Stock Market Bubble Fears Are Overblown

Turn on any media outlet and odds are you’ll hear cries of worrisome exuberance.

Valuations, meme trades, a lack of volatility, and more have birthed top callers everywhere you look.

We don’t see it that way. In fact, we’ll offer 3 data-driven studies signaling stock market bubble fears are overblown.

Chew on this. The S&P 500 is up 35% since early April and 87% since this bull market began in October 2022.

This proves that investors need to be proactive during the market’s darkest hours.

Even more, investors should fight the urge to sell after a massive rebound.

It’s natural to want lock-in gains after such a crowd-stunning run.

Unfortunately, when it comes to investing, trades that feel good in the moment usually underperform. It’s the initially uncomfortable and unpopular trades that tend to be the big winners over time.

Being bullish the last 6 months has not been popular…but more importantly, it’s been very profitable.

If you’re concerned about late-stage bull markets or Fed rate cuts, read this note.

We’ll even highlight the sectors to own in Q4.

As a bonus, we’ll wrap up with a list of the top outlier stocks in our favored sectors.

Stock Market Bubble Fears Are Overblown

Tune out the bubble talk.

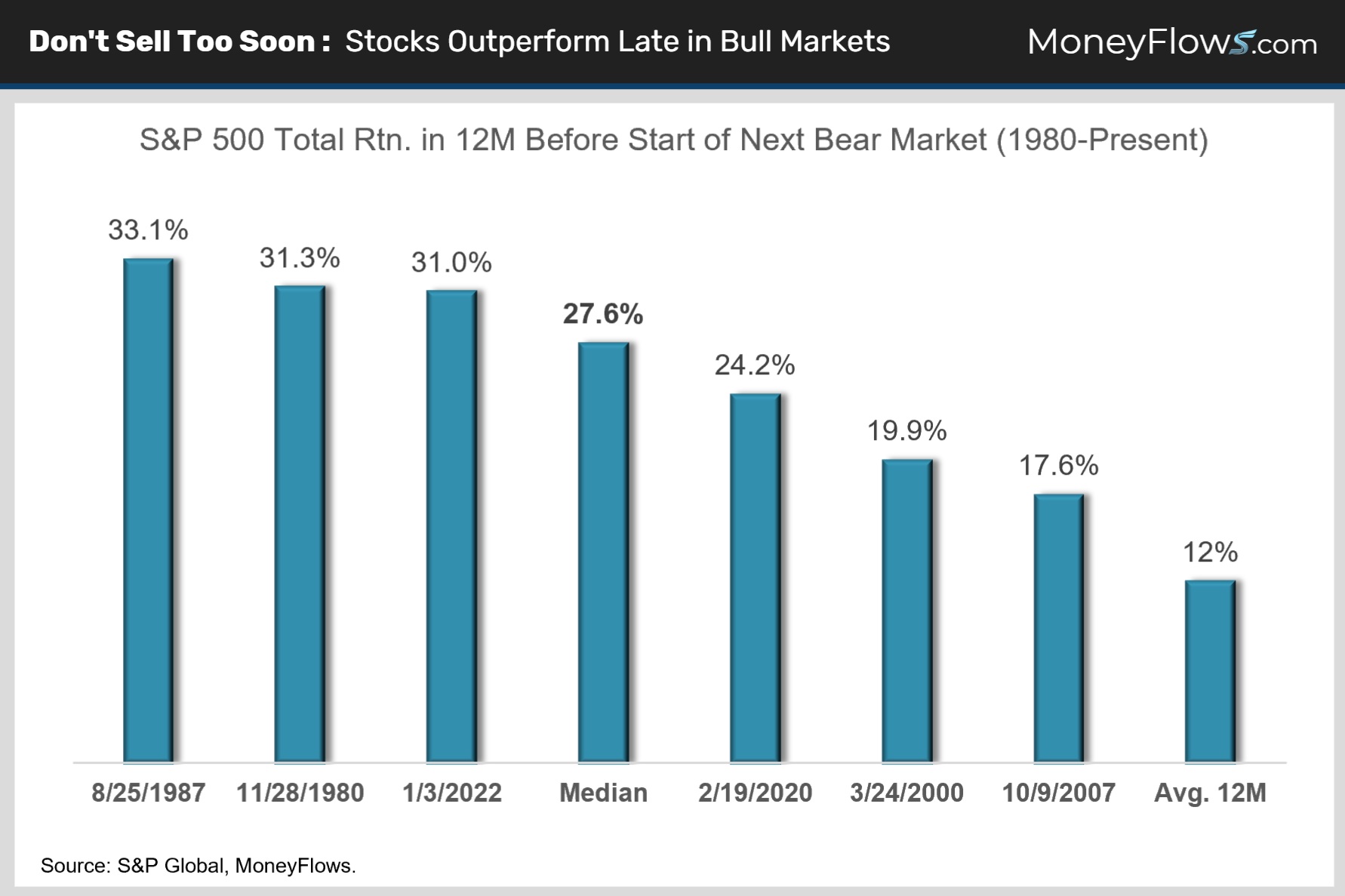

We analyzed S&P 500 performance in major bull markets since 1987 to see how equities do later in their respective stock market cycle.

Big Gains Come Late in Bull Markets

In the final 12 months of a bull market, the market has posted a huge median advance of 27.6%. That’s roughly 3X its average annual historical 12-month gain (chart)!

Why?

After shunning equities earlier in the bull market, the crowd finally tires of missing out and piles into stocks.

This time-tested performance-chase turbocharges returns in the later phases of bull markets.

Here’s the bottom line: the smart money (that’s you) wins big sticking around late.

Pick your bear market and note the huge runup 12-months before it began:

Selling out early is very costly.

OK let’s shift gears and check out the next big reason stock market bubble fears are overblown.

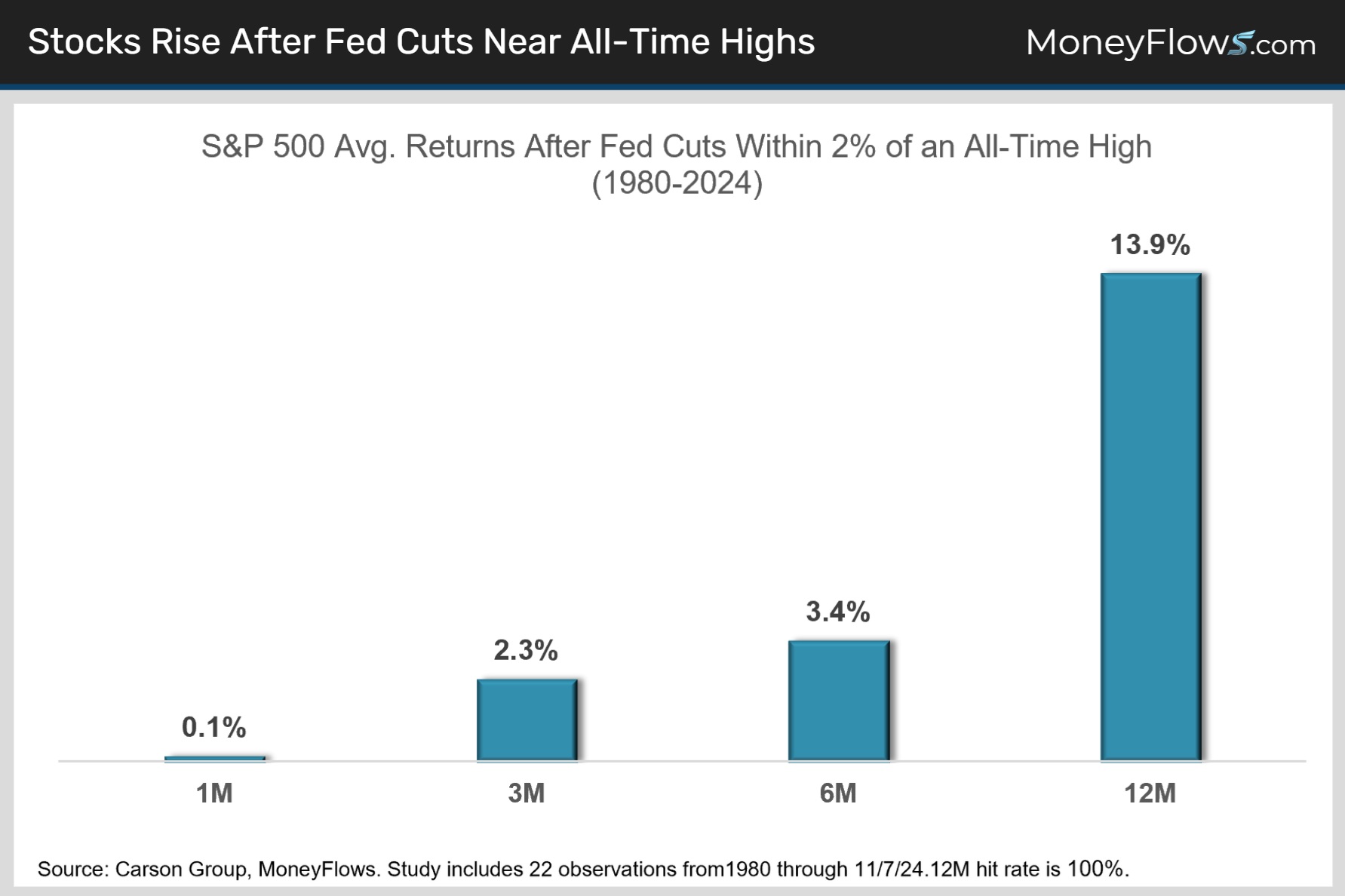

Fed Rate Cuts Pack More Punch with Stocks at All-Time Highs

We all know stocks like rate cuts. But it turns out not all rate cuts are created equal.

The stock market’s level and trend matters a lot.

Stocks do great when the Fed cuts rates with the S&P trading near all-time highs, as it was when the Fed last eased on September 17.

According to a recent study by the Carson Group, since 1980, the S&P has averaged a robust 13.9% 12-month gain after the Fed eases with the index within 2% of an all-time high (chart).

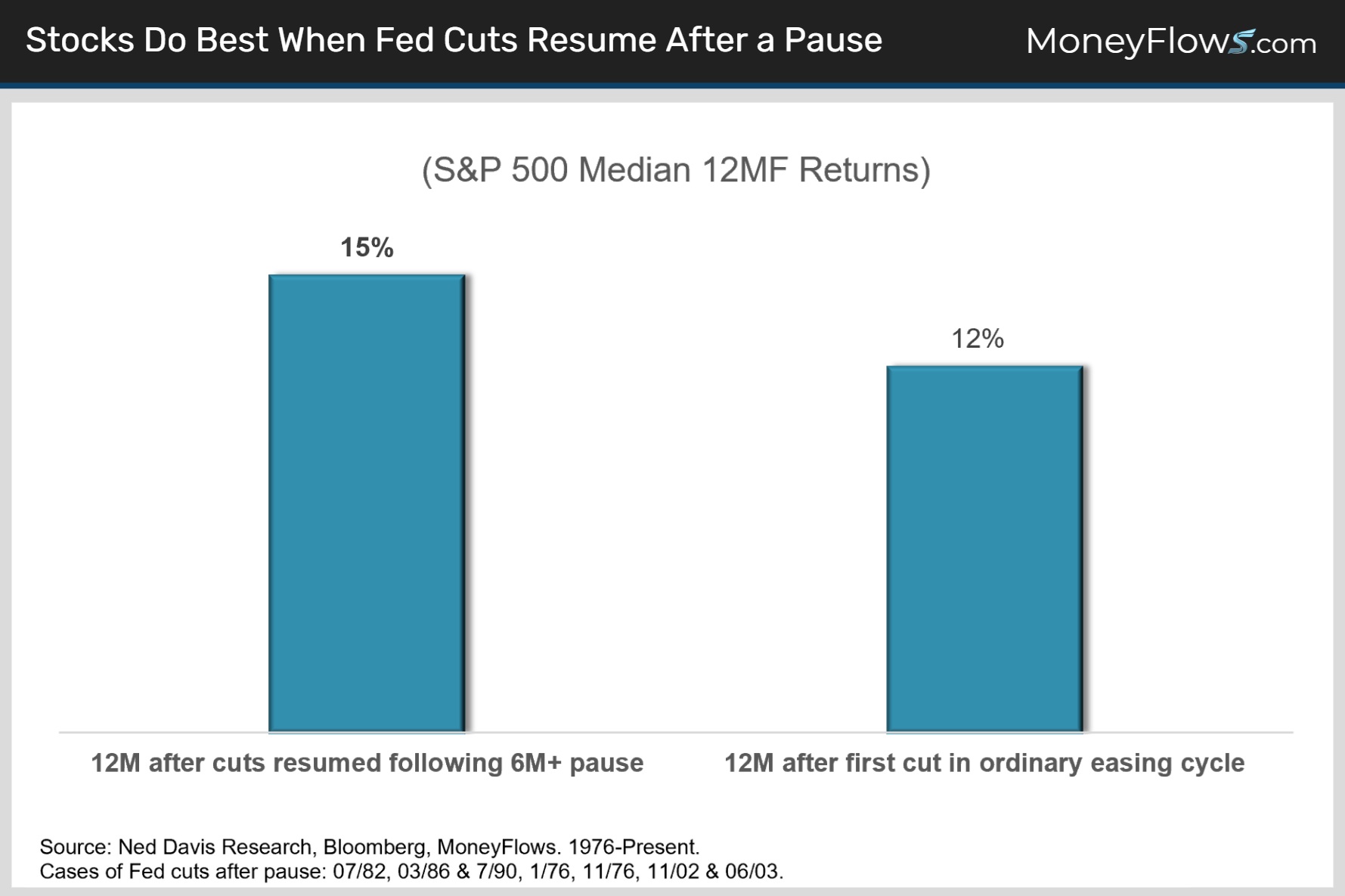

And given this is a restart in rate cuts, history favors this setup too.

When Rate Cuts Restart After a Pause, Stocks Outperform

The Fed’s September 17 rate cut was its first since it paused its easing campaign last November.

History says a long pause in Fed easing cycles juices the benefits for stocks.

Check out this next chart.

According to Ned Davis Research, since 1976, the S&P 500 has gained a median 15% a year after rate cuts resumed following a pause of six months or more.

That compares to only a 12% median 12-month S&P gain during ordinary easing cycles (chart).

Further reading, small-cap and NASDAQ stocks surge 12-months after the Fed restarts rate cuts.

What This Means for Your Portfolio

We’ve made a contrarian bull case for stocks. Now, let’s tackle portfolio construction.

Many investors are wondering if they should be trimming cyclical winners and leaning into depressed defensives like staples and health care.

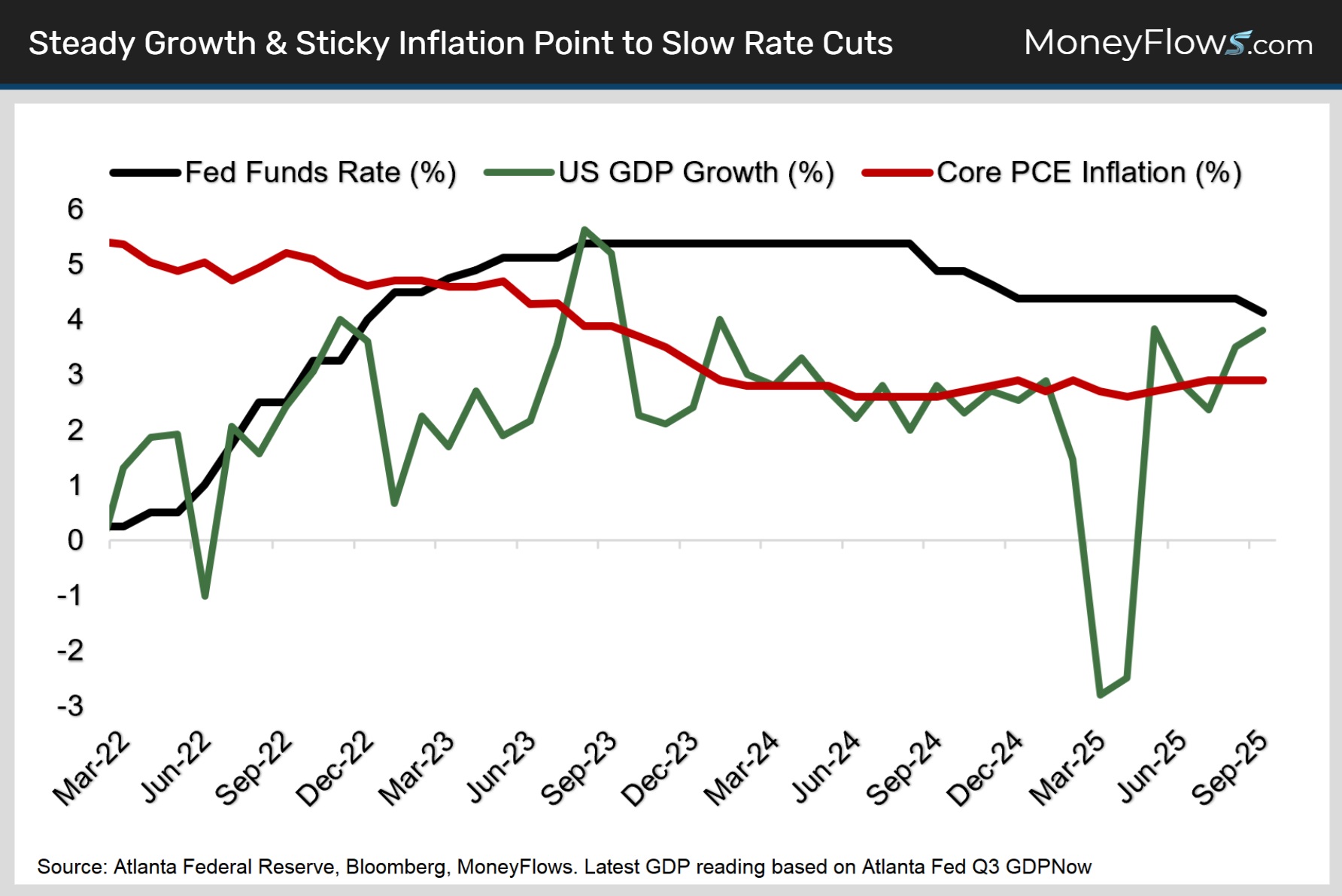

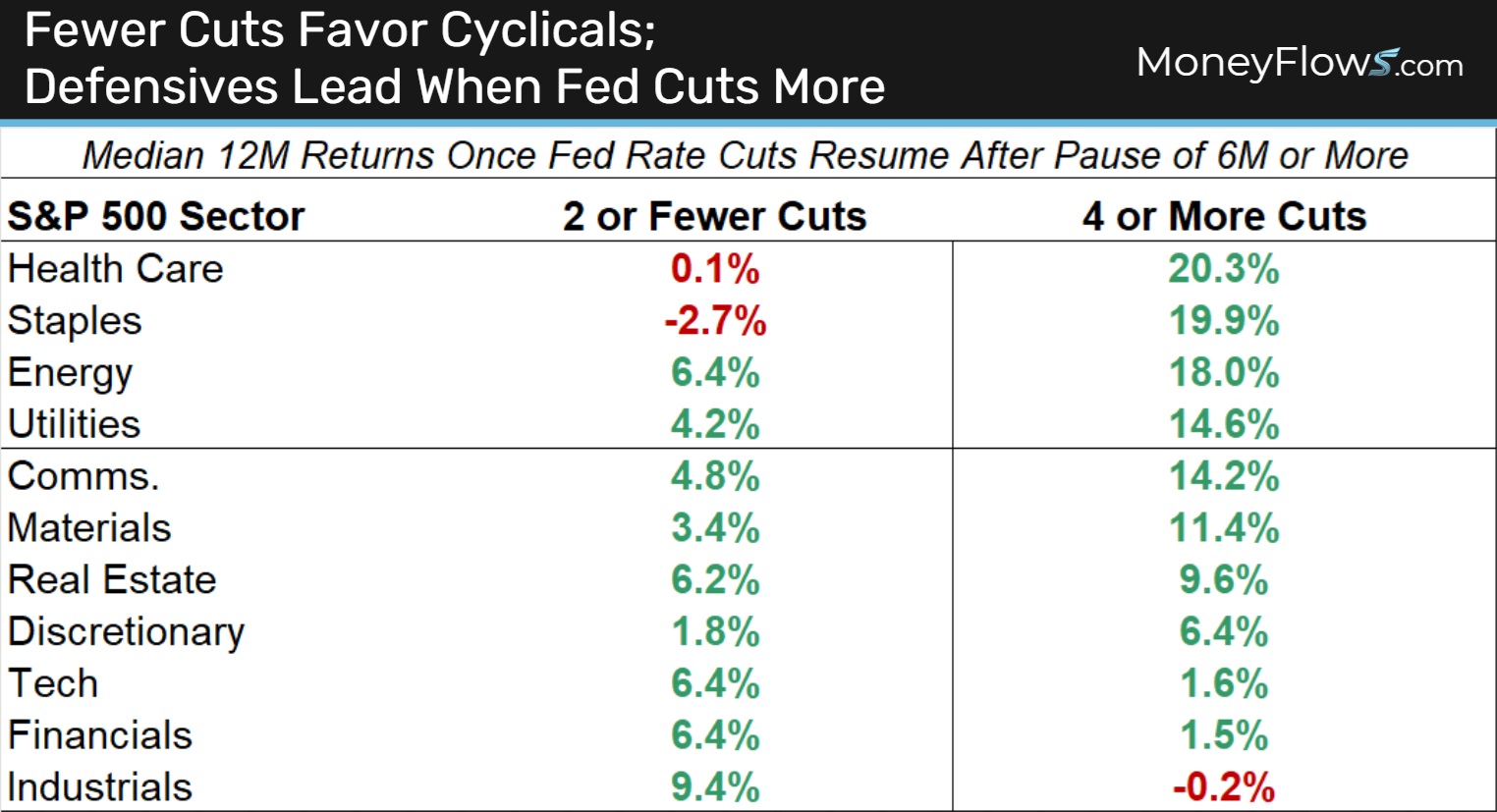

History suggests the strength of the economy and pace of Fed rate cuts will dictate equity investors’ sector preferences.

We think the Fed will ease gradually moving forward. Despite a weaker labor market, the overall economy remains healthy thanks to the AI infrastructure boom and a resilient high-end consumer (half of spending).

Meanwhile, core inflation has been sticky near 3% for almost two years and many Fed governors worry that tariff price pressures have yet to hit fully home (chart).

In the four cycles where the Fed delivered only one or two cuts after pausing, the economy was generally strong like it is today and cyclical sectors like industrials, tech and financials outperformed (chart).

However, in cycles where four or more cuts were needed, the economy tended to be weaker and investors leaned more defensive, with health care and staples delivering the highest median returns.

Given our belief that the Fed will tighten gradually over the coming year, we maintain our long-standing cyclical sector bias.

That said, the pace of Fed rate cuts is never easy to predict and many other factors impact sector leadership.

With that in mind, from a macro standpoint, we’re more open to a barbel sector strategy that we’ve been in a while. Stick with a healthy dose of cyclicals but start buying depressed, best of breed defensives with juicy dividends.

Bull markets rotate. It’s what they do. Look no further than the recent monster rip in big pharma. Make sure you’re positioned accordingly.

Look for today’s picks to include the usual tech, utilities and industrial suspects, plus beaten down health care blue chips seeing renewed inflows.

Where most research houses got it wrong the last 6 months, MoneyFlows got it right.

Good things happen when you follow the data instead of the crowd!

As the Fed likely eases gradually, lean into winning cyclicals and depressed defensives favored by institutions to outperform.

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get access to our proprietary indicators and learn how our approach finds the best stocks in the market.

Reach out about our Advisor solution here, if you’re a money manager or RIA and want portfolio solutions.

Below, for PRO subscribers, we offer a sector diversified list of our favorite 20 outliers as ranked by our proprietary MAP Score.

This time, be early.

We witnessed the biggest dip in months.

There’s plenty of opportunity when you go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.