Fed Rate Cuts Pack More Punch When Earnings Growth is Strong

Market volatility is up as increasingly skittish investors try to front run potential drawdowns.

This is normal and expected in bull markets.

We see this latest pullback as short-lived given 2 macro forces: Fed rate cuts pack more punch when earnings growth is strong.

Take the latest dip in stride and don’t let this choppy price action scare you. Short, sharp pullbacks are normal in the later stages of bull markets.

We saw the same thing back in 1998 and 1999 long before the bull market’s ultimate peak in March 2000.

Remember, juicy returns come later in up-trending markets as FOMO takes over!

Expect short term dips to keep being bought quickly as the crowd fears losing out more than losses.

And when you couple this with easing Fed policy and a solid earnings picture, the case to buy the dip is only strengthened…with evidence.

We’ll unpack the proof below.

As a bonus, we’ve got a diversified list of 25 top-ranked stocks attracting big money capital.

Earnings Growth is Trending Higher

Thanks to AI and the Mag 7, S&P 500 profit growth is strong despite bifurcated economic growth.

The labor market is softening due to companies’ increasing focus on labor efficiency. Meanwhile, the housing market and other rate-sensitive areas are also sluggish. They’re why the Fed is cutting rates.

However, the AI infrastructure boom and a resilient high-end consumer are bolstering overall economic momentum. The Atlanta Fed’s latest Q4 GDP Nowcast stands at a surprisingly resilient 4%.

Turning to trade, tariffs are a larger headwind in Q3 than they were during Q2. Customs duties in Q3 totaled $93 billion, a 33% increase relative to Q2.

Nevertheless, S&P 500 net profit margins stand at an impressive 12.8%, well above their 12.1% 5-year average, thanks to strong sales growth and management teams’ ability to navigate trade uncertainty.

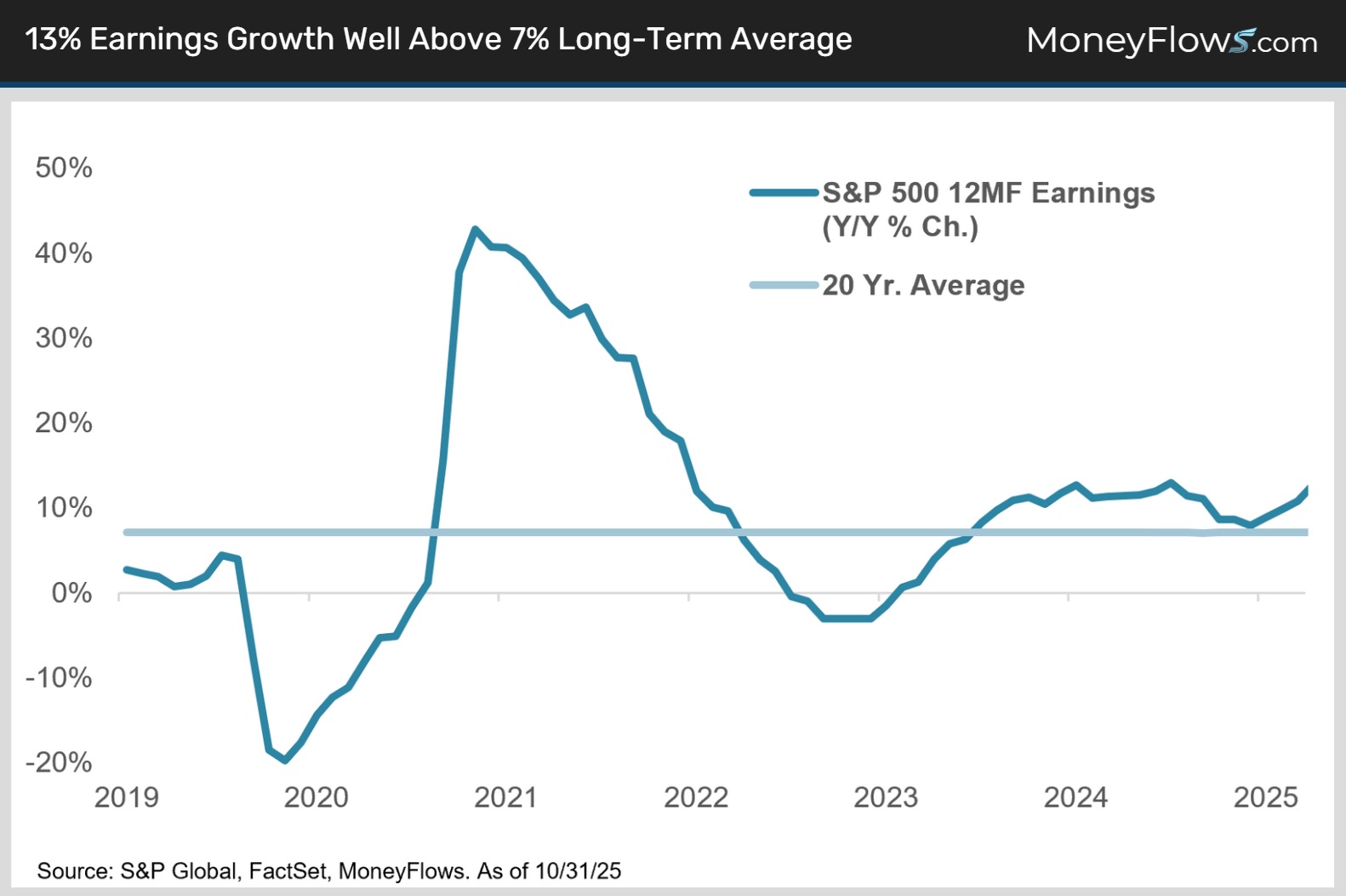

When you add it all up, 12-month forward S&P 500 earnings have been steadily revised up and now stand at $299.60, representing 12.8% Y/Y growth, well above their 7% long-term average (chart).

When earnings hold up, stocks perform well.

And there’s reason to believe analysts still aren’t constructive enough on the earnings outlook.

Wall Street Analysts Typically Underestimate Earnings Growth

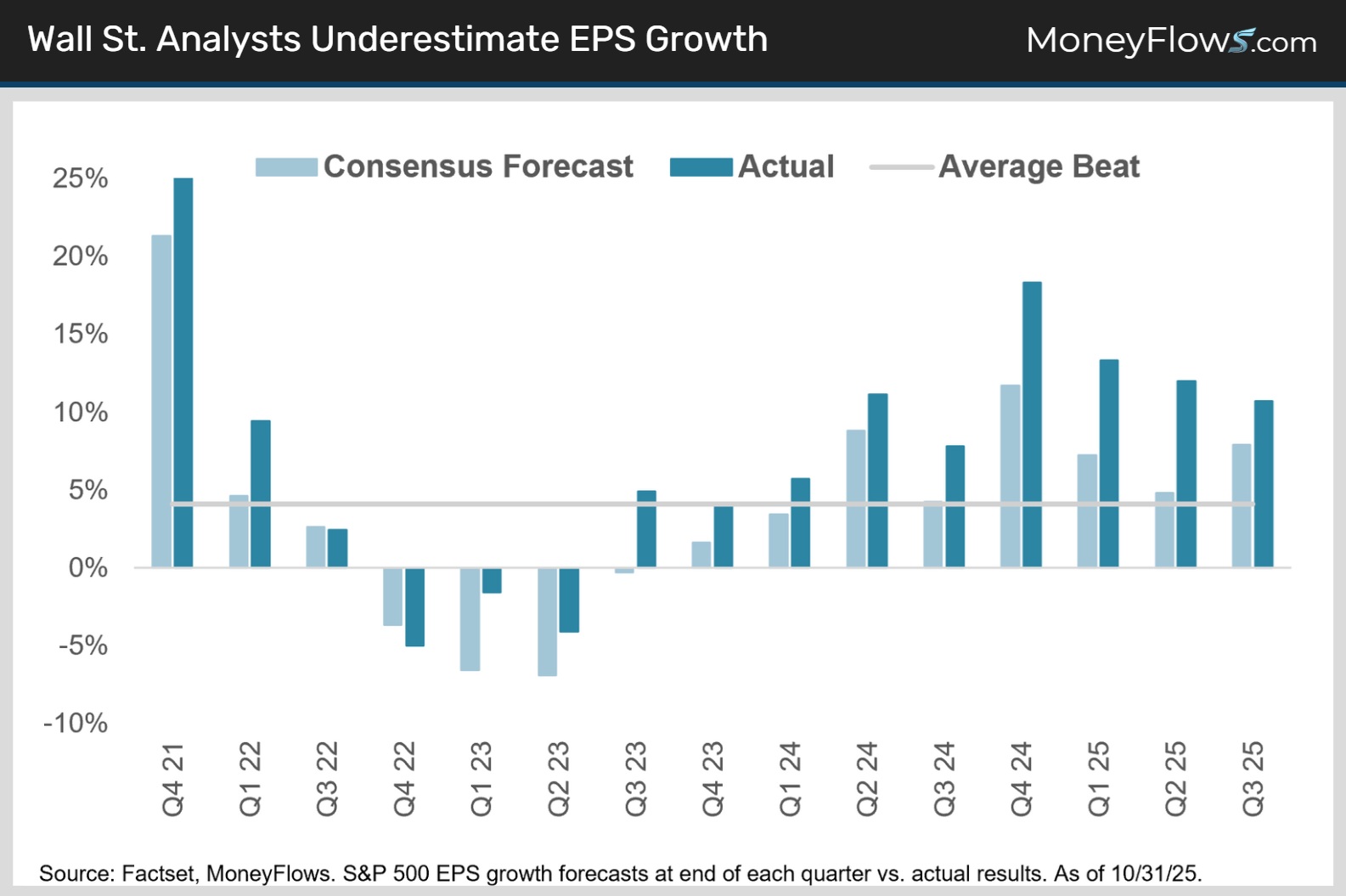

At the start of the Q3 earnings season, Wall Street analysts forecasted consensus Q3 S&P 500 EPS growth of 7.9% on revenue growth of 6%, per FactSet.

With 64% of S&P 500 constituents reporting through October 31, actual EPS growth is 10.7%, on 7.9% sales growth.

Big earnings upside is nothing new.

74% of S&P 500 companies have beaten Street estimates over the past decade with 64% beating revenue forecasts, according to FactSet.

More recently, the quarterly beat rate has averaged 4.1% since Q4 2021 (chart).

AI is fueling the booming earnings picture.

Couple this with easier Fed policy, and you’ve got a cocktail to supercharge markets.

Fed Rate Cuts Pack More Punch When Earnings Growth is Strong

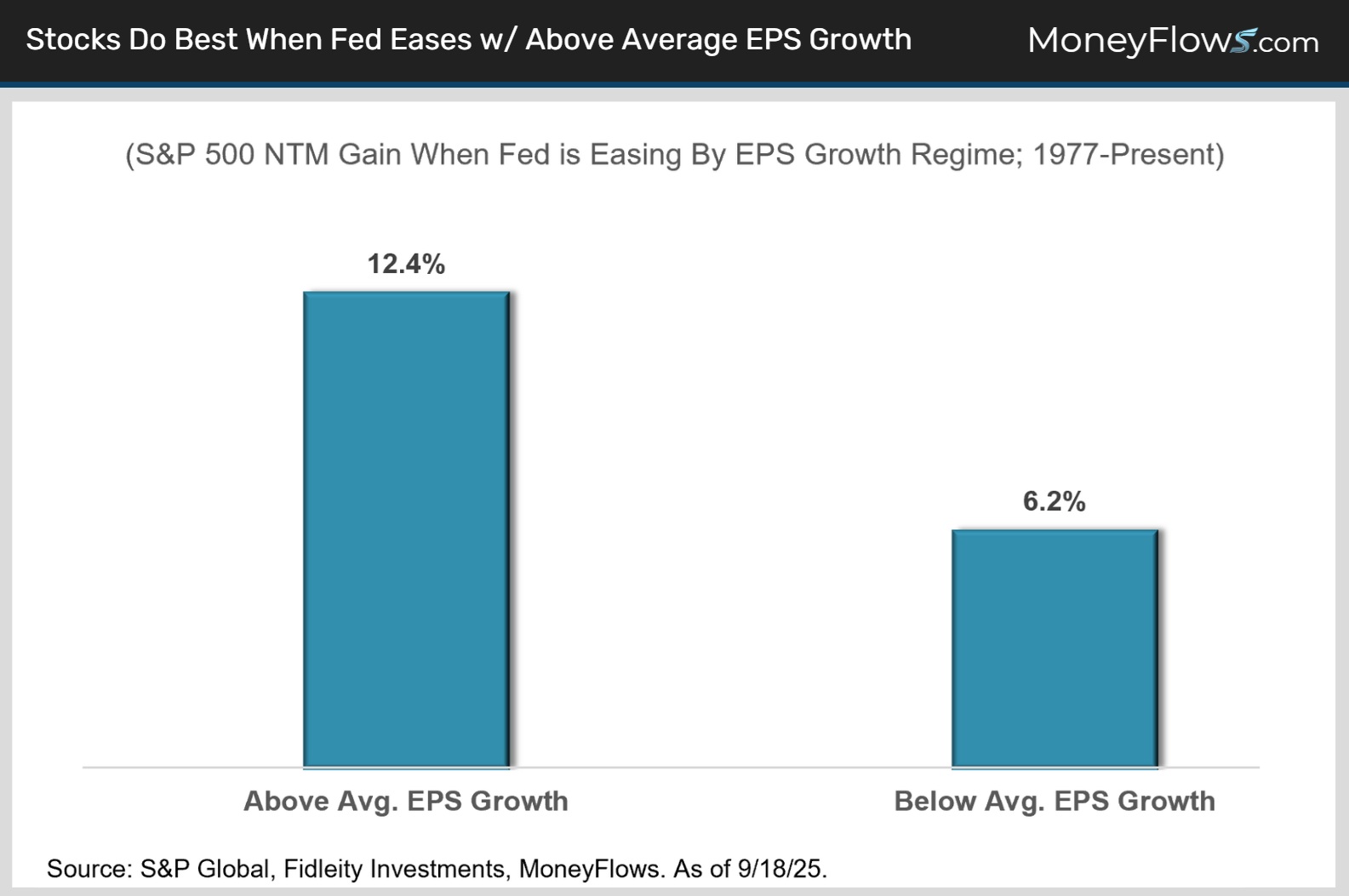

The Fed has cut rates twice since September, bringing the Fed funds rate down to 3.875%.

Markets see the Fed cutting rates another 75 to 100 basis points by the end of 2026.

It’s rare for the Fed to be cutting rates when earnings growth is this strong.

Here’s the signal:

Since 1977, when the Fed is easing and earnings growth is above average, the S&P 500 gains an average 12.4% per year vs. only half as much during rate cutting cycles with below average profit growth:

But this doesn’t mean all stocks are poised to climb under this favorable scenario.

Stock Dispersion is Near All-Time Highs

We’ve made a bull case for equities based on the winning combination of Fed easing and strong earnings momentum. Now let’s tackle the importance of choosing the right stocks.

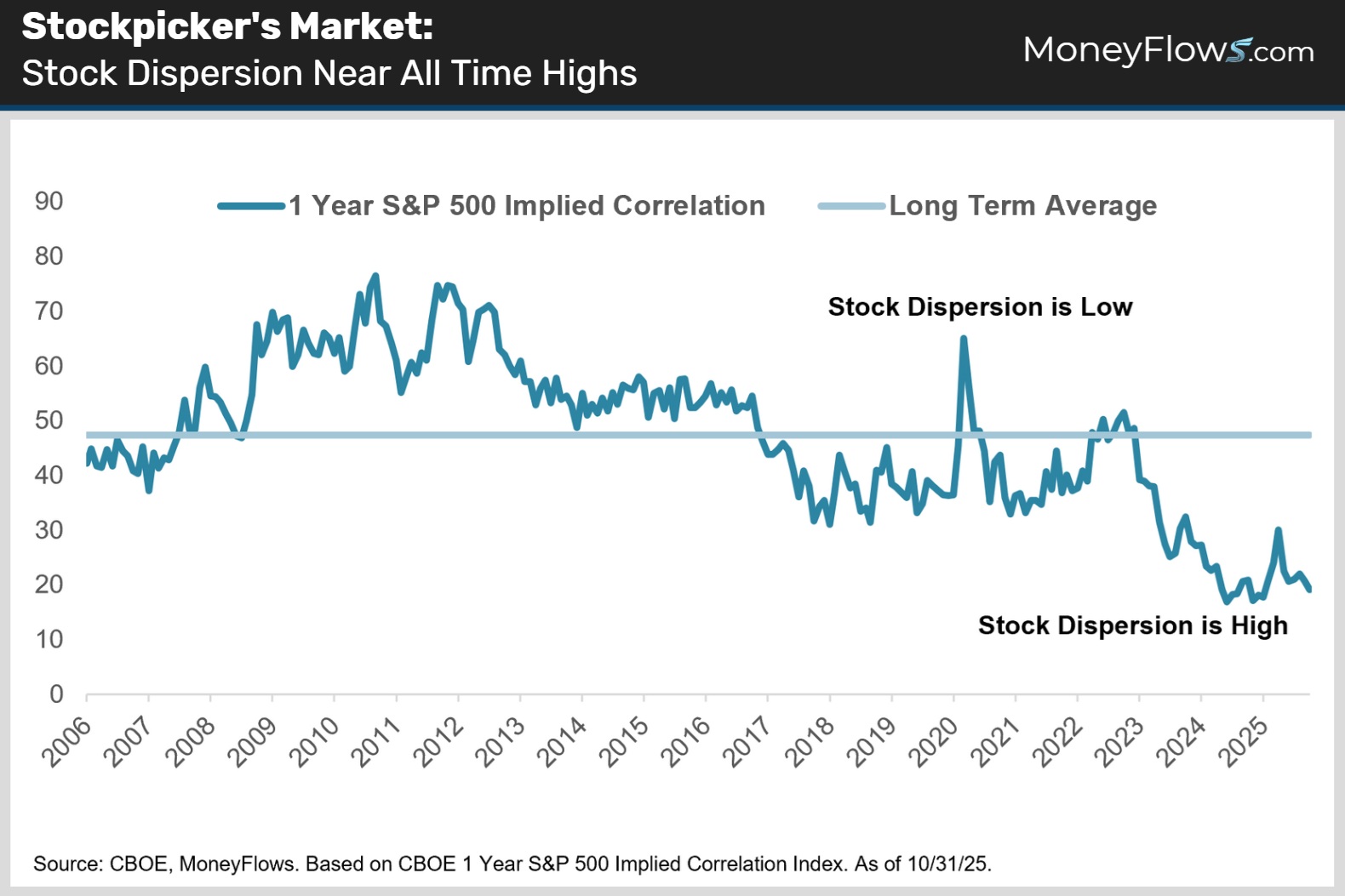

Here’s a fact. The market’s rising tide isn’t lifting all boats equally. Only 51% of S&P 500 companies are trading north of their 200-day moving averages.

This is a real stock picker’s market.

And to prove this, check this out.

Stock dispersion, which measures the spread between winners and losers has rarely been wider. Winners have soared. Losers have tanked:

OK but how do you separate the big outliers from everyone else?

Simple, just follow the flows!

MoneyFlows is built to find big winners early.

Having a bullish macro backdrop is one piece of the puzzle. Aligning your portfolio with high-quality stocks loved by big money players is the other.

We screened our equity coverage universe, across all cap sizes and sectors, to find the 25 stocks seeing the strongest big money inflows.

Where most research houses got it wrong the last 6 months, MoneyFlows got it right.

Good things happen when you follow the data instead of the crowd!

As the Fed keeps easing and profits power ever higher, lean into winning stocks seeing the strongest institutional support.

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get our proprietary indicators and learn how our approach finds the best stocks in the market.

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here and our Emerging Advisor Program.

Below is a sector diversified list of the top 25 outliers as ranked by their big money inflows and our proprietary MAP Score.

This time, be early.

Our process helps investors “be early” to trends.

Go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.