Lower Rates & Oil Prices will Keep the Bull Market on Track

After an epic 40% run, off its April lows, the S&P 500 has finally succumbed to profit taking.

We’ve covered many positives up to now: Fed easing, accelerating earnings growth, fiscal stimulus, deregulation, ramping productivity and increasing M&A.

But new ones are emerging. Lower rates & oil prices will keep the bull market on track.

Tune out the doom-loop.

Pull backs are normal and healthy. They extend bull markets by resetting investor expectations.

Today, we’ll give you two new reasons to stay constructive on equities.

We’ll highlight our favorite factor for this market and the best sectors to buy on dips.

As a bonus, we’ll give you a diversified list of winning outlier stocks under big institutional buy pressure.

Lower Rates & Oil Prices will Keep the Bull Market on Track

There’s a powerful macro cocktail forming.

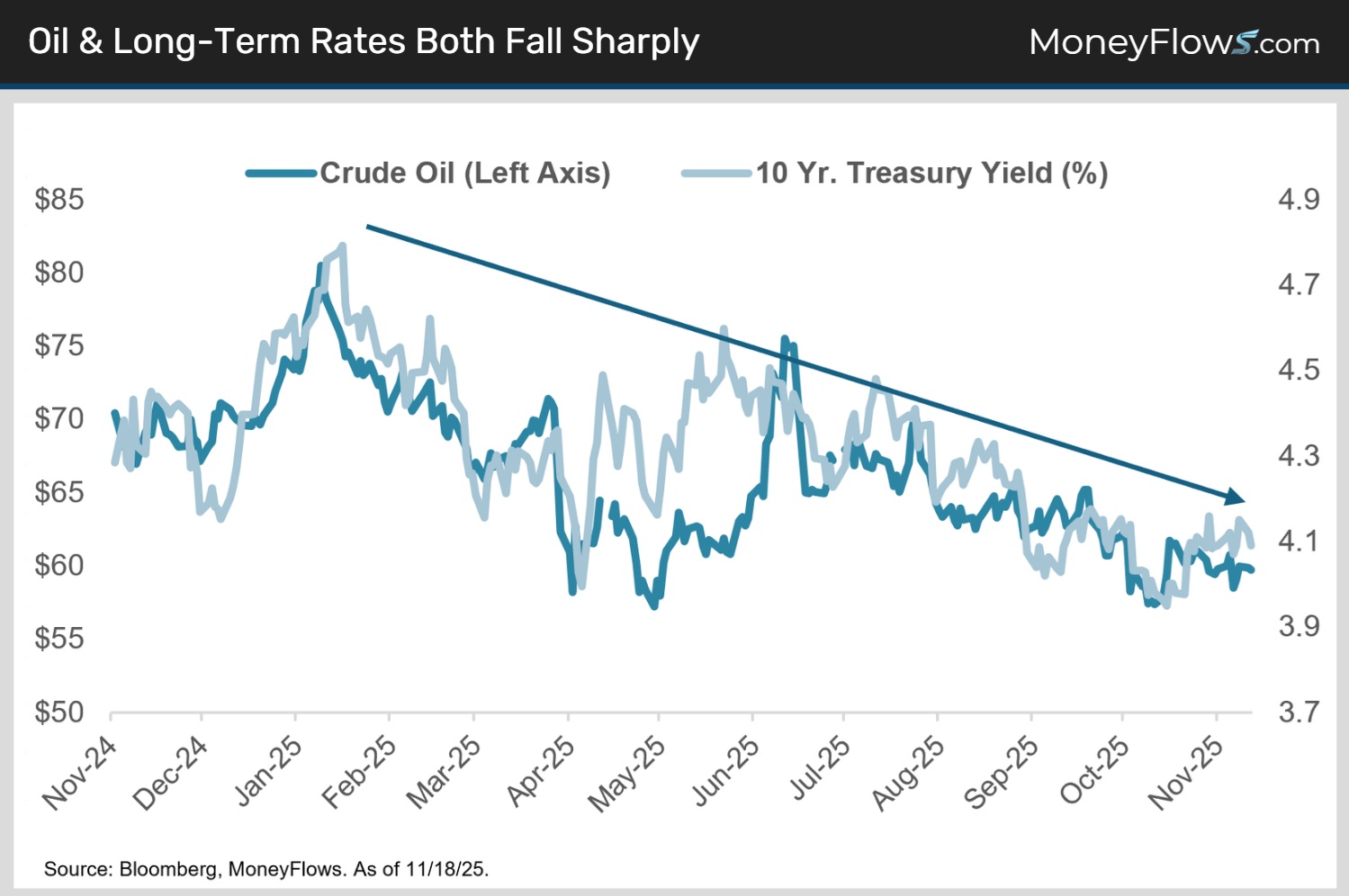

Simultaneous deep declines in crude oil and long-term rates are plunging.

Together, they will help consumers and businesses. And historically this combo has boosted subsequent stock returns.

Long-term interest rates are down 15% since January while WTI crude oil has fallen 25% over the same timeframe:

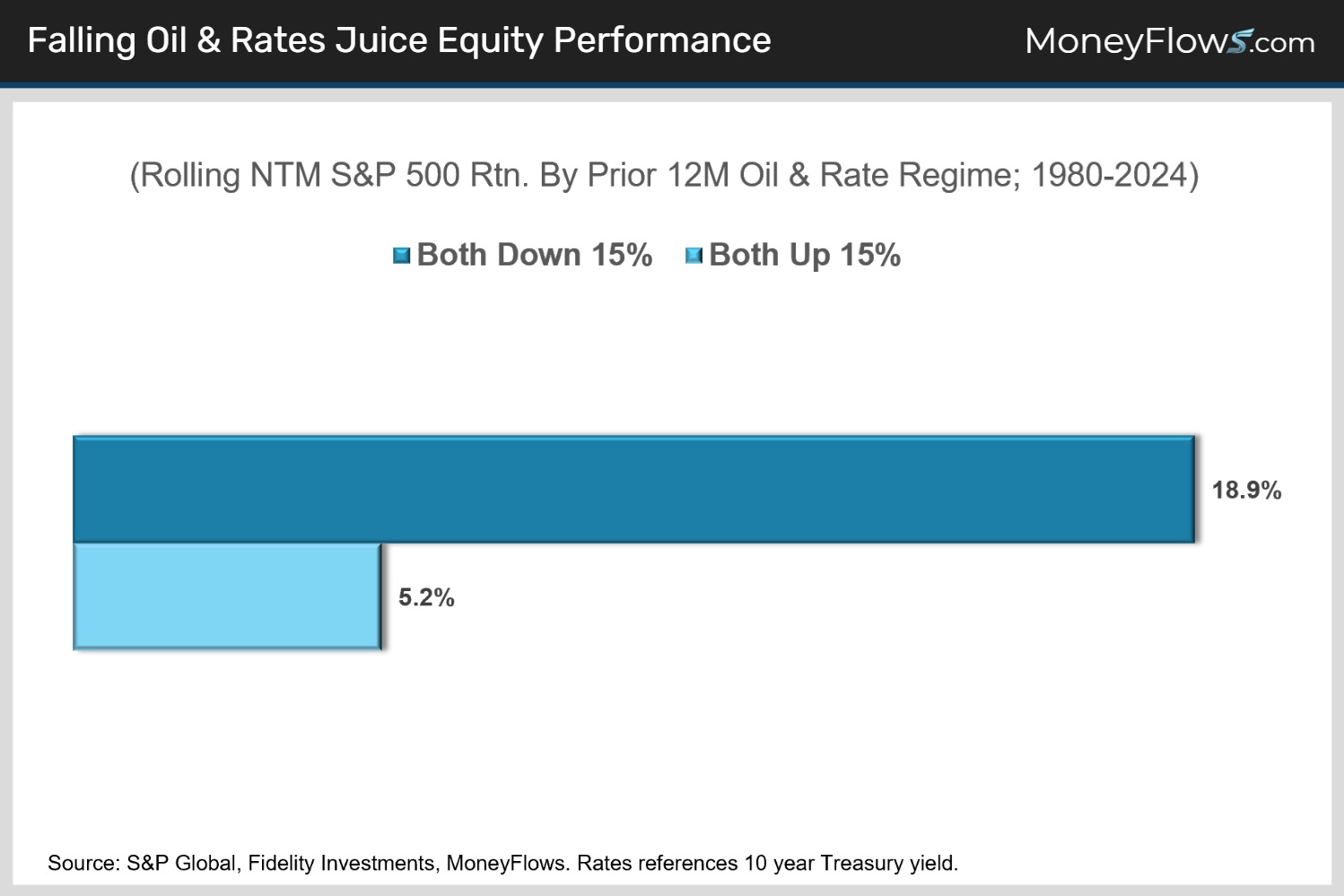

This is highly stimulative for stocks.

Since 1980, when both 10-year yields and oil prices fell 15% or more in the prior year, the S&P 500 returned an average of 18.9% over the next 12 months.

That’s triple the return when both oil and rates gain 15%+:

Lower rates improve financing costs and amp capital investment. Lower oil eases pressure at the pump.

It’s no wonder this tends to precede market upside.

Now let’s dive into where to lean long.

What This Means for Your Portfolio

On October 27, we told you High Quality Stocks are the Big Opportunity Right Now.

Sure enough, a huge quality rotation started in early November as overheated, speculative quantum, nuclear, fintech, crypto and marginal AI trades have all rightly collapsed.

Meanwhile, AI adjacent blue chips across the tech, industrials and utilities sectors have seen healthy profit taking, while “best of breed” names in long neglected counter-cyclical sectors like health care and staples are finally catching a bid.

Stick with quality - it’s key when volatility rises.

Digging deeper, even though defensives outperform during drawdowns, we favor buying blue chip cyclical stocks on weakness – it’s far more profitable over the long run.

That doesn’t mean ignoring high quality defensive stocks like Eli Lilly (LLY) - winning portfolios should always be sector diversified - defensives offer crucial ballast when volatility spikes.

But dips in tech, financials, discretionary, industrials, biotech, medical devices and materials offer the most upside into 2026.

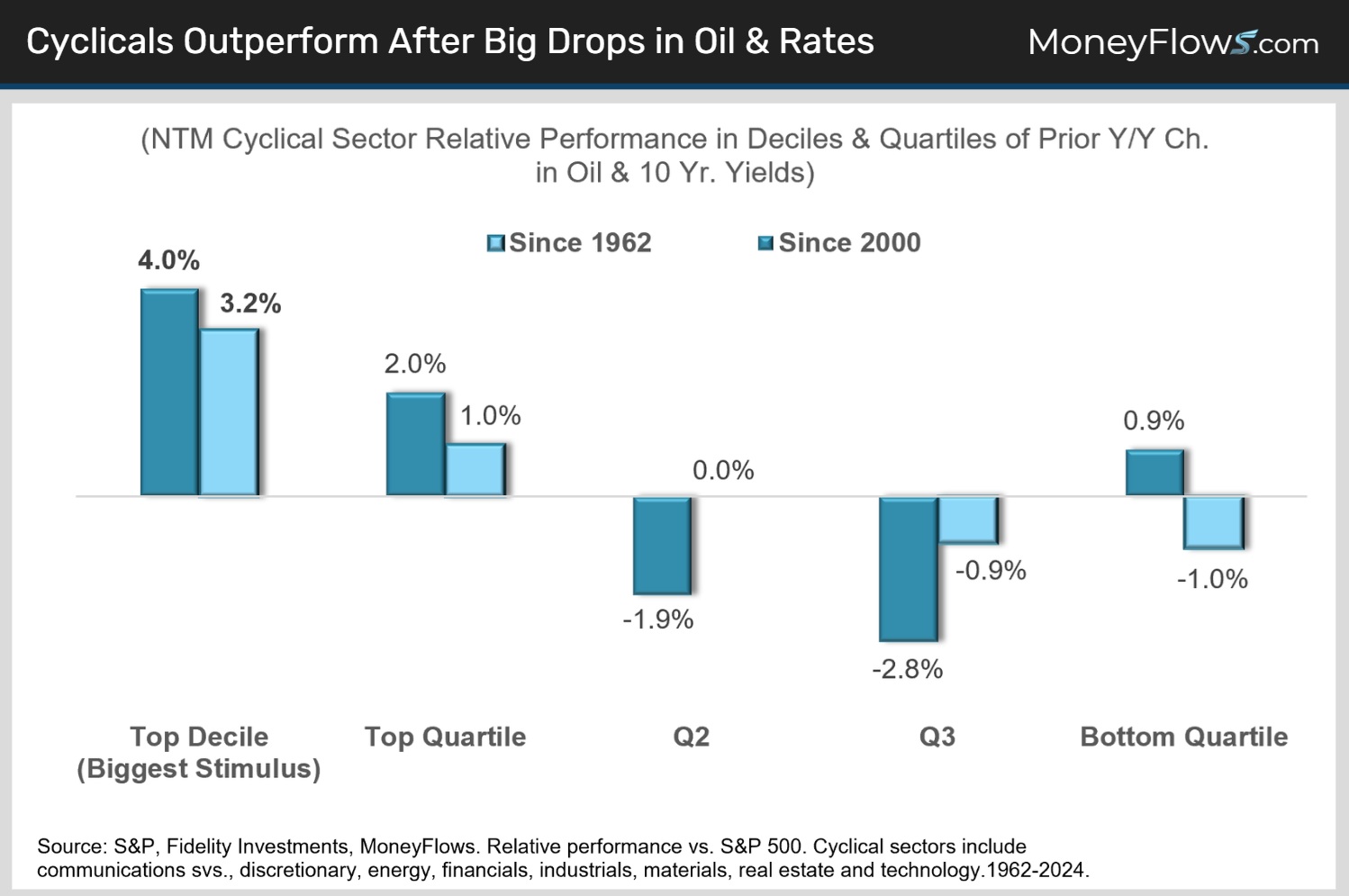

Here’s why: Cyclicals are more economically sensitive and thus have benefited most when interest rates and oil prices have fallen historically.

The combined percentage decline of Treasury yields and crude prices is in the top decile since 1962.

When these two key business and consumer input costs fell this far in the past, cyclical sectors have gone on to outperform the S&P 500 by huge margins over the next 12 months.

Specifically, cyclicals have beaten the S&P 500 by 4% and 3.2% each year since 2000 (recent) and 1962 (long-term), respectively:

Don’t invest based on today.

Focus on tomorrow.

Where most research houses got it wrong the last four months, MoneyFlows got it right.

Below is a list of the top 25 cyclical stocks ranked by their inflows and our proprietary MAP Score. It’s dominated by tech, industrials, biotech and discretionary names.

To get access and make even more from this call to action, sign up for a PRO membership.

If you’re a money manager or RIA, our Advisor Solution will unpack our unique data on your portfolios...keeping you winning into 2026.

Rarely does volatility strike.

When it does, be ready to act with an evidence-based strategy.

Given the heightened volatility lately, there’s no better time than now to become a PRO member.

For a limited time, new annual subscribers can join for 30% off the regular price!

Just use CYBER30 at checkout.

Go into 2026 with confidence and market-beating insights you can’t find anywhere else.

These selloffs create a valuable window that won’t last long.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.