Midterm Election Year Strategy for 2026

As investors approach 2026, they need a game plan for a historically volatile scenario.

The election cycle has predictable trends that we all need to heed.

Here is the midterm election year strategy for 2026.

Our portfolios have benefited from Mega-cap dominance in the last few years. At last measure, the top 10 stocks in the S&P 500 now account for 40% of the pie.

But could this dominance take a back seat in 2026? I believe it is possible.

Now, I’m not calling for a bear market. I’m simply suggesting we should be open to a change in leadership as we head into 2026.

This stance revolves around the weakness that typically comes in midterm election years.

What’s unique about today’s market is we are in a rate-cutting cycle. And if President Trump announces a dovish Fed chair, rates can spiral fast.

This should boost value-oriented areas rich in dividend income.

Recently those quiet sectors have gotten a boost of life…and I believe they can generate a lot of alpha next year.

Midterm Election Year Strategy for 2026

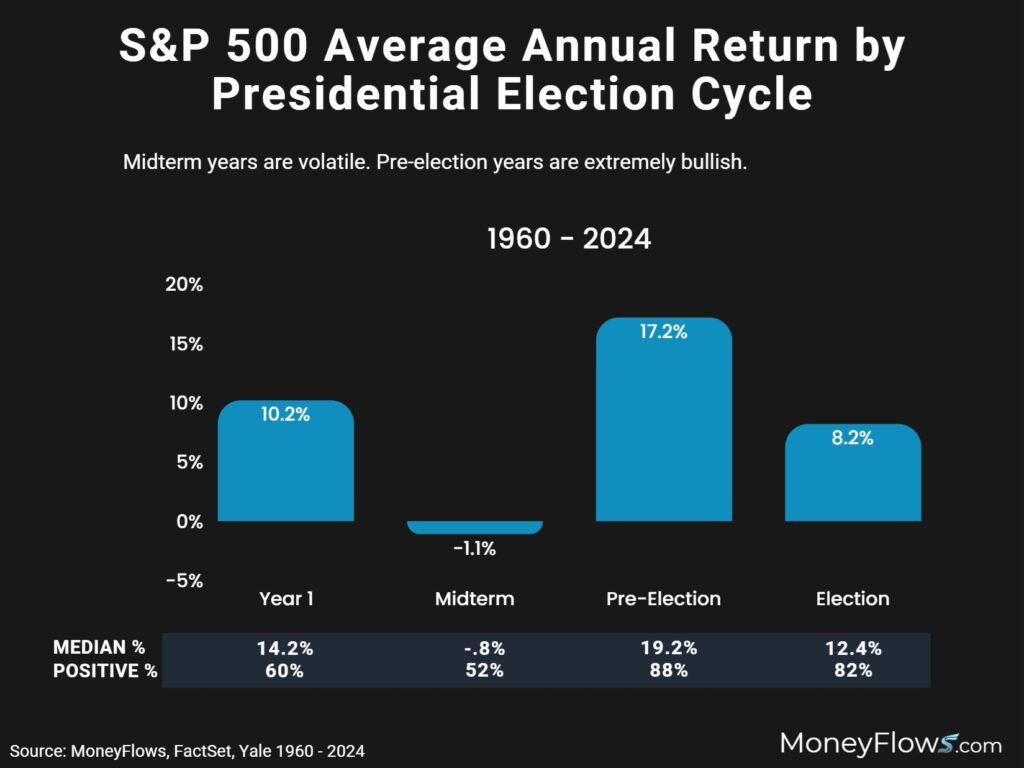

We all have learned that markets return about 10% each year spanning decades.

What you may not realize is that midterm years drastically underperform the average. Those who were around for 2022 saw this firsthand when the S&P 500 fell 19% due to runaway inflation.

And before that, 2018 was a tough year as stocks shed 6%.

Turns out this weakness has been around for decades.

Since 1960, midterm election years have returned an average -1.1% for the S&P 500:

I should also point out that pre-election years (2027) tend to be violently positive with average returns of 17.2%. So be careful zipping up the bear suit too tight.

Expect a higher level of choppiness.

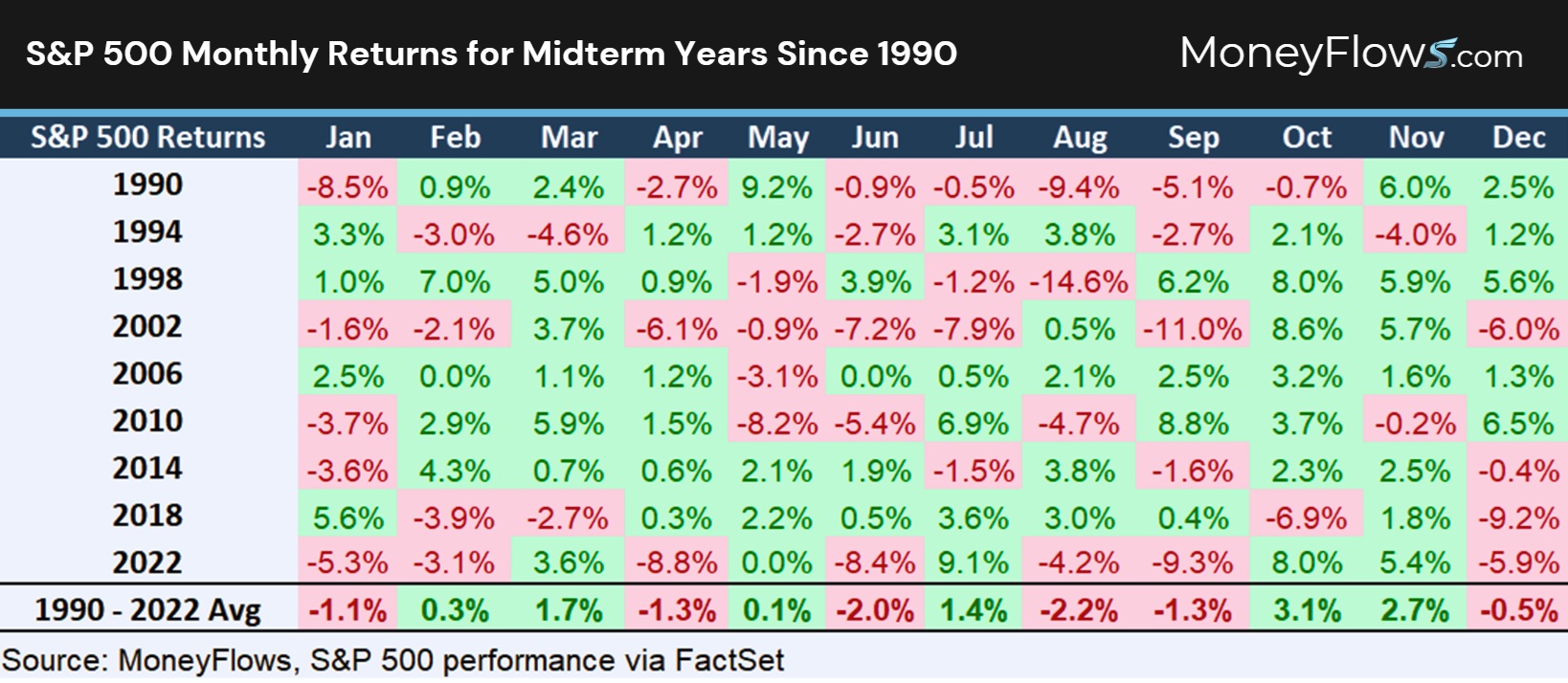

If we look at monthly returns for midterm years more recently since 1990, you’ll find overall ho hum returns January through September, then a boost in early Q4:

We actually dove into these historical tendencies back in mid-2022. You can revisit our message then.

The main takeaway then was how stocks usually struggle heading into September before a big ramp typically in October.

As next year unfolds, expect me to revisit this playbook.

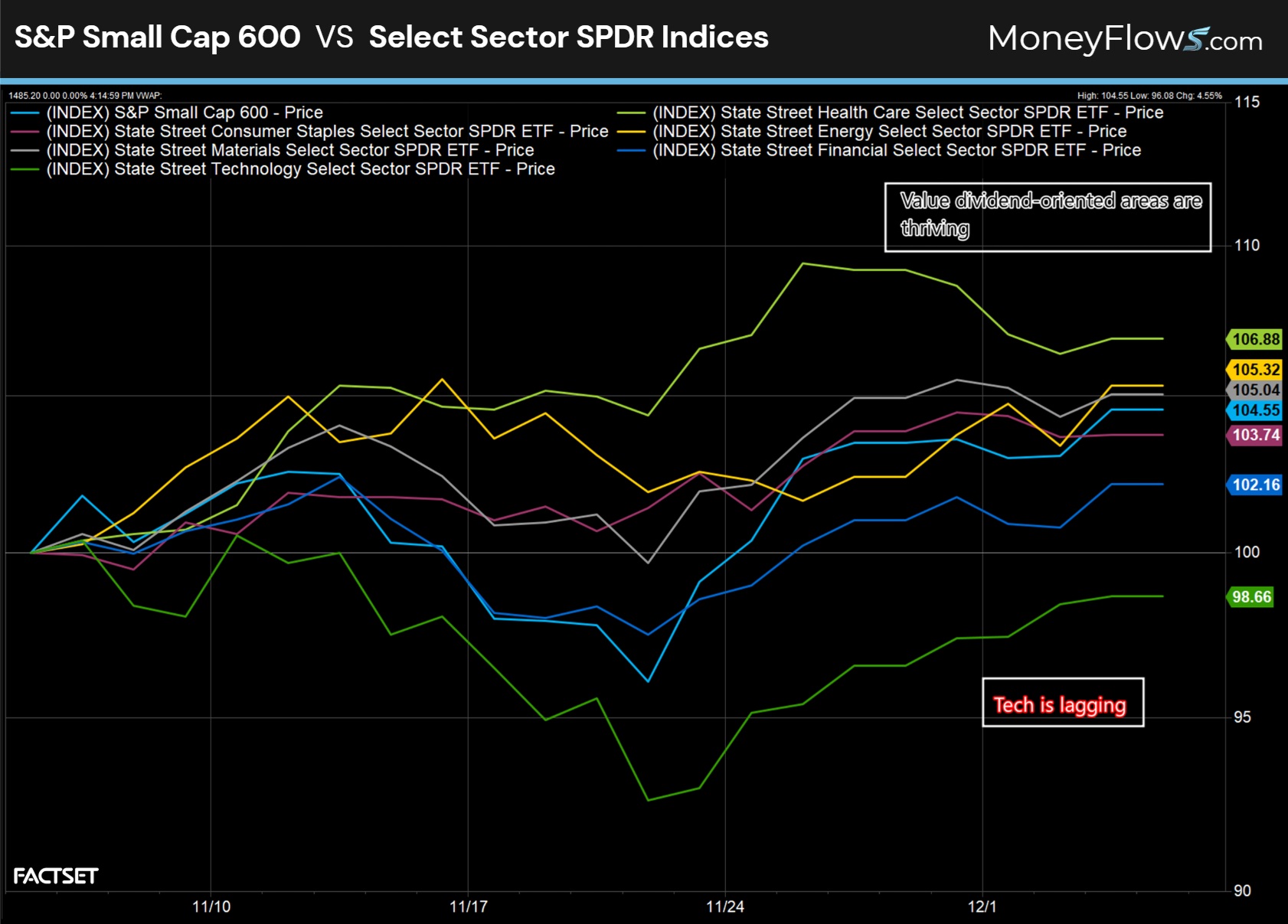

And as I stated earlier, be open to a change in leadership. We could be staring at a sidelined Tech sector while value-oriented areas surge due to falling interest rates.

As of this morning, estimates point to a lowly 3% Fed Funds rate by next summer.

I believe this is partly why value plays have been surging recently…to get ahead of this macro shift.

Here I illustrate the broadening that’s taking shape in markets the last month. Small-caps as defined by the S&P Small Cap 600 has gained 4.55%.

Health Care stocks (XLV ETF) have surged 6.88%. Energy stocks (XLE ETF) have gained 5.32%.

Materials (XLB ETF), Staples (XLP ETF), and Financials (XLF) have all held up well.

The one lagging area has been Technology stocks with the XLK ETF down 1.3% over the same period:

Of course it’s too early to know if these trends will continue, but our data clearly shows risk-on appetite in value tilted groups.

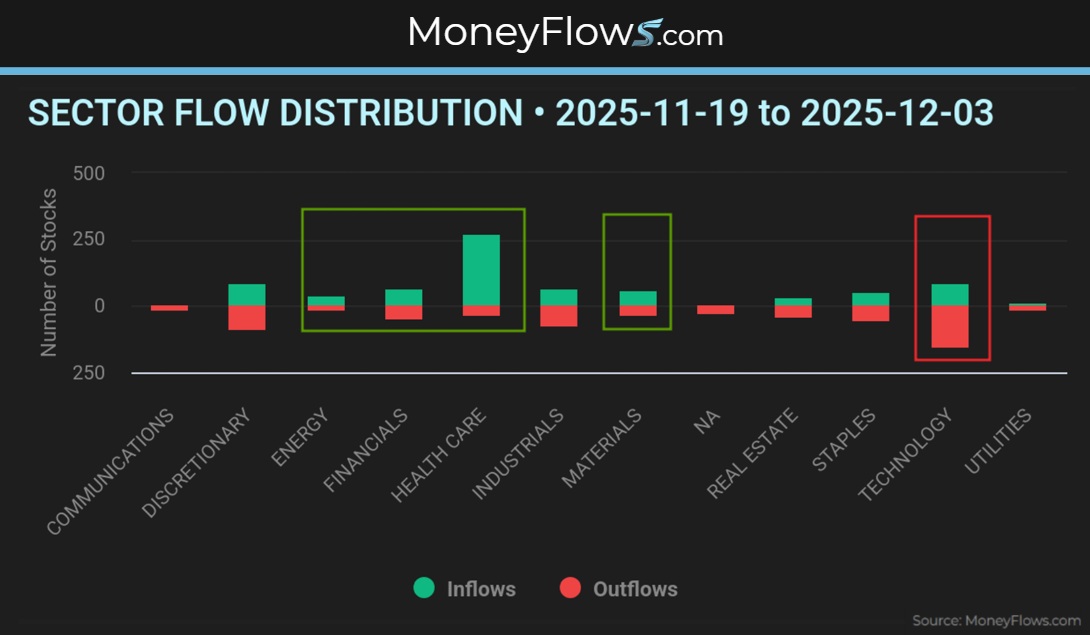

Here is a snapshot of sector flows the last 2 weeks. We can see healthy action in Energy, Financials, Health Care and Materials.

Technology has attracted net outflows:

Obviously there will be tech winners and losers in 2026. What’s possible is sideways action in the group while prior benchwarmers gain ground.

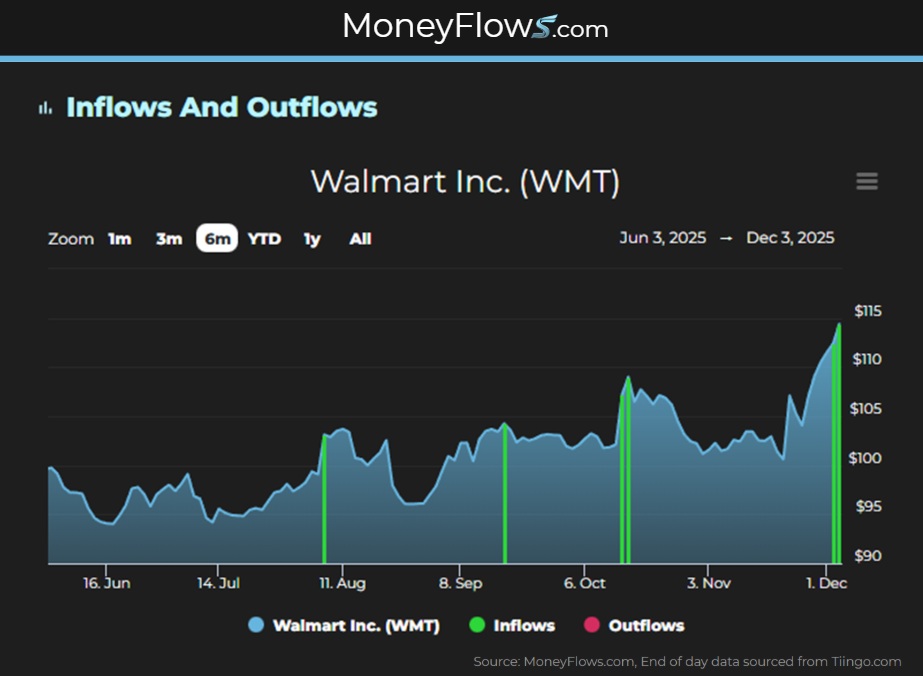

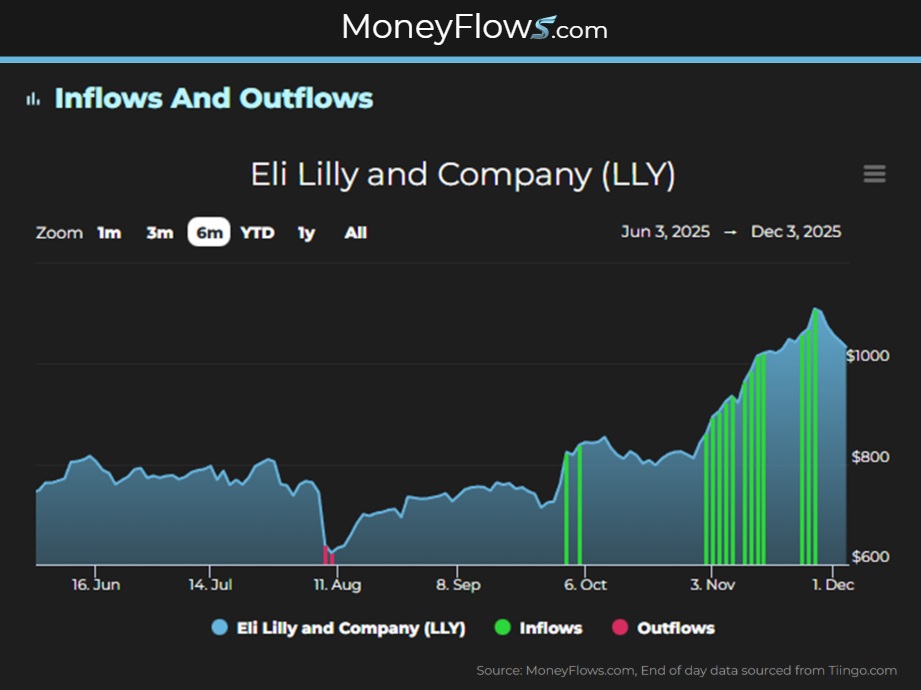

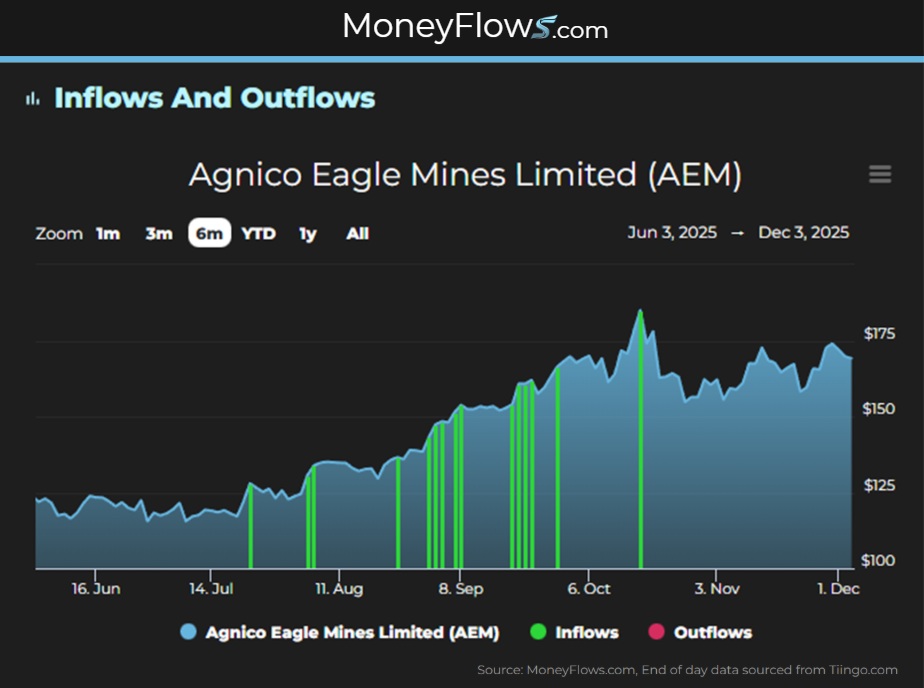

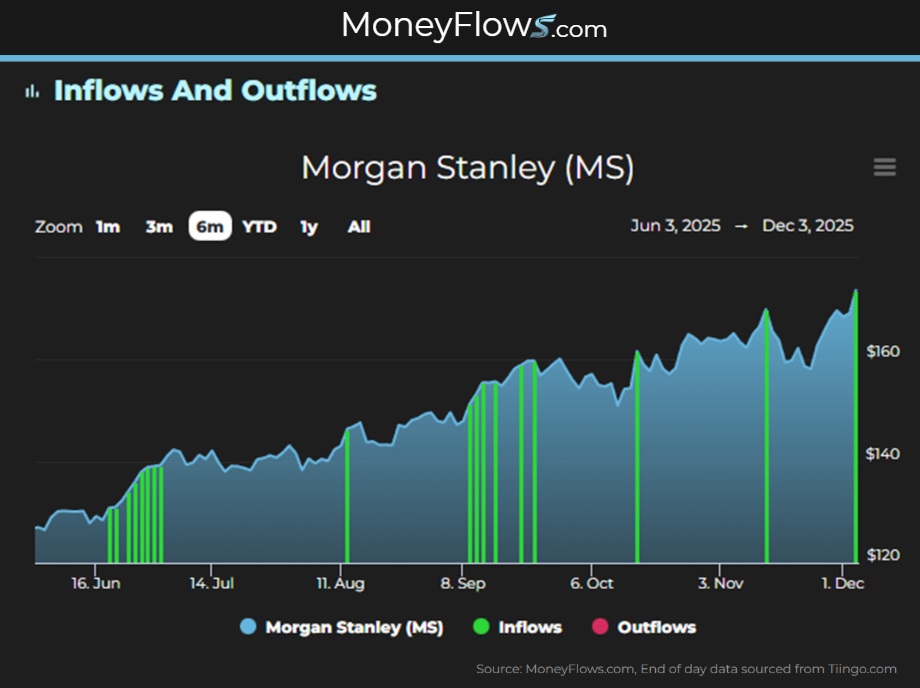

Money is put to work constantly in Staples giant Walmart (WMT), pharma giant Eli Lilly (LLY), gold miner Agnico Eagle Mines (AEM), and bank powerhouse Morgan Stanley (MS):

This is why tracking money flows is so powerful. You can get up to speed on tomorrow’s biggest trends, early.

And with 2026 being a midterm year, prepare for new leadership. Be on the lookout for rotations.

We will find the outliers…and bring them to you each and every week.

That’s a game plan!

For one more day, new PRO (Annual) subscribers can join for 30% off the regular price!

Just use CYBER30 at checkout.

Go into 2026 with confidence and market-beating insights you can’t find anywhere else.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.