When the Fed Cuts Rates, Buy Semiconductor Stocks

The long wait is over.

The Federal Reserve lowered interest rates.

Here’s how to make the most of it…get bullish on technology.

When the Fed cuts rates, buy semiconductor stocks.

It’s an amazing time to be an investor. Markets are at all-time highs, interest rates are coming down, and the economy is humming along.

Few could have imagined how strong the rally has been from the market lows.

But MoneyFlows saw a path to an unthinkable rally at the April depths.

As the market has twisted and turned, we’ve remained bullish. And today, that view will get an upgrade.

We will make the case of why you need to overweight semiconductor stocks specifically in the months and years ahead.

Our data has shown an immense appetite for high-quality tech stocks.

And history suggests the party is only just getting started.

Money Flows Favor Technology Stocks

The A.I. revolution is in full swing. Day after day we see continual buying across the board.

All-star companies like NVIDIA (NVDA), Broadcom (AVGO), Lam Research (LRCX) and KLA Corp. (KLAC) keep accelerating.

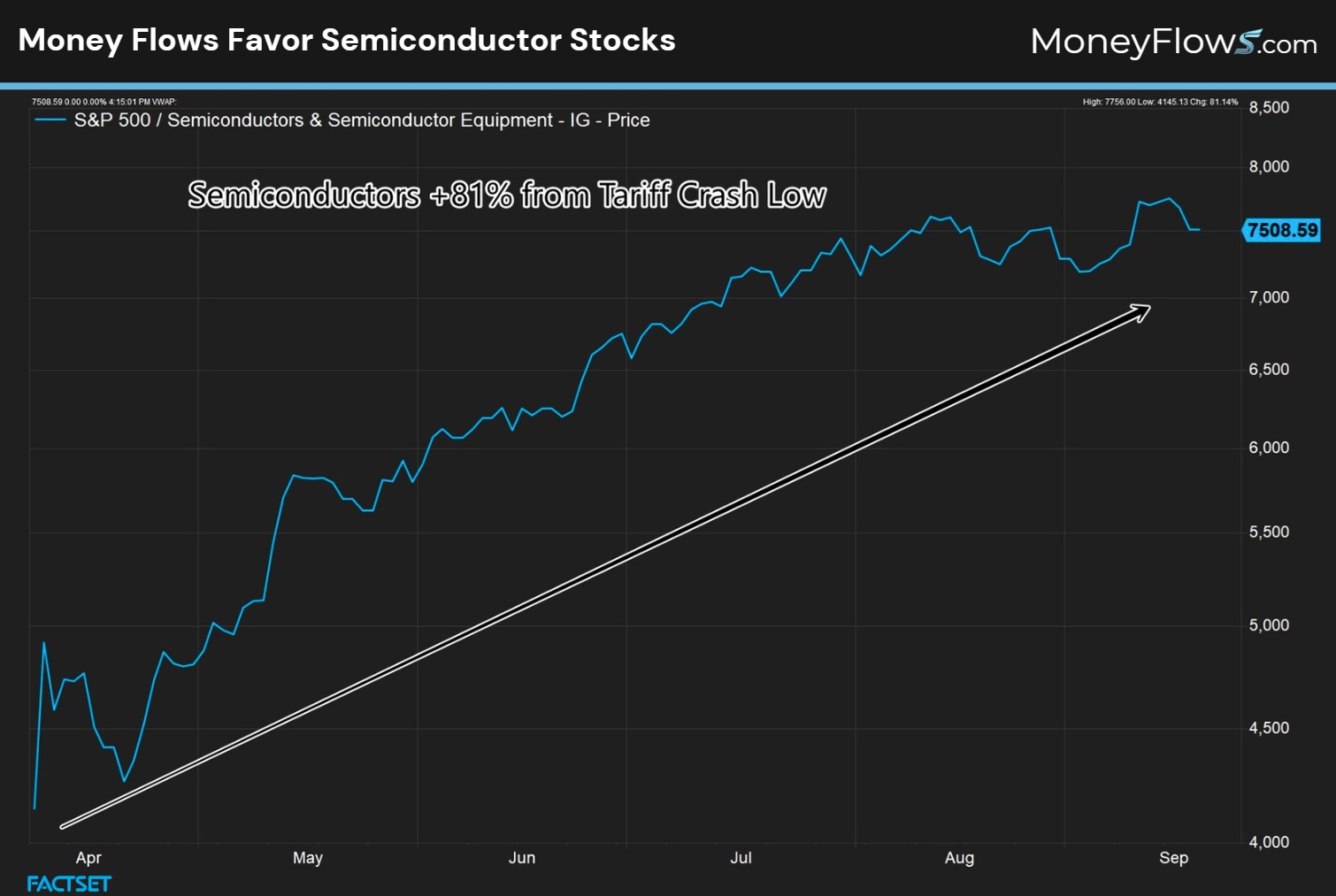

This has led to an incredible 81% gain in the S&P 500 Semiconductors & Semiconductor Equipment index from the April 8th low:

This level of support can only exist when capital is rushing into discrete stocks week after week.

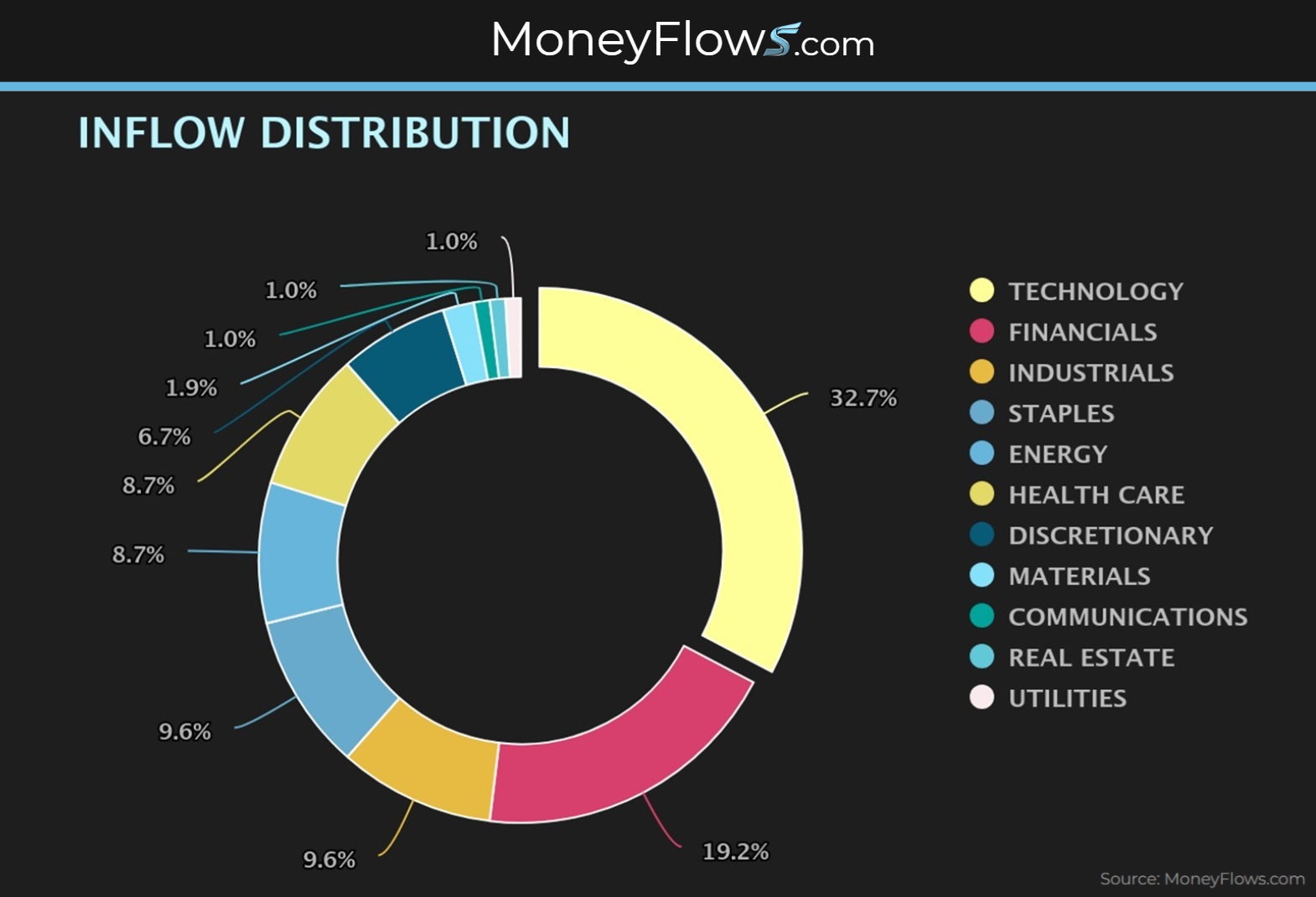

Just yesterday, 1/3rd of all of our equity inflows were focused in Technology stocks:

This isn’t new information.

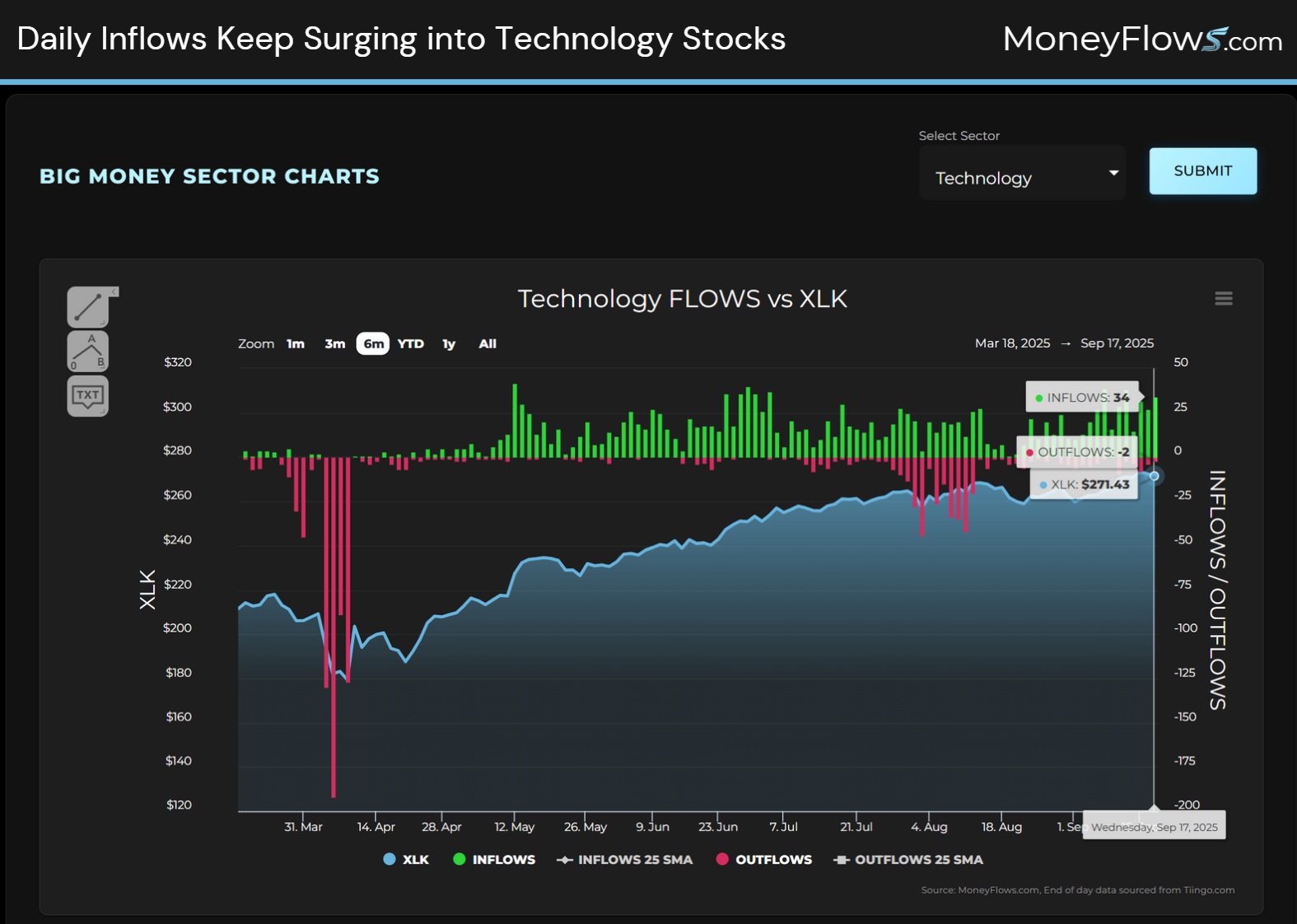

This has been the theme for months.

Note the daily inflows into technology stocks below. This is why the group keeps surging:

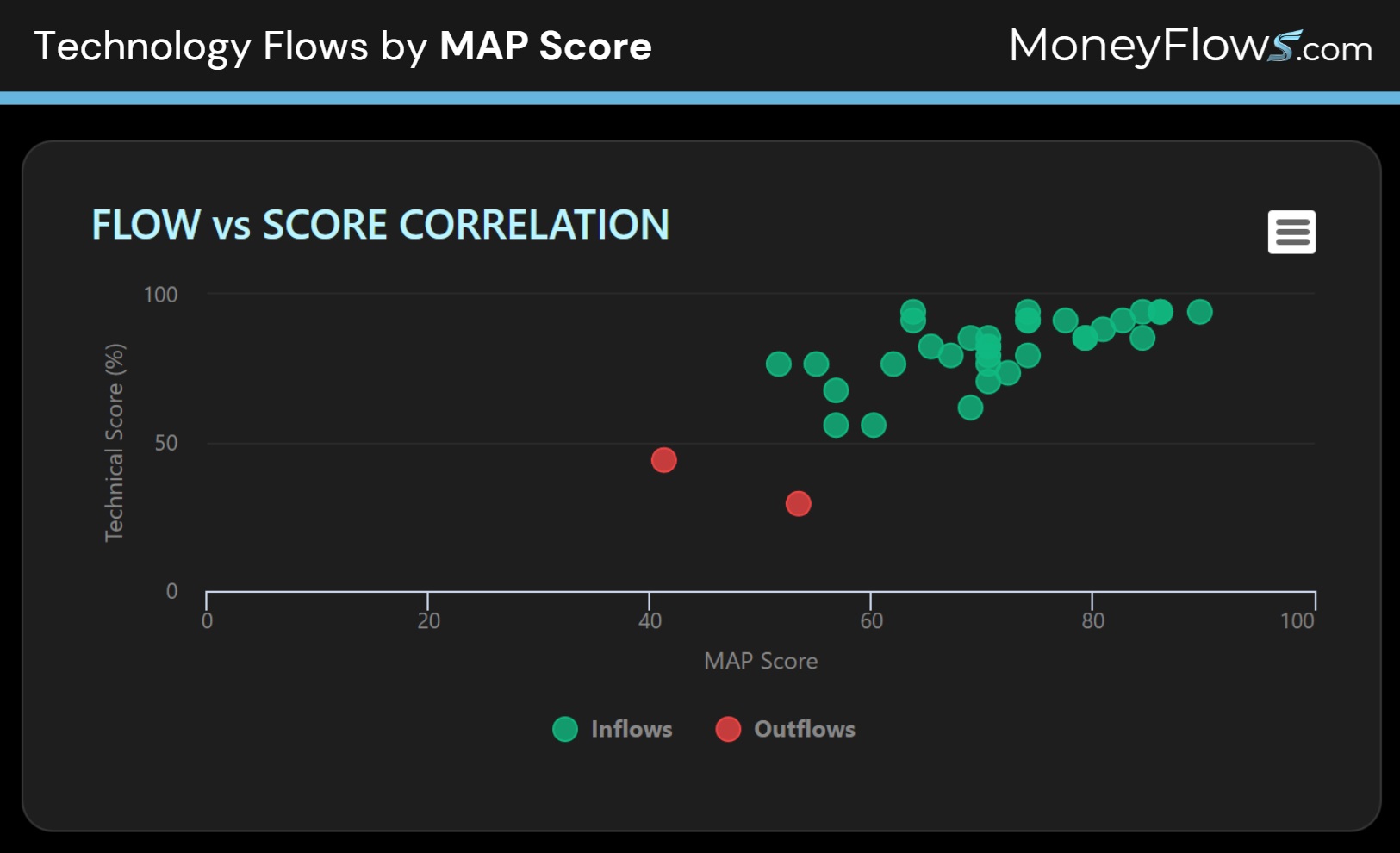

And it isn’t just any technology stocks that are booming. The top-tier companies with accelerating earnings are the beneficiaries of capital.

Below are the daily Technology flows mapped by MAP Score. Most of the stocks are in the 70+ rating range:

Outlier stocks command the highest rated flows and scores.

Now that we know where capital is flowing, let’s zero in on why the latest Fed rate cut will boost this area even further.

If you’re a bear on technology stocks…I’d suggest you look away now.

When the Fed Cuts Rates, Buy Semiconductor Stocks

Lower rates spur growth.

Capital gets easier to access and bottom lines improve.

Couple this with the A.I. revolution that’s taking place and you’re staring at a cocktail of massive equity gains ahead.

Let’s unpack 3 major reasons you’ll want to tilt your portfolios in favor of growth-heavy semiconductors.

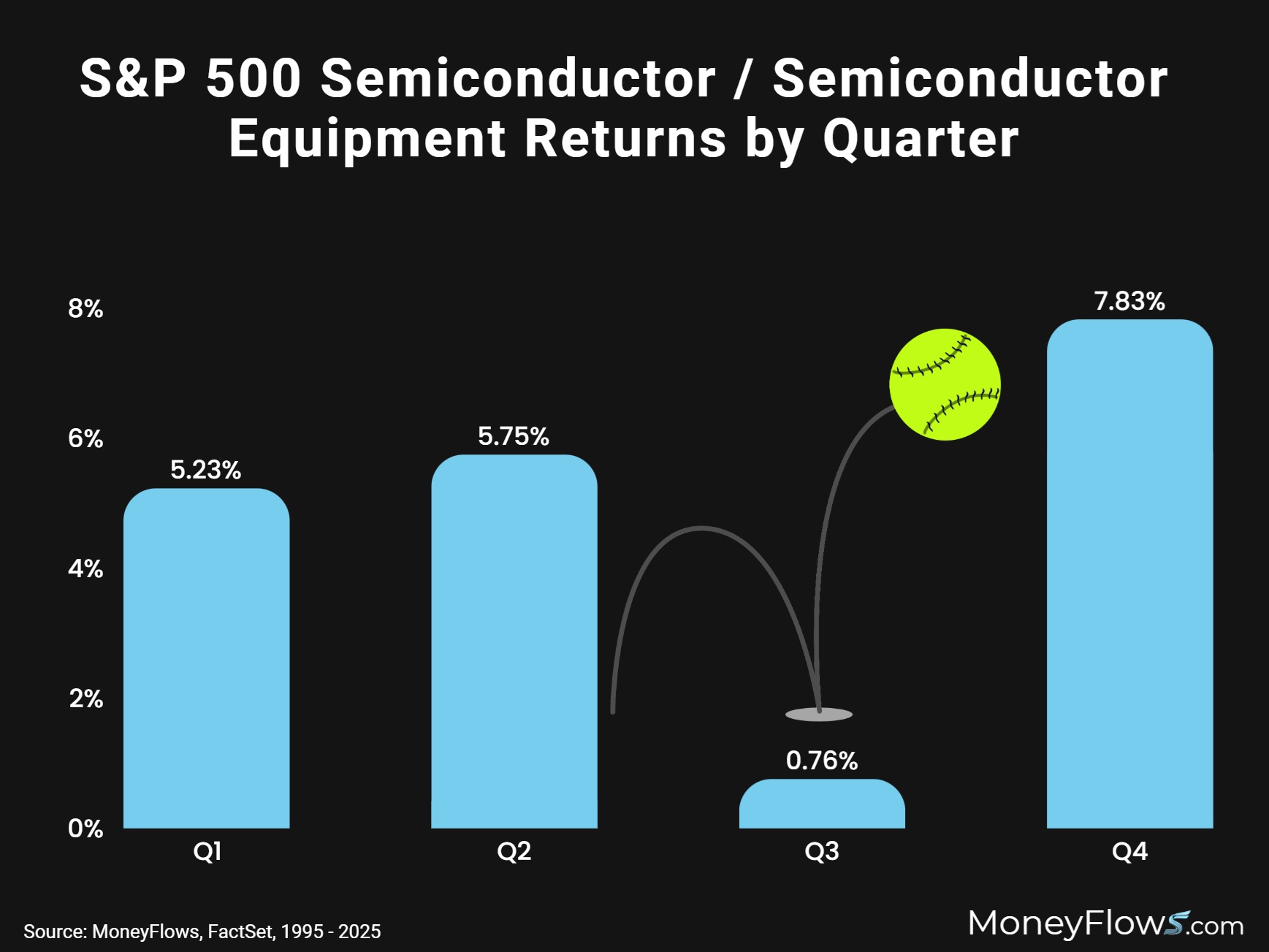

First, let’s look at semiconductor returns by quarter.

Reason number 1 to buy semiconductors comes down to seasonality.

Back to 1995, the S&P 500 Semiconductor / Semiconductor Equipment group shows its best performance in the 4th quarter with an average gain of 7.83%.

Notably, the worst performing quarter is Q3 which is coming to a close soon:

But we know seasonal trends aren’t enough to make investment decisions. You need a fundamental catalyst.

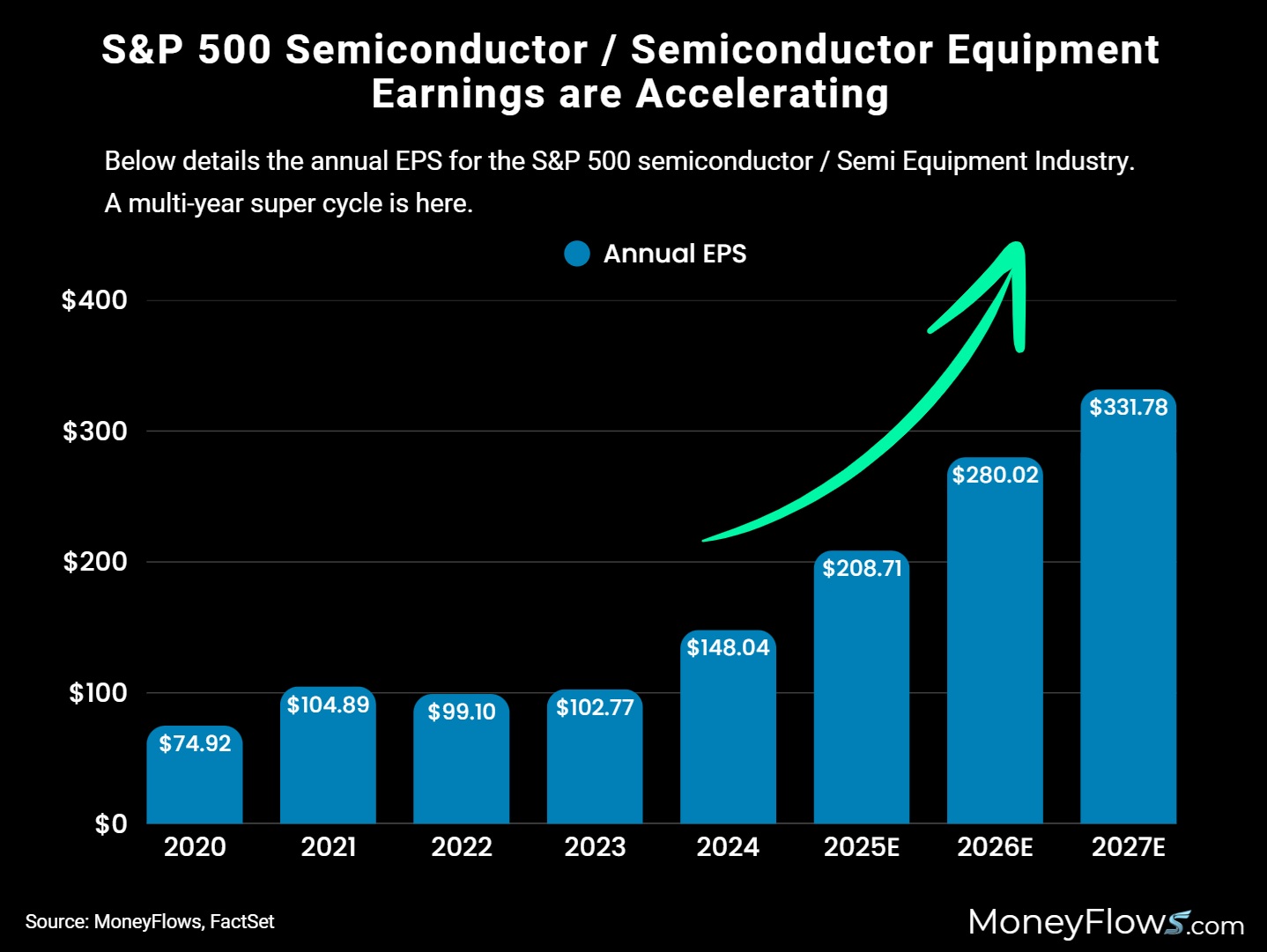

Given the multi-year super cycle in A.I., earnings are accelerating at a mind-boggling pace. There’s a reason we told you to buy semiconductors hand over fist last summer.

It all comes down to earnings.

Reason number 2 to buy semiconductors is simply due to the earnings acceleration picture.

In 2025, earnings per share for the S&P 500 Semiconductor industry is slated to reach $208.71.

In 2026 that number will surge 34% to $280.02 per share.

In 2027, estimates are calling for 18% growth to $331.78 per share.

This is the reason money is violently flowing into high-quality semiconductor companies.

Now let’s drive home the biggest catalyst of all…

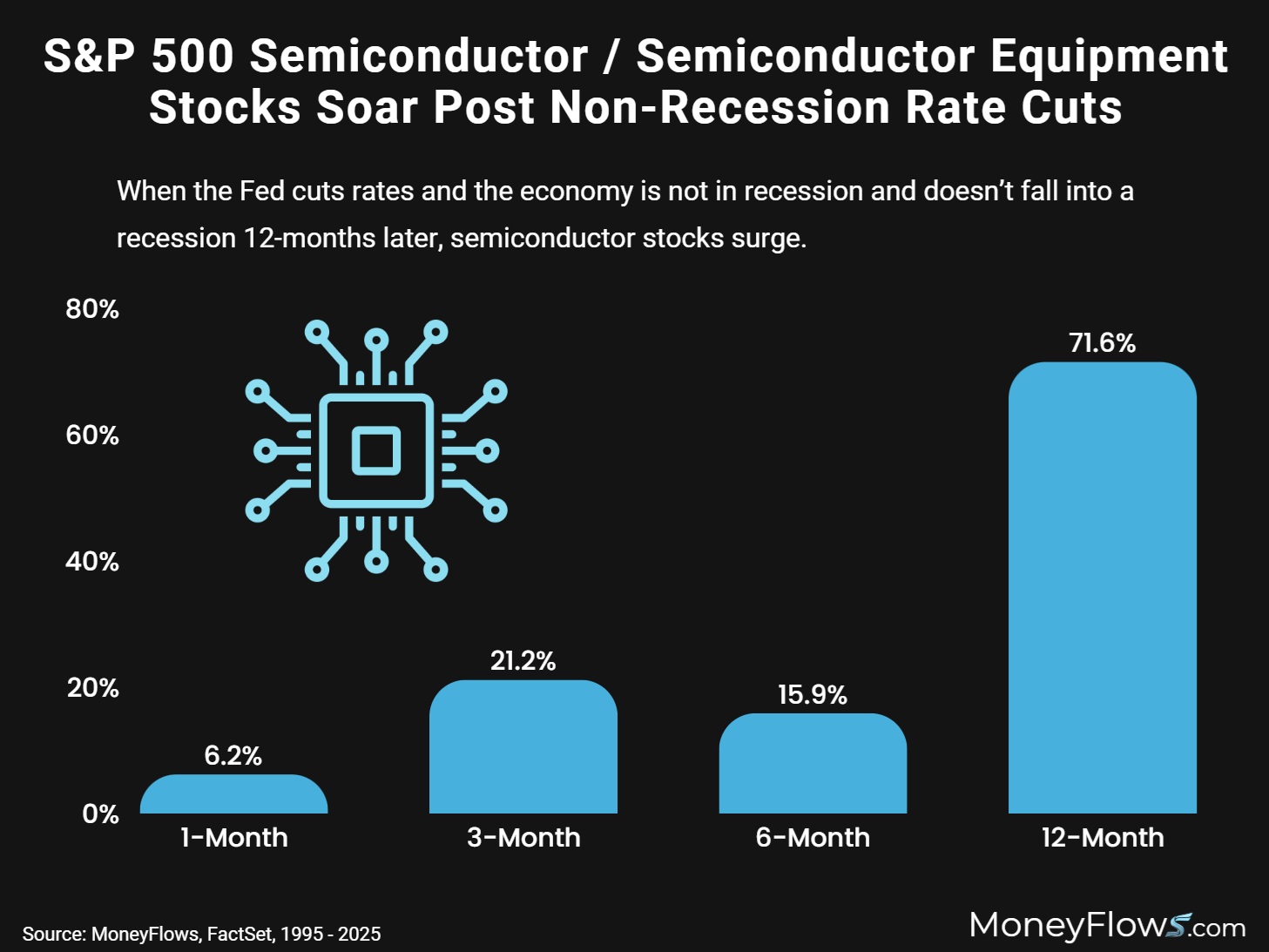

When the Fed cuts rates, buy semiconductor stocks.

Reason number 3 to back up the truck with semiconductor exposure is due to the fact that when the Fed cuts rates and the economy isn’t in recession and doesn’t fall into one 12-months later, the group soars.

From 1995 – 2025, 12-month average returns for semiconductors when the Fed cuts rates and the economy holds up is a staggering 71.6%:

This is the opportunity in front of you today.

If your portfolio is lacking all-star technology exposure, MoneyFlows will help.

Our process not only scores thousands of stocks each day, but we showcase the best of breed. Those are the outliers all over our research reports week after week.

Become a PRO member today and learn our top 6 ranked semiconductor stocks below.

If you’re a money manager, our Advisor solution offers portfolio analytics and ETF flows.

We showcase constituent ranks on thousands of stocks and ETFs.

Money flows positioned our subscribers for success in April.

Don’t follow the news.

Go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.