Extreme Market Concentration is a Buy Signal

There are always spooky scare stories around.

The noise always amplifies in the fall.

Pundits are at it again. They’re spinning a tale about how a top-heavy market is somehow bearish.

In fact, it’s the opposite.

Extreme market concentration is a buy signal.

Most popular bearish narratives have a kernel of truth to them and work some of the time. That fuels media chatter, confirming investors’ existing biases.

Before you know it, they’re taken as gospel. It’s easy to take the bait and shoot thyself in the foot.

Fear not, MoneyFlows has you covered. We follow the data to fight hype with facts.

Today, we’ll debunk the all-so-popular concentration fearmongering. Then, as a bonus we’ll unpack a September signal study.

Finally, you’ll learn the sectors to buy near-term, including a diversified list of top outliers seeing the biggest inflows.

Extreme Market Concentration is a Buy Signal

Fewer companies are commanding a larger share of the market these days.

The bears are terrified that high S&P 500 index concentration makes an imminent market crash inevitable.

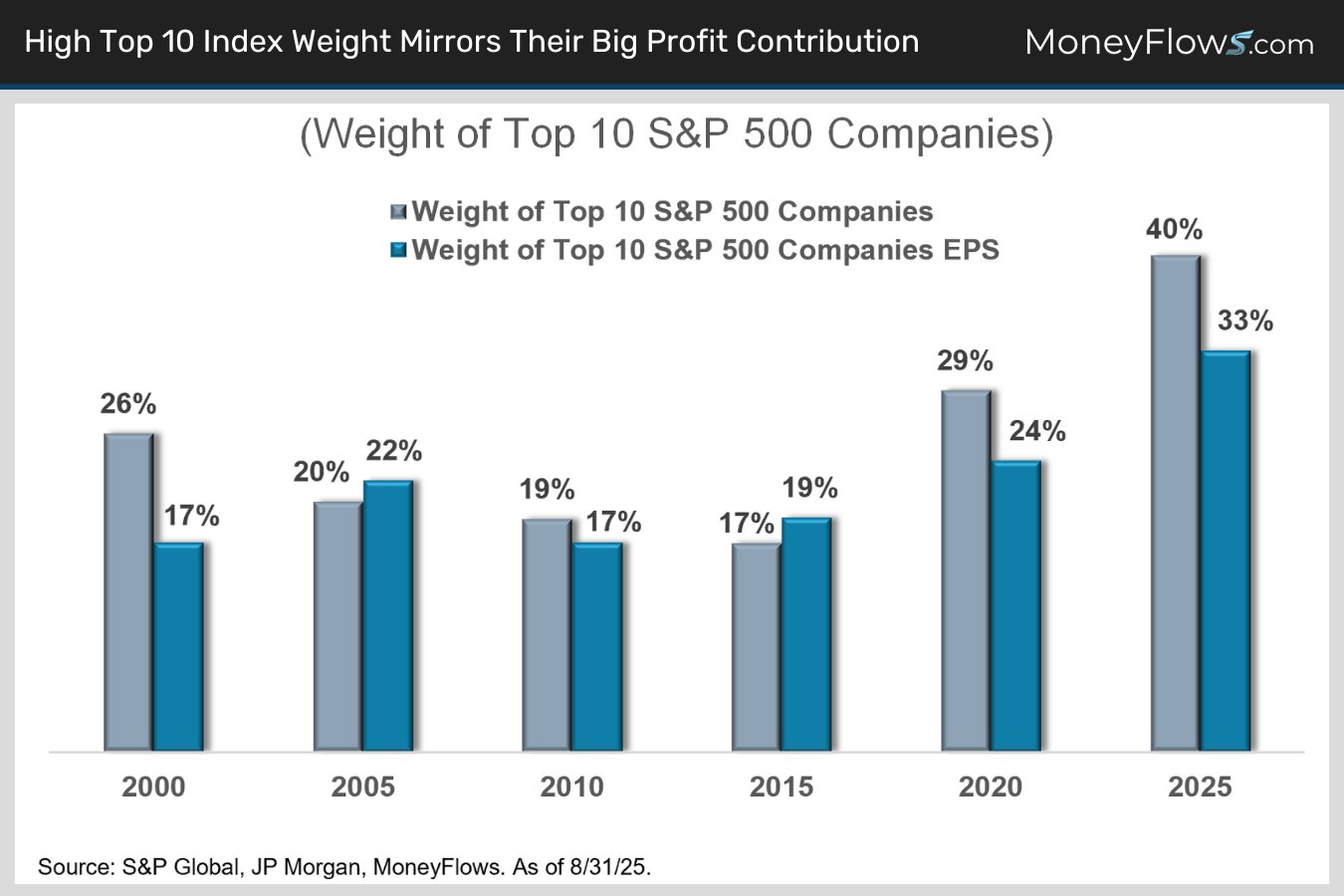

It’s true that the S&P 500 has become more top-heavy in 2025. The biggest 10 companies now comprise 40% of the index versus only 17% in 2015.

That’s a sizable jump from just a decade ago.

But here’s why this new reality isn’t something to fret over.

Ten stocks representing 40% of the index simply reflects their massive 32.5% share of S&P 500 earnings, up from only 17% in 2015 (chart).

Note how earnings-heavy the top 10 is today versus 2000:

The 2nd quarter was a case in point.

The top ten stocks saw EPS grow 25% vs. 8% for the rest of the S&P, per FactSet.

By boosting overall index profit growth, rising index concentration has actually improved equity returns.

It’s bullish not bearish.

Check out this next chart.

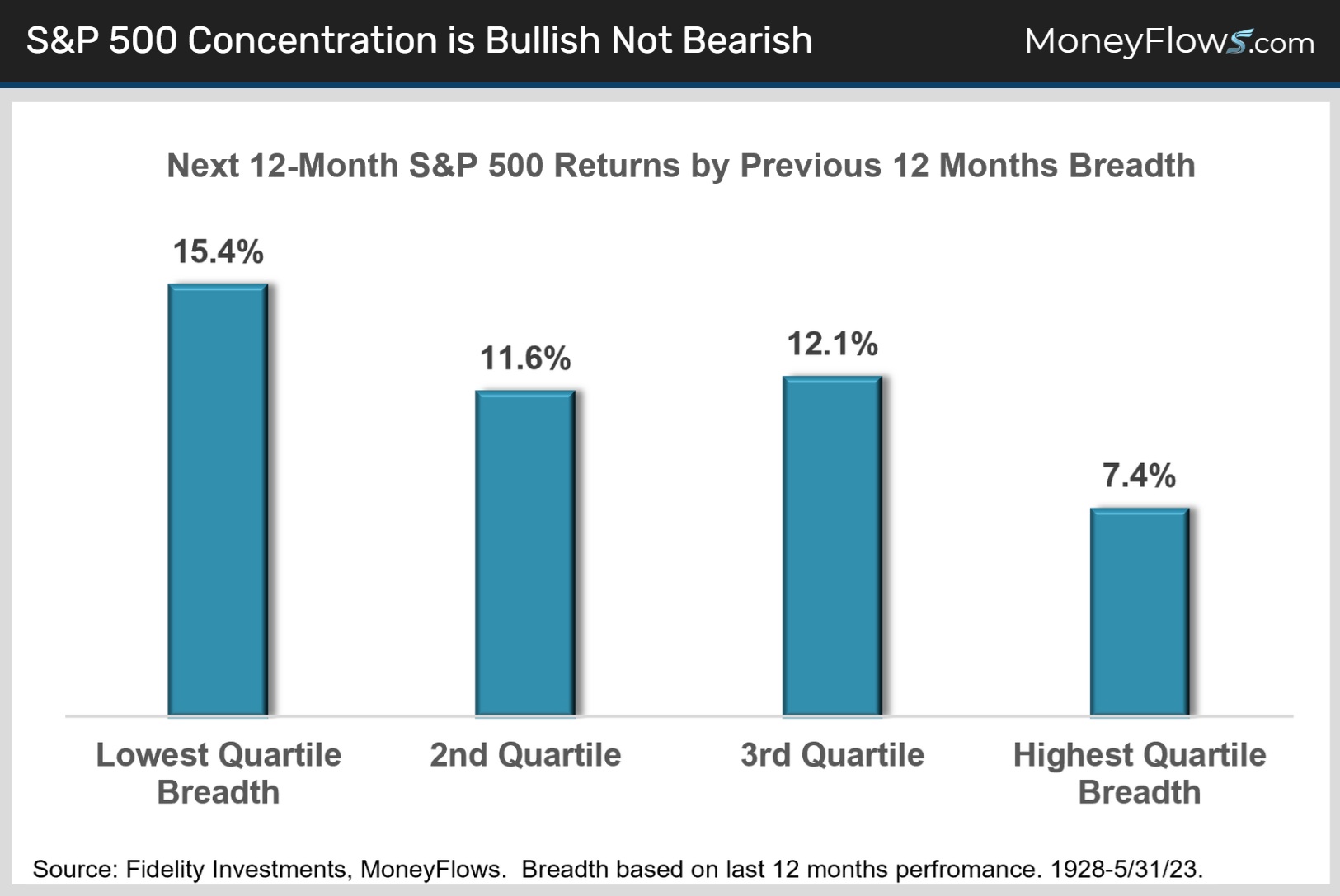

When we measure S&P 500 constituents that have outperformed the index on a 12-month basis, currently just 29.2% of stocks are beating the benchmark.

Since 1928, weak breadth readings like this have forecasted 15.4% NTM average returns for the index.

On the flip side, when breadth is ultra strong and plenty of stocks are outperforming, you can expect stocks to average just 7.4% gains 12-months later (chart).

Weak breadth is a great recipe for big market gains:

Now let’s address September.

Bears love to beat the seasonal drum.

Seasonal September Bull Signal

2025’s bearish seasonal angst seems worse than usual.

Maybe that’s because the S&P 500 has fallen in four of the past five Septembers.

Maybe it’s because stocks are up 30% since early April.

Whatever the reason, tune it out.

While September’s average return of -0.7% is the worst of any month, its performance is skewed lower by a few nasty outliers:

- September 2002 saw an 11% drubbing.

- September 2008 saw equities slied 8.9%

- September 2011 the SPX fell 7.2%

- September 2022 large caps slid 9.4%

September’s median decline is only half as bad at -0.35% with 45% of Septembers positive since 1950.

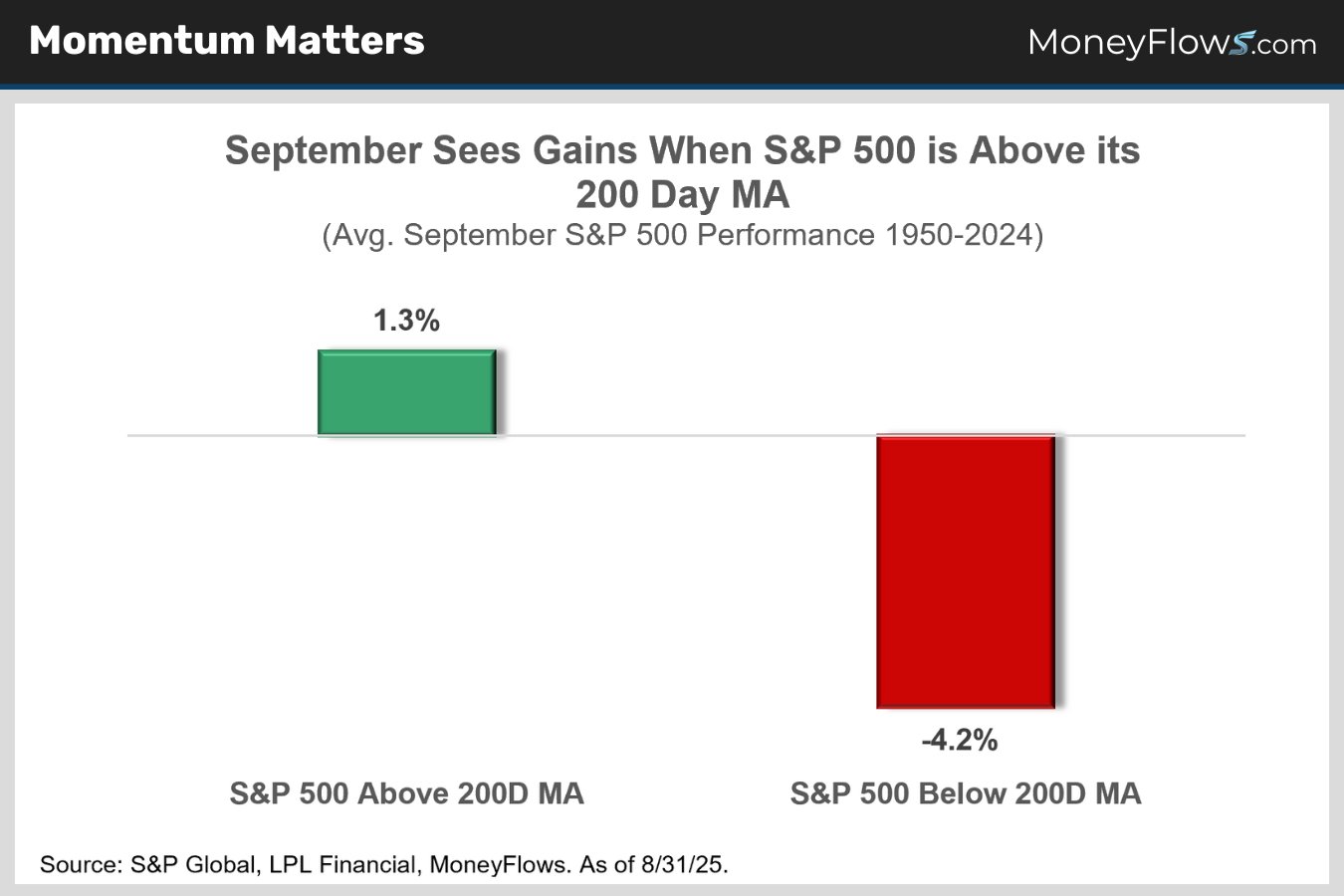

It’s easy to miss that when market momentum is strong, September has been a good month.

The S&P 500 ended August at 6460, well north of its 200-day moving average down at 5961.

Since 1950, when the S&P 500 is above its 200-day moving average going into September, the average price gain for the month is a healthy 1.3%, with a 60% positivity rate.

This compares to an average September price decline of 4.2% and a positivity rate of only 15% when the index is below its 200-DMA going into the month (chart).

The trend is your friend heading into September:

Said simply, remain constructive on stocks.

What This Means for Your Portfolio

We’ve made a contrarian bull case for stocks. Now, let’s tackle portfolio construction.

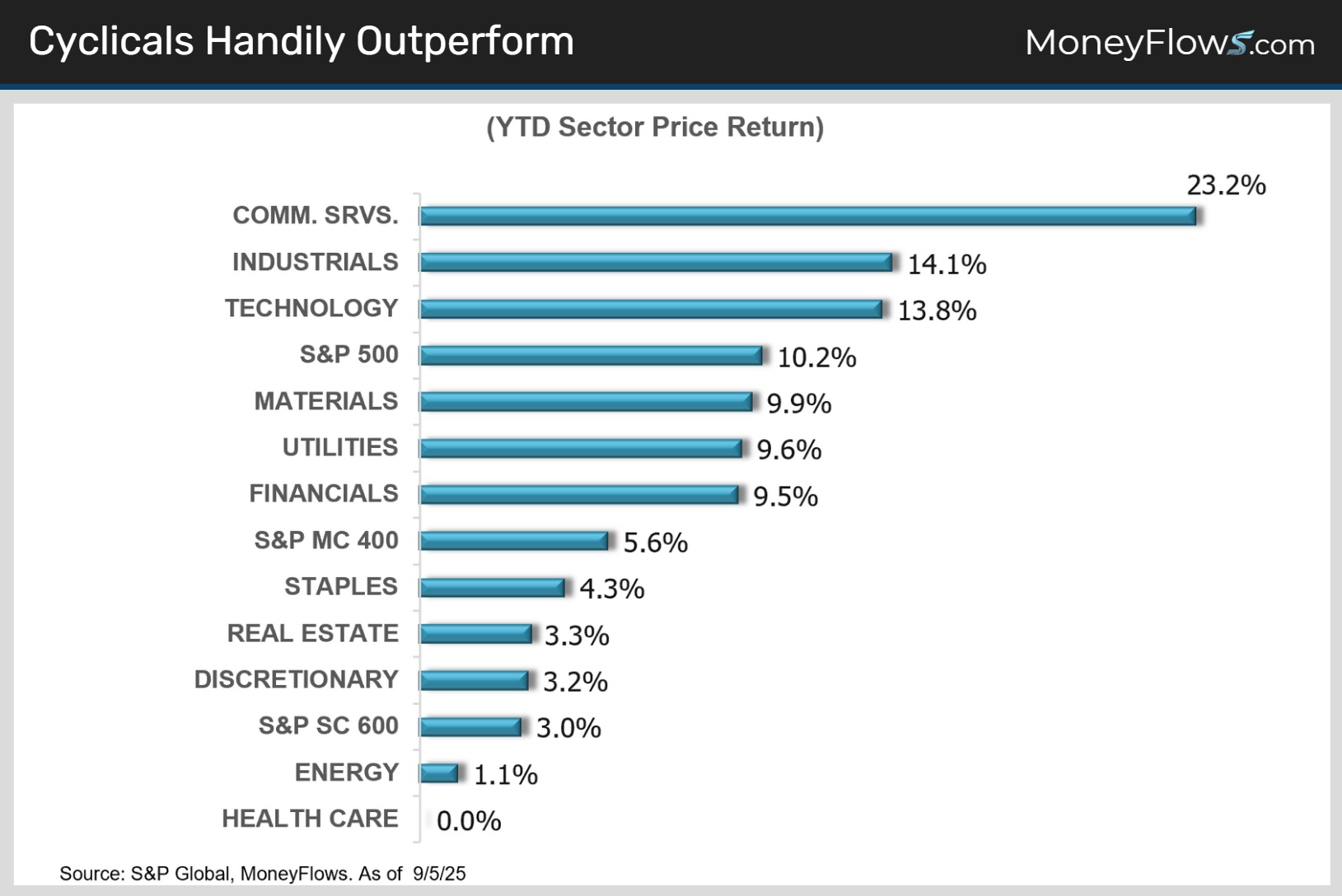

Many investors are wondering if they should be trimming cyclical winners and leaning into defensives after their big YTD outperformance (chart).

Communications Services and Industrials top the leaderboard while Healthcare and Energy lag:

Trimming winners is a mistake. We’d be buying cyclicals on any dips.

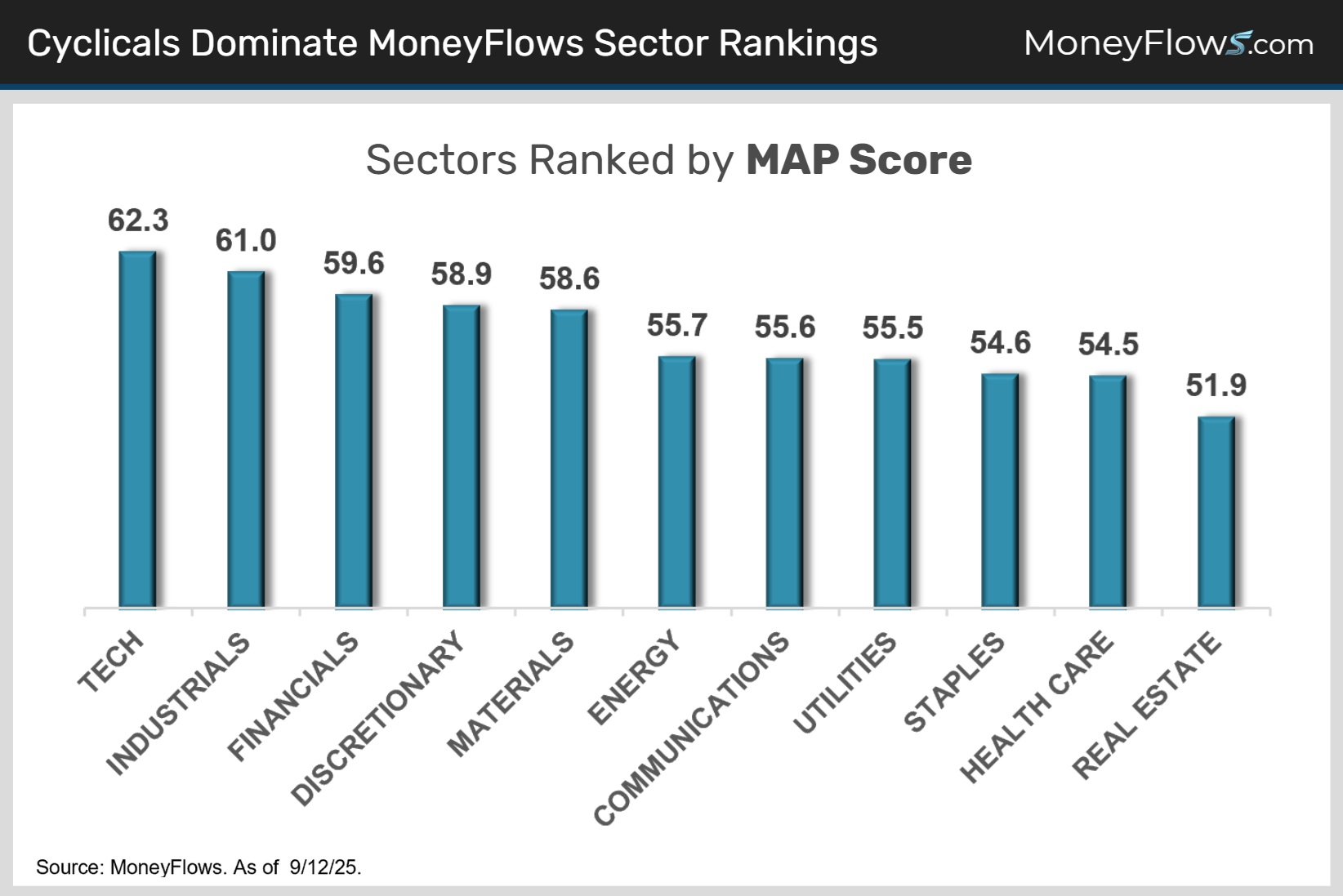

They still top our sector rankings with Technology, Industrials, Financials, and Financials Discretionary scoring the best MAP Scores:

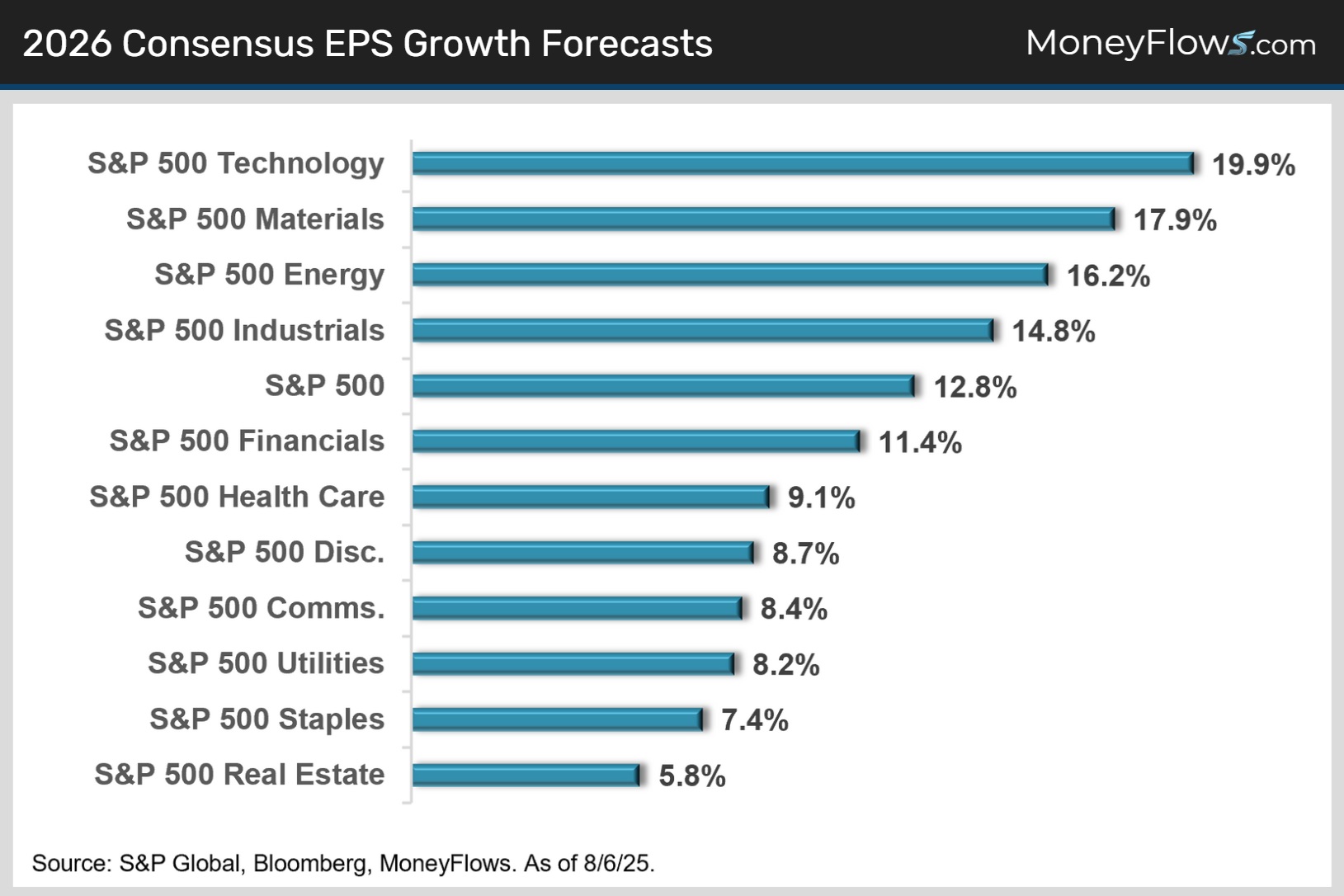

Not only have cyclicals enjoyed positive earnings revisions all year, they also generally sport a much healthier 2026 earnings outlook than defensive sectors.

Technology, Materials, Energy, and Industrials are forecast to grow earnings the most:

Investors worry that with growth slowing, tariff-induced, sticky inflation means the Fed will only cut rates once. We’ll take the other side.

The economy is ls slowing, not stalling and any tariff inflation will be short lived.

Once stagflation fears ease, we expect cyclical sectors to lead the next leg of this rally. That means avoiding bottom fishing in defensives beyond core best of breed names needed to maintain portfolio diversification.

Where most research houses got it wrong the last 5 months, MoneyFlows got it right.

Good things happen when you follow the data instead of the crowd!

We’ve put together a 15-stock list of must-own names to ride the cyclical bull market.

As the Fed is slated to cut rates this week, lean into economically sensitive companies loved by institutions to outperform

To get access and make even more from this call to action, sign up for a PRO membership.

You’ll get access to our proprietary indicators and learn how our approach finds the best stocks in the market.

If you’re a money manager or RIA and want portfolio solutions, reach out about our Advisor solution here.

Below is a list of the Top 5 stocks ranked by our proprietary MAP Score in the tech, industrials and discretionary sectors.

Don’t wait for the media to sound the bull whistle.

By then the train will have left the station.

This time, be early.

Go with the flows!

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.