MoneyFlows’ 10 Biggest Calls in 2025

As the year comes to an end, looking back is just as important as looking forward.

I’m proud of the research we produced in a very challenging year.

In this post we will be recapping MoneyFlows 10 biggest calls in 2025.

Markets dealt with a lot this year.

We saw a tariff crash, a crowd-stunning recovery, USA credit downgrade, government shutdown, and forced liquidations.

While we didn’t have a perfect record…when it mattered, we remained constructive using an evidence-based approach.

Congrats if you hung in there. It wasn’t easy given all of the non-stop negativity in the media.

This is a reminder to be careful what you consume…more importantly, follow the data.

Keep it simple.

If you’re curious on our views heading into 2026, I’m betting that prior unloved groups like small caps will see a revival.

Our macro analyst, Alec Young, highlights new opportunities next year.

Now let’s review one of the wildest years in recent memory…and unpack some of our biggest non-consensus calls.

MoneyFlows’ 10 Biggest Calls in 2025

You may have forgotten that 2025 started off in the dumps.

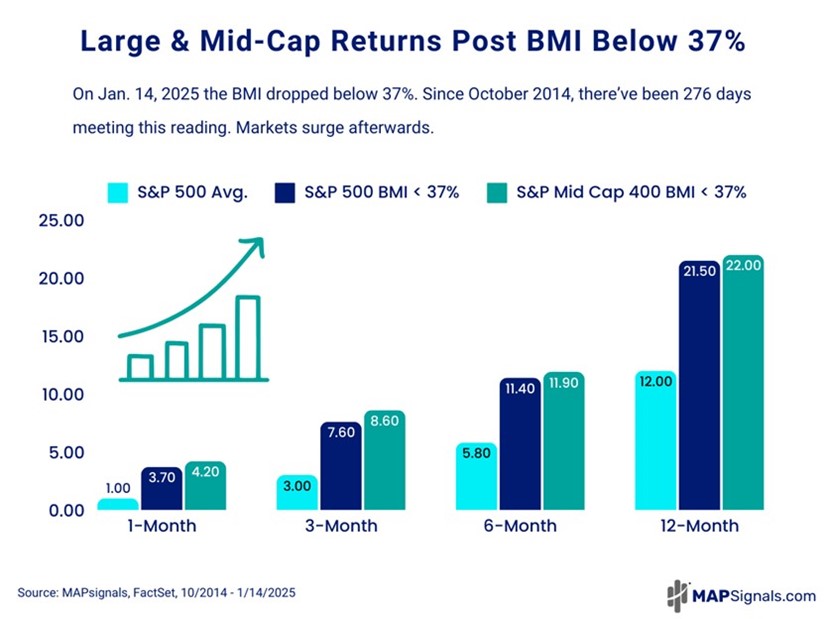

Number 1 – Our Big Money Index (BMI) collapsed to near oversold readings of 36%.

That’s a massive buy signal looking back historically.

While it wasn’t perfect, the S&P 500 gained 19.5% since this call while the S&P Mid Cap 400 jumped 7.2%.

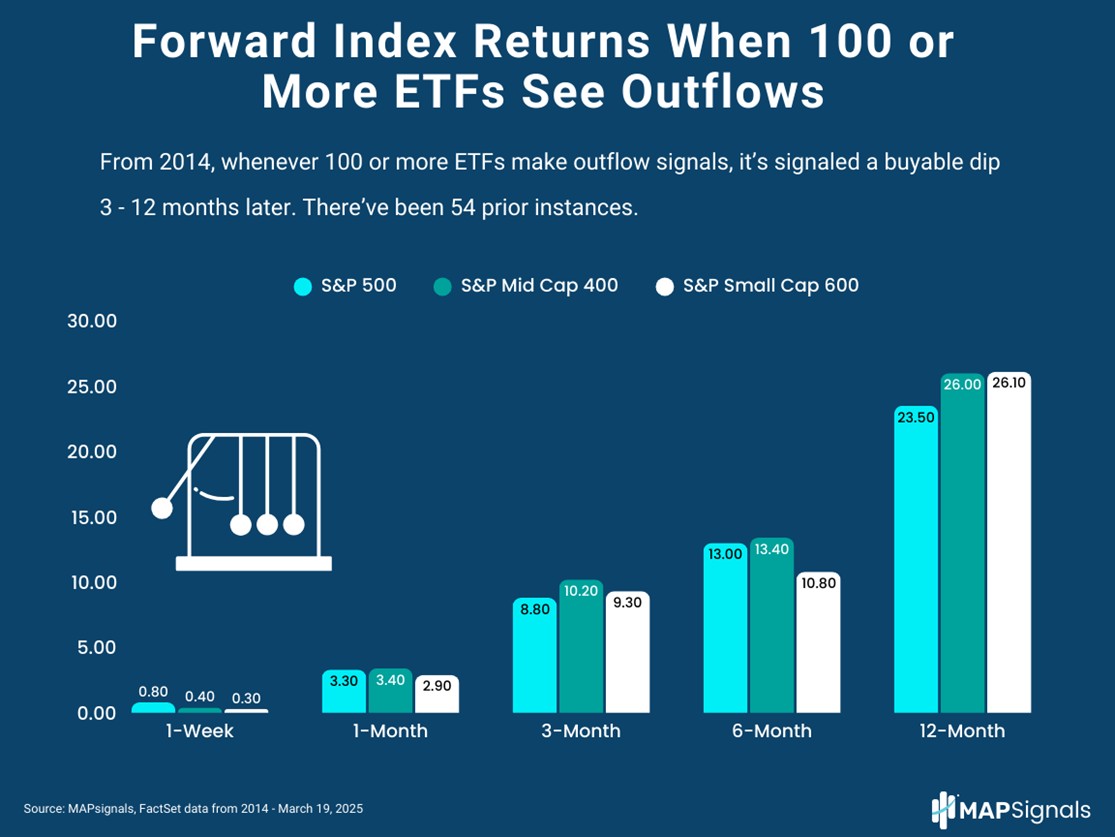

Number 2 – In March we highlighted how Forced ETF liquidations are a buy signal.

On Wall Street, when everyone rushes for the exits, back up the truck. Here’s the evidence.

Whenever 100 or more ETFs see outflows, stocks of all sizes show monster forward performance.

Since this post, the S&P 500 gained 23%. The S&P Small Cap 600 jumped 16.3%. The S&P Mid Cap 400 ripped 14.1%.

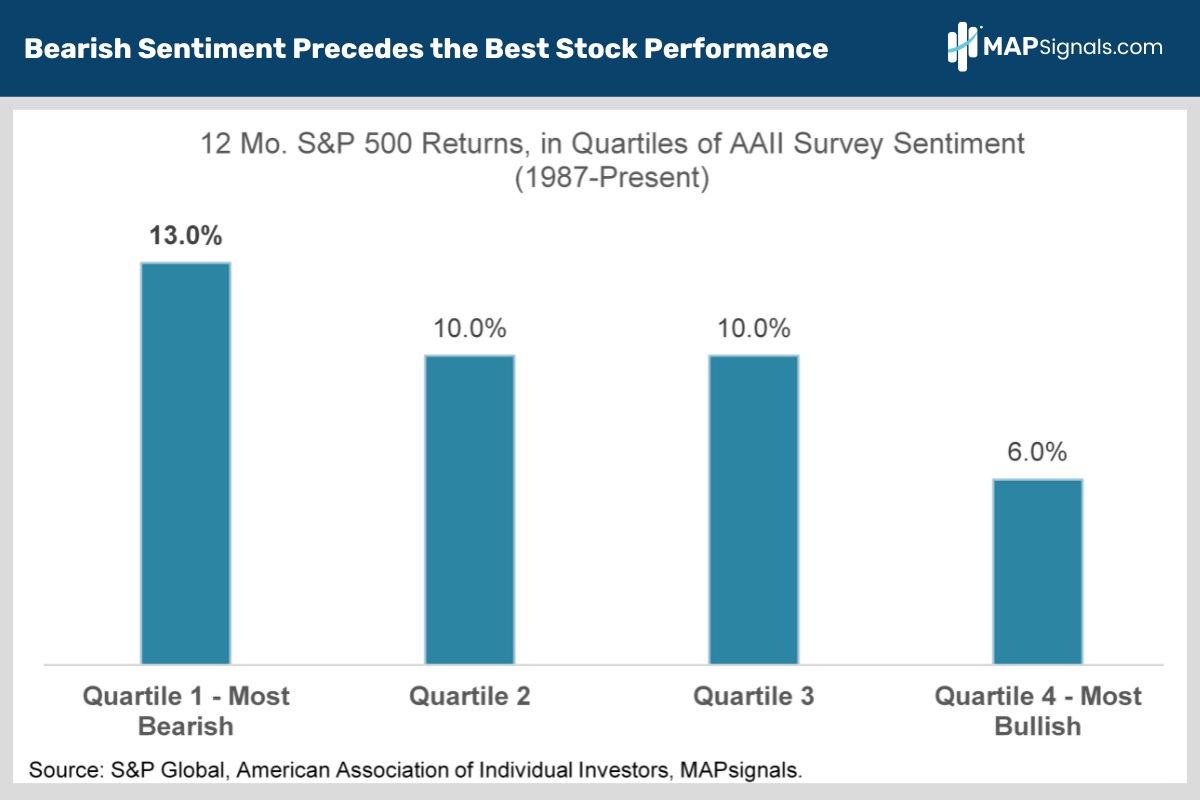

Number 3 – In March, investors faced a correction. Pundits cried how financial Armageddon was ahead.

Alec Young suggested to buy the dip simply because of the pure negative sentiment. He was right. A study suggested how extreme bearish sentiment often leads to a 13% gain 12-months later for stocks.

The S&P 500 is up 20.7% since this post.

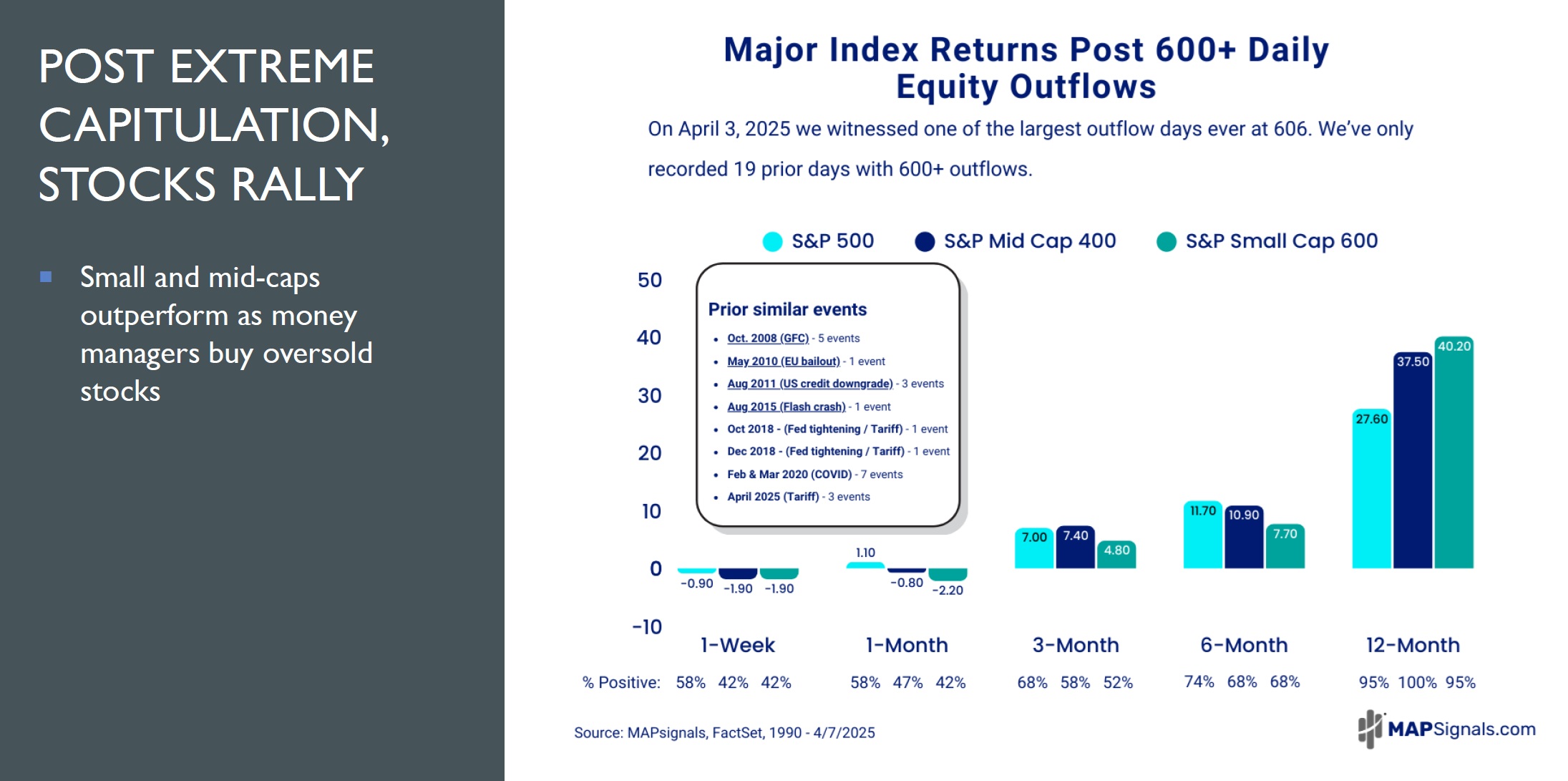

Number 4 – at the tariff crash lows, we made our boldest call of the year to buy stocks aggressively with 15 extreme charts for April 2025.

Only during the COVID-19 crash can I remember a time when the crowd was this offsides. Few saw what we saw.

Capitulation is the ultimate buy signal.

We prepared subscribers for a breath-taking rally ahead.

Since this post on April 10th, the S&P 500 rallied 32.1%.

Small and mid-caps vaulted 30.8% and 25.7% respectively:

Number 5 – in early May we told you to buy mega cap tech stocks.

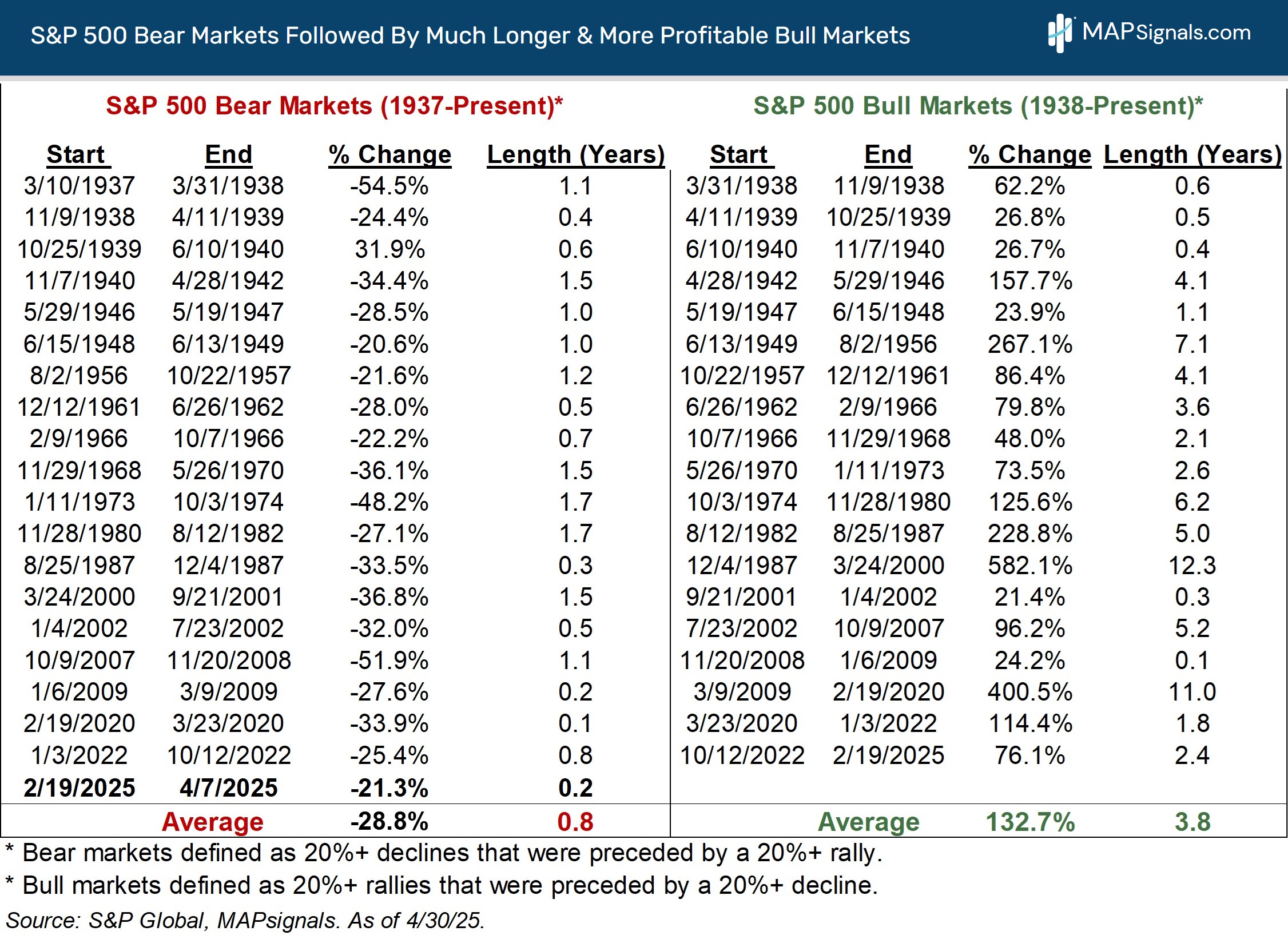

While talking heads were debating the market’s next move, we showcased compelling evidence that bear markets are a great time to buy stocks.

Number 6 – stocks perform well after a USA credit downgrade.

The media fanned the bearish flames after Moody’s downgraded the United States credit rating to Aa1 from Aaa.

We studied history and told you to buy any weakness simply because history proves that stocks will recover.

Since this post, the S&P 500 climbed 16.6%.

Small and mid-caps jumped 13.6% and 9.2% respectively.

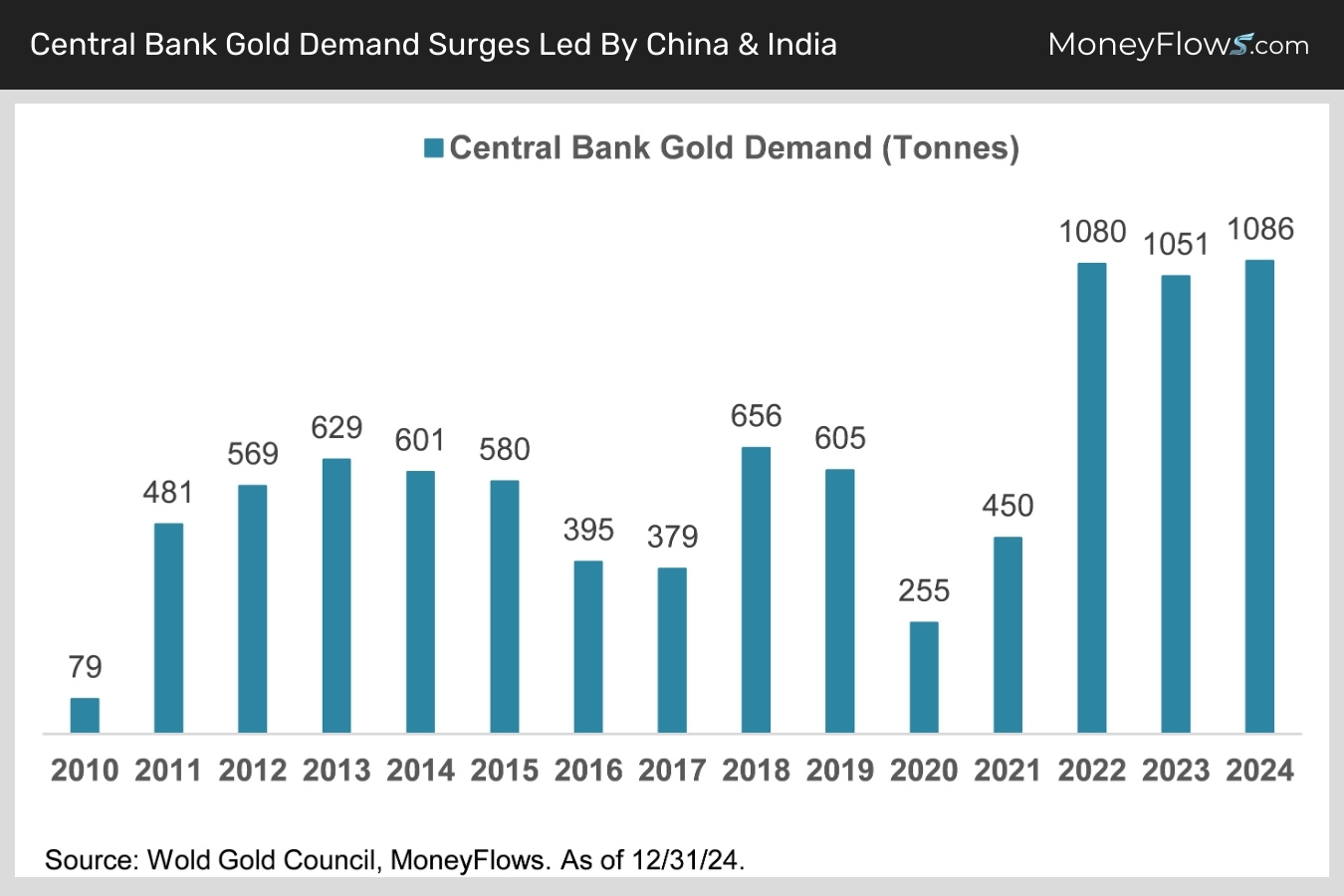

Number 7 – we reminded you to buy the dip in gold in late May.

We highlighted the diversification benefits of precious metals and the demand from central banks as reasons to buy the dip.

We highlighted State Street’s GLDM ETF as a way to play this theme. That fund has gained 31.3% since this post.

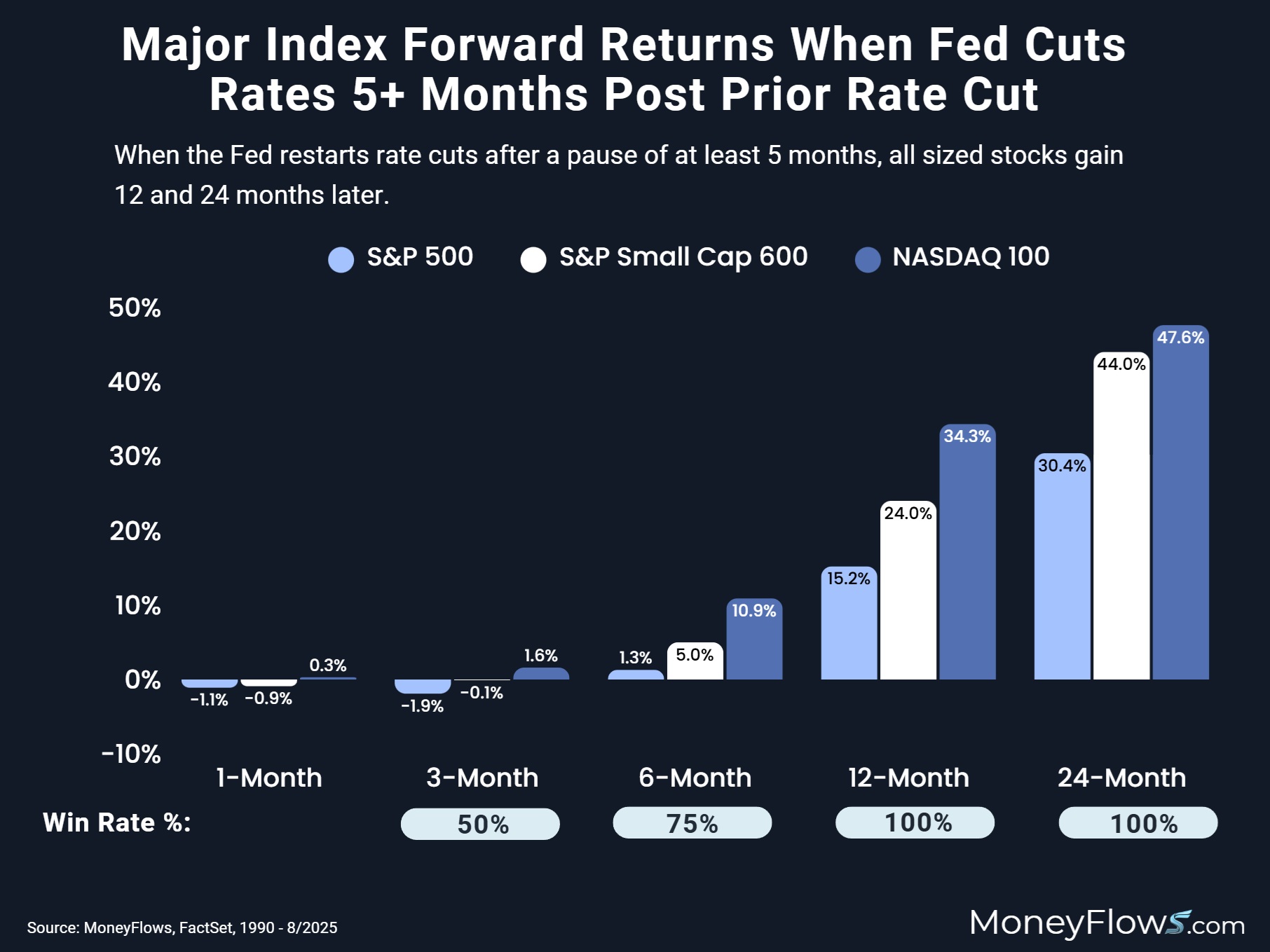

Number 8 – in August we made the non-consensus call that Small-caps will make all-time highs.

Not only were our flows signaling massive institutional appetite for smaller companies, but we also noted how a restart in rate cuts has been a tailwind for stocks.

4 months have passed since this post.

Stocks have done well across the board with the NASDAQ 100 jumping 7.7%, the S&P 500 climbing 6.5%, and small-caps bumping 3.6%.

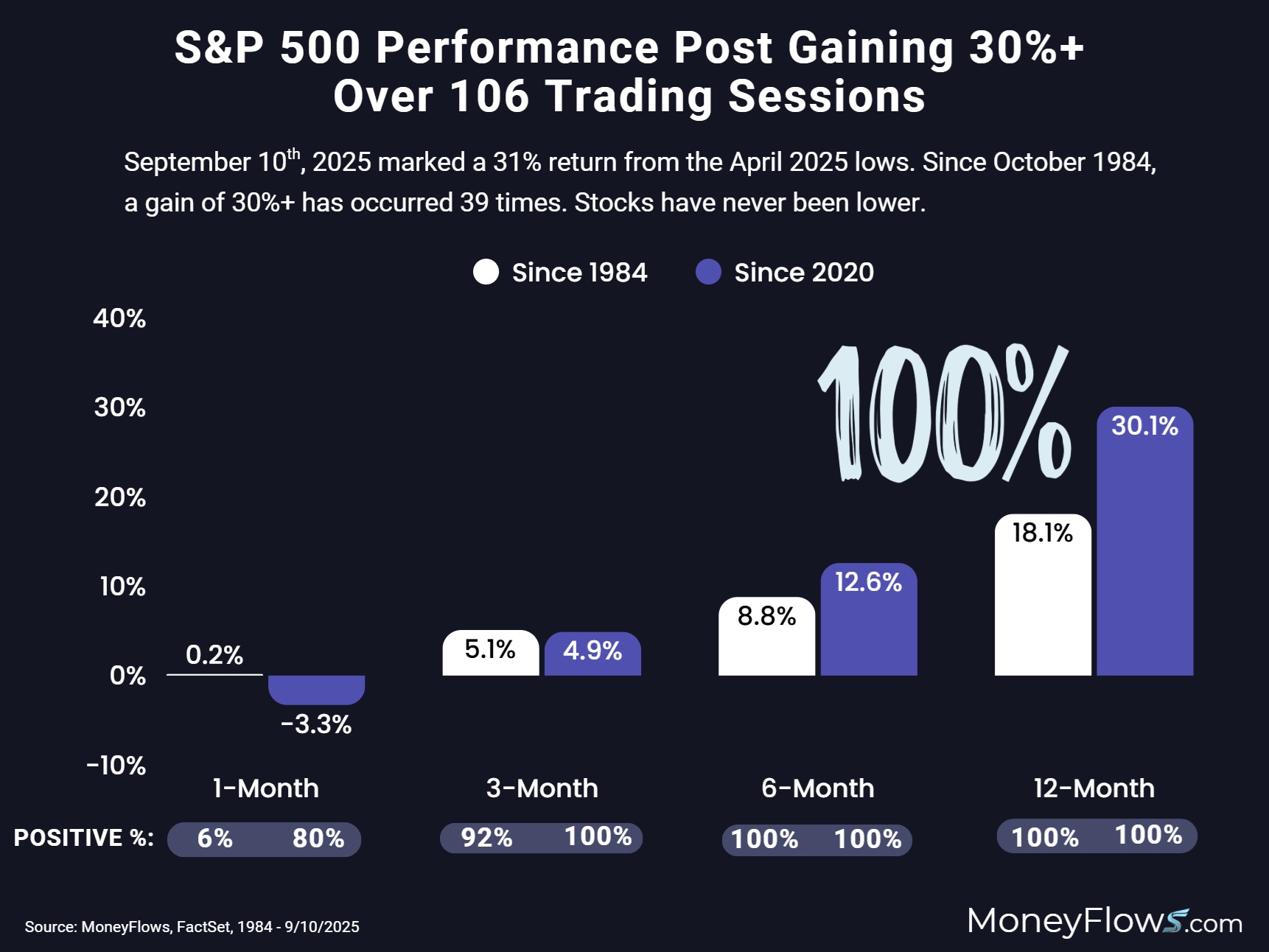

Number 9 – in September we outlined an undefeated buy signal for equities.

While talking heads touted reasons to take profits given the steep rally, we tested that theory and found the exact opposite to be true.

The S&P 500 soared 31% in 106 trading sessions. Historically, that level of thrust signaled more gains:

Since this post, the S&P 500 has jumped 5.1%.

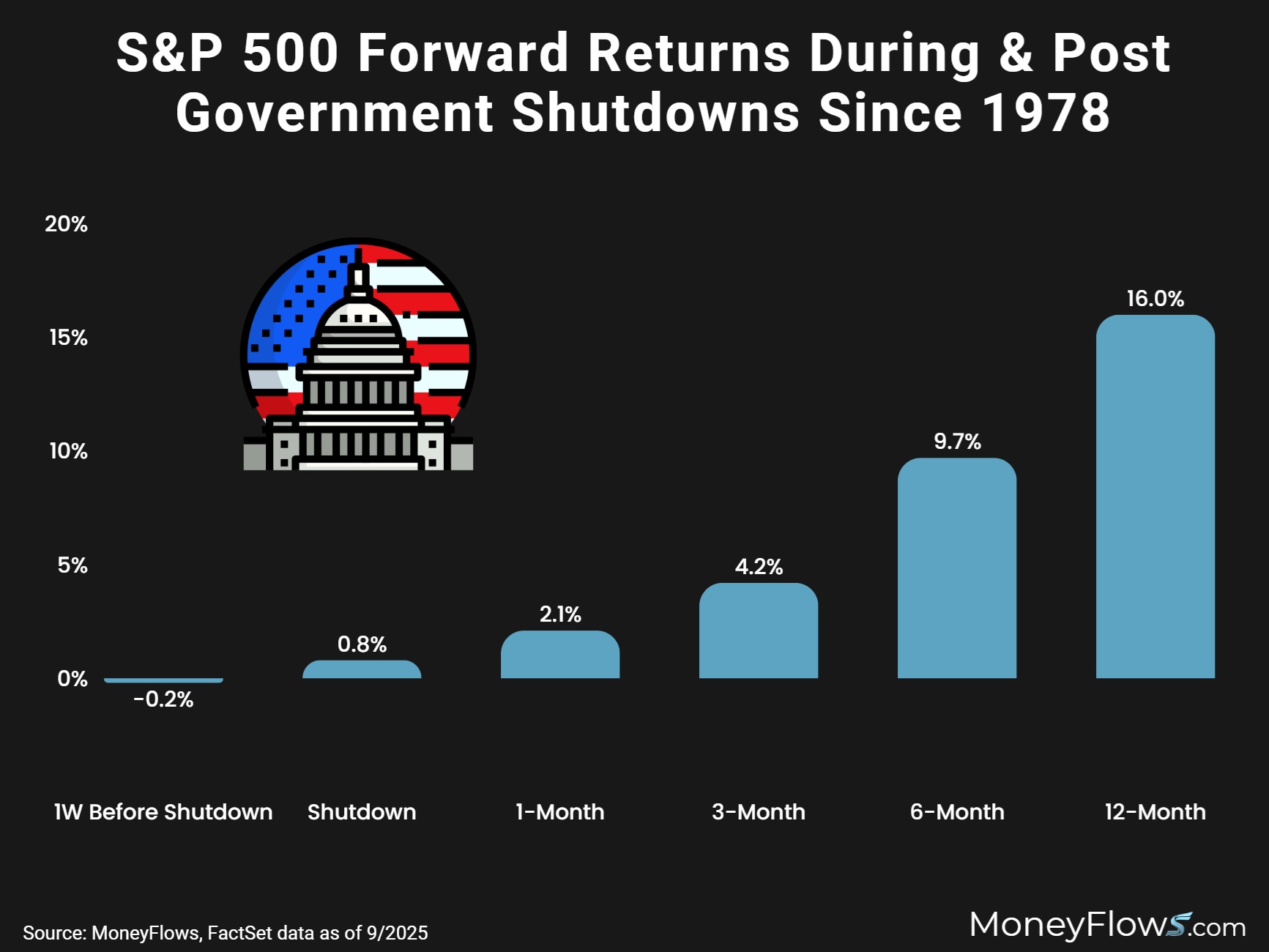

Number 10 – we told you that a government shutdown is a reason to buy stocks.

It was easy to get fearful during the long government shutdown in 2025. The financial media debated non-stop on the risks of a shutdown.

We studied history and found reasons to remain invested.

Since the government shutdown on October 1, 2025 the S&P 500 has climbed 3.1%.

And that’s a wrap!

What’s the main takeaway as we head into 2026?

Simple.

Ask the questions few are asking.

Study data…follow the flow of money for clues.

There will be winning themes and stocks this year…you’ll just need a map to help you spot them.

Can you outperform without MoneyFlows research? Maybe.

But I can’t recommend it.

Happy New Year everyone!

If you are a serious investor wanting cutting-edge research that will help you outperform, give our PRO membership a try. You’ll learn the stocks that are beaming with institutional support.

If you manage money or are an RIA, our Advisor Solution offers portfolio and ETF insights unlike any other offering out there.

Lastly, check out our latest video discussing our 2026 Market Outlook with Chief Investment Strategist, Alec Young.