Best Oversold Gold Stocks for November 2025

After a blistering start to the year, Gold has finally cooled.

On Tuesday October 21, 2025, the shiny metal fell 6.43%…its largest decline in over a decade.

Mining companies felt the brunt too.

Here are the best oversold gold stocks for November 2025 to buy the dip.

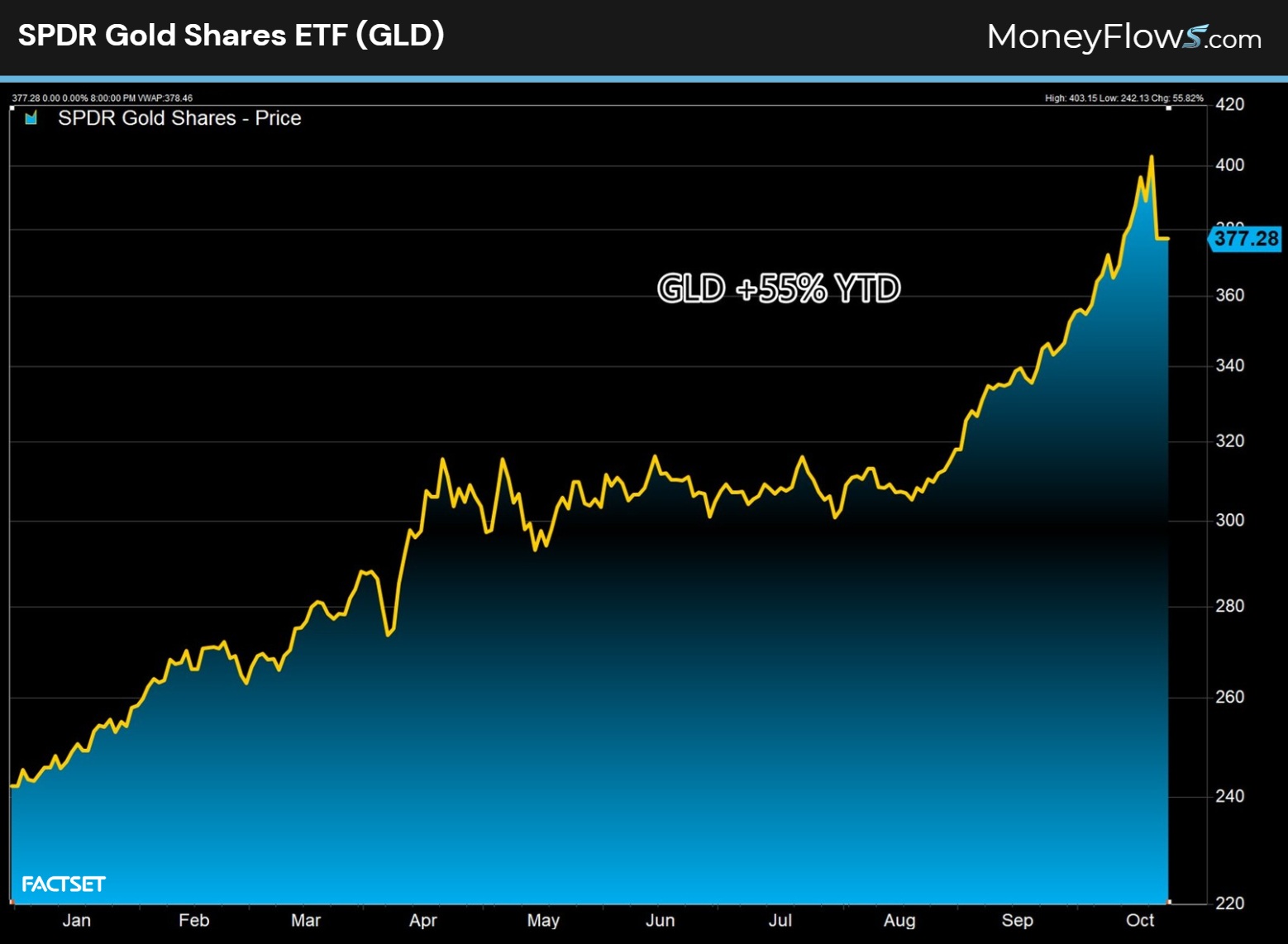

Perspective is key. Even after a sharp decline, the SPDR Gold Shares ETF (GLD) is still up a staggering 55.8% in 2025.

What’s behind the massive climb? Rising deficits, sticky inflation, and support from central banks are key contributors.

Back in May we highlighted why it’s a good idea to buy the dip in gold.

Today we’ll showcase 3 stocks levered to the precious metal.

Each of these have been beneficiaries of major institutional support.

In fact, one name in particular has been one of the most bought stocks for years.

Find these stocks early and they can supercharge your portfolio.

Best Oversold Gold Stocks for November 2025

Even after the huge decline earlier this week, gold prices are still up 6.1% for the month of October.

When you zoom out, you see a beautiful uptrend:

This macro backdrop allows mining stocks to capture more profits…ultimately lifting the shares higher and higher.

Best of breed gold companies easily outperform when the precious metal is rising steadily. And Big Money has been along for the ride for a long while.

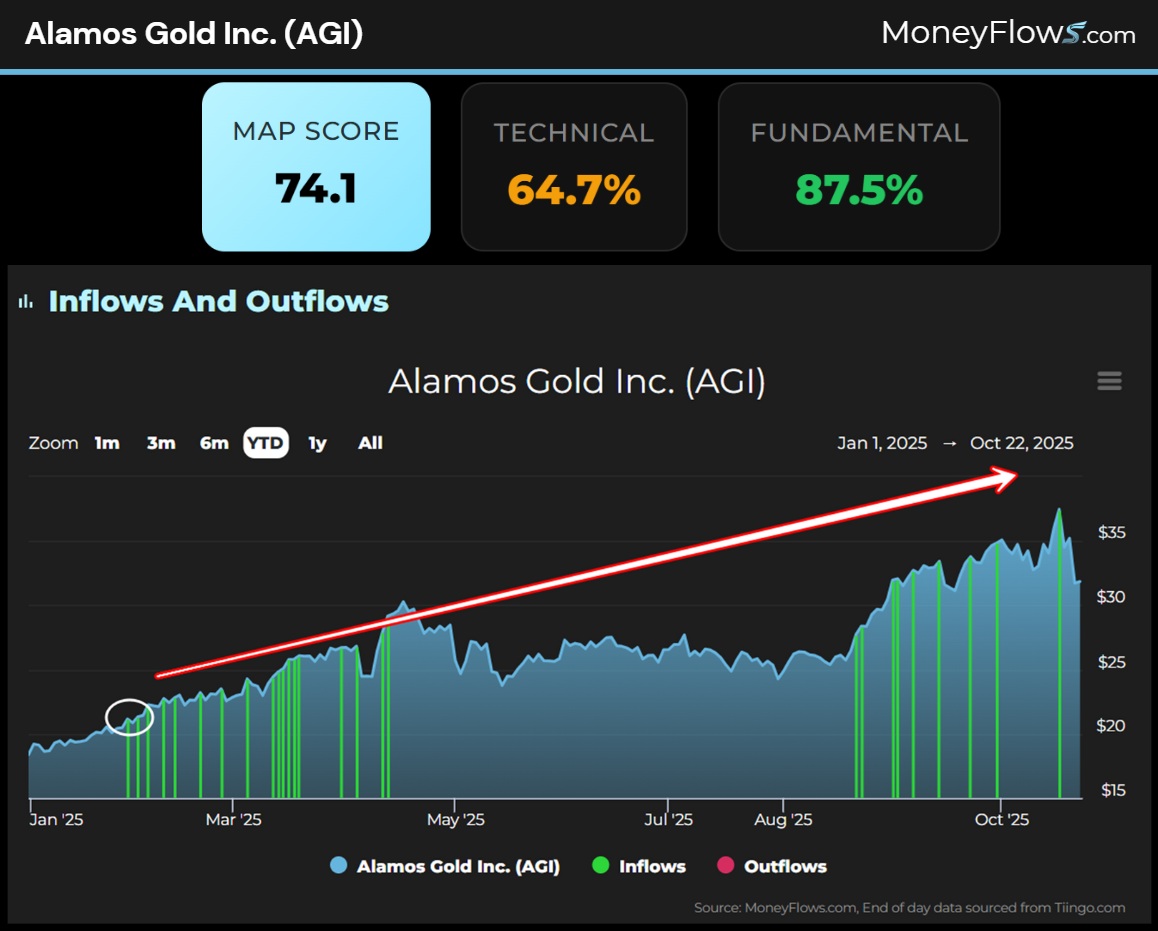

The first oversold gold stock is Alamos Gold (AGI). This gold producer saw sales of $1.34 billion in 2024 and is expected to soar to $1.9 billion in 2025.

Even better, net income climbed to $284 million last year and is projected to soar to $597 million in 2025.

With numbers like that, it should be no surprise that the stock has been heavily owned by investors.

Below showcases how nonstop inflows have been the story for AGI.

Alamos has easily outperformed this year with a 72.7% gain.

With an overall MAP Score of 74.1, this name easily ranks as a top gold miner:

Institutional investors are always hunting for the top earnings growers in the market.

Let’s unpack another gold name under pressure.

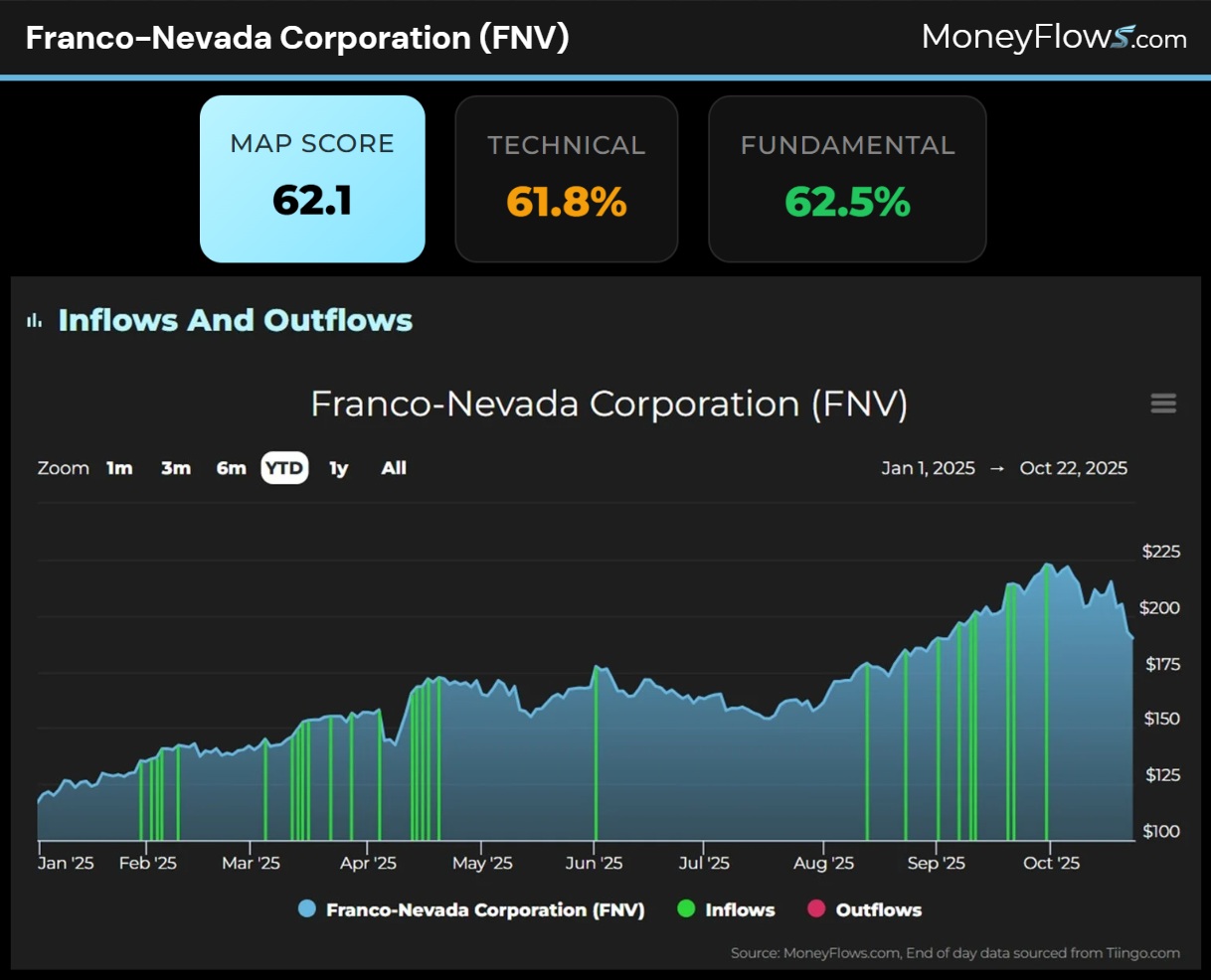

The second oversold gold stock to consider is Franco-Nevada (FNV). This gold royalty play has been a bellwether in our research for years.

In 2024, revenues came in at $1.11 billion and are expected to soar 48% in 2025 to $1.65 billion.

Net income is expected to explode to $971 million this year, up from $552 million last year.

Growth metrics like this will always attract investor attention. Below shows a wall of inflows powering the shares higher in 2025.

The stock has gained 61.5% YTD.

Shares are down 15.8% from recent highs. That’s dropped the technical score down to 61.8%:

It pays to go with the flows.

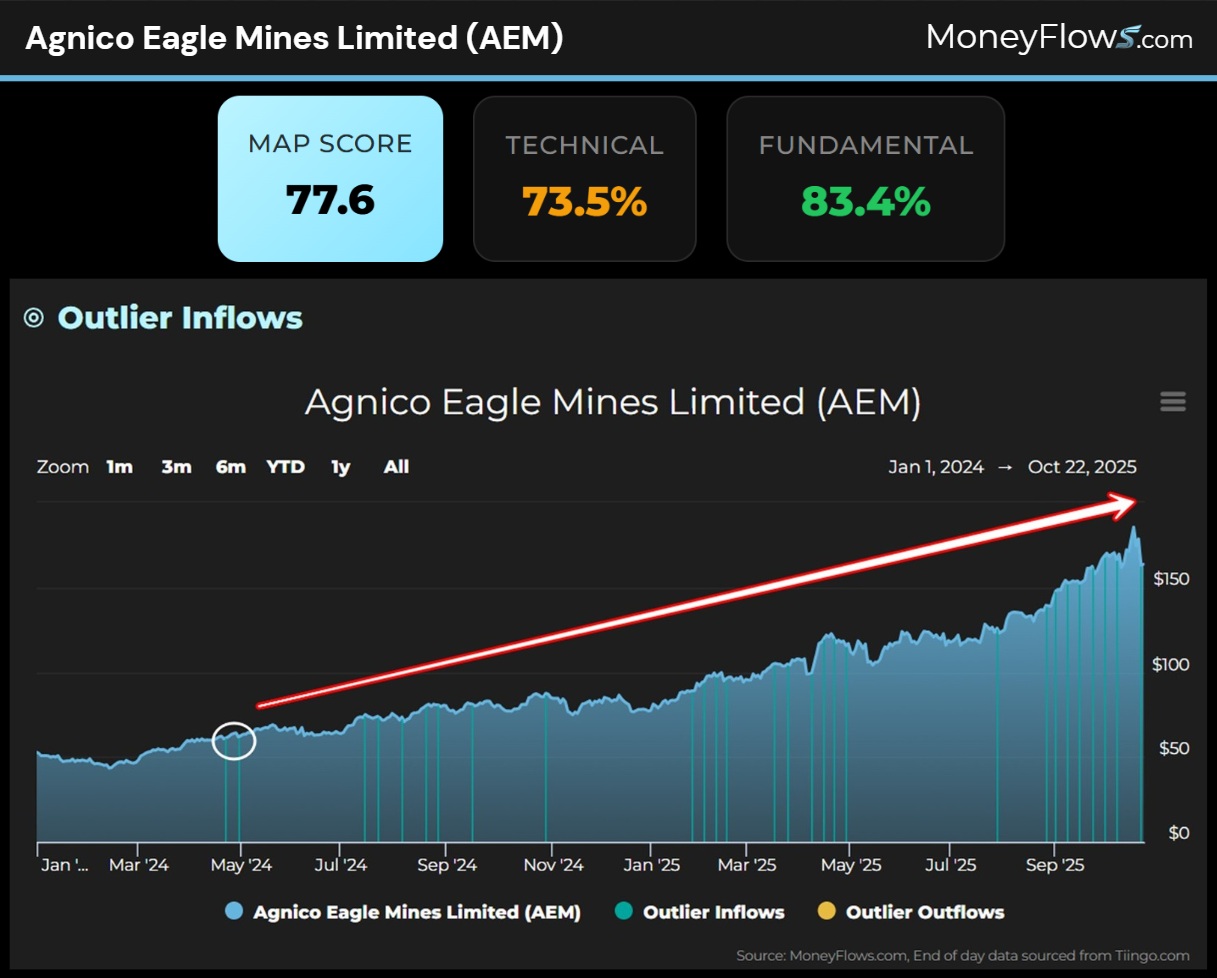

The number 3 oversold gold stock is Agnico Eagle Mines (AEM). This company has some of the best metrics you’ll find in the gold space.

In 2024, Agnico’s sales clocked in at $8.28 billion and are estimated to ramp to $11.39 billion in 2025.

Profit growth is what sets AEM apart. In 2024 net income stood at $1.89 billion are expected to more than double to $3.89 billion this year.

That level of execution is why shares are up 109% in 2025. On a 2-year basis, the stock has more than tripled, gaining 231%.

Back in July, I showcased Agnico as a top outlier stock in 2025. Few stocks show the level of support that AEM has had in the last few years.

That’s the power of the MoneyFlows process.

The blue lines below indicate the times when AEM was on our rare Outlier 20 report. All outlier stocks have charts like this:

Smart investors will pick up on the biggest trends early in their cycle.

Our unique software spots tomorrow’s winning names over and over again.

As markets come under pressure, focusing on top-ranking names loved by institutions is the way to outperform.

Become a PRO member today and learn our top-ranked stocks. Go ahead and plot money flows on your favorite stocks too.

Professional money managers and RIAs looking for additional portfolio solutions please reach out about our Advisor Solution and Emerging Advisor Program.

Pullbacks offer a golden opportunity.

Just make sure you’re on the right side of the Big Money.