3 Policy Tailwinds for a Rotation into Cyclical Stocks

The S&P 500 hit a new all-time high on June 27.

This ricochet rally has been epic. The S&P recovered all of its 21% spring swoon in just 57 trading days.

It’s far from over…if you know where to deploy assets.

Today we’ll unpack 3 policy tailwinds for a rotation into cyclical stocks.

Let’s first rewind the tape.

On June 9th, we told you 3 Bullish Forces Will Drive Stocks to All-Time Highs.

Since 1950, this rebound to new highs has been the fastest of the S&P’s 14 drawdowns of over 20%.

Speed and size aren’t the only notable things about this rally. It’s also one of the most hated.

Many are missing out. The bears’ worry list is even longer than usual.

Just don’t fall for it. There are three underappreciated macro policy forces that point to further upside for stocks.

These tailwinds are already in motion with cyclical sectors seeing big money inflows. We’ll highlight 20 of the best to play this theme.

News Better than Feared = Lean Bullish

It’s amazing how skeptical the crowd is in the face of record stock prices.

Here’s the biggest point the bears miss: stocks don't trade on good or bad, they trade on better or worse.

Sure, the macro isn’t perfect, but it’s a lot better than it was three months ago when stocks bottomed.

Once markets have discounted a really dire scenario (think early April), they can recover quickly if reality turns out better than feared.

That’s exactly what’s happening.

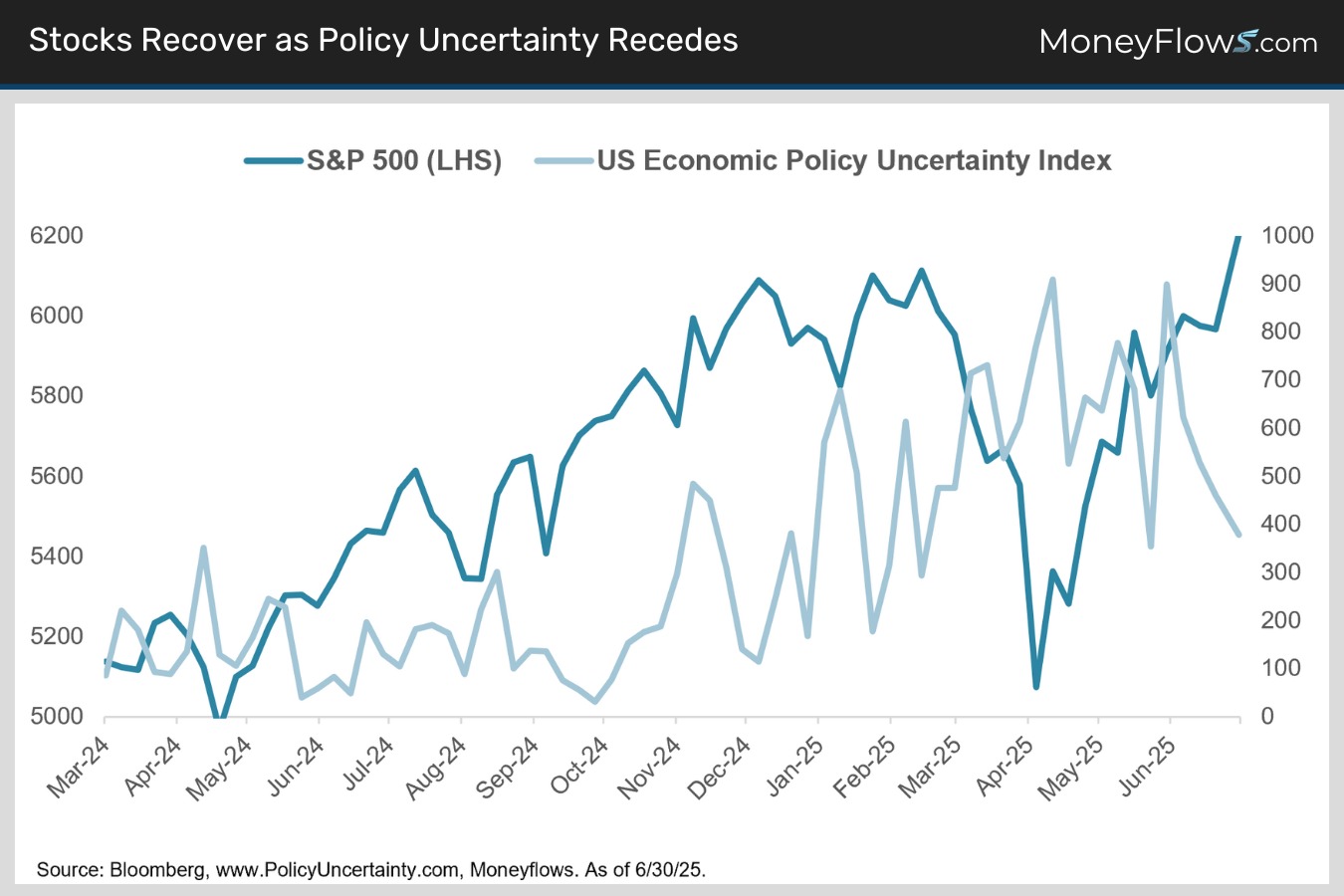

As economic policy uncertainty has receded, stocks have recovered and broken out to new highs (chart):

Let’s dig deeper to unpack why three specific government policies point to more equity upside ahead.

3 Policy Tailwinds for a Rotation into Cyclical Stocks

The number 1 policy tailwind starts with tariffs.

Tariffs Surprise to the Downside

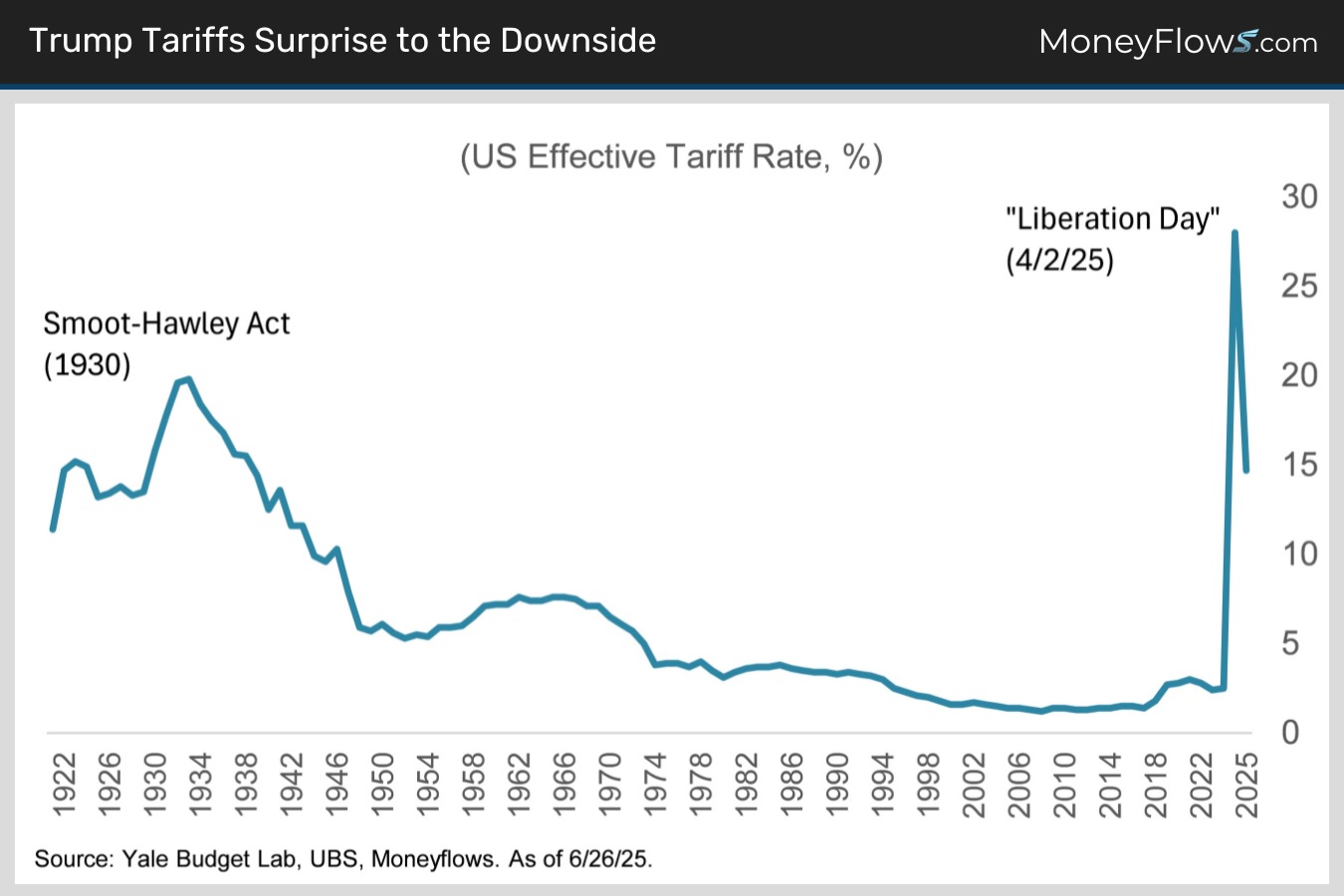

There’s no better example of “better than feared” outcomes than what’s happening with trade policy.

Even though imports represent only 11% of US GDP, tariffs continue to drive widespread economic worries ranging from growth fears to inflation jitters.

While the current 15% effective tariff rate is much higher than 2024’s 3% rate, it’s much lower than the 28% stocks priced in during the post "Liberation Day" meltdown in early April (chart).

Falling effective tariff rates have allowed stocks to look through tariff risk, not because it’s gone, but because it’s likely to be much better than initially feared.

While tariff “tape bombs” can certainly drive short-term profit taking after an epic run, as long as effective tariffs come in near or below 15%, don't expect trade risks to reverse this massive equity rally.

Now let’s shift to Uncle Sam.

Policy tailwind number 2 amounts to the stimulative effect of lower taxes.

Tax Cuts Will Turbocharge Growth

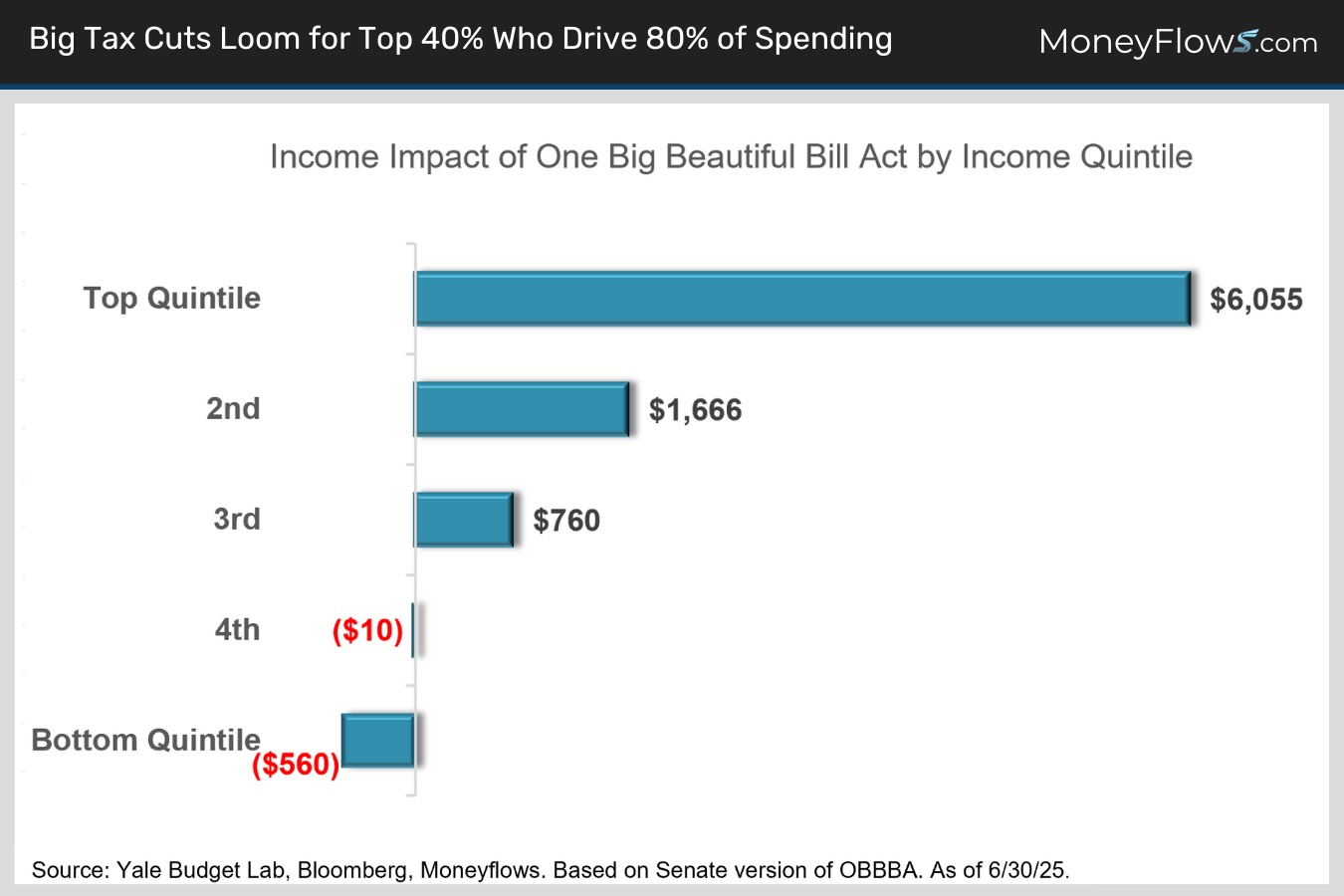

The President signed the One Big Beautiful Bill Act (OBBBA) into law on July 4. It extends the 2017 personal income tax cuts, increases state and local tax deductions, raises defense spending, and reduces Medicare outlays.

In addition, three business tax deductions have been made permanent: the ability to use depreciation and amortization as the basis for interest expensing, the R&D write-off, and immediate 100% bonus depreciation of certain property, including most machinery and factories.

Bears worry tax cuts will drive up long-term interest rates, crimping equity valuations and making it harder to afford the interest on our $36 trillion national debt.

Here’s our contrarian take:

Net-net the OBBBA is great news for economic growth.

Here’s why: consumer spending is roughly 70% of economic activity.

A March 2025 Wall Street Journal study found the top 40% of consumers by income drive 80% of total spending.

This cohort stands to benefit handsomely from the OBBBA with the top two income quintiles forecast to get $6055 and $1666 tax cuts, respectively, beginning in 2026 (chart).

History proves faster economic growth translates into higher government tax receipts. This will keep debt servicing costs manageable.

It’s not different this time.

Lower tariffs…check.

Lower taxes…check.

Lower rates…check this out.

Fed Rate Cuts are Delayed, Not Denied

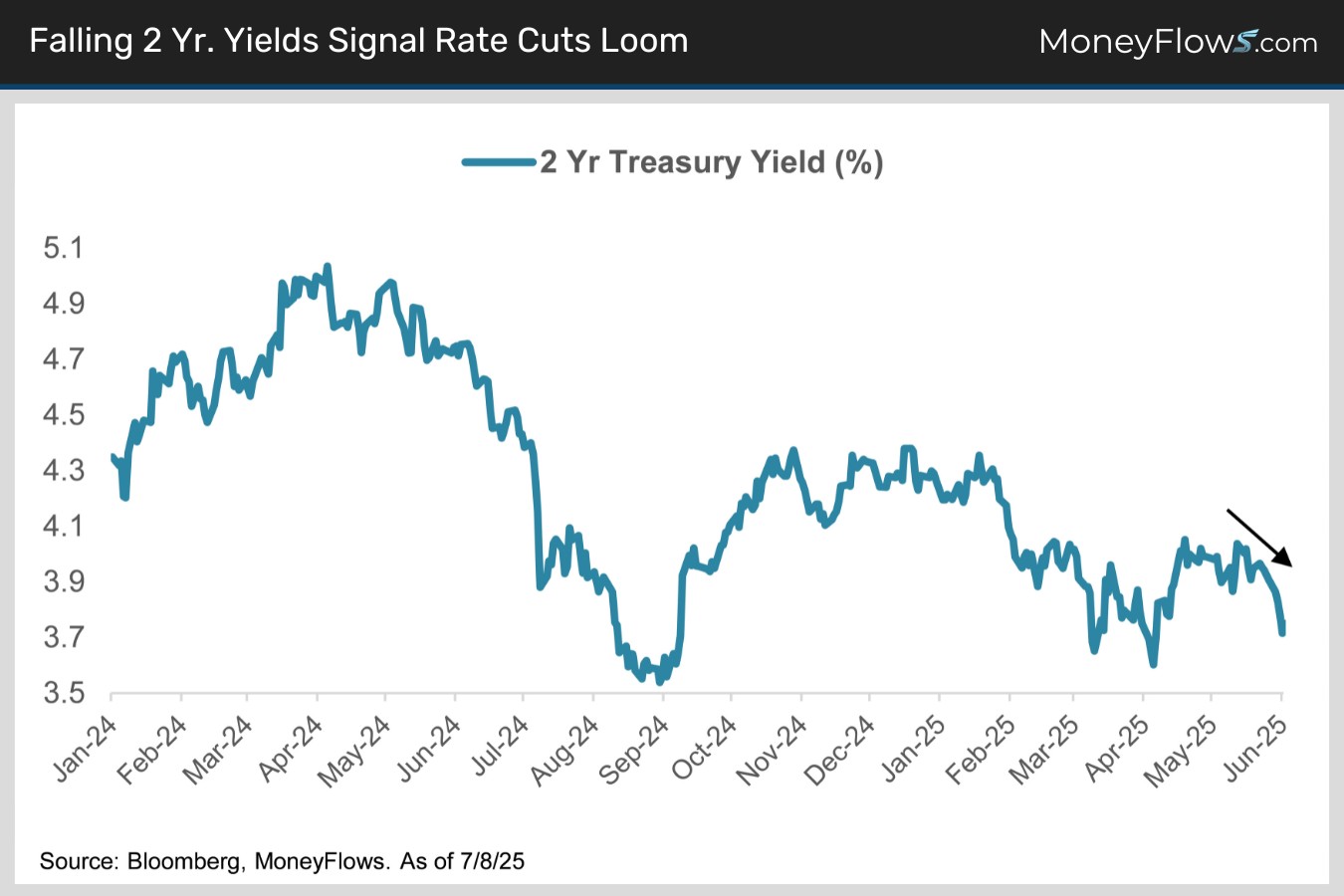

Monetary policy could be yet another example of reality turning out better than the crowd expects.

The Fed has signaled they don’t want to cut interest rates until they’re sure tariffs won’t put upward pressure on inflation.

Many are worried no rate cuts are coming anytime soon.

We disagree. Tariffs represent a one-time price hike, not the start of an uncontrollable upward cost spiral.

In addition, housing – the biggest component in US inflation data - is seeing disinflation, helping cool the overall price trend.

The bond market appears to agree. One year forward inflation expectations stand at only 2.4% down from 2.9% in early April at the height of tariff uncertainty.

The two-year Treasury yield acts as a proxy for anticipated fed policy. It has fallen to 3.87% from 4.35% in February, signaling an increasing likelihood of Fed rate cuts sooner rather than later (chart).

Once the Fed signals it’s ready to ease, expect monetary policy accommodation to act as an equity tailwind well into 2026.

All of these policy boosters are tremendous for cyclical stocks.

Let’s outline the MoneyFlows picture for your portfolio.

We’ve made a policy driven bull case for stocks. Now, let’s tackle portfolio construction.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.