Buy the Dip in Gold

2025’s epic volatility is a great reminder of the importance of diversification.

Adding gold to your portfolio gives you a smoother ride.

Even after a recent 10% correction, gold is still up over 20% YTD, beating everything from bitcoin to large, mid and small cap stocks, international equities and bonds of all stripes.

Gold’s big ramp reflects a combination of trade and economic uncertainty, dollar weakness, record central bank buying and geopolitical risk.

Today, we’ll show you why you should buy the dip in gold and why the shiny metal deserves a permanent satellite allocation in your portfolio.

Then, we’ll offer a way to play it with a superior, under the radar bullion ETF, and three elite gold stocks seeing big institutional buying.

Buy the Dip in Gold for the Golden Track Record

Gold can be streaky.

It does best during periods of heightened inflationary, geopolitical and policy uncertainty. Conversely, gold can underperform when the macroeconomic backdrop is more benign.

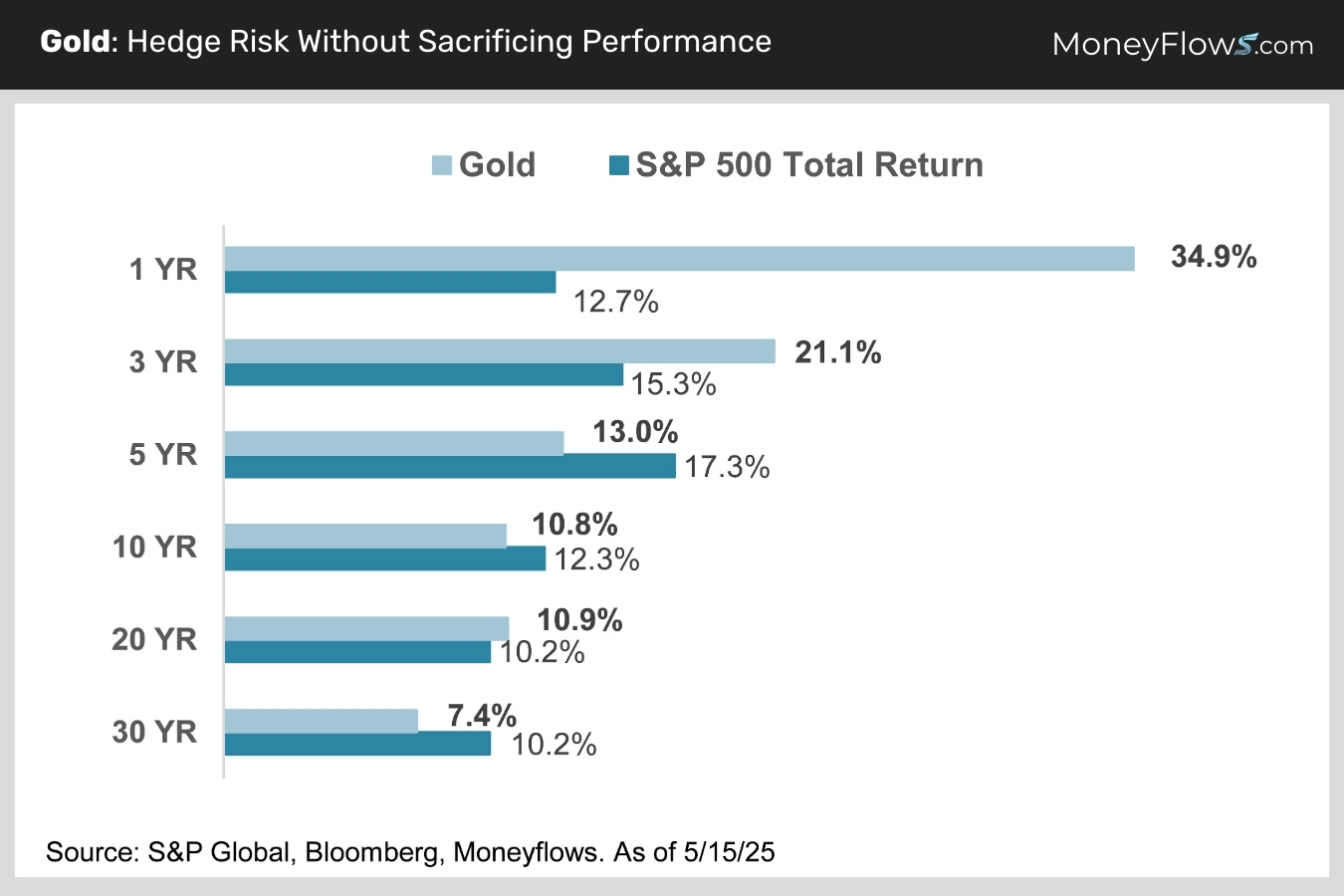

While short-term performance varies, over the long run, gold has crushed bonds and been very competitive with stocks (chart).

Over the last 20 years, gold has edged out the S&P 500:

But owning the precious metal isn’t just an appreciation play.

Gold Boosts Portfolio Diversification

The case for gold doesn’t stop at strong performance.

The next best thing to strong returns is an investment that adds diversification to your overall portfolio.

The vast majority of risk assets largely move in lockstep with each other, rising and falling together, albeit to different degrees. Think large cap stocks and high yield bonds, for example.

The only widely held investment that offers true diversification is long-term Treasuries. They usually rally when risk rises, cushioning portfolios from volatility.

But Treasuries come with a catch – mediocre returns and outsized risk if rates rise for a prolonged period.

The holy grail is an investment that performs well and can zig while everything else zags.

Gold fits the bill beautifully.

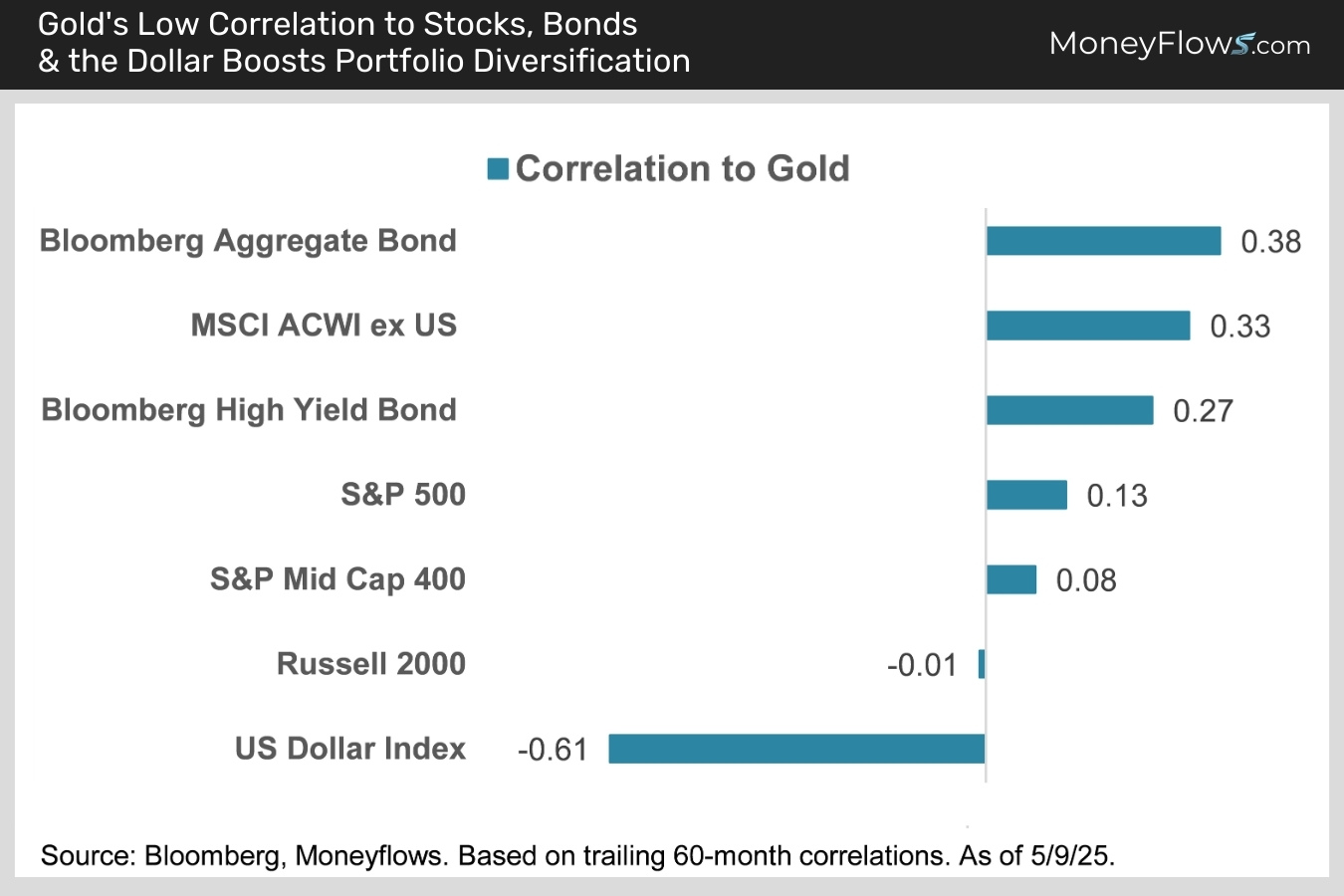

Gold has low correlations to everything from high-quality bonds to high-yield bonds, to large, mid and small cap stocks, and even dollar denominated international equities.

Best of all, gold is very negatively correlated to the dollar (chart).

Since all the aforementioned asset classes are dollar denominated, gold’s ability to zig while the buck zags supercharges its ability to diversify your overall portfolio.

What’s Driving Demand for Gold

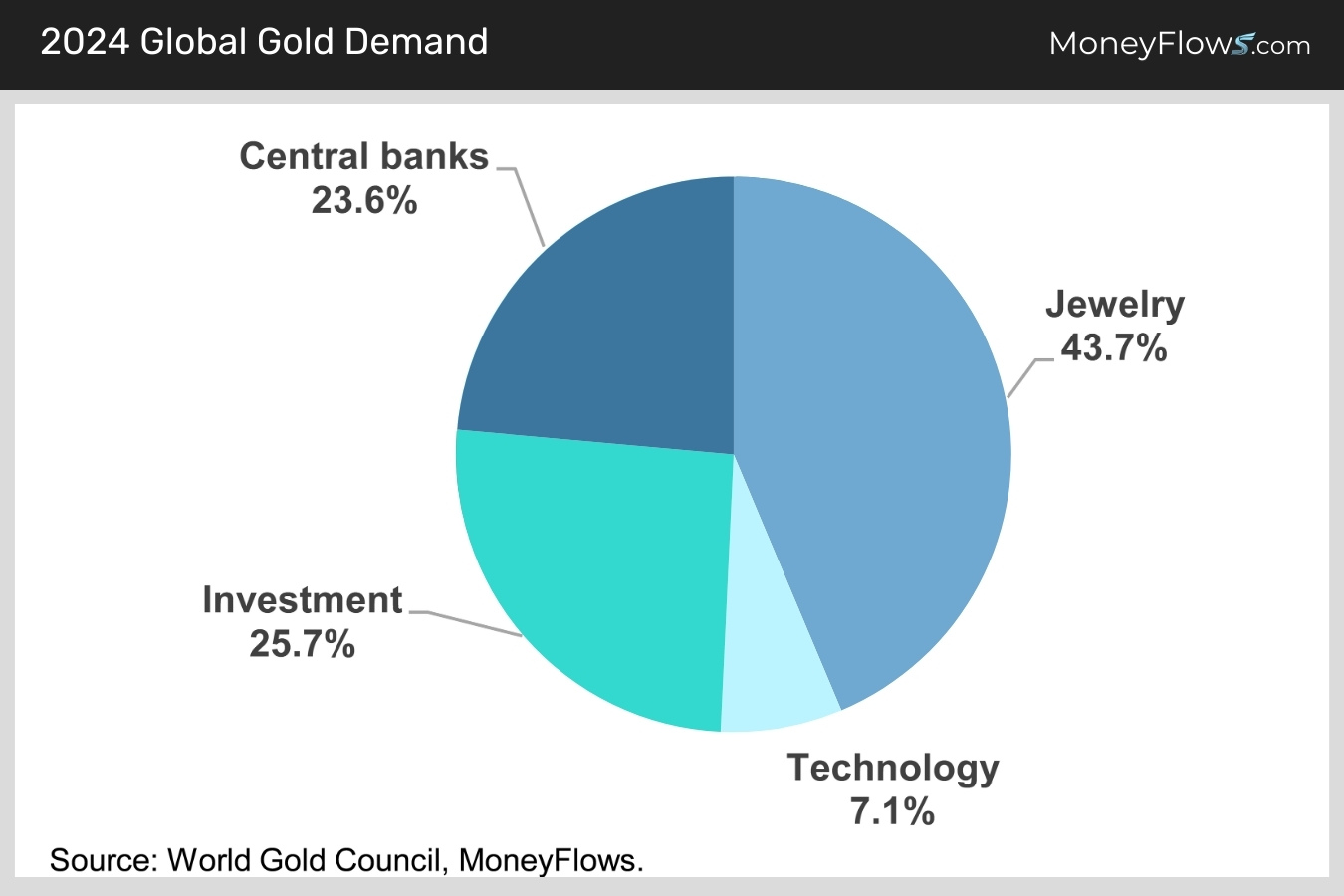

Demand for gold comes from four sources: jewelry 43.7%, investment 25.7%, central banks 23.6%, and technological uses including electronics and dentistry 7.1% (chart).

Central banks around the world continue to grow their stores of bullion. Although they represent only 23.7% of total demand, it’s growing the fastest.

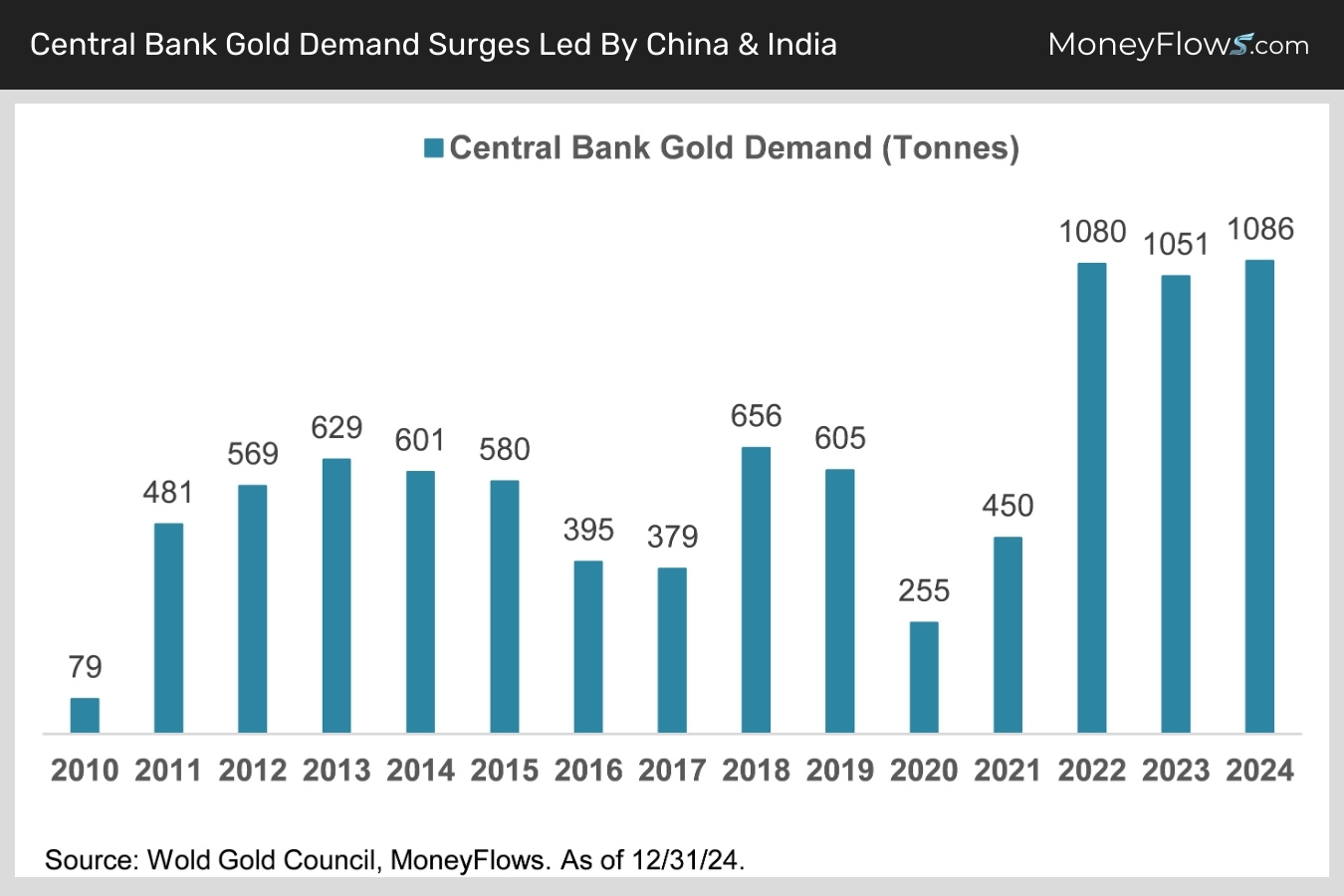

In 2024, central banks bought 1086 tons of gold, more than doubling the 450 tons purchased in 2021 (chart).

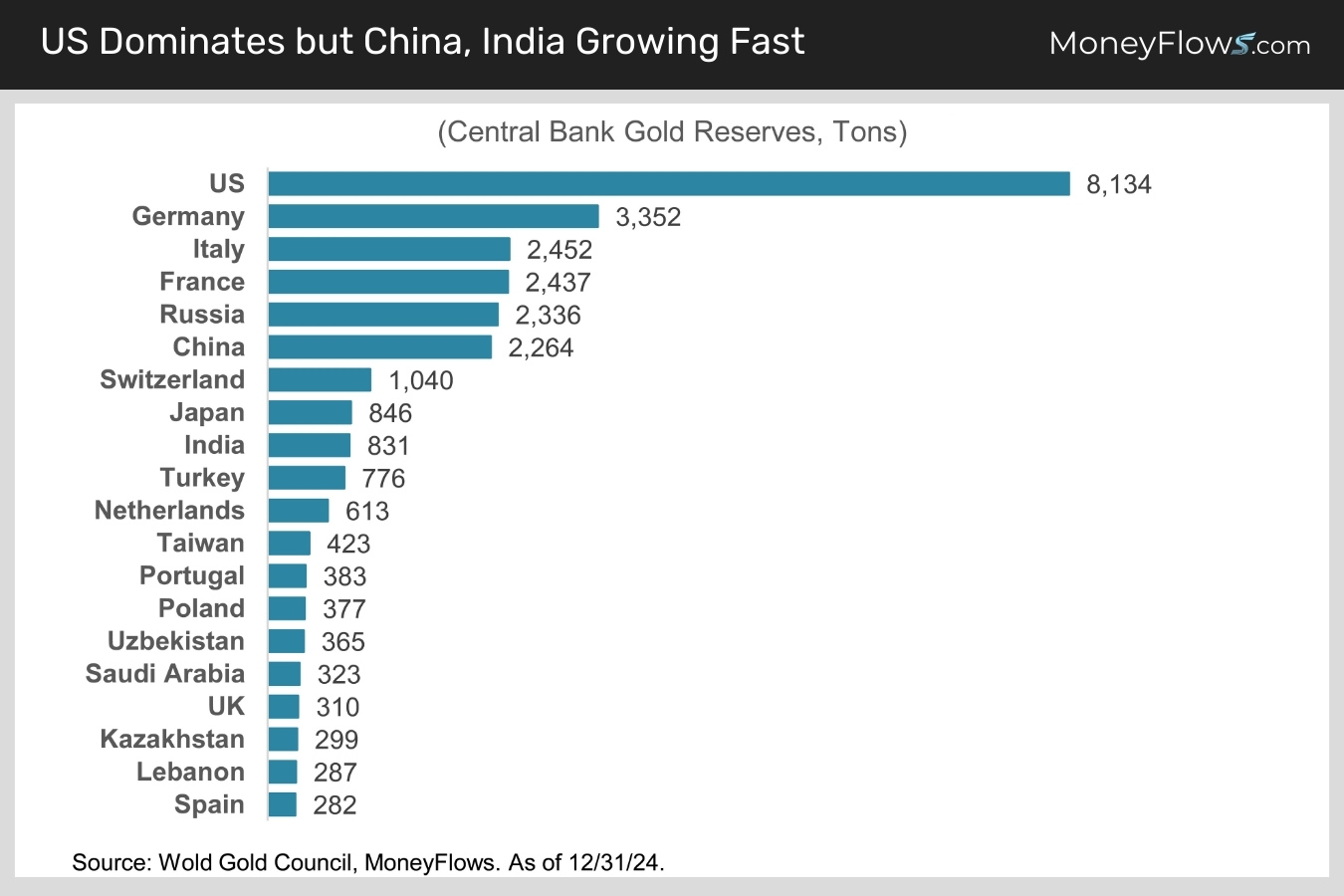

Emerging markets such as China, India, Poland and Turkey have added the most to their gold reserves since 2019, driven by geopolitical uncertainty, which is driving demand for an alternative to the U.S. dollar.

Given China’s increasingly competitive relationship with Washington, there’s no reason to think emerging market central bank demand will end anytime soon.

Below is the latest global ranking of central bank gold holdings:

How to Play Gold

We’ve made a macro case for gold. Now, let’s tackle portfolio construction.

There are two ways to play the price of gold.

First off, you can own gold bullion outright.

But physical gold bars and coins have big drawbacks. Dealer fees are high. It’s expensive to insure and difficult to store in size, and it’s taxed as a collectable at ordinary income tax rates rather than the lower capital gains rate.

Gold ETFs in tax deferred brokerage accounts are the way to go.

But not all gold ETFs are created equal.

State Street’s GLD is the category leader, but its annual expense ratio is a high 0.4%.

State Street launched GLDM in 2020 to meet strong demand for a cheaper alternative.

GLDM has all the great characteristics of GLD with an expense ratio of only 0.1%.

The choice is clear. Buy GLDM for exposure to gold bullion.

For Miners, It’s About More Than Just the Gold Price

The second way to get gold exposure is with gold mining and/or royalty-stream stocks.

A rising gold price environment is obviously good news for gold equities, but you have to be very choosy.

That’s where the MoneyFlows scoring system comes into play.

Organic growth doesn’t come easy for miners. Finding new gold deposits, or expanding existing ones, is a difficult, lengthy, capital and labor-intensive process, often happening in far flung, risky overseas jurisdictions.

As a result, there’s a huge performance gap between elite gold stocks and the rest of the pack.

Many of the biggest, best-known miners like Barrick (ABX) and Newmont (NEM) have underperformed for years, making market cap weighted gold mining ETFs a poor choice.

This article is accessible to PRO memberships.

Continue reading this article with a PRO Subscription.

Already have a subscription? Login.