3 Momentum Signal Studies Highlight Big Upside Ahead

Records have been set. And with the S&P 500 up roughly 30% since early April, most pundits are skeptical the rebound can continue.

History proves otherwise.

On July 14, we made a macro case for equities in 3 Positive Policy Tailwinds for Cyclical Stocks.

We’ll keep riding this bull. These 3 momentum signal studies highlight big upside ahead.

It turns out that big recoveries spell good news for equities.

Not only that, but bull markets also last for multiple years…with the 4th year offering an acceleration.

Don’t listen to doomers telling you to sit this one out.

As a bonus, we’ll highlight our favorite factor and a diversified list of our highest ranked stocks in the category.

3 Momentum Signal Studies Highlight Big Upside Ahead

Stocks erased all of their 18.9% Spring swoon when the S&P 500 set a fresh all-time high on June 27.

Now everyone wants to know if stocks can keep rallying.

Fortunately, we are answering this million-dollar question on everyone’s mind.

Yes, this rally is going higher.

Stock Market Recoveries Post Corrections Since 1950

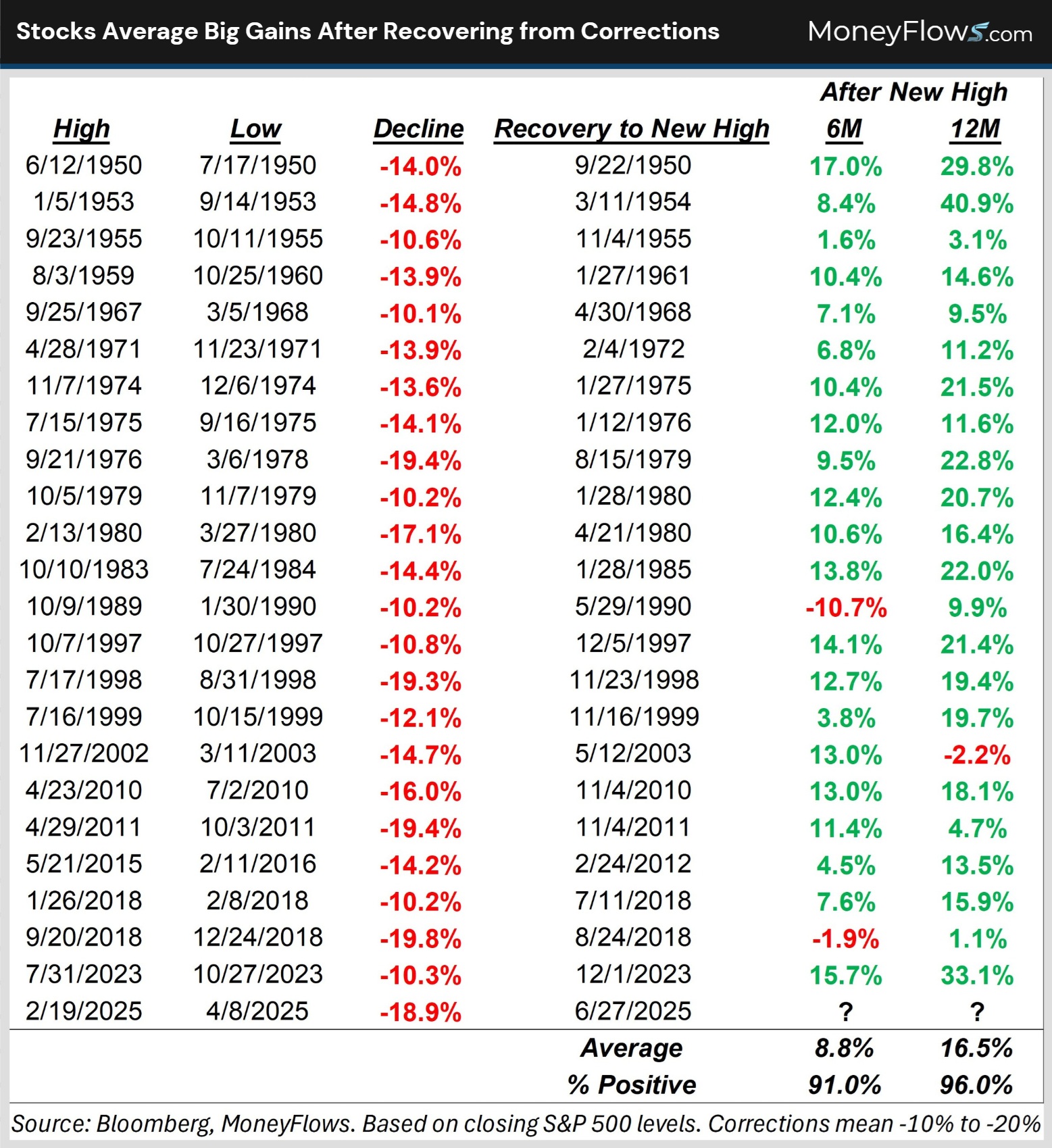

We analyzed all 23 S&P 500 corrections (declines of 10% to 20%) since 1950 to see how stocks do 6 and 12-months after they’ve recovered all their correction losses.

The results were surprisingly upbeat. The S&P 500 averages a gain of 8.8% and 16.5% after 6 and 12-months respectively, both of which are well above their long-term averages.

And there’s plenty of upside left. The S&P is only up 2.5% since recovering every bit of its Spring drawdown.

Note how stocks are positive greater than 90% of the time 6 and 12-months after a full recovery is made:

OK let’s shift gears and see how this bull market stacks up historically.

Bull Markets Average 133% Gains Lasting 3.8 Years

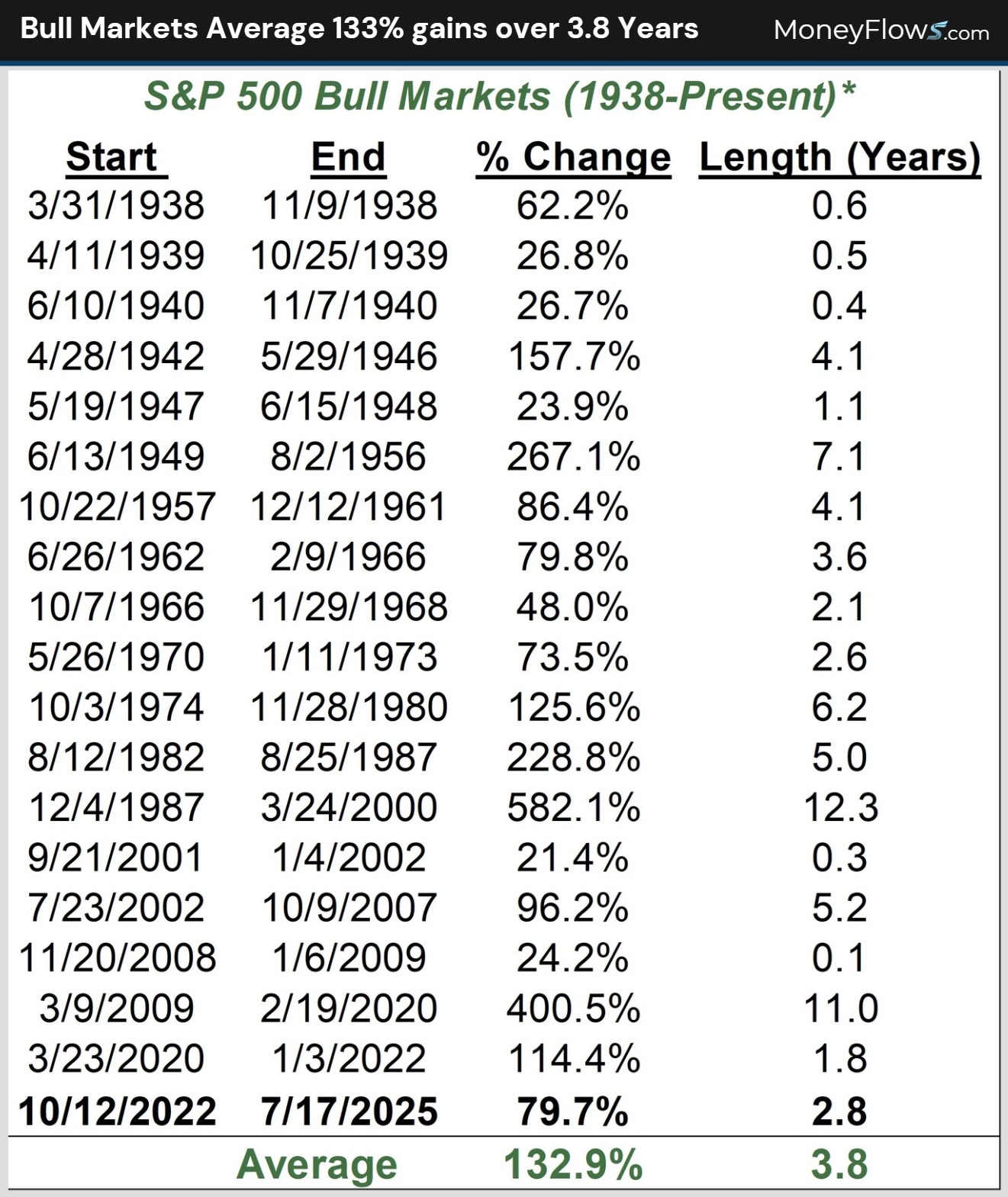

There have been 19 S&P 500 bull markets since 1938.

The average bull market advance is 133%, lasting just under four years.

By comparison, the current bull market that began October 2022 is only up 80% in just 2.8 years (chart).

So, here again, history says this rally likely has further upside and another year to run.

But wait, it gets better. We dug deeper and analyzed bull market returns by year.

4th Year of Bull Market Shows Acceleration

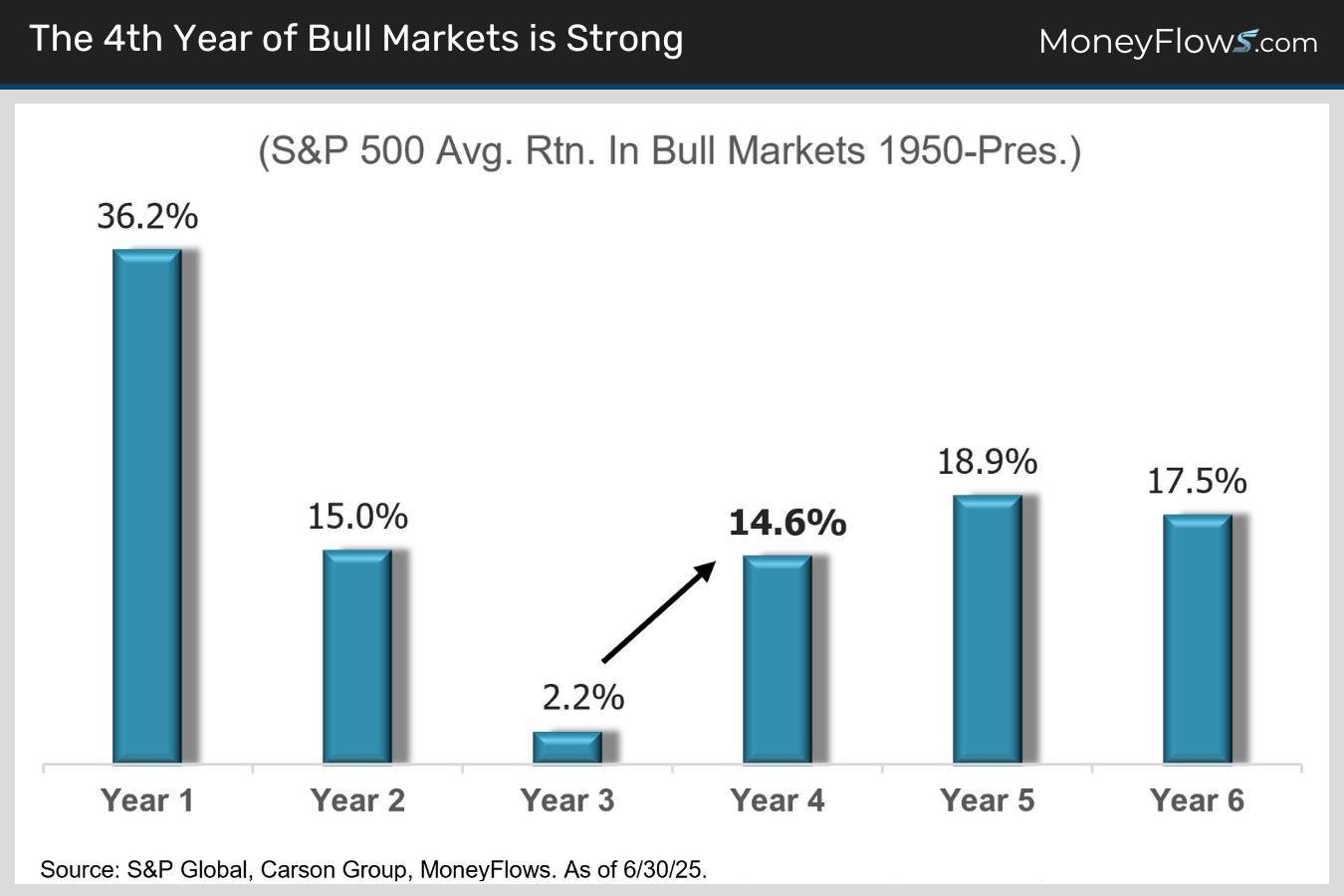

This bull’s 4th birthday is coming up on October 12.

It turns out that the fourth year of a bull market has averaged a very healthy market beating gain of 14.6% (chart).

This is an acceleration from the 2.2% average performance in the 3rd year.

Taken all together, that’s three, bankable historical analogues all pointing to further gains ahead.

Now let’s dive into the best ways to play for upside.

What This Means for Your Portfolio

We’ve made a historically driven bull case for stocks. Now, let’s tackle portfolio construction.

History says strength begets more strength. In short, respect momentum – it tends to persist.

Momentum is the top performing factor YTD by a wide margin. It was up 19% in the first half vs. only 6.2% for the S&P 500. No other factor was anywhere close.

Our top ranked sectors - industrials, tech and financials – are 2025’s best performers and feature heavily in momentum strategies.

We regularly see healthy profit taking in top momentum names. We think these dips are buyable as we expect momentum stocks to continue to lead the market higher through year-end.

While most research houses were too conservative and got it wrong the last few months, MoneyFlows got it right.

For access to the below list of stocks, become a PRO member or if you’re a money manager or RIA, contact us about our Advisor Solution subscription.

Some of the best bets in the market today are high-quality momentum names.

Not only because of their relative performance, but due to their earnings momentum as well.

Many of the stocks below have been massive winners for us.

We think there's plenty of gas in the tank to see big gains later this year.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.