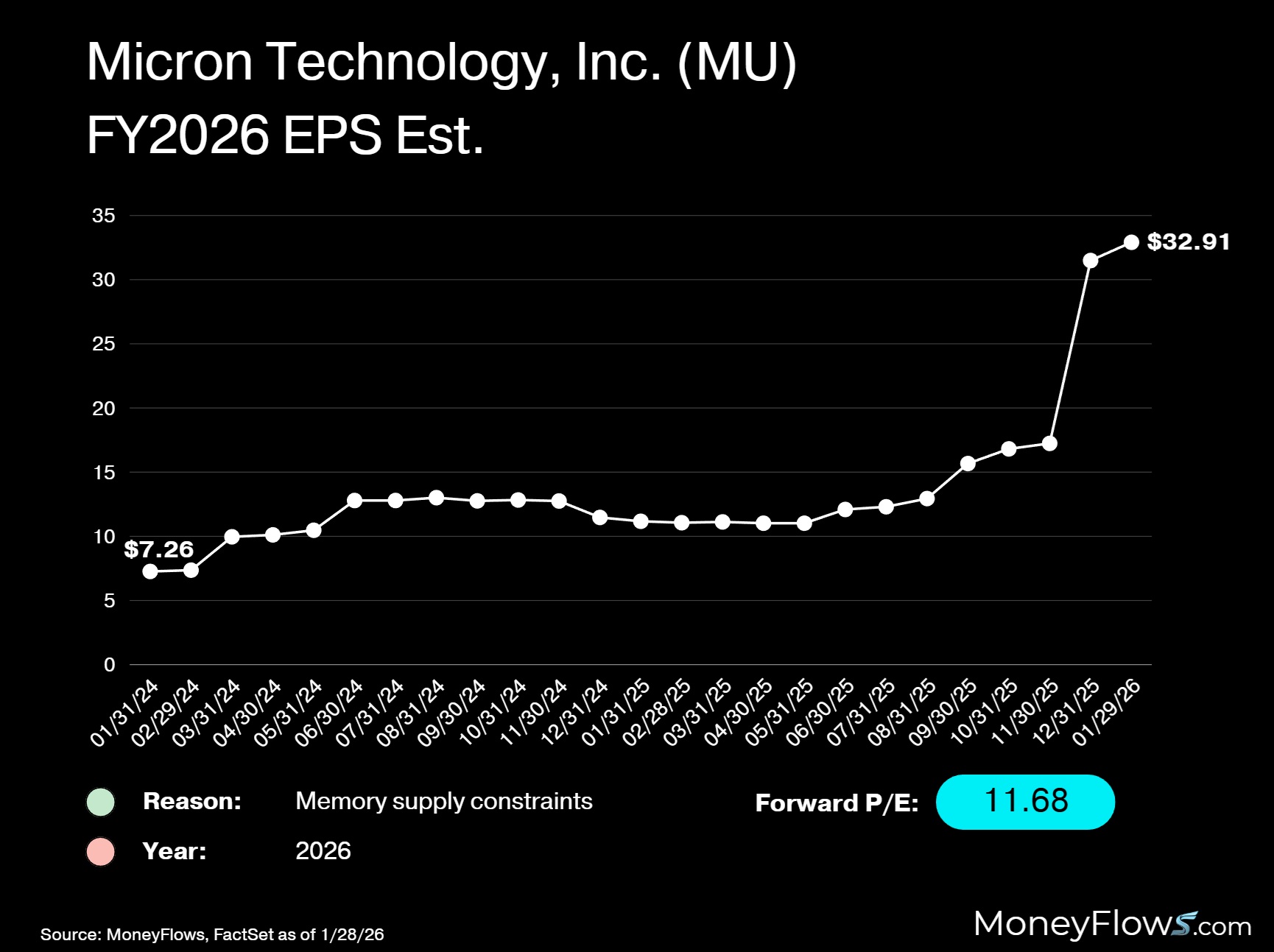

To give you an idea of how wicked this raise was, have a look at Micron’s FY2026 EPS estimate graphic.

Estimated earnings per share have climbed from $7.26 in January 2024 to a whopping $32.91 as of January 28, 2026:

Folks, if you think institutions were caught off guard – think again.

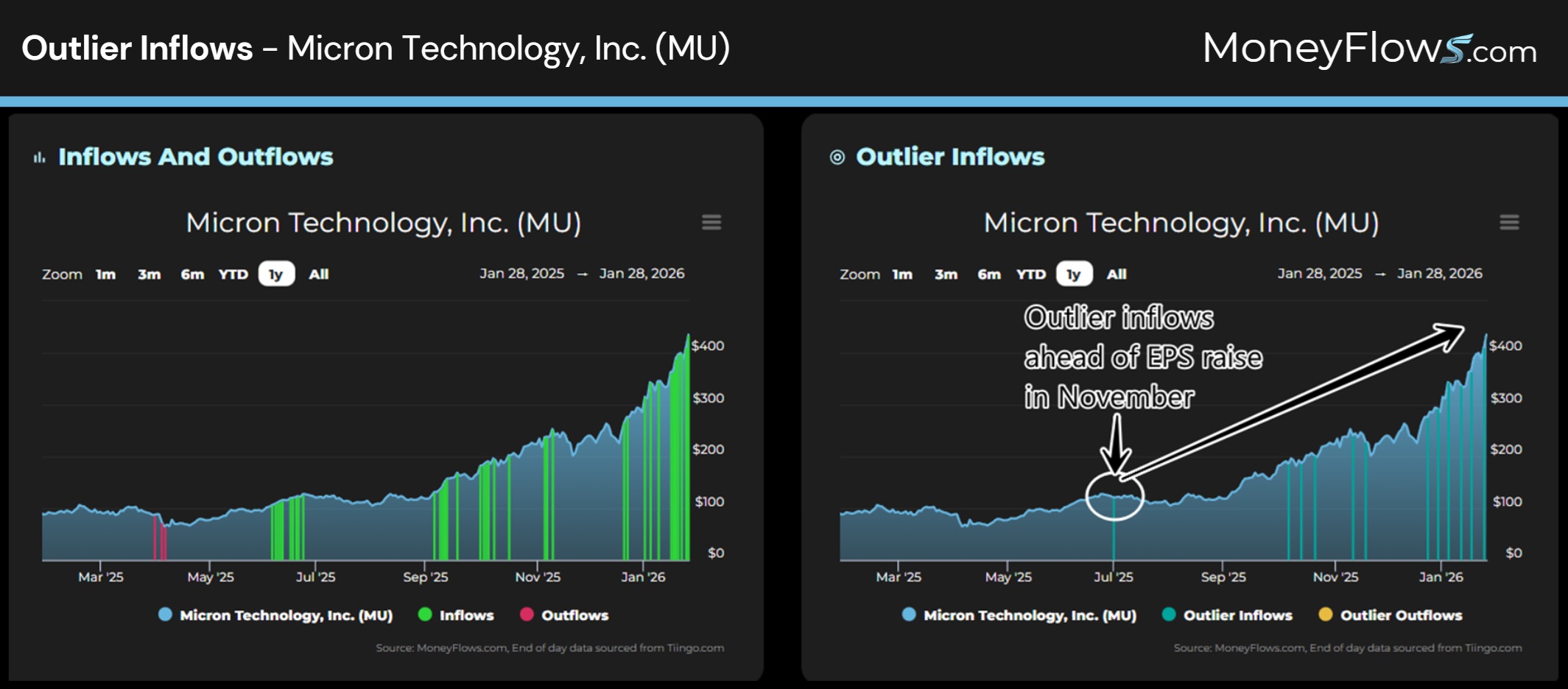

MU shares have been under extreme accumulation since July. And the stock has been regularly profiled in our Outlier 20 report since MU shares traded at $120.

At last measure the stock has reached $435 per share:

Let’s say it again: Earnings follow stocks!

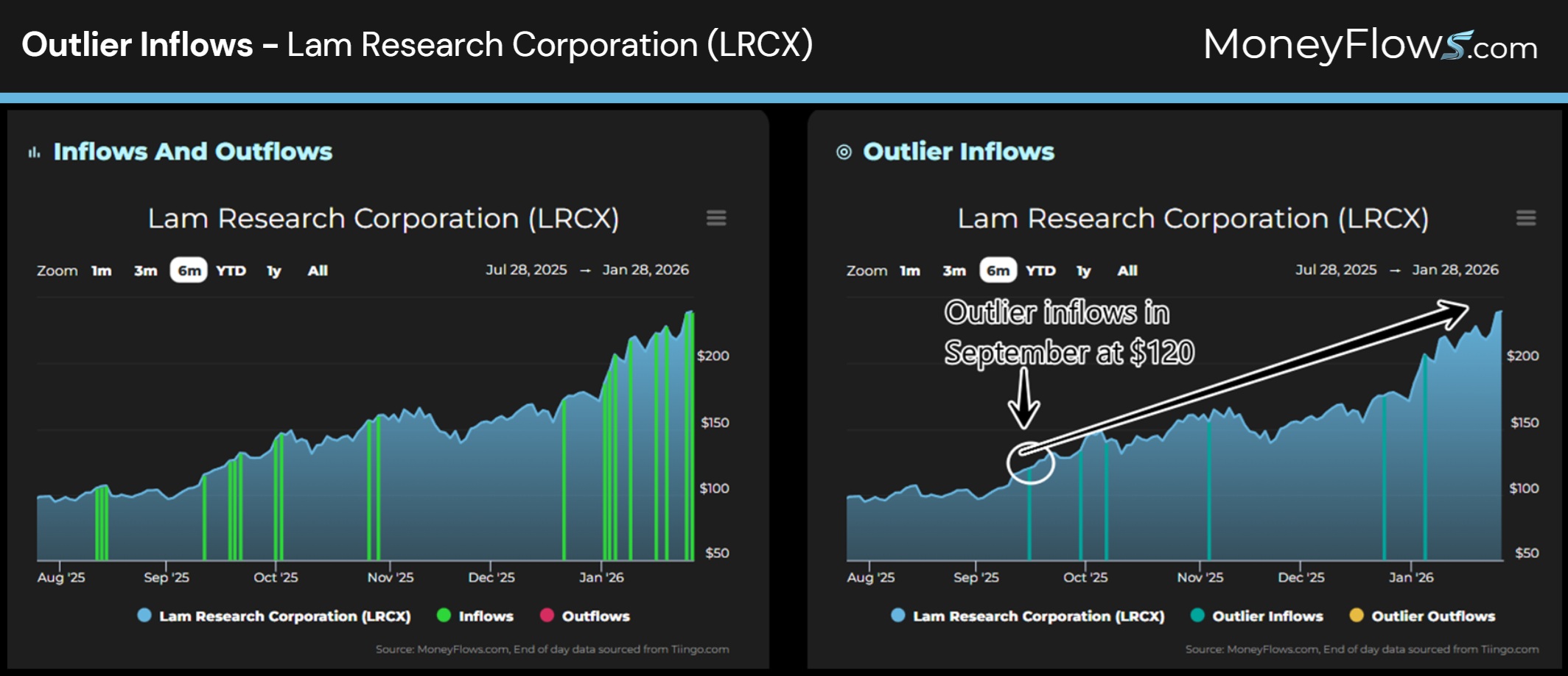

The number 3 best AI stock for 2026 is Lam Research (LRCX).

Lam Research is a leading semiconductor equipment processor. The $300 billion market cap firm has been on a tear with shares gaining 218% over the last year.

Much of the enthusiasm is due to the continued strong High Bandwidth Memory (HBM) DRAM segment.

Just last night the company easily beat and raised earnings expectations.

For Q3, Lam guided to revenues of $5.7 billion at the midpoint, easily beating estimates of $5.33 billion.

Q3 EPS was raised to $1.35/share at the midpoint, well above analysts’ expectations of $1.20 per share.

Here’s the deal. The beat and raise has been well understood by the Big Money. Our data has picked up on under-the-radar inflows since September.

More importantly, LRCX made our Outlier 20 report repeatedly given the gains in forward-looking earnings.

All outlier stocks have charts like this…the stairway to heaven:

Look, 2026 is proving to be the year of the stock picker.

Our research repeatedly finds tomorrow’s leading equities months ahead of the crowd.

Can you outperform in 2026 without MoneyFlows research? Maybe…

I just can’t recommend it!

Get your portfolio on the right side of the Big Money.

Make 2026 your best year yet.

Our PRO subscription allows you to spot daily flows and access our weekly Outlier 20 report.

This is the report that has found EVERY SINGLE ONE of our Outlier stocks.

Professional money managers and RIAs looking for additional portfolio solutions including ETF flows & ranks and your own Portfolio Tracking tools, please reach out about our Advisor Solution and Emerging Advisor Program.

And don’t miss my latest video on the Huge Market Rotation Leaving the S&P 500 in the Dust. You can also listen via podcast here.